Buy Now Pay Later is a short-term financing option that provides extra financial freedom to customers. Generally, BNPL allows you to make any purchase and pay later in a given time. One may also choose to pay in installments at regular intervals with Buy Now Pay Later.

According to studies, India’s Buy Now Pay Later option is flourishing, and by 2026, it will have risen tenfold. The basic reason underlying BNPL’s success is that consumers find it easier to adopt.

What is BNPL Payment?

Buy Now Pay Later (BNPL) is a short-term financing solution which allows individuals and businesses to make advance purchases and defer payment to a later date. This can be done through a one-time delayed payment or in equal installments over a pre-defined tenure. BNPL is gaining popularity worldwide due to its ease of use, no paperwork, and suitability for both B2C and B2B users.

BNPL offers more flexibility as compared to standard credit methods. Customers can directly access funds without going through a long loan approval process. Businesses can use BNPL to manage their cash flow, purchase inventories, and supplier’s payments without using their important monetary reserves.

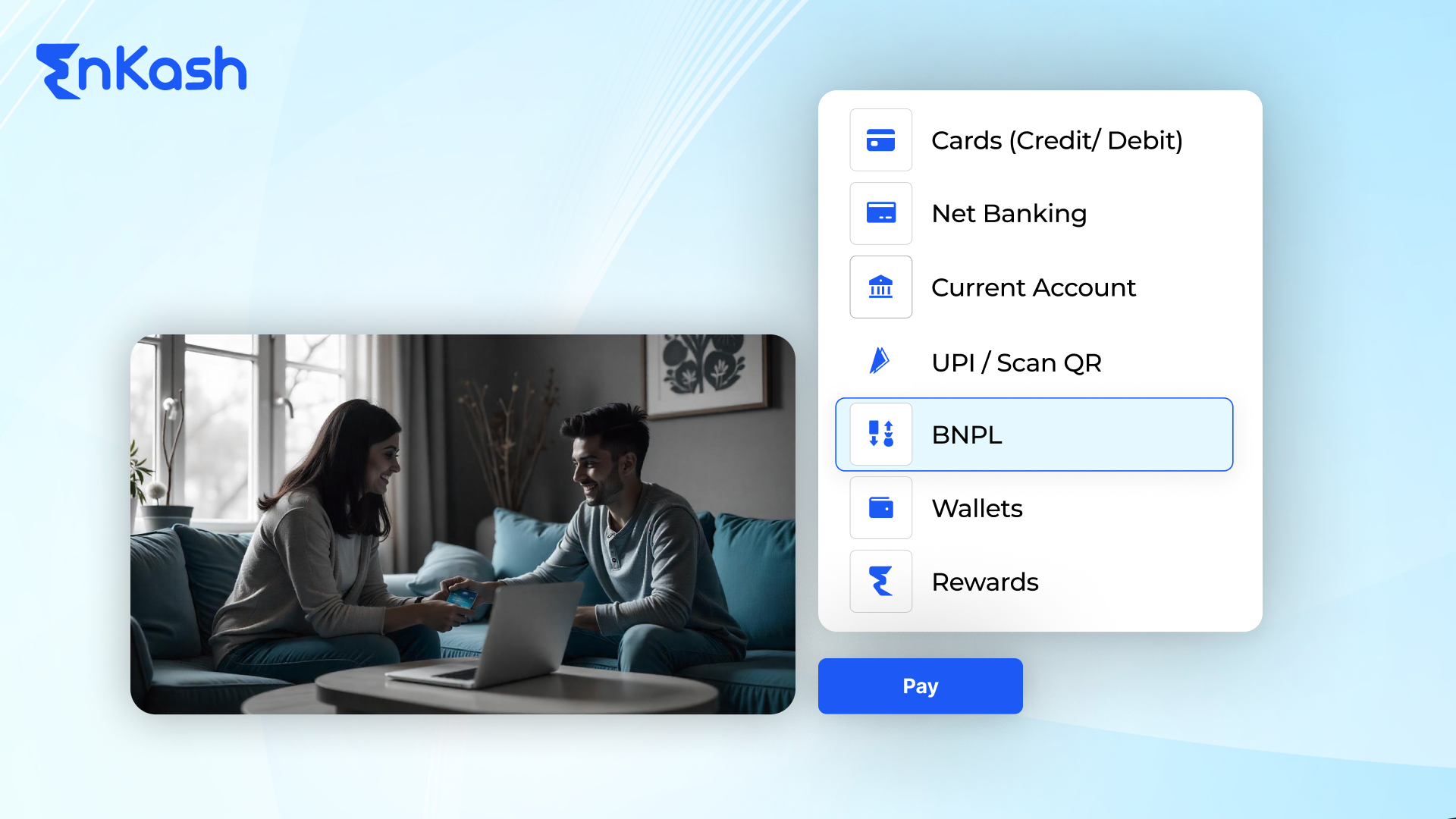

BNPL platforms often merge directly into online checkout processes, making the experience flawless for users. These platforms analyze the buyer’s solvency in real time using alternative data points such as transaction history, bank statements, spending behavior and CIBIL score.

Why is BNPL Growing Rapidly in India?

India’s fintech revolution and the wide adoption of digital payments after the pandemic have accelerated the BNPL. Market reports say that the Indian BNPL sector will grow tenfold by 2026. Key growth drivers include:

- Increasing demands for flexible credit among Gen Z and Millennials.

- Lack of standard credit access for SMBs.

- Rise in digital financial products

- Flawless integration with e-commerce platforms and B2B platforms

Overall, BNPL is emerging as a strong alternative to traditional credit solutions— standardizing the access to short-term financing methods across both consumer and business segments.

How Does BNPL Work?

BNPL works by allowing consumers, and in the case of B2B, businesses, to purchase products or services and defer payments. Re-payments could be made in interest-free or low-interest-rate installments over a fixed time period.

Key Features of BNPL:

- Instant credit approval

- Flexible repayment periods (generally between 1 week to 36 months)

- No or low interest depending on the provider of BNPL service.

- Negligible documentation and quick KYC of customers.

- Integration at checkout page on e-commerce platforms.

Difference Between Credit Card and BNPL

Both credit cards and BNPL (Buy Now Pay Later) are the tools for partial payments, they are different in structure, availability, and usage. For small and medium businesses (SMBs), understanding these differences is the main key to optimizing the cash flow and choosing the right financing strategy for their business requirements.

Credit cards are revolving lines of credit issued by the banks or financial institutions having PPI license offering users the ability to borrow an amount up to a certain limit and repay over a fixed period of time. BNPL, on the other hand, offers a short-term, point-of-sale financing that allows users to split purchases into manageable payments, often with little or no interest on it.

A detailed comparison to help you decide which option is better for your business needs:

Credit cards offer ongoing revolving credit with wide flexibility but at higher cost and strict eligibility criteria for users . BNPL provides a faster and lower-risk short-term financing option, making it a very valuable option for SMBs that need flexibility without the long approval processes . Understanding the difference between the standard credit card and BNPL can help many businesses to make better decisions.

Interest Rate Comparison (Credit Card vs BNPL)

Interest rates are one of the most important factors when comparing financing methods like Credit Cards and Buy Now Pay Later (BNPL) . While both offer partial payments, depending on provider terms, repayment cycles, and consumption patterns, their financial outcomes can differ significantly.

Credit cards usually carry higher annual interest rates, specially if balances are not paid off within the grace period. These rates compound quickly and lead to considerable financial burdens for SMBs. In contrast, BNPL offers specially in B2B transactions might come with zero-interest periods, making them more cost-effective to manage short-term cash flows and operating expenses of business.

Key Points:

For businesses with high cash flow and high monthly expenses, BNPL might offer low borrowing rate and more flexibility as compared to credit cards. But, credit cards may still be useful for emergency situations or when users need long-term repayment options . You should always compare offers, fees, and repayment policies to select the most cost-effective solution for your specific business needs.

Why BNPL is Crucial for SMBs in India

Small and Medium Businesses (SMBs) are the backbone of India’s economy but they face serious credit challenges. According to the World Bank, Indian SMBs face a $380 billion credit gap. Standard bank loans and credit cards are often falling short due to:

- High interest rates.

- Hard approval processes

- Complex repayment structures

BNPL as a Game-Changer for SMBs

With flexible payment methods and fast approval process, B2B BNPL offers an alternative credit option that supports working capital, procurement, and business continuity in the long term.

Digital transformations and the movement to online B2B platforms have further speed up the adoption of BNPL solutions for enterprises, wholesalers, and distributors.

Role of Fintechs like EnKash in BNPL

Fintech platforms like EnKash are using technology, data, and networks to deliver BNPL services with:

- Instant KYC and underwriting.

- Credit without any collateral security.

- Greater flexibility and better control.

BNPL is no longer limited to consumer retail. It’s transforming B2B transactions by immersing financing directly at the point of purchase.

Introduction to SMBs and BNPL

In India, Small and Medium Businesses (SMBs) are quite literally the backbone of our economy. This sector battles with a plethora of challenges, with lack of access to credit being one of the biggest ones on the list. According to the World Bank, Indian SMBs face a $380 billion credit gap, making it difficult for them to meet short-term expenses and manage day-to-day operations.

Secondly, small businesses survive by being agile but relying only on bank loans or credit cards since funding may not make them competitive enough. When you sign up for either of these, you limit yourself to one financial source, and you could also be paying interest or fees even when you’re not actively using those funds.

In this environment, the need for liquidity and access to capital is humongous, and businesses search for flexible alternatives to service their needs.

The pandemic has accelerated digital B2B payments and e-commerce. There was a need to adapt to ever-changing customer expectations. Every link in the business line- whether Manufacturer, distributor, wholesaler, or retailer and those that buy from them, had to modernize themselves and accept digital invoicing operations and payment methods.

Today, B2B BNPL (Buy Now, Pay Later) is a payment option readily available at checkout for B2B e-commerce platforms.

It enables users to make a purchase on credit and repay in installments. The B2B BNPL is an unsecured loan, and its payment period can range from 1 week to 36 months. Products like these help provide access to working capital, enhance cash flow management and increase liquidity to boost the growth of SMBs.

What has made this possible? Well, fintechs offering B2B BNPL like EnKash, have harnessed data and technology to create a better product and customer experience. The features include greater flexibility and better terms, quick underwriting, and instant KYC, all available at checkout. Large networks and big data are employed on the e-commerce platforms where BNPL thrives.

So, are you an Enterprise looking to reduce its BNPL management costs by 55 to 80 percent by lowering man-hours, improving spending controls, reducing overall transaction times, and improving operational efficiencies? If yes, then the B2B BNPL solutions provider- the Purchase Card or P Card is your go-to savior! Read on.

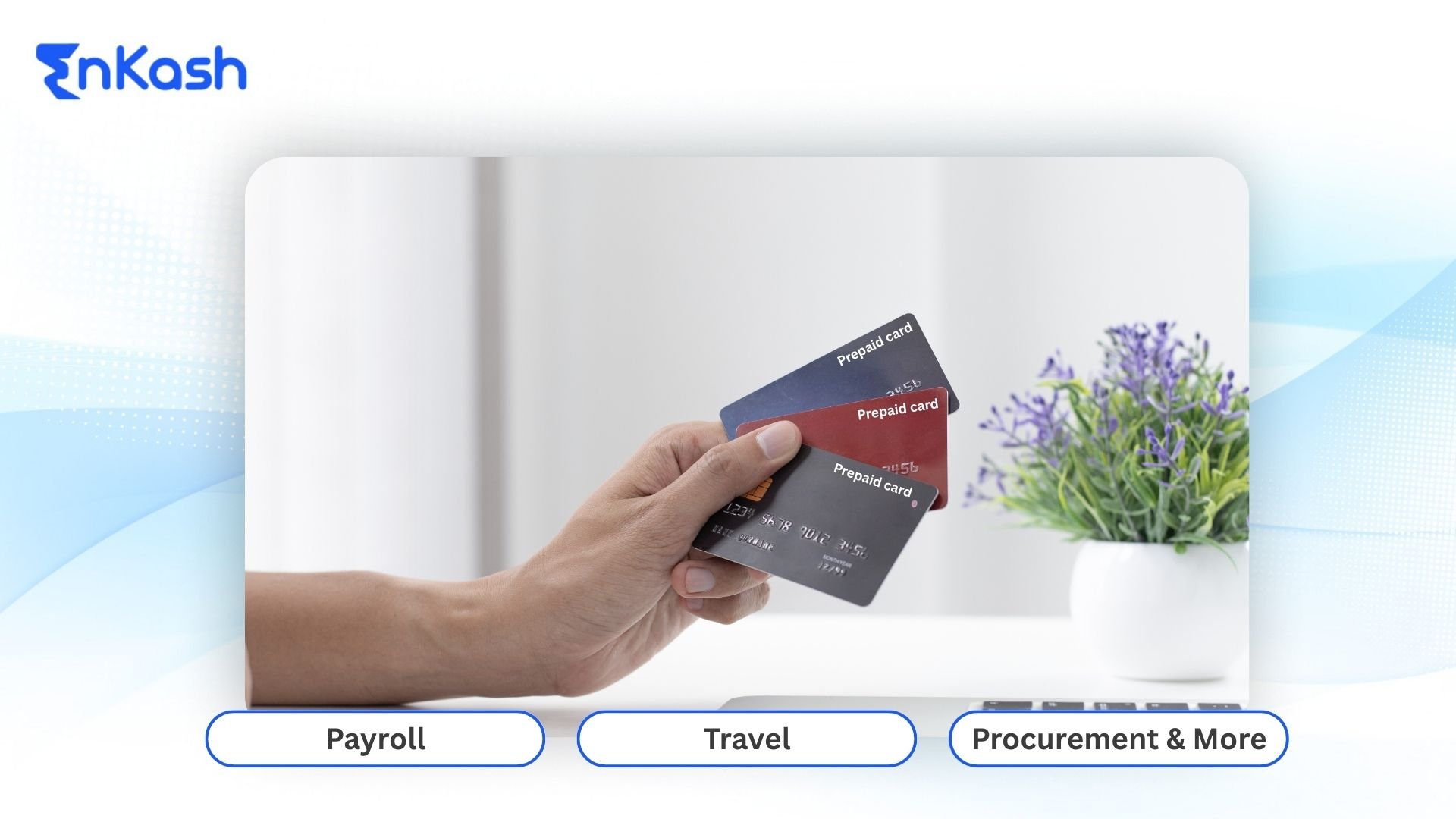

How are purchase cards solving B2B BNPL?

Purchasing cards, also known as P-Cards, are commercial cards that you can use to make B2B payments as an alternative financing option. For instance, EnKash has a unique purchase card program that offers solutions to SMEs like- quick credit evaluation, collateral-free financing options, and minimum documentation

Add to this- no foreclosure charges and a variable credit and billing cycle suited to the specific business needs so that cash flows are not impacted. With these benefits of Purchase cards, businesses like yours are already on their way to halving their BNPL woes!

The Purchase card also offers attractive cashback and rewards on expenditure, and P-cards provide a revolving credit line to pay your dues within 30-45 days of the credit cycle. It is backed by an Expense Management Platform that allows you to track payments in real-time and get great cash flow management visibility. The EnKash Purchase Card is used to pay for office supplies, rent and other office utilities, supplier and vendor payments, and any business-related payments.

Advantages of Purchase cards over other BNPL financing options

Provide instant credit to your business buyers and increase your overall sales by 2X!

- Streamlined and Simplified Procure-to-Pay process

- On-Time Procurement of products and services

- Reduced transaction costs

- Complete Control with real-time tracking of expenses

No two businesses are alike- let’s talk about a Purchase card that understands your business and is tailored for you especially!

To know more, visit EnKash. You can also click below on Signup Now and we will reach out to you soon.