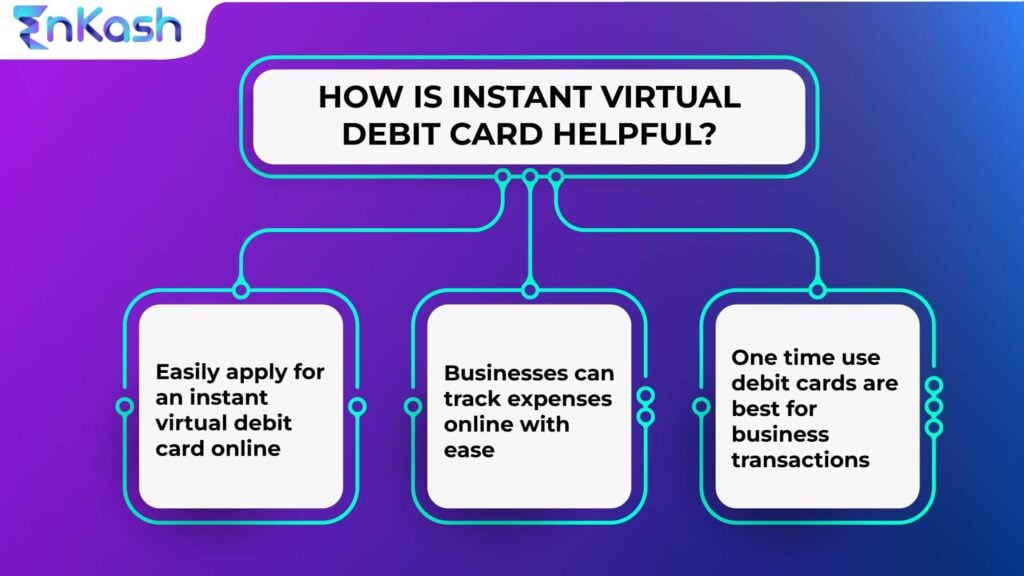

Virtual debit cards are the easiest way for businesses to manage and track online expenses in real time. These cards are like ATM cards but exist only in the virtual form. The card is used for online transactions without the need to carry it around. This helps businesses protect themselves from online fraud, theft and losing the card. The biggest benefit for businesses that a business can apply for an instant virtual debit card online and then activate the one-time use virtual debit card feature, meaning they will expire after one transaction. Getting a virtual debit card is extremely convenient as there are platforms such as EnKash where you can apply to get an instant virtual debit card online in just a few steps.

A virtual debit card is like conventional debit cards and contains the below-mentioned information

- CVV number

- Cardholder’s name

- Validity date

- Card type

- Debit card number

- Transaction setting

Read ahead for detailed information about a virtual debit card and how to get an instant virtual debit card online.

What Is a Virtual Debit Card?

Virtual debit cards are a perfect alternative to physical debit cards as they are extremely convenient and secure for all transactions. In addition, you can connect your account in the bank with virtual debit cards and use them to make online purchases or other transactions that can be made with a physical debit card.

Usually issued by financial institutions or banks, you can also apply for an virtual card online. These virtual debit cards have additional features, such as setting spending limits or tracking transactions. To use a virtual debit card, you will need to link it to your bank account and provide the necessary information to complete a transaction. For example, companies often transfer a certain amount to the linked business account in bank with virtual debit card, which reflects in the overall balance. Some virtual debit cards may also require you to provide additional authentication, such as a one-time passcode or biometric information.

You can apply for an instant virtual debit card online from your preferred platform to avail the benefits mentioned below.

Understanding the Difference Between Physical vs. Virtual Debit Card

While both are payment methods linked to your bank account, there are key differences between physical and virtual debit cards:

Physical Debit Card:

Tangible: A physical card you can carry and use for in-person transactions and ATM withdrawals.

Wider acceptance: Accepted at most stores and merchants globally.

Security: May have chip and PIN technology for added security.

Risk of loss or theft: Can be lost or stolen, potentially leading to unauthorized transactions.

Replacement: Requires contacting your bank and waiting for a new card.

Virtual Debit Card:

Digital: Exists only electronically, used for online transactions.

Limited acceptance: Not accepted at all physical stores, and some online merchants may not accept them.

Enhanced security: Often offer unique card numbers for each transaction, reducing fraud risk.

No risk of loss or theft: Cannot be physically lost or stolen.

Instant issuance: Can be created and activated immediately online.

Choosing between them depends on your needs:

- For frequent online transactions: Virtual debit card offers security and convenience

- For regular in-person purchases: Physical debit card is necessary

Virtual Debit vs. Virtual Credit Card: Choosing the Right Digital Card for You!

Both virtual options offer similar benefits like convenience and security. However, there are some key differences:

Debit cards: Directly deduct funds from your bank account, limiting spending to your available balance.

Credit cards: Allow you to borrow money up to a credit limit, requiring repayment later with interest.

Choose based on your spending habits:

- For controlled spending: Virtual debit card ensures you don’t overspend

- For building credit or larger purchases: Virtual credit card may be suitable (use responsibly and pay your balance on time)

Benefits of a Virtual Debit Card for Businessess

These virtual business cards offer immense benefits to organizations. Considering these are digital cards, they are environmentally friendly and safe to use. Here are the key benefits of virtual debit cards for companies:

1. Extra security layer

Virtual debit cards are unique, extremely secure, and can be used as a one-time debit card. This practice makes the transaction more secure as it helps prevent fraudulent activity and reduces identity theft risk.

2. Ease of convenience

Virtual debit cards can be easily created and used online, which makes them convenient for businesses that need to make frequent or large payments. They can also be used to pay employees or contractors remotely.

3. Excellent cost savings

Virtual debit cards can help businesses save money on fees associated with traditional debit card transactions, such as ATM or international transaction fees.

4. Greater control

Businesses can limit the amount of money spent with virtual debit cards, helping prevent overspending and enabling better budgeting and financial planning.

5. Enhanced tracking and reporting:

Virtual debit cards can give businesses greater visibility and transparency into spending, enabling them to track expenses and analyze financial data more effectively.

6. Block it at your convenience

To block the physical debit card, you must connect with the respective bank’s customer service or apply for it via the bank. Whereas for the virtual debit card, you must log in at the provider platform and block it. You can block the card within minutes if you suspect unauthorized spending or activity.

7. Discounts and offers

Before applying for an instant virtual debit card online, you need to check the exclusive offers provided by these lenders. Multiple platforms offer various additional services, discounts and offer on various items, including food, dining, and shopping. At times, users also get points which can be redeemed to score more discounts on stores or items. This varies as per the card providers.

8. One-time use virtual debit card

In case you want more safety during transactions, you can enable the one-time use virtual debit card feature. In this, once the transaction is initiated, the debit card will expire, and you will apply for a new instant virtual debit card online.

8. Instant virtual debit card online

Unlike physical debit cards, you will not have to visit the bank or apply for the card and wait weeks to get it delivered to your address. Instead, you can easily get an instant virtual debit card online in simple steps. There are various banks with virtual debit card offers; however, you must compare these exclusive offers and read the terms and conditions thoroughly before applying for one.

9. Resolve all the issues online

When you apply for an instant virtual debit card online at a platform, you get an account from where you can track all the expenses and raise queries if needed. You will not have to visit banks with virtual debit cards and then complaint and then wait for days to get answer.

Now that you know the multiple benefits, let us find out how you can apply for an instant virtual debit card online and how EnKash can help you with it.

Steps to Get Instant Virtual Debit Card Online

Applying for an instant virtual debit card online is easy and saves extra time and effort. The first step to applying is to find the right financial institution that provides ease of service, convenient access, and exclusive discounts or offers, if any. Once you have confirmed the institution, here are the steps that you must follow:

- Choose a Reputable Provider: Research and select a reputable virtual card provider that offers a user-friendly platform, secure infrastructure, and competitive rates

- Download the App or Access the Platform: Download the virtual card provider’s mobile application or access their online platform

- Apply for a Card: Complete the online application process, providing necessary information and linking your business bank account

- Activate Your Card: Once approved, activate your virtual card by setting a PIN or password, following the provider’s instructions

- Start Using Your Card: Make secure online payments and transactions using your virtual card details

Various organizations provide instant virtual debit card online, such as EnKash. In addition, the spend management platform offers virtual cards that businesses can use to initiate transactions and track spending in real time.

Where Can You Get a Virtual Debit Card?

Several financial institutions and platforms offer instant virtual debit cards. Here are a few examples:

- Traditional banks: Many banks now offer instant virtual debit cards through their online banking platforms

- Fintech companies: Fintech companies like EnKash specialize in providing virtual debit cards and other financial services

- Payroll providers: Some payroll providers offer virtual debit cards as an option for employees to receive their wages

Apply for an Instant Virtual Debit Card Online with EnKash

EnKash is a spend management platform that helps businesses track their overall expenditure and manage transactions such as vendor payments, rental payments, and more to optimize their financial performance. In addition, you can apply for an instant virtual debit card online at EnKash and enjoy the feature of cashless transactions without worrying about the fraud and identity theft that usually happens in the case of physical debit cards. Connect with us today!

Conclusion

Virtual debit cards offer a secure and convenient alternative to traditional debit cards, particularly for online transactions. They empower businesses to simplify expense management and individuals to enjoy safer online shopping experiences. By understanding the benefits, functionalities, and key differences between virtual debit cards and other options, you can make an informed decision that aligns with your individual needs and financial goals.

FAQs

Q: Are virtual debit cards safe?

A: Generally, virtual debit cards are considered safe due to features like unique card numbers and limited spending capabilities. However, it’s crucial to choose a reputable provider and practice safe online habits.

Q: Can I use a virtual debit card internationally?

A: Some virtual debit cards may work internationally, depending on the provider and merchant. It’s best to check with your provider beforehand.

Q: What fees are associated with virtual debit cards?

A: Fees can vary depending on the provider. Some may charge issuance fees, processing fees, or inactivity fees. Be sure to understand the fee structure before applying.

Q: Can I use a virtual debit card for cash withdrawals from ATMs?

A: Virtual debit cards are primarily intended for online transactions and may not support cash withdrawals from ATMs.

Q: What happens if I lose my virtual debit card?

A: Since the card details are stored digitally, losing a virtual debit card poses no risk. You can simply block the card through the provider’s platform and create a new one instantly.

Q: Can I use a virtual debit card for recurring payments?

A: Yes, virtual debit cards can be used for recurring payments, such as subscriptions or utility bills. However, you may need to ensure that the card has sufficient funds available for each payment.

Q: How long does it take to receive an instant virtual debit card online?

A: The process of receiving an instant virtual debit card online can vary depending on the provider. In many cases, you can receive the card details immediately after completing the application process and activating the card.

Q: Are virtual debit cards reloadable?

A: Some virtual debit cards offer the option to reload funds onto the card, while others are designed for one-time use only. It’s essential to check with the provider to determine if reloadable options are available.

Q: Can I use a virtual debit card for offline purchases?

A: Virtual debit cards are primarily designed for online transactions, so they may not be accepted for offline purchases at physical stores. However, some virtual debit card providers may offer options for using the card with select offline merchants.