For any business to flourish, a corporate credit management and a steady cash flow are crucial. The more working capital your business has, the more strategic decisions can be made concerning investment, talent acquisition, and purchases.

To maintain a healthy cash flow in your business, you need to put firm protocols in place for your Accounts Payable (AP) and Account Receivables (AR). When these two start generating cash flow like a well-oiled machine, that’s when you know that your business will never run out of money.

Cash is king, but it’s not always possible or smart to make cash payments. More often than not, businesses rely on working capital loans or credits for making their purchases and, in turn, paying their invoices or payroll.

Leverage Short-Term Credit management with Corporate Cards

There are two types of credits available in the financial landscape

- A line of credit

- Revolving credit.

Let’s see the differences between the two in detail.

A line of credit is a one-time financial arrangement or a static product that is closed once the borrower spends the set amount of credit, whereas borrowers can use revolving credit and repay it over and over again up to a certain credit limit. Revolving credit and lines of credit are facilities that offer the borrower purchase and payment flexibility.

A revolving credit product can be used up to a certain credit limit and paid down. And it remains open until such time that the lender or borrower closes the account.

On the other hand, a line of credit is a one-time arrangement such that when the credit line is paid off, the lender closes the account.

Both these financial arrangements are available to businesses. Business owners can opt for any of these credit types according to their source of financing and working capital requirements.

Major differences between A Line of Credit & Revolving Credit

Even when the two seem similar, there is one huge difference between the two types of credit-renewal of credit.

While the pool of available credit does not replenish after payments are made in revolving credit, this is not the case in a line of credit. Once you use the line of credit and pay it off in full, the account is closed and can no longer be used.

These two types of credit are substantially different from a typical loan. When you take a loan from any financial institution, you get a lump sum amount of money and the interest gets charged right away.

In a line of credit, you can borrow funds up to a certain amount in the future and the interest is charged only after the line of credit is tapped into.

In revolving credit, like that in credit cards, you are assigned a credit limit in advance. You can borrow any number of times until that credit limit is not breached, and then pay back the amount by the due date. Once that amount is paid off- fully or the due payment amount, the credit is available again to borrow against.

These kinds of credits are usually short-term credits because the interest rate charged on these credits is way higher than normal loans.

Corporate Credit Management Tips

Businesses rely heavily on credit to keep their cash flow consistent. This is where corporate cards enter to save the day. Corporate credit cards, like Purchase Cards powered by EnKash, offer excellent revolving credit which is a boon to businesses that often face cash crunch to pay off their invoices on time.

With a revolving credit line, you can defer your payments to a later date for purchases made on these P-cards.

The advantage of having a powerful purchase card is that you do not have to pay the full amount of the bill right away. For example, if you have a bill of 10 lacs INR on your P-card, you can only pay 50,000 as an initial payment and pay the rest of the bill at a later date

Likewise, by deferring payment to a later date, you are using your revolving credit wisely and can do the best credit management to track where your money goes.

By not paying the full amount, you can use the remaining credit for expansion, purchases, and payments to other overdue invoices. In this manner, a commercial purchase card can boost your business’ financial efficiency by boosting your cash flow. Also, you keep your eyes better on the source of financing working capital.

What EnKash do for your business?

With an EnKash purchase card, you will never have to face cash crunch situations because you have the option to partially settle the bills along with customizable credit cycles. Team it up with an intuitive spend management platform like that of EnKash and you’ve got yourself centralized visibility in your business finances along with control over where your money goes because you can prioritize payments based on their due dates automatically.

A purchase card can be the best weapon in your financial arsenal if you use it wisely. Direct all your corporate expenses to your P-cards and enjoy revolving credit, customized credit cycles, faster payments, and improved cash flow- all in one go.

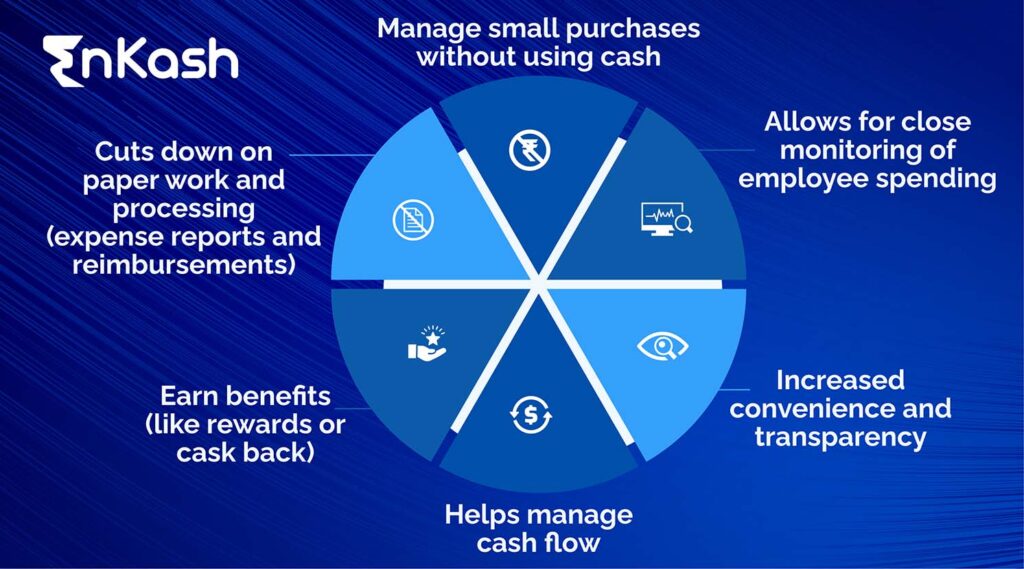

Additionally, corporate cards have many more advantages. It can eliminate most of the manual work that goes behind making payments as it is completely digital. With corporate cards, you can get real-time updates on all the transactions made on the card, and hence, reporting is faster and more detailed.

Employees can also enjoy the perks of digitization with the power of P-cards. It’s a hassle-free way of paying which empowers purchasers to make decisions faster. The finance team can have complete visibility on the expenditure on these cards as it happens so they can leverage the revolving credit into grabbing opportunities whenever they arise.

So, what are you waiting for? Revolutionize your procurement process with corporate credit cards like P-cards from EnKash and make that cash flow!

EnKash is not only a Corporate Credit Management Solution but also freedom for your financial capital management headache.