Goods and Services Tax or GST is an indirect tax levied on the supply of goods and services in India. GST is a comprehensive tax that subsumes various indirect taxes previously levied by the central and state governments. It includes value-added tax (VAT), service tax, and excise duty. Moreover, GST is administered by the Central Board of Indirect Taxes and Customs (CBIC) and is collected by the state and central governments. You can pay GST in both online and offline modes.

Now you might be wondering how to pay the GST payment online. The payment can be made easily by just following a few steps. Further in this article, we will discuss the steps to pay the GST payment in detail.

A GST challan is a document used to pay GST to the government. The GST challan specifies the amount of GST being paid, the tax period for which the payment is made, and other relevant details. GST challans can be generated online through the GST Portal or manually through a physical form.

What Is GST Payments Online?

GST payment online is the payment process towards a GST liability using a GST challan. It can be done online through the GST Portal or offline through a bank or other financial institution. GST billing can be made monthly or quarterly, depending on the person or business entity’s tax period and the GST liability. Making GST payments on time is important to avoid penalties and interest charges.

To make a GST challan payment online, businesses must first generate a GST challan using the GST portal, an online platform managed by the Indian government to administrate GST. The GST challan will include the payment details, such as the amount of GST due, the tax period, and the due date.

Once the GST challan has been generated, businesses can make the payment using the payment gateway on the GST portal. Payment can be made using various methods. Businesses need to make timely GST challan payments online, as failure to pay GST on time can result in penalties and interest charges.

Why Is It Important to Be on Time with The Taxes?

Tax payment or GST challan payment online is important because it is a legal requirement and a way for individuals and businesses to contribute to the funding of government services and programs. Taxes are used to pay for things like schools, roads, healthcare, and other public goods and services that benefit the community. Paying taxes is also a way to support a country’s economy’s overall functioning and stability. There are multiple reasons why timely payment of taxes is crucial:

1. Legal obligation

Paying taxes is a legal obligation for businesses and individuals, and failure to pay taxes on time can result in penalties and fines

2. Avoid tax fraud

Filing your taxes on time helps to prevent tax fraud, as it ensures that all of the information reported on your tax return is accurate and up to date

3. Maintaining compliance

Paying taxes on time helps businesses and individuals maintain compliance with tax laws and regulations, which is important for avoiding legal problems and maintaining a good reputation

4. Avoiding penalties and interest

If you file your taxes after the deadline, you may be subject to late fees and penalties; these can add up quickly and significantly increase the amount you owe

5. Maintaining good credit

Late payment of taxes can affect a business’s or individual’s credit rating, making it more difficult to obtain loans or other forms of credit in the future

6. Supporting government services

Taxes help fund government services and programs that benefit society, such as education, healthcare, and infrastructure

Overall, being on time with your taxes is important to avoid additional charges, prevent tax fraud, and keep your finances organized.

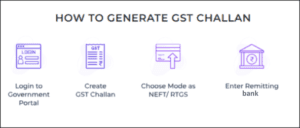

How to generate challan on the GST portal?

- Go to the official GST Portal

- Click on “Login”, and fill in your details for your GST login

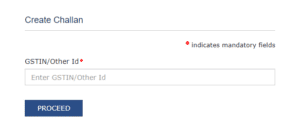

- Then click on “Services”, from the drop-down list select “Payments”, and then click on “Create Challan”

- A “Create Challan” tab will open, enter your “GSTIN/Other ID” and click on “Proceed

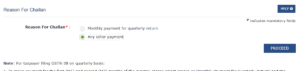

- Then you have to select the reason for challan, you have two options: “monthly payment for quarterly return/any other payment”, choose the one that suits you, and click on “Proceed”

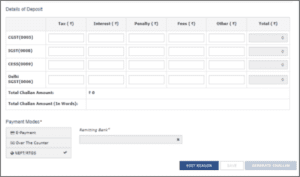

- You will now be directed to a page where you can create a GST challan by filling in the required details like CGST, IGST, CESS, etc. After filling in the details, select the payment method via which you want to pay. In this scenario, click on the “NEFT/RTGS” option, and from the drop-down list select the remitting bank

Then you’ll see three options in the bottom left, if you want to go back to the previous page and change your reason then click on “Edit Reason”. If you want to make payment later and save the changes then click on “Save”. And if you want to proceed with the payment, click on “Generate Challan” review all the details carefully and click on “Download”. Your challan will be successfully generated

How to make GST payments online on the EnKash portal?

Now Pay Your GST In Just 3 Easy Steps With EnKash

- Login on the EnKash platform using your mobile number/email and OTP. If you are new to the platform, register using your valid credentials

- Go to the “GST Payments” tab under “Olympus”

- Upload the generated challan

- You will get OCR-based auto-read & verification for maker/checker approvals

- At last, pay using a credit or other modes of payment

How to check your GST payment status on the GST portal?

To check your GST payment status, please follow the below steps:

- Visit the official GST portal

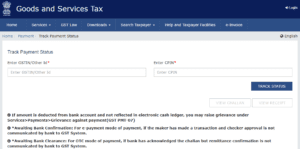

- Under “Services”, click on the “Payments” section and click on “Track Payment Status”

- On clicking the “Track Payment Status” the following page will be displayed

- Just fill in the GSTIN and CPIN of the challan you paid and click on “Track Status”

- You will then be able to see the current status of your payment

How can EnKash help?

-

Unlike the old times, now paying GST online is very convenient and time-efficient for both the public and the government. By following all the steps given above, you can now easily make GST challan online payments through both the GST and EnKash portal.

Just remember to keep your login credentials handy, and carefully fill in the tax period, the type of tax you want to pay, and select your mode of payment. It is also important to keep a record of your payment, including the confirmation message and reference number, for your records. EnKash is a spend management platform that manages a business’s transactional needs. If you are looking for an all-in-one platform for GST challan payment online, explore EnKash today!

FAQs:

- What is a GST challan?

A GST challan is a document used to pay Goods and Services Tax (GST) to the government. It specifies the amount of GST being paid, the tax period, and other relevant details.

- Why is it important to pay GST challan online on time?

Paying GST challan online on time is crucial to avoid penalties, interest charges, and legal complications. It also contributes to the government’s funding of necessary services and programs.

- Who needs to pay GST challan online?

Any individual or business registered under GST must pay GST challan online for their tax liabilities.

- What are the different payment methods for GST challan online?

You can pay online using debit/credit card, net banking, NEFT/RTGS, or through a bank challan.

- What happens if I miss the deadline for GST challan payment?

Late payments incur penalties and interest charges. The specific amount depends on the delay and the tax amount.

- Do I need to register on the GST portal to generate a challan?

Yes, you need to register on the GST portal and obtain a GSTIN for generating challans. You also use the “Other ID” option if you’re an unregistered applicant.

- What information do I need to provide when generating a challan?

You need to provide details like your GSTIN, tax period, tax type, amount payable, and payment method.