Online transactions have become a part of our daily lives in today’s digital world. With the rise of e-commerce, numerous ways exist to purchase goods and services online. One of the most suitable ways to pay for products and services online is through payment links. Payment links offer a seamless way for businesses to receive customer payments without complex payment gateway integrations. They allow for a fast and secure payment process with just a few clicks.

Whether a small business owner or a large corporation, accepting online payments is vital for your operations. By utilizing payment links, you can simplify the checkout process, resulting in more satisfied customers and increased revenue for your business. So, let us get started and learn how to generate payment link for seamless payments.

Continue reading to learn about payment links, including how to generate payment link, how to send payment link, how to create a payment link, and the benefits of using payment links to collect payments seamlessly.

What are payment links?

Before we learn how to generate payment link, let’s cover the basics.

Payment links are a type of payment request that allows merchants to accept online payments from their customers by sending a simple link. Payment links are typically created by the merchant through a payment gateway or a processor, embedded in the invoice or payment request, and then shared with the customer through email, text message. Typically, when a customer clicks on the payment link, they are directed to a dedicated payment page, which enables them to input their payment details and finalize the transaction.

One of the significant advantages of payment links is that they allow businesses to accept payments without needing a physical point-of-sale terminal or a complicated payment gateway integration. Payment links are often used for one-time payments but can also be set up for recurring payments or subscription services. They are widely used in enterprises such as e-commerce, travel, and hospitality and can be customized to suit the branding and style of the business.

So, it is suggested that you understand how to generate payment link if your goal is to offer your customers a fast and secure way to pay for goods and services online, reducing the risk of fraud and chargebacks.

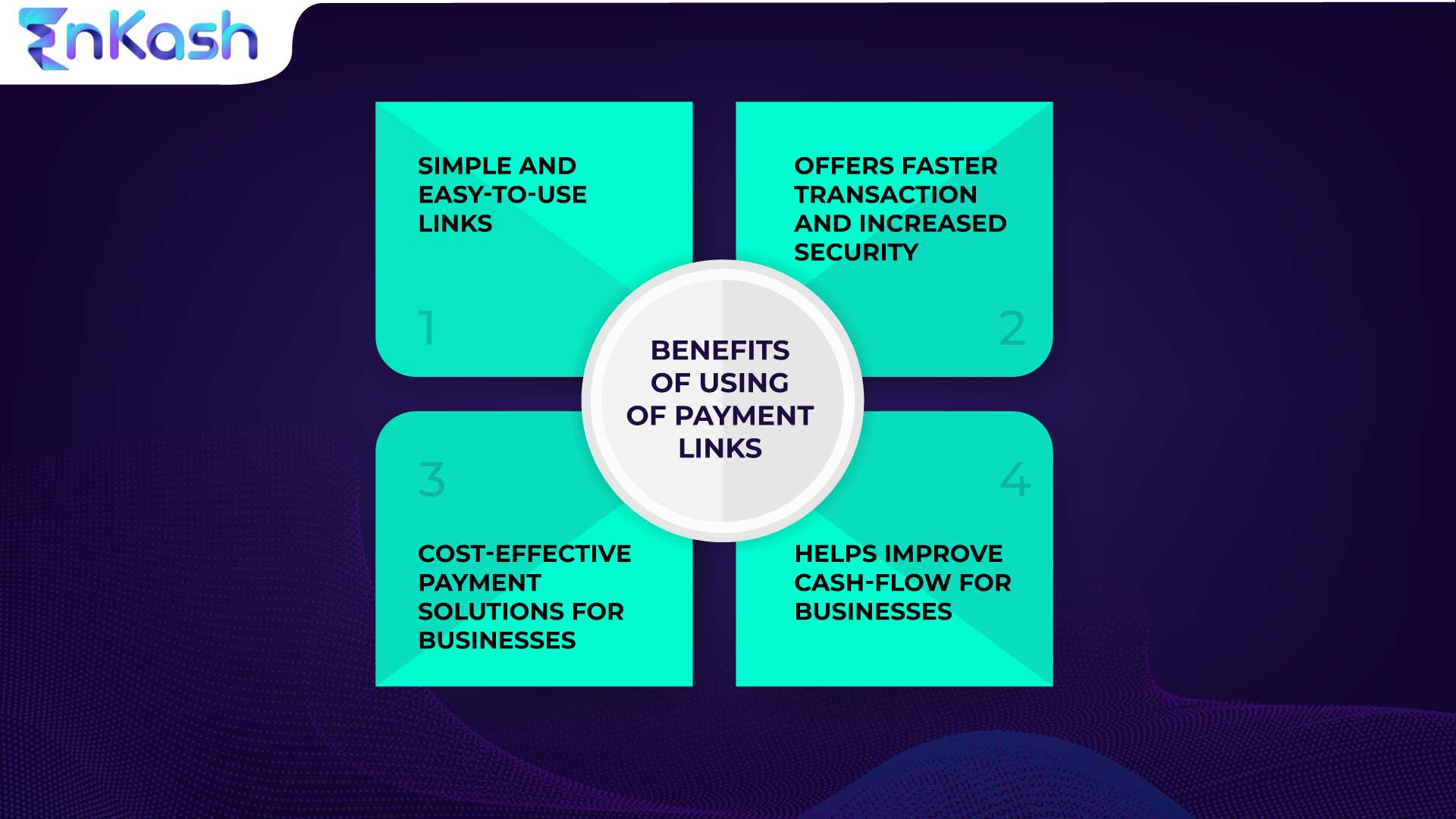

Benefits of using payment links to collect payments

There are several benefits of using payment links to collect payments. Let’s discuss the benefits before learning how to generate payment links.

- Easy to use: Payment links are simple and easy to use for the merchant and the customer. The customer does not need to enter payment information manually, as the link takes them directly to a payment page

- Faster transactions: Payment links enable more secure transactions, as the payment process is streamlined and requires fewer steps than other payment methods

- Increased security: Payment links are a secure way to collect payments, as the payment gateway or processor handles the security of the transaction, reducing the risk of fraud and chargebacks

- Better record-keeping: Payment links offer better record-keeping and reporting capabilities, which maintains a record of all transactions

- Mobile payments: Payment links enable businesses to accept mobile payments, as they can be sent and received via text message or email. This makes it easy for customers to pay from their mobile devices

- Cost-effective: Payment links are a cost-effective payment solution for businesses, as there are no setup or maintenance fees. There can be transaction fees, but they are typically lower than other payment methods

How to generate a payment link?

Learn how to generate payment link in a few simple steps. The exact process may vary depending on the payment gateway or processor you use. But here’s the most common procedure that leading payment gateways follow.

- Choose a payment gateway or processor

- Create an account with the payment gateway or processor and verify your identity and business details

- Once you log in, look for the option to create a payment link or navigate to the payment link generation

- Enter the details for the product or service you are selling, such as the amount and description

- Once you enter all the required information, click on the “generate link” or “create a link” button to generate the payment link

- Finally, copy the link and share it with your customers via email, text message

How to send a payment link?

Now that we know how to generate payment link, let’s learn how to send payment link by following the steps mentioned below:

- After generating the payment link, copy it from the payment gateway’s website

- Choose which communication channel you want to use to send the payment link

- Write a brief message to accompany the payment link, letting the customer know what the payment is for and any other relevant information

- Once you have composed the message and pasted the payment link, please send it to your customer

- Consider sending a payment reminder if the customer needs to complete the payment within a reasonable time

Now you know how to generate payment link as well as how to send payment link to the customer for fast and secure payment collection, let’s move on to the benefits of using payment links below.

After following the steps outlined above, you must be aware of how to generate payment link for your products or services in just a few clicks. If you haven’t already, connect with EnKash today and collect faster payments with embedded payment links. Sign up now on EnKash to explore the benefits of payment links for a smooth and hassle-free payment process.