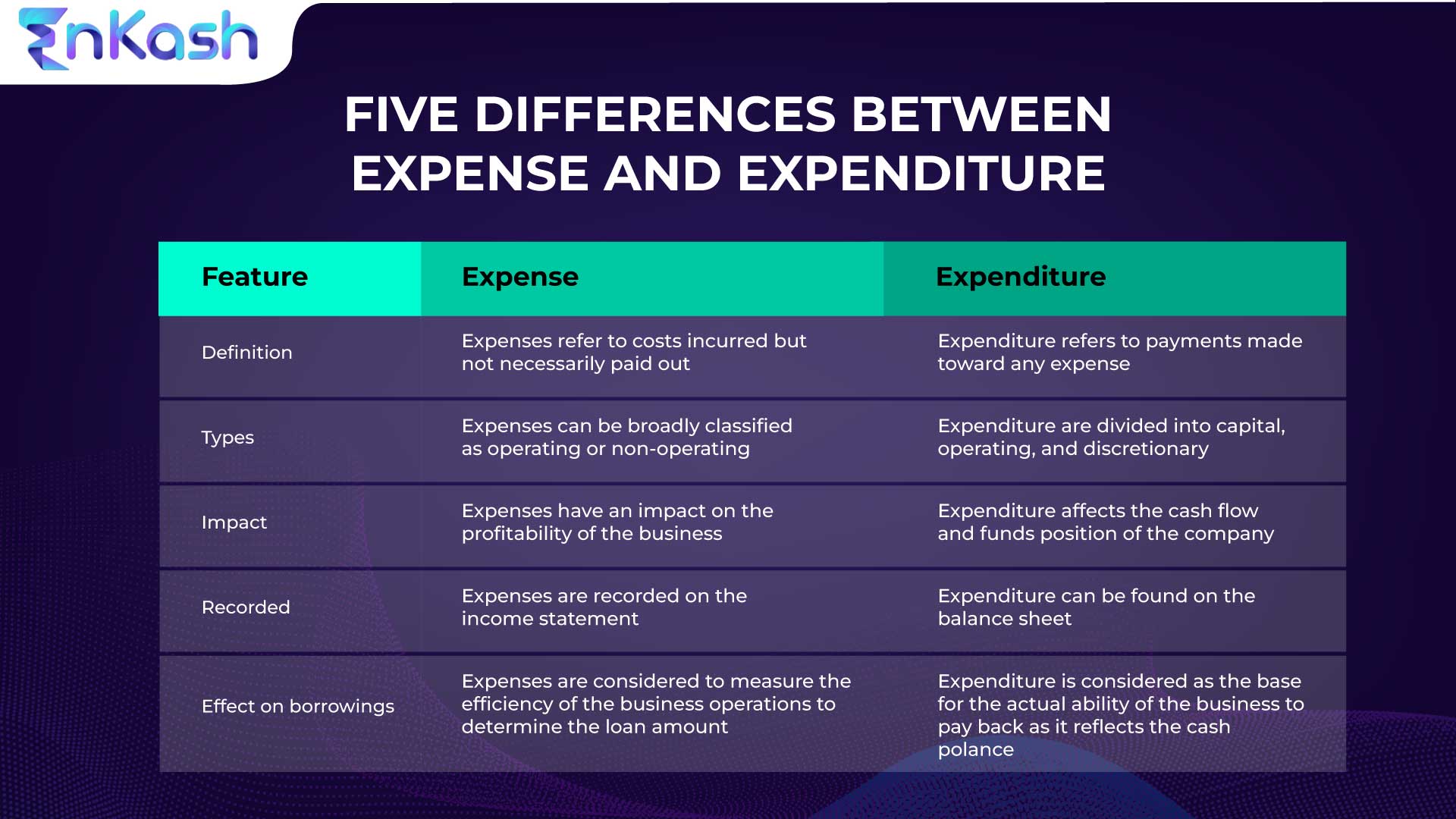

Are expenses and expenditures really different? If yes, what are the differences? These must be some thoughts running through your head when you read the title. However, the fact is that the terms ‘expense’ and ‘expenditure’ have some subtle differences and it is crucial to understand what these are. Let’s dive deeper without much delay.

In this Article

ToggleWhat do expenses mean?

Expenses can be defined as the cost a business incurs to procure goods or services. Any expense that a company incurs is noted or recorded in the income statement as a negative figure in the column denoting revenue. Expenses need not always be related directly to the products or services that a business sells.

How many types of expenses does a business incur?

In most cases, expenses can be divided into two categories—direct and indirect expenses. Direct expenses are those expenses that are incurred toward the products or services that the business transacts. Indirect expenses are also called overhead and include expenses like rent, marketing, and other such expenses. Furthermore, the payments toward expenses can either be fixed or variable. For instance, rent is a fixed expense that needs to be paid consistently at fixed levels on a regular basis. Payments like consumables and commissions to salespeople can vary according to many factors.

Now that we have an idea about what expenses mean, let’s take a look at what expenditure means before moving on to the differences between the two.

What does expenditure mean?

Expenditure relates to the outflow of funds that are related to the business. Expenditure relates to the payment you make toward expenses and therefore has more to do with the cash flow of the business.

What are the different types of expenditure?

Generally speaking, most businesses categorize expenditure as capital expenditure, operating expenditure, and discretionary. As the name suggests capital expenditure relates to the money you pay towards capital equipment. In the same way, payments made toward operations related to the running of the business, including rent, salaries, utilities, and more are considered operating expenditure. Discretionary expenditure are those payments that are more of a choice than an absolute necessity. These include advertisement, employee recreation, etc.

Also Read: What Are Non-operating Expenses and What Is Their Impact?

What is the difference between expense and expenditure?

Expenses can be defined as the costs you incur for your business during a particular period while expenditure refers to the payments that your business makes during a time period. Often businesses incur an expense that they are committed to paying but delay the payment, even though it reflects in their book of accounts as an expense. Once the payment is made it becomes an expenditure.

As Asia’s 1st and smartest spend management platform, EnKash offers you the means to streamline, track, pay, and control your expenses. And our dashboard shows you the clear position of expenditure to plan your cash flow better.

Gurgaon Mumbai Pune Bengaluru

Gurgaon Mumbai Pune Bengaluru