A bulk payment is a payment method that lets the payer make multiple debit payments to a bulk list. A bulk list is a list of beneficiaries or accounts the business intends to pay from a single debit account.

Bulk payments ensure faster payments helping establish better relationships with merchants. The most common and easier way to make a bulk payment is via bank wire transfer. There are different kinds of bulk payments that businesses can choose from. So, let’s dig deeper to know the available options.

Different Types of Bulk Payments

There are two types of bulk payments — Standard Domestic Bulk Payment & Bulk Inter Account Transfer (IAT).

Standard Domestic Bulk Payment

This type of bulk payment enables businesses to make payments to multiple beneficiaries from a single account. It has further classifications:

Immediate Bulk Payments (IBULK): These payments are processed immediately after the bulk list is created.

Next-Day Bulk Payments (NBULK): The bulk payment is credited the next day after the payment has been made.

Future Dated Bulk Payments (FBULK): In this case, bulk payments can be scheduled for a later date as per convenience.

Bulk Inter Account Transfer (IAT)

Bulk Inter Account Transfer (IAT) allows businesses to send funds to multiple beneficiaries from a single debit account. Bulk IAT is used to make international payment transfers. This inter-account transfer is relatively more reliable and secure. However, it is a complicated process as it is dependent on different technologies that vary according to the business’s location and target audience.

Different ways to make bulk payments

Businesses can make bulk payments to their vendors in various ways:

Bank Transfers

To make bank transfers, businesses need a platform that can handle various transactions at the same time. Businesses can make use of APIs for this task. Many banks offer corporate bulk transfer options. Enterprises can make bulk tax payments via their company’s registered bank account.

Challenges with Corporate Bulk Bank Transfers

Limited working hours: Corporate internet banking portals work as per working hours defined by the banks. Most businesses need 24*7 payment services.

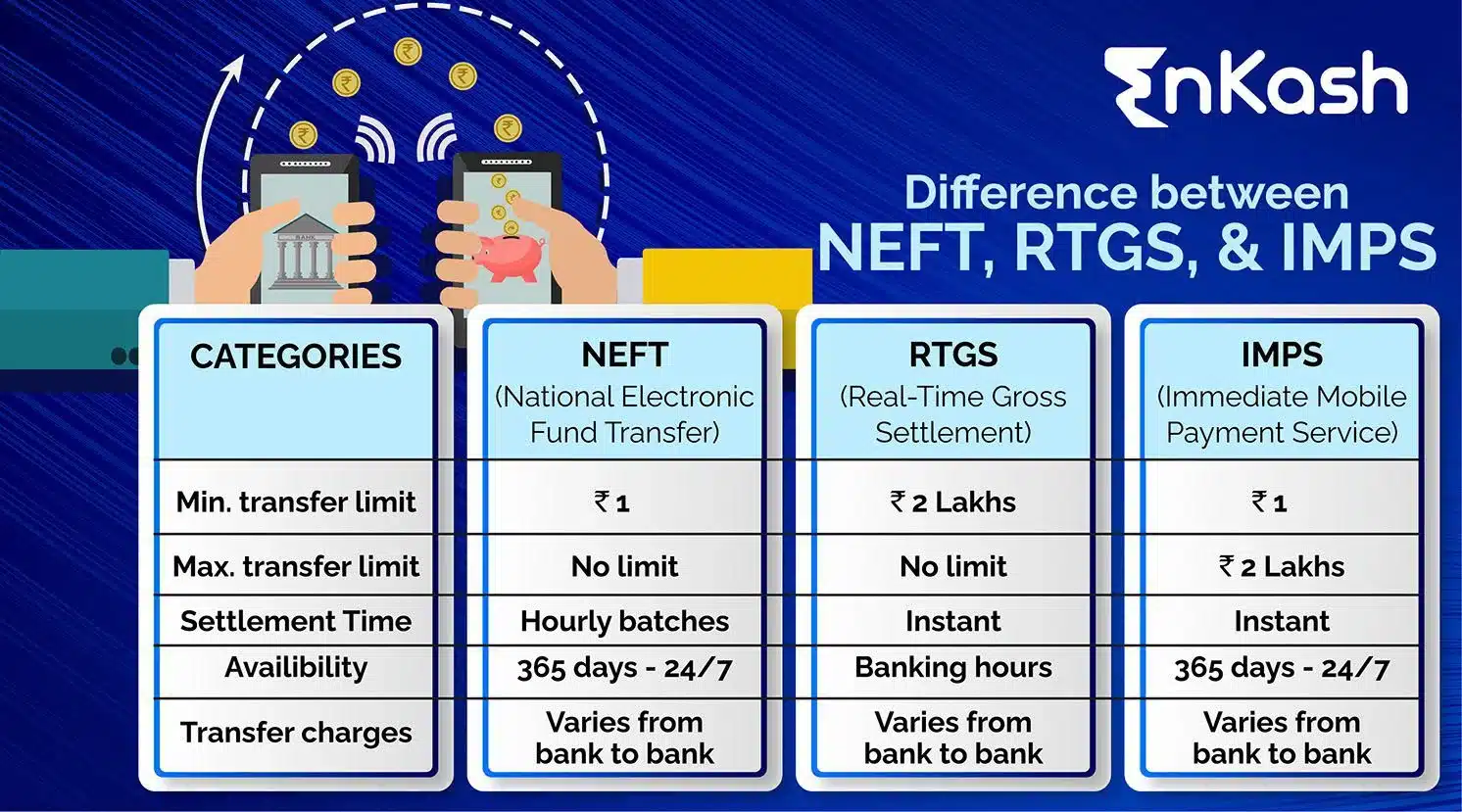

Payment modes: Most of these internet banking portals do not support IMPS or UPI on bulk transfers. This limits the payment modes for businesses to transact.

Complicated file upload formats: The bulk list with beneficiary details has to be uploaded in a certain format.

Waiting period: There is a waiting period known as a “cooling period” required to add multiple beneficiaries to the account.

Bank account verification: Corporate portals do not verify bank accounts before funds transfer. This increases the chances of failed transfers. This also affects the reconciliation process making it tedious.

Payouts

A great alternative to corporate banking solutions, bulk payouts make transfers to multiple beneficiaries easy. EnKash’s Express Pay can be used by businesses to make bulk payments to different vendors at the same time.

Benefits of EnKash bulk payout:

- It offers multiple payment options like NEFT, RTGS, IMPS, UPI, debit cards, connected banking, and more.

- It works 24*7 allowing businesses to make payments round the clock and not work as per banking hours.

- EnKash provides a simplified user-friendly dashboard for data management and reconciliation. It enables businesses to use APIs or Excel for uploading bulk lists and payment files.

- The platform verifies the beneficiary’s bank account details helping reduce the chances of transaction failure.

- Businesses can add beneficiaries within minutes and make transactions instantly.

- EnKash is compatible with all operating systems and modern browsers.

Benefits of Bulk Payments

Multiple advantages come along with making bulk payments to your vendor or merchant. Some of them are listed below:

Faster Speed

It is a faster payment system and a more efficient way of sending money to various recipients. In addition, they are timely automated, and fuss-free options.

Increased Security

Payments are extremely regulated. Bank and payment gateways comply with high security and trusted policies to ensure the safety and security of the organization’s data.

High Scalability

The larger the business, the more it needs to process larger transactions. Therefore, the manual bulk transfer file uploading option cannot be sustained in the long run. Thus, automatic reconciliation becomes necessary.

Cost Effective

The finance team cannot solely calculate individual employee wages or vendor commissions. Thus, payments using the bulk method can help you save time and resources for an organization by automating these tasks.

International Transfer

Advanced bulk payment systems, for example, payouts, support mass transfer from India to other nations. However, the purpose of the transfer should be pre-defined. So, now with the bulk payment option, you can easily transfer money to international accounts without chaos.

Now that you know what bulk payment is or how it benefits the growth and ease of payment for the business, here is a detailed guide to exploring its need.

Need for Bulk Payment

In business, there are continuous incoming and outgoing payments involved.

Payouts

Companies should pay their vendors, employees, or merchants on time. Therefore, you need to ensure they are paid immediately and timely in their bank accounts.

Refunds

Refunds frequently appear in the businesses. You must rapidly process payments if you want to keep your clients happy. If there are any delays, consider refund orders through payout connections.

Contest

When running a contest, large companies and retailers require a mechanism to distribute the prizes in large quantities. So, they require speedy and large payments to earn their customers’ trust.

Salaries and reimbursements

Processing payroll or employee reimbursements are another example of bulk payments that businesses need to work on.

Therefore, bulk payments offer vast possibilities with its set of advantages. Additionally, if you make multiple payments to a list of beneficiaries, you can run your business smoothly and fuss-free, which is why you must get in touch with EnKash.

Know more about bulk payouts with these FAQs.

What is the difference between a bulk list and a bulk payment?

A bulk list is the list of recipients or beneficiaries who will receive the payment. Bulk payment is the transfer of funds from a company’s bank account to multiple bank accounts at the same time.

How can businesses make recurring bulk payments?

Businesses can make recurring bulk payments with the e-nach mandate. Recurring payments can also be made via credit/debit cards and with UPI autopay.

What does the future hold for bulk payment?

Bulk payments help businesses streamline their payables. With business expanding, the need to have bulk payments in place will become inevitable.