In the world of business, effective payable management is a critical component of success. Whether you are running a small or large business, the management of accounts payable can be a daunting task. However, it is essential for the smooth functioning of your business.

Payable management includes tracking, processing, and managing expenses owed by a company to its suppliers, vendors, or creditors. In this blog, we will discuss the importance of efficient payable management in business operations, benefits, and considerations for automating payable management. We will also talk about how one can establish effective communication channels with vendors and best practices for maintaining efficient payable management in your business.

Importance of efficient payable management in business operations

Efficient payable management is crucial to maintain the financial stability of your business. It enables your company to track expenses accurately and make timely payments to suppliers and vendors, thereby enhancing your credibility and reputation in the market. By streamlining your payable management process, you can avoid overdue payments, interest penalties, and potential legal issues. Moreover, efficient payable management provides you with an accurate and timely picture of your company’s cash flow, which helps you make better decisions and forecast future cash requirements.

Benefits and considerations for automating payable management

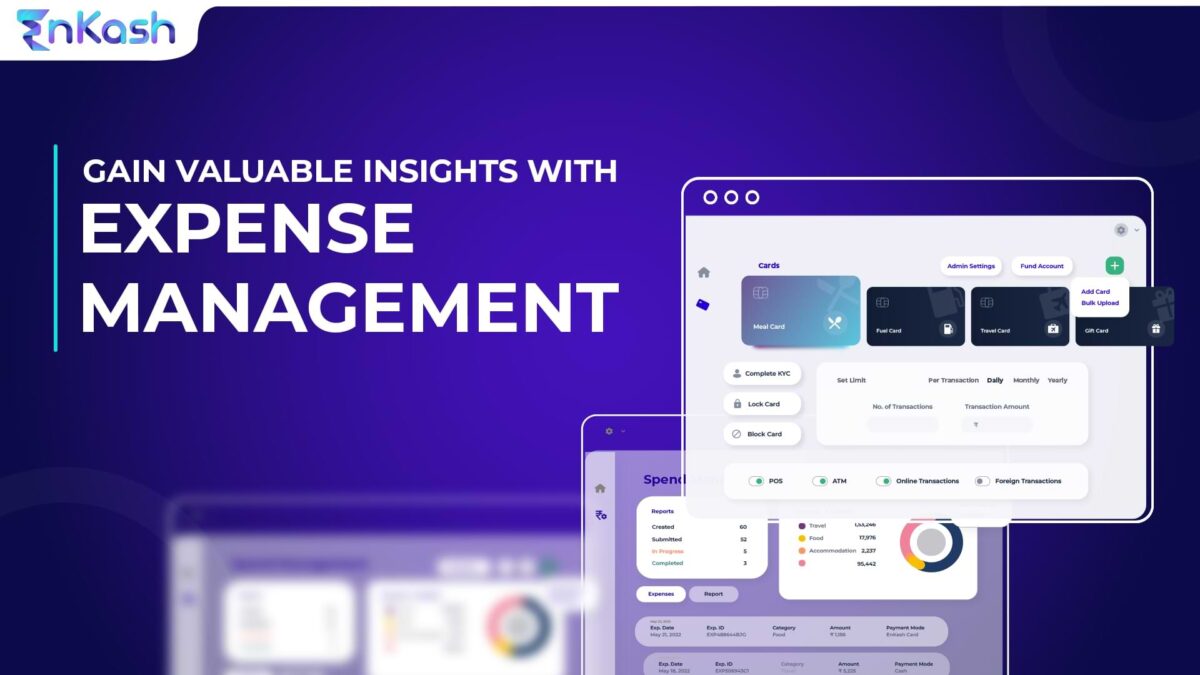

Automation of account payable management is a cost-effective and time-saving way to manage your payable system. Implementing accounts payable software can help you manage your payable system more efficiently, with less manual intervention. The benefits of automating your payable management system are numerous.

Firstly, it reduces the time and effort required to process invoices and payments. It also eliminates the need for paper-based processes, reducing the risk of errors and enhancing your financial information’s security. Secondly, automating payable management ensures that payments are made on time, and you can avoid late payment penalties. Thirdly, it enables you to capture early payment discounts and reduce the cost of goods sold.

However, while implementing accounts payable software can be beneficial, several factors must be considered. These include the cost of the software, training requirements, and the need to integrate with existing systems. Evaluating the software’s functionality and suitability for your business is crucial before investing in it.

How to establish effective communication channels with vendors

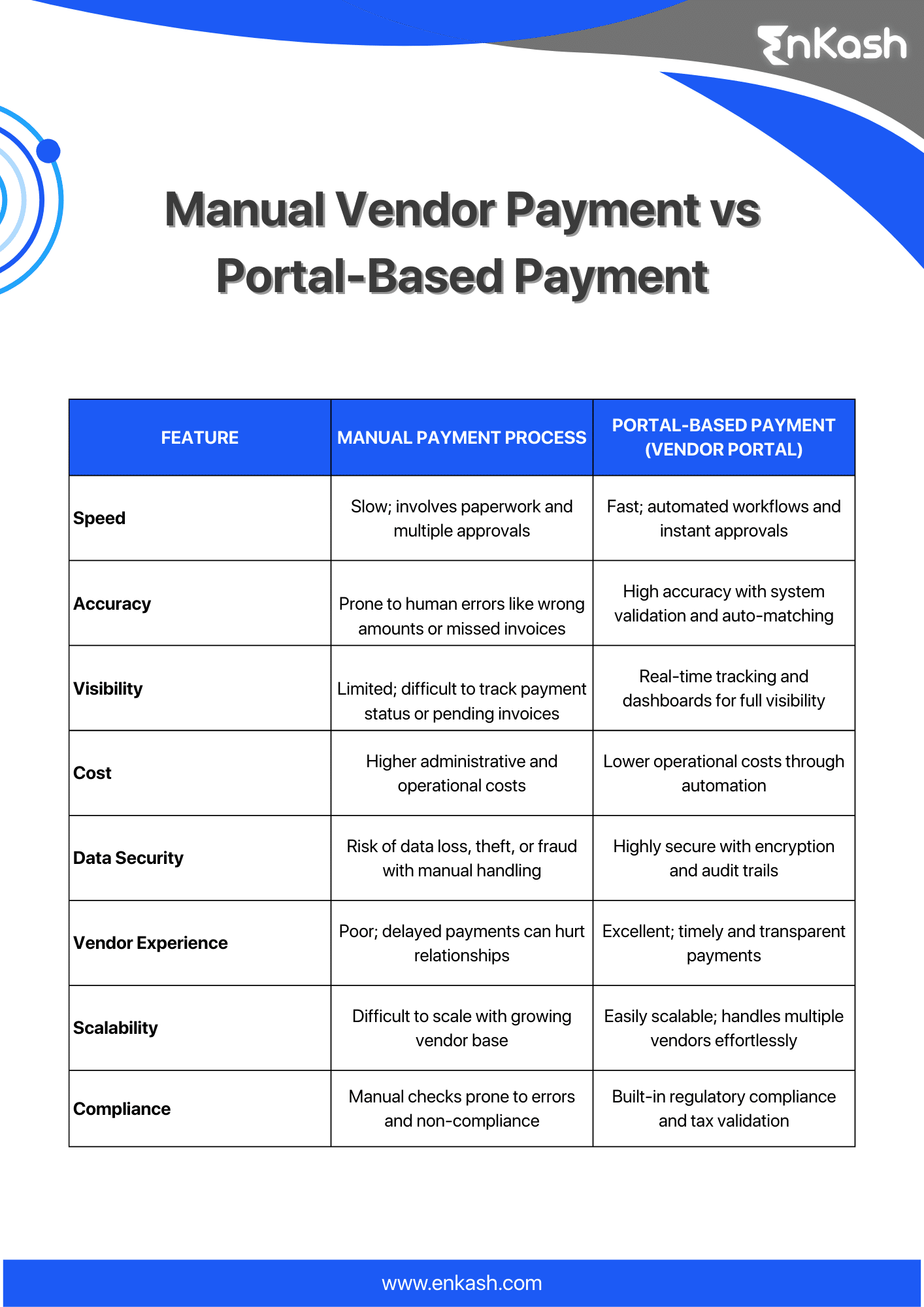

Establishing effective communication channels with vendors is an essential component of efficient payable management. Clear communication is essential to ensure that invoices are processed accurately and payments are made on time. It is crucial to have a clear and concise system for communicating with vendors. This can be achieved through regular meetings or calls, a vendor portal, or an email system that provides vendors with real-time updates on the status of their invoices and payments.

Furthermore, building a positive relationship with vendors can be beneficial in the long run. By fostering a good relationship, you can negotiate better payment terms, discounts, and other incentives that can help you save money and improve your cash flow.

Best practices for maintaining efficient payable management in your business

There are several best practices that you can follow to maintain efficient payable management in your business.

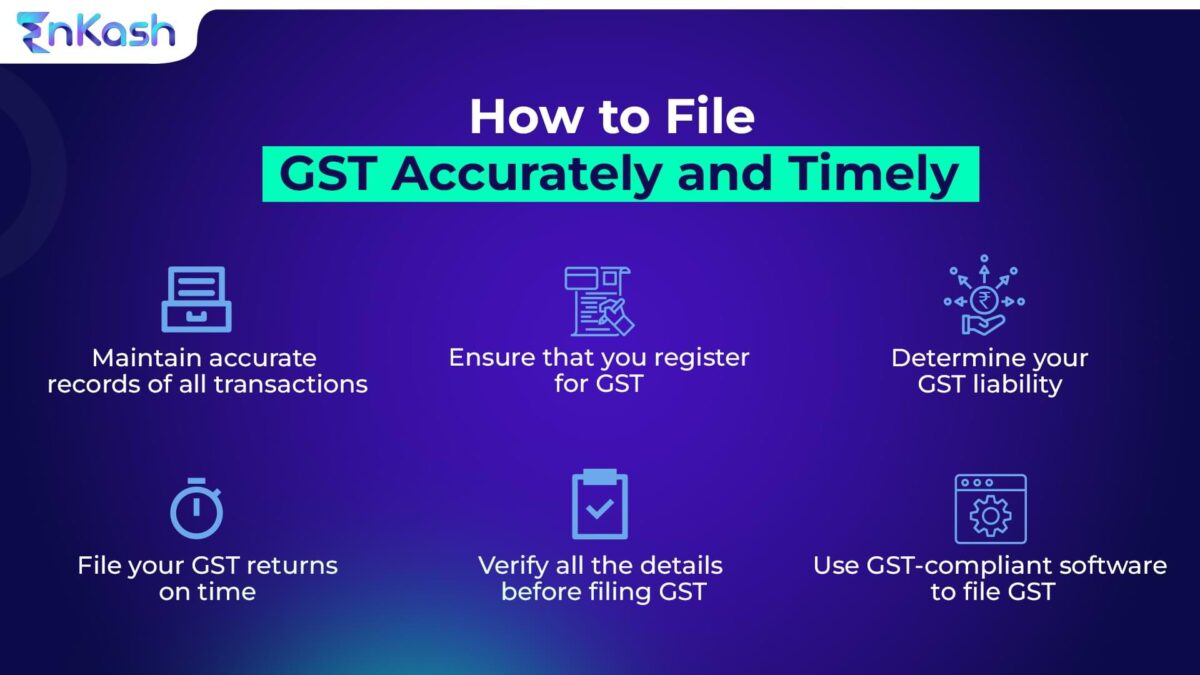

Firstly, establish clear policies and procedures for processing invoices and making payments. This includes setting up clear guidelines for approving invoices, verifying the accuracy of data, and ensuring that payments are made on time.

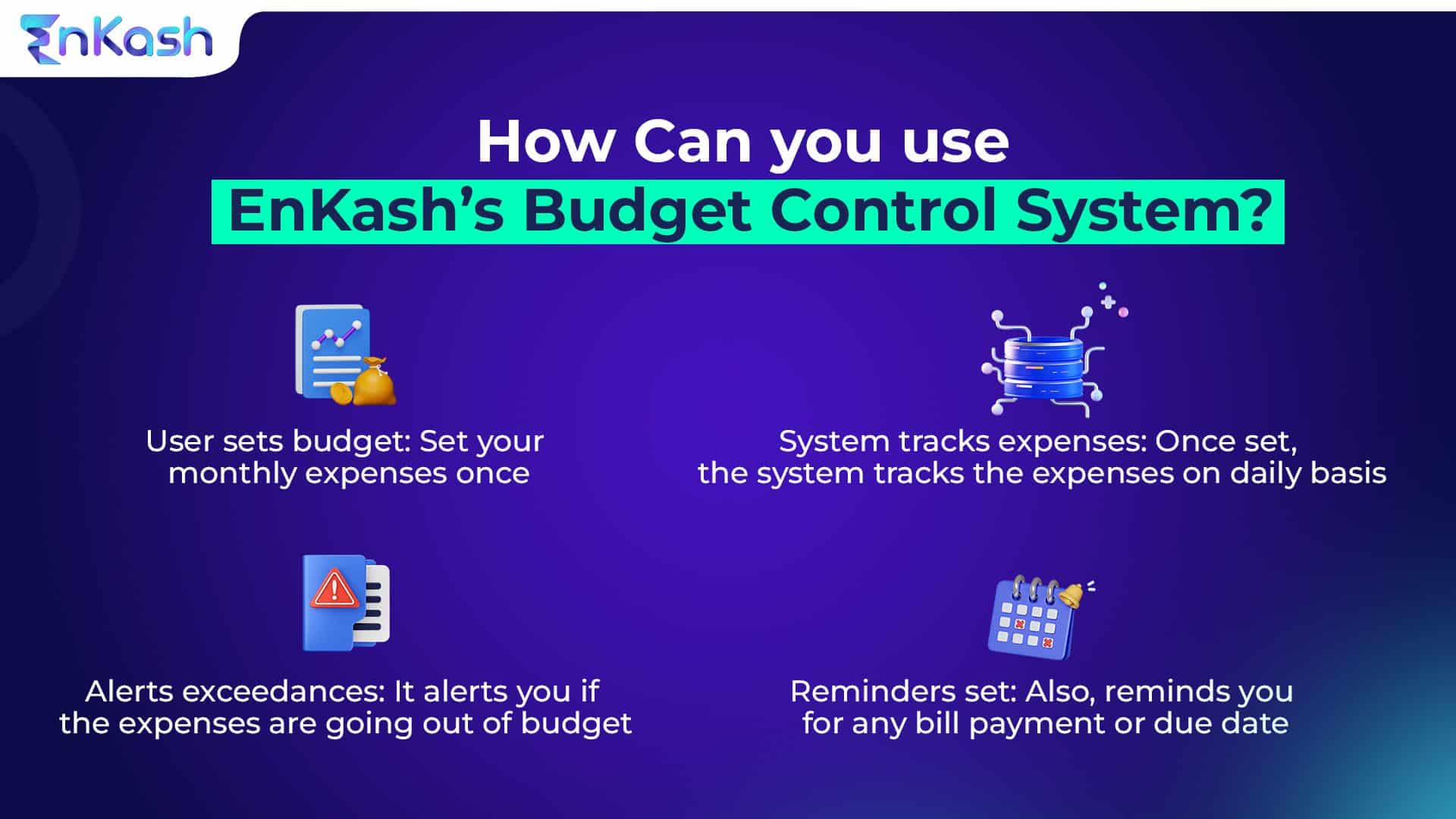

Secondly, implement a system for tracking and monitoring expenses. This will enable you to identify areas where you can reduce costs and optimize cash flow.

Thirdly, use automation to streamline your payable management process. This includes implementing accounts payable software, using electronic payment methods, and eliminating manual processes where possible.

Moreover, it is essential to maintain accurate and up-to-date records of your payable system. This includes maintaining a database of vendors, invoices, and payments, and reconciling your accounts regularly. Additionally, regularly review your payable system’s performance and identify areas where you can improve efficiency and reduce costs.

Conclusion

Efficient payable management is critical for the smooth functioning of any business, regardless of its size or industry. By implementing best practices and automating your payable management system, you can reduce the time and effort required to manage your expenses and payments, improve cash flow, and enhance your credibility with vendors.

Establishing effective communication channels with vendors is essential to ensure that invoices are processed accurately and payments are made on time. Moreover, building a positive relationship with vendors can help you negotiate better payment terms, discounts, and other incentives that can benefit your business in the long run.

While automating your payable management system can be beneficial, it is essential to consider the cost and suitability of the software for your business. It is also crucial to establish clear policies and procedures for processing invoices and making payments, track and monitor expenses, maintain accurate records, and regularly review your payable system’s performance.

In conclusion, efficient payable management is critical for any business that wants to maintain financial stability, improve cash flow, and enhance its credibility with vendors. You can streamline your business operations and achieve long-term success by implementing best practices and automating your payable management system.