An entrepreneurial wave has engulfed the day. At present, the number of new (recognized) startups is well over 127,000, a terrific rise from 726 (in 2016-17)—one major factor being the rise of fintech players in recent years. Thanks to them, all businesses, especially those that start from scratch, can now fuel their startups with easy money or “working capital loans”, often with no collateral.

The fundamentals of business are quite simple & universal:

Money makes money: Startups earn more when they invest more, be it in inventory, resources, marketing, etc. However, money is a complex entity, because people believe that a business that has to take out loans from the market isn’t doing well, which in reality is not correct.

We say a smart working capital loan can build a roadmap to IPO listings! And you’ll agree to that as you read along.

What is Working Capital Loan?

We often dread a loan for its never-ending cycle of EMIs. But unlike a home loan or a car loan, a “working capital loan” is much easier to avail and vital for a business

Working capital is a continuous want; one needs a consistent cash flow to pay the people who work for you (“payroll”), to pay the “rent” for the land used, for the machineries, and to restock components/ finished products for future needs (“inventory”).

Company revenue may fluctuate monthly, seasonally or quarterly, but cash needs don’t. In short, working capital is the money that keeps your startup going on a day-to-day basis. And a working capital loan makes sure you always have enough working capital in hand.

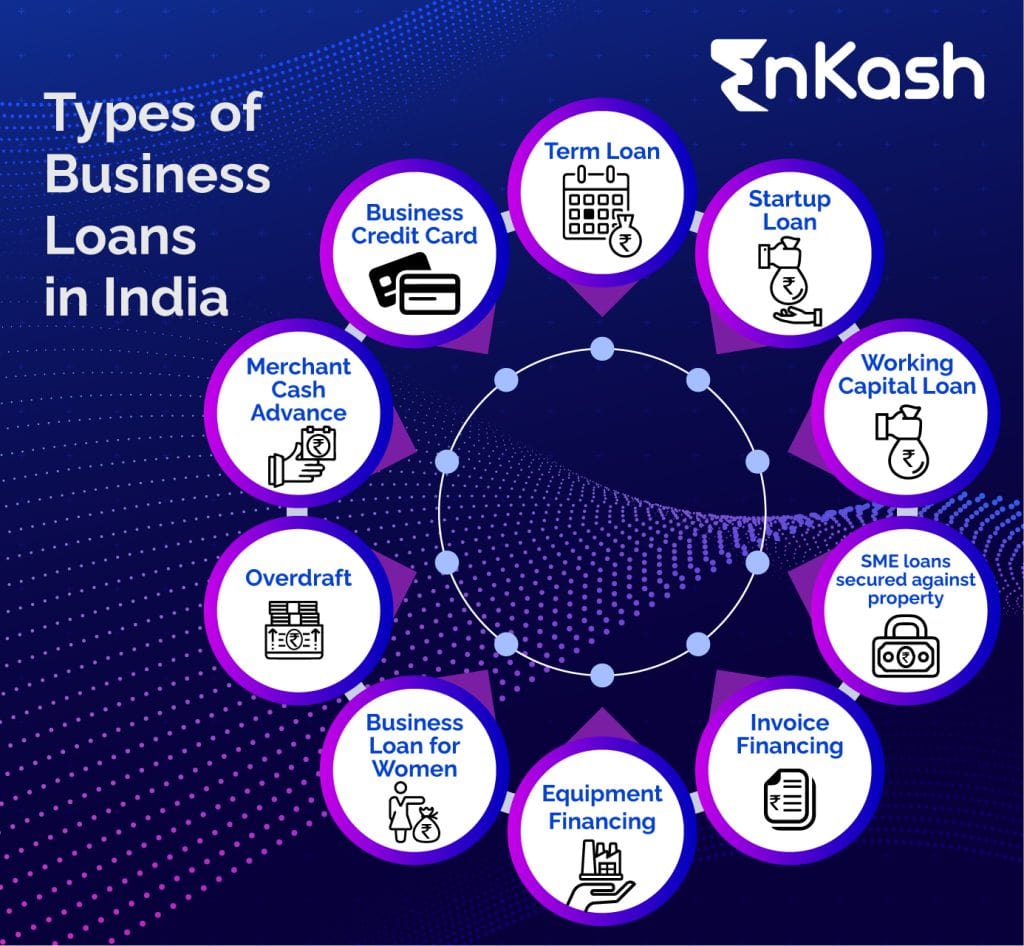

Types of Working Capital Loan available for SMEs & Entrepreneurs:

Working capital loans are basically two types: Secured loans (collateral required) and Unsecured loans (without collateral).

Some popular working capital loans are:

- Bank Overdraft/ Line of credit: This loan is gained through a pre-approved withdrawal limit on your current bank account.

- Merchant cash advance/Factoring: This is the loan availed against future credit transactions instead of the current sales receipt; here, the fees can be high, and it might affect your future credit score too.

- Short-term loans/Installment loans: a secured loan type, this is one of the better-known working capital finance options used by Indian SMEs. It is the money lent against a fixed interest rate for one year or less.

- Business Credit cards: Corporate cards like the Credit Card are unlike traditional loans, are used to finance unforeseen capital needs and can be your all-in-one virtual card for all business transactions.

- Equity Funding: Many early startups use personal resources or investors (family and friends) against the startup’s part (equity share).

- Trade creditor: This is the loan availed on placing bulk orders. Usually, suppliers lend such loans to SMEs.

Learn How EnKash Can Help You Boost Working Capital

Why & When do you need working capital finance?

Consider the following scenario: Prasad, a 32-year-old farmer, decides to start an agritech startup.

He has the expertise, the technology, and the human people. He decides to bet on his idea by selling some of his assets and is making decent revenue. People like his products, but product sales is limited.

There is also a backlog of non-payments from clients, which will take time to recover. In technical terms, his company’s liquidity (or cash in hand) is diminishing without affecting its market value.

His key concerns are:

- How does he pay his people for the following month?

- Should he make further purchases to stock up his inventory?

- Should he invest in marketing?

- Has he failed as an entrepreneur?

If you are living this dilemma, don’t fret! You are not alone. In India, millions of startup founders & merchants, from the smallest Kirana store to the largest supply chain owners, face this problem (or a part of it).

Many would agree that Prasad can perform much better if he gets monetary aid. And that is exactly where top fintech companies in India 2020, like the EnKash, enter the scene.

Capital finance will help startups with the following:

- Fulfilling cash needs for rent, payroll, inventory, and other daily operations is vital for sustenance.

- Improve the company’s growth curve with marketing and achieve increased retail sales.

- Improve the company’s liquidity status until recovery from unpaid invoices.

- Invest more in future plans of expansion

Check your eligibility before approaching for a loan!

Loan eligibility varies from lender to lender but here are some general eligibility criteria that are taken into consideration:

Business Age: It is necessary for a business to be operational for at least a year for it to be eligible for a loan.

Credit Score: Most lenders require you to have a good credit score (typically above 700) as it shows that you can handle debt easily and can make timely repayments.

Annual Revenue: Another important factor is yearly revenue, having a good yearly revenue is important as it tells a lender about your repayment capacity

Business Plan: A solid business plan showcasing your future projections and growth strategies can strengthen your loan application.

Documents Required for Working Capital Loans

The specific documents required will vary depending on the lender, but common requirements include:

- Filled out application form with photographs

- Aadhar Card, PAN Card, Driving license, Voter ID Card, Passport, and Utility bills of the applicant

- Business registration documents like certificate of registration/incorporation

- 1 Year Bank statement

- If the lender requires, he can ask for more documents

5 Quick Ways To Get Financial Help From Lenders In India

Financial aid, in the face of an emergency, can be quickly availed through:

- Lending from friends and relatives for quick cash.

- Applying for quick, collateral-free loans on fintech platforms like EnKash (where the loans can be approved within 3 business days and zero collateral, all through a DIY interface).

- Mortgaging of land/ property and eligible assets against withdrawn amount.

- Applying under Pradhan Mantri Rozgar Yojana (PMRY) and other eligible government schemes (under PMRY, eligible candidates can avail up to 5 lakh of loan for business setup).

- Availing gold loans against mortgaged jewelry and valuables.

Benefits of Working Capital Loans

Financial Stability and Flexibility: Having a working capital loan can benefit a business in numerous ways, it can give a business the ability to manage cash flow for operational expenses like salary disbursement, rental payment, utility payments, and investment in inventory/stocks. Moreover, it also paves the way for a business to continue smooth operations even when the market is down.

Enhanced Business Growth: With access to working capital, businesses can invest in strategic initiatives to drive growth. Whether it’s expanding marketing efforts, launching new products or services, or entering new markets, working capital loans empower entrepreneurs to take calculated risks and pursue avenues that can lead to increased revenue and market share. This ability to invest in growth initiatives sets the stage for long-term success and competitiveness.

Improved Cash Flow Management: Managing cash flow is crucial for sustaining operations and meeting financial obligations. Working capital loans provide a buffer against cash flow challenges caused by delayed payments from customers or unexpected expenses. By bridging gaps in cash flow, these loans prevent disruptions in business operations and allow for smoother financial management, reducing the risk of defaulting on payments or missing opportunities due to cash shortages.

Operational Efficiency and Agility: Timely access to working capital enables businesses to operate more efficiently and respond swiftly to market dynamics. Whether it’s taking advantage of supplier discounts by making bulk purchases, securing timely payments to suppliers and vendors, or optimizing inventory levels, working capital loans empower businesses to streamline operations and enhance overall efficiency. This agility in operations is especially crucial in competitive industries where quick decision-making and execution can make a significant difference.

Crisis Resilience and Risk Mitigation: In times of crisis or economic uncertainty, having adequate working capital becomes even more critical. Working capital loans provide a safety net that allows businesses to navigate through challenging periods, such as economic downturns, market disruptions, or unexpected emergencies. By having sufficient liquidity, businesses can withstand temporary setbacks, sustain operations, and position themselves for recovery and future growth.

Strategic Investment Opportunities: Beyond day-to-day operational needs, working capital loans enable businesses to seize strategic investment opportunities that can drive long-term value. Whether it’s acquiring key assets, investing in technology upgrades, or pursuing mergers and acquisitions, access to working capital empowers businesses to make strategic decisions that contribute to their competitiveness and market position.

Credit Building and Financial Health: Responsible utilization of working capital loans can contribute to building a positive credit history and improving the financial health of businesses. By demonstrating the ability to manage debt and meet financial obligations, businesses can enhance their creditworthiness, access larger loan amounts at favorable terms in the future, and strengthen their overall financial standing in the eyes of lenders and investors.

To know more, visit EnKash. You can also click below on Signup Now and we will reach out to you soon.