Accounting is a key to the success of any business that gives ultimate success in a business. And if you do not have business accounting software, you can’t imagine how much loss you are going to face towards the success of your business.

In the present day, many firms are there to assist entrepreneurs because most of them do not go with accounting software. This article is for the SMEs and entrepreneurs who need to know what happens when accounting fails and the list of best accounting software in India.

When starting a new business, it is important to have a fixed vision in mind. From figuring out expansion plans to devising a scalable strategy, every move needs to be planned. Moreover, if the business plan covers accounting software, then it is an advantage for a business.

The accounting software price in India is nominal and entrepreneurs can easily afford the same. Every business begins with a plan of growing; ideally to have multiple branches spread across the country, and in due time, become a global brand. With such massive corporations come massive scalability issues. One major setback could be accountings and finance.

Working capital is what keeps the wheels of the company moving. A steady cash flow, complemented with profits, can take your business to newer heights. While it is ambitious to keep growing and expanding the boundaries of your business, it is also essential to identify and pre-empt the issues that may arise from that growth.

When your business is spread across different cities and time zones, problems may arise in handling expenses but that can be covered up via expense management software.. To move money easily between different branches, you might end up creating multiple bank accounts.

While it may seem wise at the moment, having more than one account for your business can lead to more problems than solutions. Let’s shed some light on the challenges that a business finance team can face upon having separate accounts for multiple branches.

Challenges Faced by Business Finance Teams

Lack of Visibility

When your business has multiple bank accounts, it gets tough for the finance team of the head office to report actual numbers because the data is spread across multiple locations that do not communicate in real-time. Visibility of cash flow is crucial to make an important executive decision regarding upcoming payments and purchases.

When you do not know where exactly your business stands in terms of working capital, you cannot think two steps ahead to grab an opportunity before it is lost forever.

Monitoring Finances

With multiple bank accounts for one business, it gets hard to keep track of where and how money is being spent as a lack of expense approval system may result in the failure of a business.

This kind of loophole in finances might allow maverick spending habits and inculcate an environment of expense fraud. It is always better to curb the possibility of fraud than to deal with it after it has happened. This could be possible only when the business owners pick one software from the list of top 10 accounting software in India.

Foreign Exchange

When your business is spread across the globe, you’d need to deal with multiple currencies to stay current. Doing so would require real-time currency conversion, local language support, and dealing with transaction fees- all of which can become too stressful to handle manually.

At this crucial point, accounting software is the best option for you as it manages the business account that enables you to go with foreign exchange smoothly.

Multiple Legislations

Multiple countries mean multiple laws and legislations which you need to know to conduct business. Each country has its own set of tax brackets, charges, and other requirements which allows your business to stay compliant with its norms.

Legacy systems cannot be of much help in this scenario. To overcome the various laws of different countries, you need to apply a smart technique, i.e., Business Accounting Software. It will work like an expense approval system to track all your payouts at a place.

Lack of Real-Time Transaction Reports

To maintain a current cash flow summary and detailed reports about the financial health of your business, it is pivotal to have information on finances in all branches. Having offices in different time zones can hinder data reconciliation, which in turn affects productivity and efficiency.

Insurgency

It is never ideal to display your company’s books out in the open. While transparency is highly sought after in this new-age working environment, finances can be a bit tricky to deal with.

If a rogue employee has access and information regarding the business’s working capital, cash flow, and bottom line, they can leak such sensitive information to competitors.

This also might lead to insurgency among the company employees because of influence, power dynamics, and lack of faith. This scenario could lead to real trouble in security and compliance of business finances.

No doubt, Insurgency is a big threat in a company, and to handle the same, you must go with top accounting software in India. The software not only protects your business but also gives a growth shape.

How To Handle Multiple Account Issues In A Business?

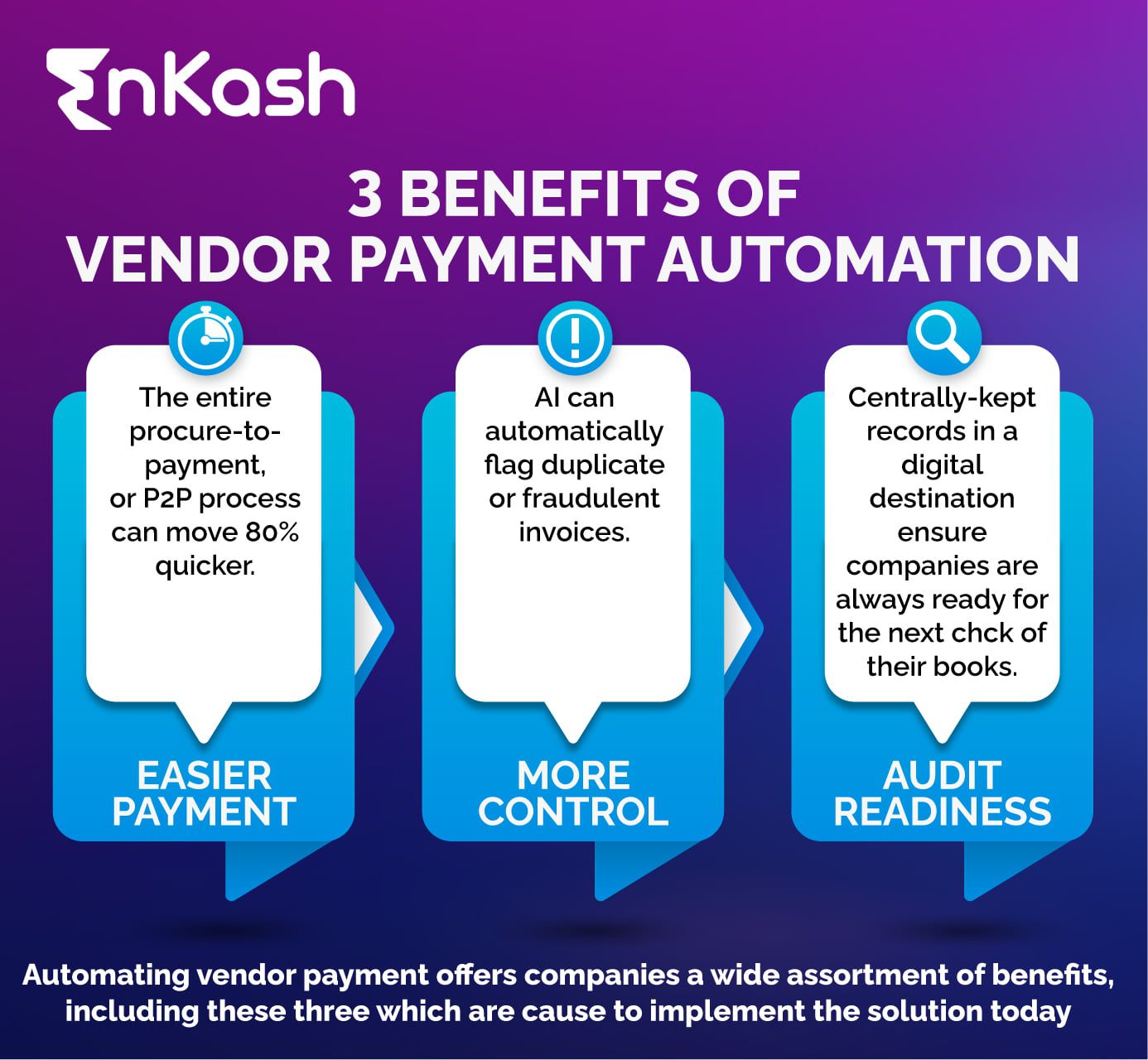

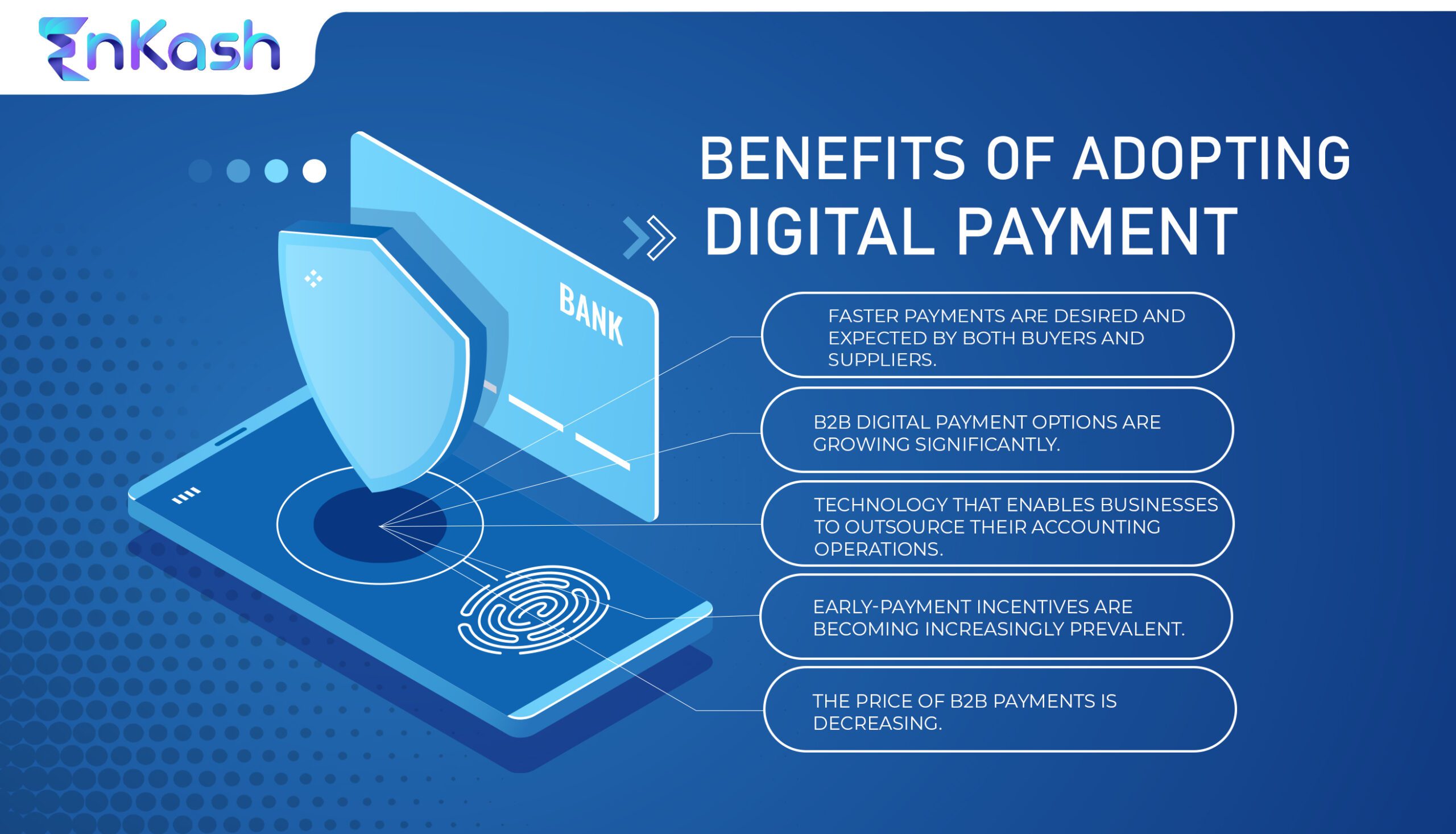

Having multiple branches does not necessarily mean that you need to have multiple bank accounts for all your branches. With expense management software and integrated accounting tool like EnKash, you can achieve centralized control over your finances while enabling decentralized spending.

It’s a win-win situation for you as the business is not under any direct threat of expense fraud while your employees feel empowered to make independent executive decisions regarding purchases and payments. Moreover, you also got the expense approval system control in your hand that is very important to run any business.

Another brownie point that a smart accounting software earns is that each branch can have visibility of their branch’s AR, AP and cash flow whereas the head office has complete visibility of AR, AP, cash flow, working capital, and bottom line of not just individual branches but also of the entire business ecosystem- from a single platform!

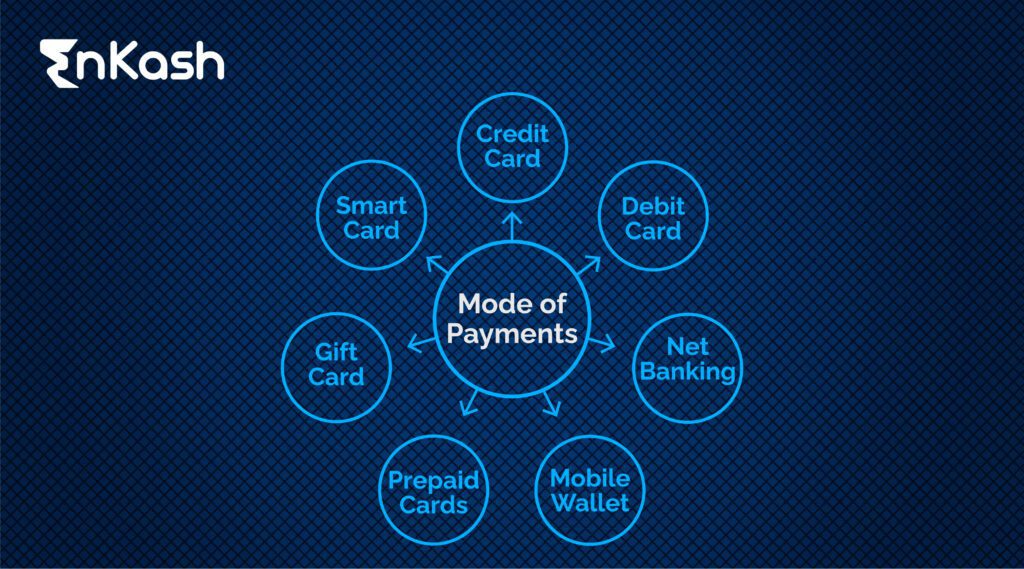

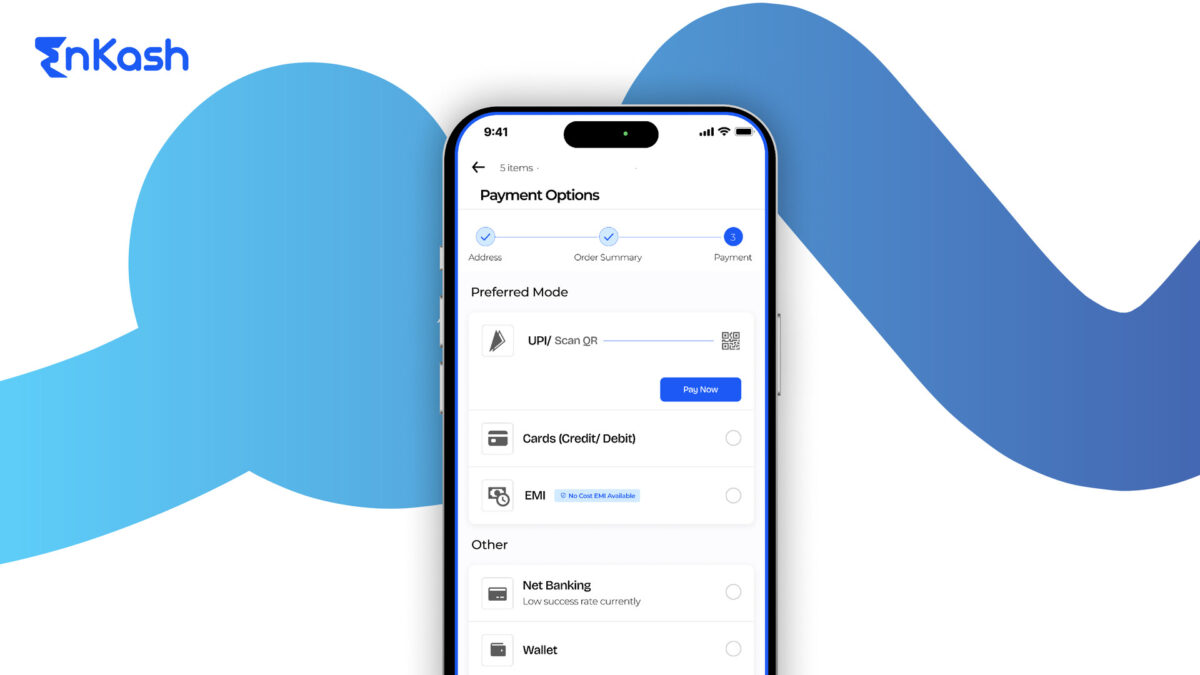

EnKash also offers another brilliant solution as an alternative to separate branch accounts- corporate cards! With a huge variety of corporate expense cards, you can empower your company’s branches to make independent financial decisions while your cash flow is controlled centrally by the head office. Have a glimpse at India’s first Corporate Card for SMEs and Entrepreneurs to manage the expenses on a single dashboard.

Corporate Cards

Corporate cards are one of the business accounting software that can be issued on an employee basis, team basis, or division basis. They can be prepaid cards with a max cap or they can be virtual cards with a one-off spend capacity.

These cards can be issued on the fly and can be used across all merchants. You can also pre-decide the authorised merchants, nature of the expense and also allot a flexible credit cycle for your credit cards. While the spending occurs at the branch level, the control is always regained at the head office level.

Corporate Cards are the finest way to get hold of an expense approval system that gives you the power to handle the money flow without any fear. The head finance division has all the control- they can cancel or block cards if they notice any suspicious spend pattern, if the usage policy is being breached and if any other issue arises that needs to be looked into.

These cards have a superlative level of security because in case of stolen or missing cards they can be blocked at any time from the head office right from the accounting software.

Top 10 Accounting Softwares In India

In the modern-day, technology has overridden almost everything and everyone is following the same to win the race. In a business, there are many obstacles such as security breaches, data leaks, and many more.

To remove such obstacles, you must try a smart tool, i.e., expense management software. The software not only secures your business but will also enhance the same. So, let’s have a glimpse of the top accounting software in India.

- Tally.ERP9

- Zoho Books

- MargERP 9+

- QuickBooks India

- ProfitBooks

- Business Accounting Software

- myBooks

- Logic

- Saral

- Vyapar

The above-listed accounting software will help you to enhance your business. On the off chance, if you fail to judge the right software for your business then go with EnKash. With EnKash, you can create a road map for your business’s success easily and efficiently.

With EnKash, you can create a road map for your business’s success easily and efficiently. If you want to boost your business finances and increase your process efficiency by 50% while decreasing costs by 10%.

Let EnKash work its 8-Step Magic for your business with its intelligent integrated accounting platform that works seamlessly with your existing accounting software and the corporate cards for flexible payment solutions. Also, you can manage and track all your payouts with the best accounting software in India, incorporating EnKash.