Did you know that secured credit cards offer a valuable solution for businesses seeking to build or repair their credit? Whether you're a startup, a small business, or an established corporation, choosing the right secured bank card is crucial for managing your finances effectively.

This blog will guide you through the process of selecting a secured credit card that suits your corporate requirements, helping you make an informed decision that aligns with your business goals.

In this Article

Toggle5 tips for selecting a secured credit card for your business

Interest rates and fees

Start by evaluating interest rates and fees associated with different secured credit cards. Look for competitive interest rates that suit your budget and minimize costs. Ensure that annual, application, or processing fees, whichever is applicable, are reasonable and won't burden your company's finances.

Credit limit

Consider the credit limit each secured bank credit card offers. The credit limit determines how much you can spend using the card, so choose one that accommodates your business expenses. However, be cautious not to opt for an unnecessarily high credit limit that may tempt you to overspend.

Reporting to credit bureaus

One of the primary purposes of a secured credit card is to build or repair your business credit. Confirm that the credit card issuer reports your payment activities to major credit bureaus, such as Experian, Equifax, and TransUnion. Regular reporting can help boost your credit score over time.

Security deposit

Secured credit line requires a security deposit as collateral, which protects the issuer in case of default. Consider the minimum and maximum security deposit requirements of each card. Evaluate if the deposit aligns with your financial capabilities and whether it's refundable or can be converted into an unsecured card in the future.

Additional features and benefits

Some secured credit cards offer additional perks and benefits. These may include rewards programs, cashback offers, travel insurance, purchase protection, or extended warranty coverage. Assess these features and determine if they align with your business requirements and provide added value.

Eligibility Criteria for a Secured Credit Card

Credit history requirements

Secured credit cards are designed for businesses with limited or poor credit history. However, different cards may have varying credit score requirements. Check if the card you're considering suits your credit profile, ensuring you meet the minimum criteria.

Income and revenue verification

Many secured credit cards require income or revenue verification to assess your ability to make payments. Review the specific requirements for each card and ensure your business can provide the necessary documentation.

Business entity type

Some secured credit cards may have restrictions based on the type of business entity you have. For instance, certain cards may only be available to sole proprietors, while others may cater specifically to corporations or partnerships. Verify that the card you're interested in suits your business structure.

How to Apply for a Secured Credit Card Online?

Follow the steps below to apply for a secured credit card online:

Step 1: Find the right secured credit card provider and make sure they match your business requirements

Step 2: Sign up on the provider’s website and create an account by filling out the basic details along with PAN and aadhaar details

Step 3: Your details like personal and official credit score along with other documents will be checked

Step 4: Upon verification, a card will be issued against a defined credit limit

Conclusion

Choosing the right secured credit card for your corporate requirements involves carefully evaluating several factors. Compare the interest rates, fees, credit limits, and security deposit requirements to ensure they align with your financial goals. Confirm that the card reports your payment activities to credit bureaus, helping you build or repair your business credit. Take advantage of additional features or benefits that enhance your card’s value. Finally, review the eligibility criteria to ensure your business meets the requirements.

A secured credit card can be invaluable in establishing a strong credit history for your business. By selecting the right card, you can pave the way for future financial opportunities and confidently achieve your corporate goals.

Remember, choosing a secured credit card is an opportunity to build your business’s creditworthiness and establish a solid financial foundation. By taking the time to research and evaluate different options, you can make an informed decision with EnKash. Contact the fintech solution providers to set your business up for long-term success. With the right secured credit card, you can effectively manage your corporate expenses, improve your credit profile, and unlock future financial opportunities.

To know more about choosing the right secured credit card, read the FAQs:

Q - How does a secured credit card work for business?

A - A secure credit card works like a regular credit card. It is designed for businesses with no poor credit history. These cards are difficult to get relatively as need a collateral against their issuance. They are issued after checking credit history and against a defined credit limit based on the history.

Businesses can use these cards to build their credit score without any burden; right from ground level.

Q - Difference between a secured and unsecured credit card?

Secured cards need a deposit as a collateral. This deposit sets your credit limit. Unsecured cards don't require upfront money. Issuers approve unsecured cards based on your credit history and grant a credit limit.

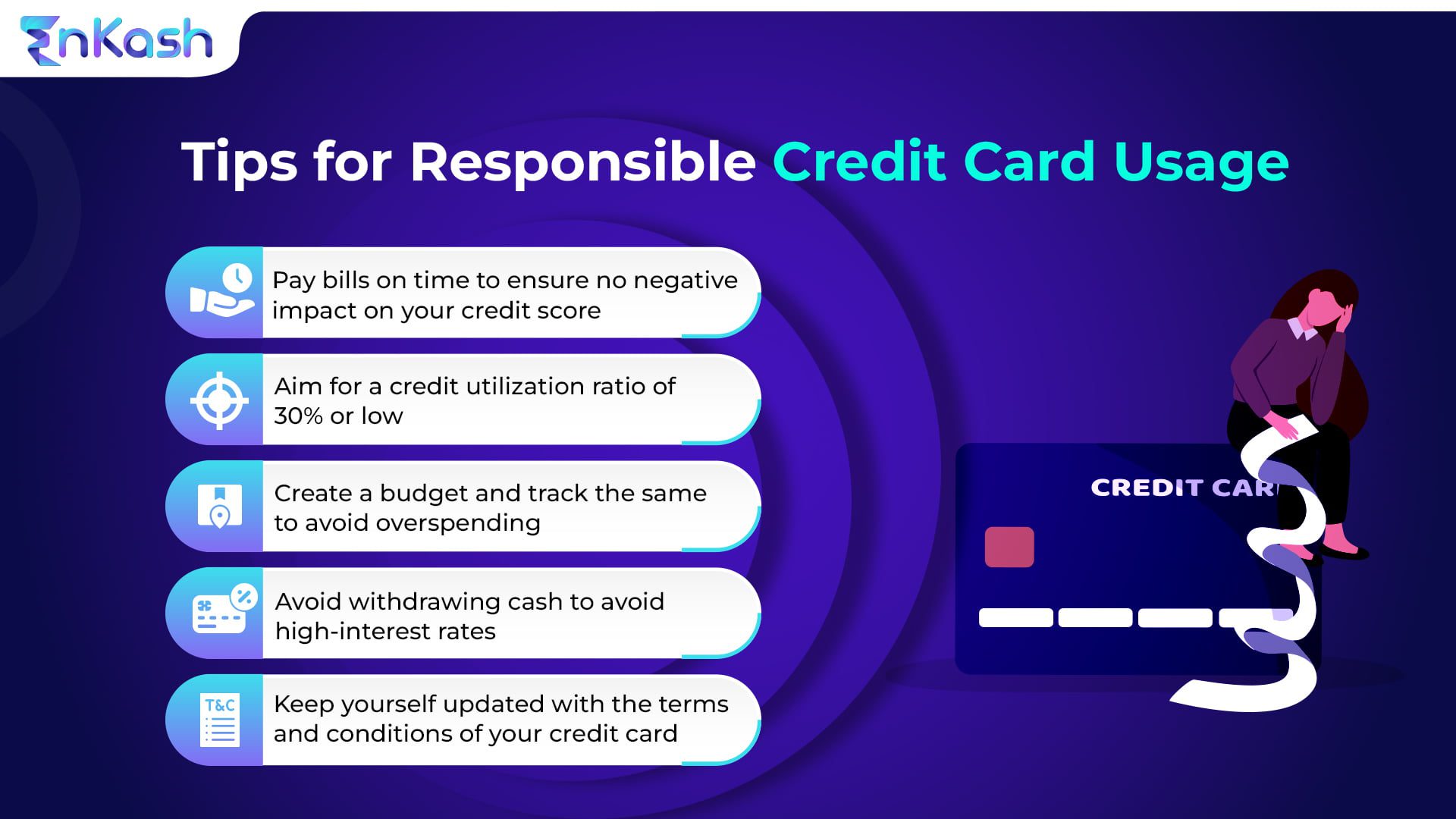

Q - How secured cards can improve your credit score

Secured credit cards can rebuilt your credit score using the following ways:

Credit History: A secured card allows you to start building one from scratch. With responsible usage, on-time payments and good credit habits, you can positively mpacts your score.

Demonstrating Creditworthiness: By making your payments on time each month, you can demonstrate your creditworthiness to lenders. This shows them you're a reliable borrower and increases their confidence in extending you credit in the future.

Credit Utilization Ratio: Secured cards typically have lower credit limits than traditional cards. Maintaining a low balance relative to your credit limit improves your credit utilization ratio which is a major factor in credit scoring.

Potential Limit Increase: Some secured card issuers offer credit limit increases after a period of responsible usage. This can further improve your credit utilization ratio and your overall credit score.

Graduation to Unsecured Cards: A period of on-time payments and good credit behavior can convince some issuers to convert your secured card to an unsecured card with a higher credit limit.

Gurgaon Mumbai Pune Bengaluru

Gurgaon Mumbai Pune Bengaluru