Are you struggling to get a loan or credit due to a poor credit score? Well, did you know you have the ability to increase your CIBIL score in days by simply changing your behavior towards the credit? A credit score is considered to be one of the most important factors when applying for a loan or a credit card.

At EnKash, our customers often ask us how they can improve their credit score. In this article, we are sharing some easy tips on how to increase your CIBIL score to help you handle your finances better.

Why Do You Need a Good Credit Score?

A good credit score is important because a score of 750 and above will help you get better and quicker loans, premium credit cards, etc. at attractive interest rates. In contrast, a poor credit score can create a lot of issues when you need funds immediately. Not only this, it leads to higher interest rates and fewer loan options. Hence, maintaining a good credit score is essential to meet your future financial needs.

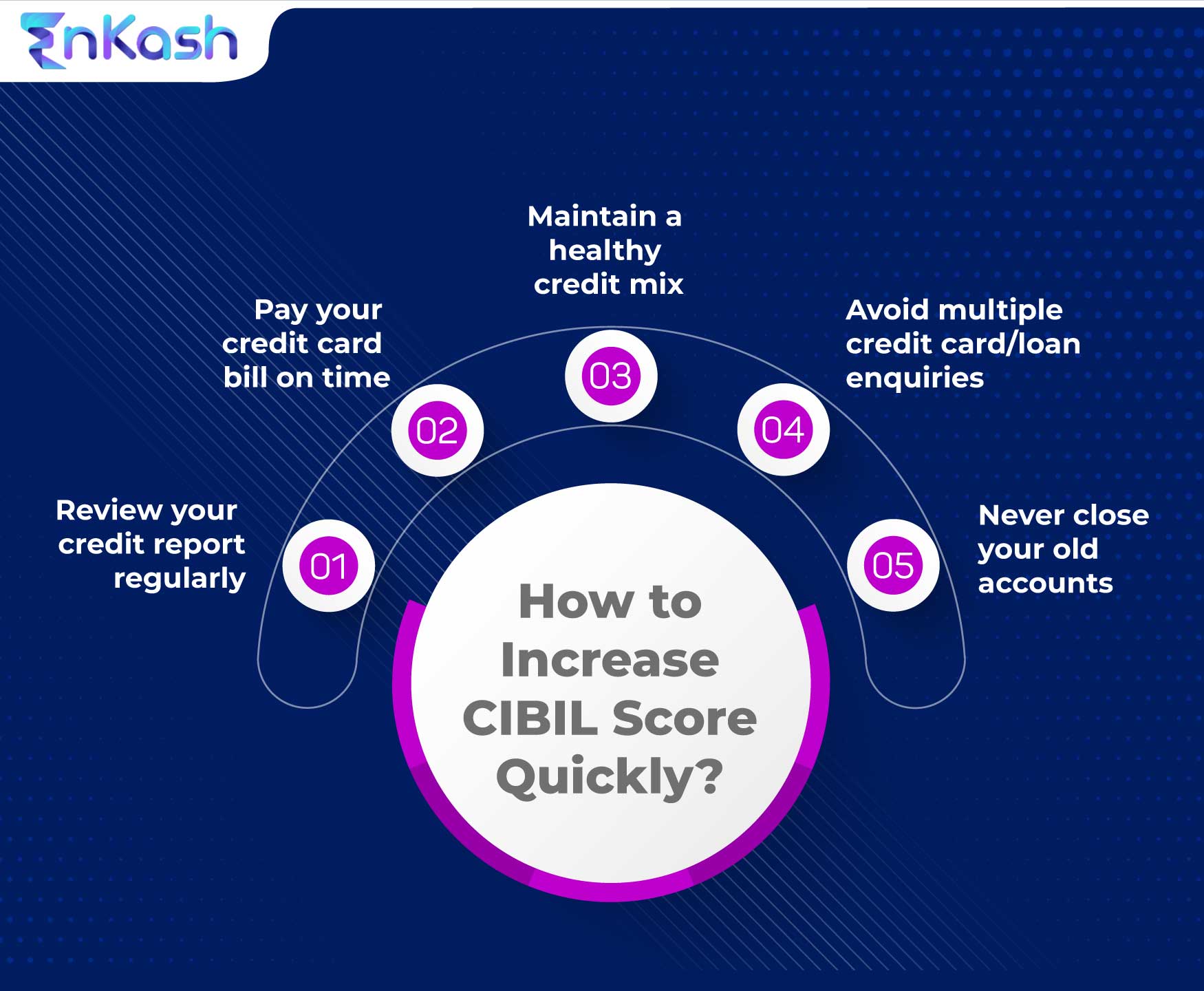

How to Increase CIBIL Score Quickly?

You can follow the tips mentioned below to help you increase your credit score in no time:

5 ways to keep a check on your CIBIL Score

- Review Your Credit Report Regularly

You must track your credit report regularly to stay updated on your credit score. Moreover, it helps you to keep a track of any errors in your credit report. You can immediately raise a dispute for any sort of inaccuracy in your credit report to the CIBIL and get it updated at the earliest. This will help you improve your credit score.

- Pay Your Credit Card Bill on Time

Do you know every bill that you miss paying lowers your credit score? However, it is important that you pay your credit card bill on time to help you improve your CIBIL Score in the long run. Remember, you must pay the total amount due on your credit card since the outstanding amount along with the new transaction on your credit card will attract an interest rate which will again adversely impact your credit score. The easy way to pay your dues on time is by setting the payments by setting up reminders, auto-pay mode, etc. - Maintain a Healthy Credit Mix

One of the foremost reasons for a low credit score is unsecured loans i.e., personal loans, business loans, etc. These loans are sanctioned without any collateral. This makes such loans high-risk in nature in comparison to secured loans i.e., auto loans, home loans, etc. However, to improve your credit score, you should always create a healthy credit mix of secured loans and unsecured loans since this no longer makes you a high-risk borrower for the banks.

- Avoid Multiple Credit Card/Loan Enquiries

Another way to improve your credit score is by limiting your loan and credit card applications as it gives a wrong impression to the lenders about you being ‘credit hungry’.Not only this, it might come across as if you might already have an additional debt and may not to repay it later. - Never Close Your Old Accounts

You must never close your old account as it shows your long association with the banks and financial institutions along with your long repayment history. If you decide to close your old accounts, it completely nullifies all your previous records with the issuing bank. Hence, it will negatively impact your credit score.

The Bottom Line

A credit score of 750 and above is usually considered a good credit score by most lenders. However, if you want to avail a loan or a credit card at lower interest rates make sure you consider the above simple tips to see a gradual increase in your credit score.