To successfully run a business, the business owner must learn how to manage expenses effectively for continuous growth and profits. More than half of the startups face cash flow issues, so maintaining a small business expense report is crucial. But, with the expense reporting software, one can easily overcome and minimize these issues. Effective management of expenses will help you save money, cut unnecessary costs, and improve your business’s financial health in the long run.

Read on to learn how expense reporting software will help you track the company’s expenditures effectively.

Importance of expense reporting

Knowing exactly how much you spend will help you give a clear picture of the small business expense report and how you can save extra. Below mentioned are some of the benefits of tracking business expenses through expense management software.

Create and stick to a budget

Keeping track of expenses will help you stay within the budget specified for you. If you have no idea how much you are spending or how much you should, you won’t be able to classify whether you are overspending, underspending, or spending at the wrong place. Creating a well-defined budget will help ensure you have enough money stored to meet emergency requirements and that you do not unnecessarily overspend.

Create accurate financial statements

Accurate financial reporting will help to make better business decisions. In addition, the more accurate the financial statement is, the better it will be for you to pay the right amount of tax.

Pay the right amount of tax

Some of the taxes that business incurs are tax deductible and can be claimed. These claims help reduce the tax your company pays on its income. However, it’s important to understand different sets of rules regarding how you can claim your expenses entirely depending upon the type of business that you run.

Ways to keep track of your company’s expenses

Good expense management software can help you with expense reporting for your business and, thus, avoid confusion with invoices and accounting at the end of each accounting period. Manual tracking is an old methodology for expense reporting or tracking business expenses. Now, businesses rely on software to record transactions automatically.

Continue reading to understand how to keep track of business expenses.

Open a dedicated business bank account

It’s a good idea to register a separate bank account for your business, even if you are a sole proprietor or managing a tiny business. It is simpler to keep track of all the money that comes into and out of your firm when you have a business bank account. Additionally, it enables you to distinguish between business and private costs, which is advantageous during tax season. Thus, it makes it simpler to compare the balances of your personal and business accounts, preventing you from discovering that you have more money in one account than the other.

This helps prevent issues if you have more money than you anticipated in your personal or business accounts, which is another factor in maintaining awareness of your company’s cash flow.

Ideally, you should conduct all company dealings through your business account and keep your finances separate. Additionally, this will enable you to reconcile your books and bank statements successfully.

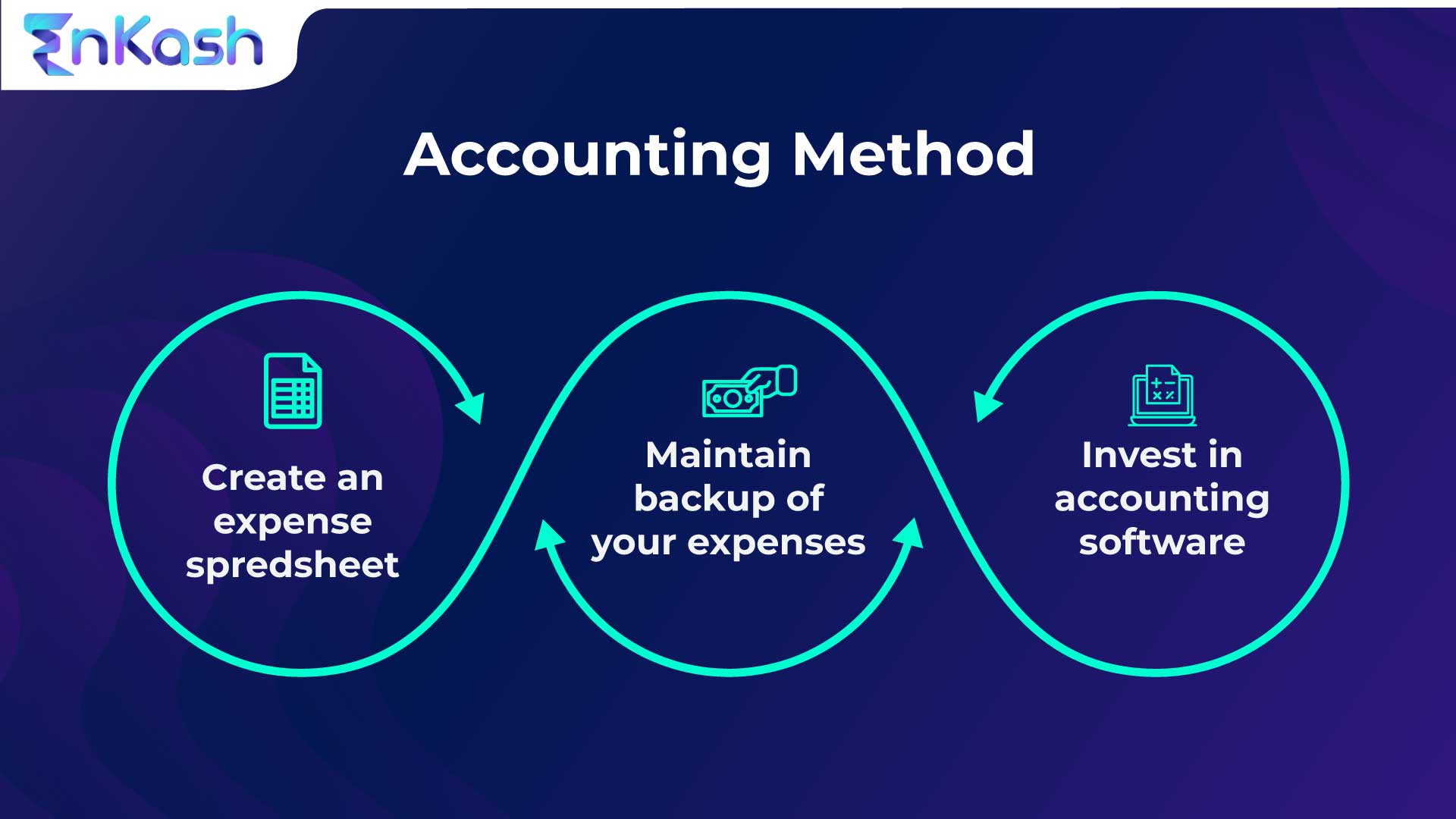

Decide on the way to record the transactions

While setting up the accounting system, you must decide how to record the transactions. It can be cash accounting or accrual accounting. In the case of a cash accounting method, you record the revenue when the cash is received for the expenses made. Whereas, in the case of the accrual accounting method, the revenue and the expenses are recorded when they are earned.

This accounting method is more complex and requires professionals.

Wrapping up

The financial health of your business can be improved by keeping track of spending, which makes expense reporting so important. It motivates you to make better decisions for your company’s future and helps you save money, minimize expenses, pay the appropriate tax, and generate correct financial accounts.

You can use trustworthy accounting software to fully automate the expense reporting process or manually track your spending. As a result, you can easily streamline budgeting, control spending, and improve cash flow with EnKash. We provide the best expense-tracking software that offers customizable budget management services to clients. With our well-designed services, you can now get your hands on various rewards and cashback by paying for business expenses on time.

We help you power your business with our intuitive, modern, and centralized expense reporting or tracking software. EnKash helps you to save time and effort across payables, expenses, collections, and accounting. In addition, you can now simplify and customize all your expenses in one place. So, get in touch with EnKash, and get your hands on the best and most trusted services!