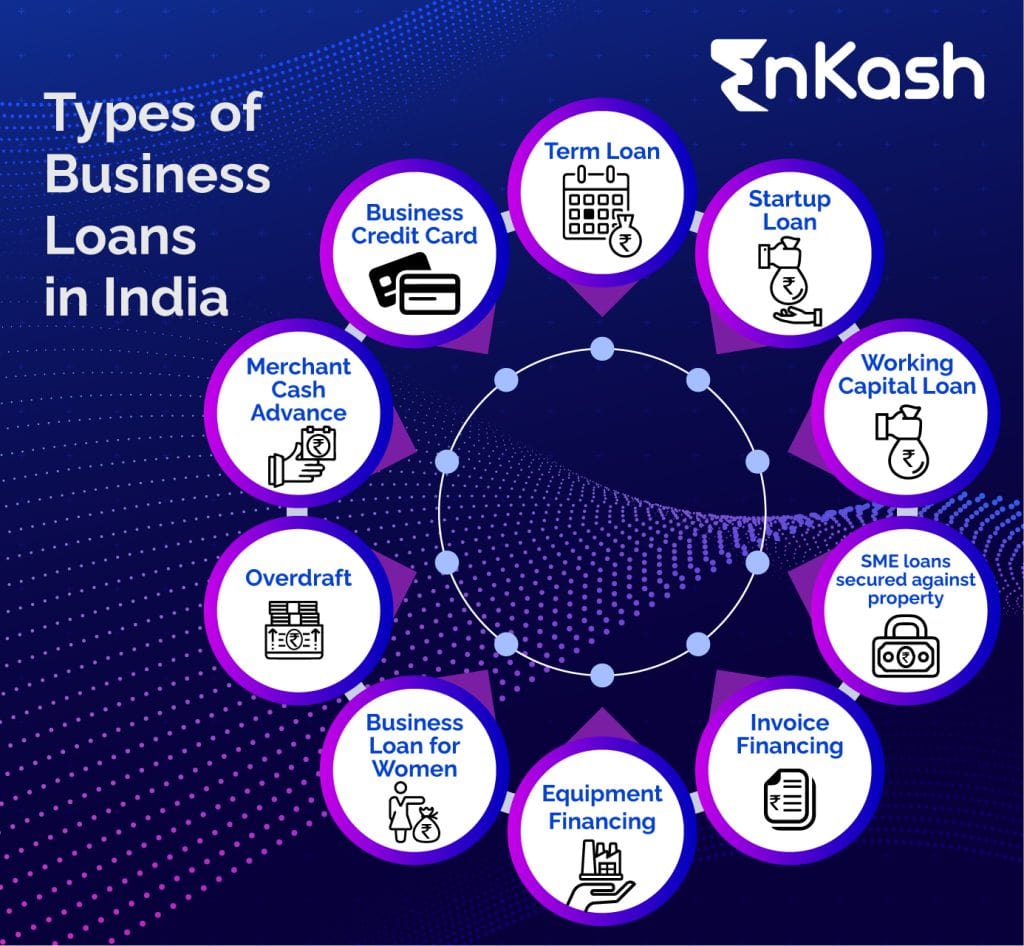

A corporate credit card is an incredible financial instrument for businesses to carry out financial tasks with ease. It offers the business complete and centralized control over the company funds, which ultimately allows them to take strategic business decisions regarding necessary expenses.

Corporate Card: Meaning and Advantages

A corporate credit card is a financial tool similar to a standard credit card but is used essentially for corporate needs. The company issues these cards to a selective group of employees to carry out important financial expenditures on behalf of the corporate firm. To further simplify corporate card meaning and its extensive usage for growing business, listed below are some of the most prominent advantages which make it the ultimate financial instrument for businesses.

- A corporate credit card allows the business to manage, control and streamline all the company funds under one domain

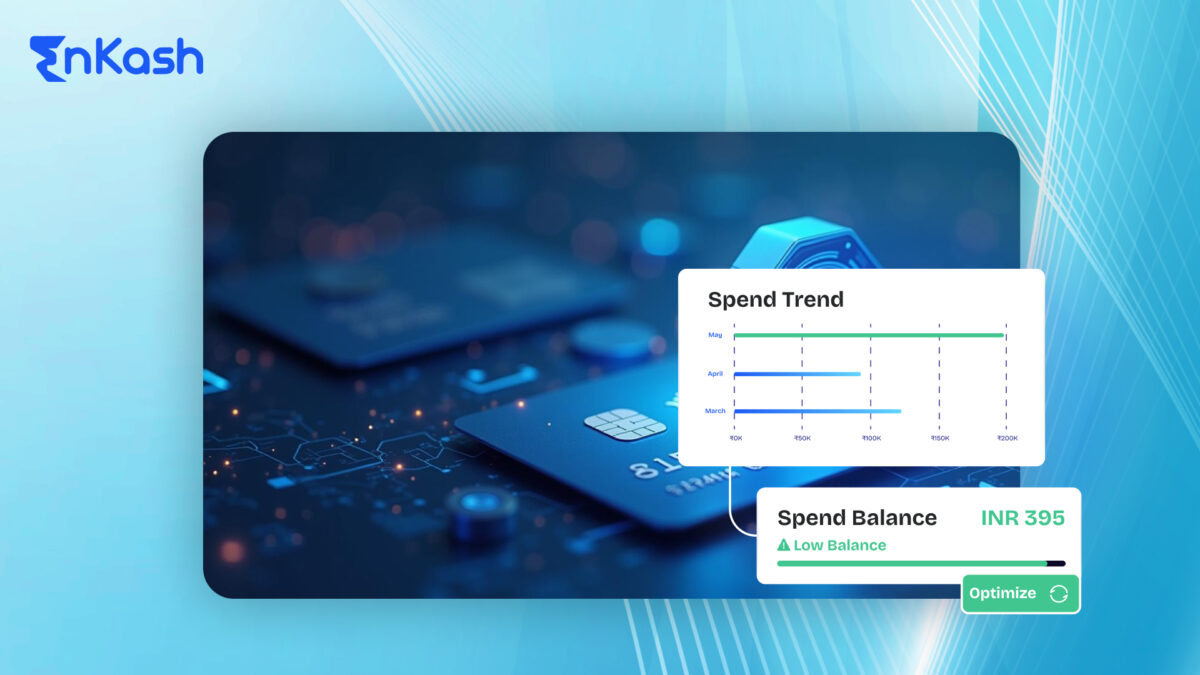

- A business can track its financial expenditure and formulate strategic plans to curb unnecessary spending with corporate credit cards, India

- The company can even set limits on the card to avoid incidents of overspending

- Also, with the help of corporate credit cards, companies can now have a bird’s eye view of their business finances; this allows them to track any potential financial leaks

- Additionally, a corporate credit card in India improves the employee’s efficiency and productivity exponentially, as they do not have to go through the complicated procedure of reimbursements

A corporate card opens a multitude of excellent business growth opportunities, but only if the company has a stringent and reliable corporate card policy in place. In addition, a corporate credit card policy and procedure allows the company to set proper regulations for the employees to adhere to and benchmarks for other corporates who want to do business with them.

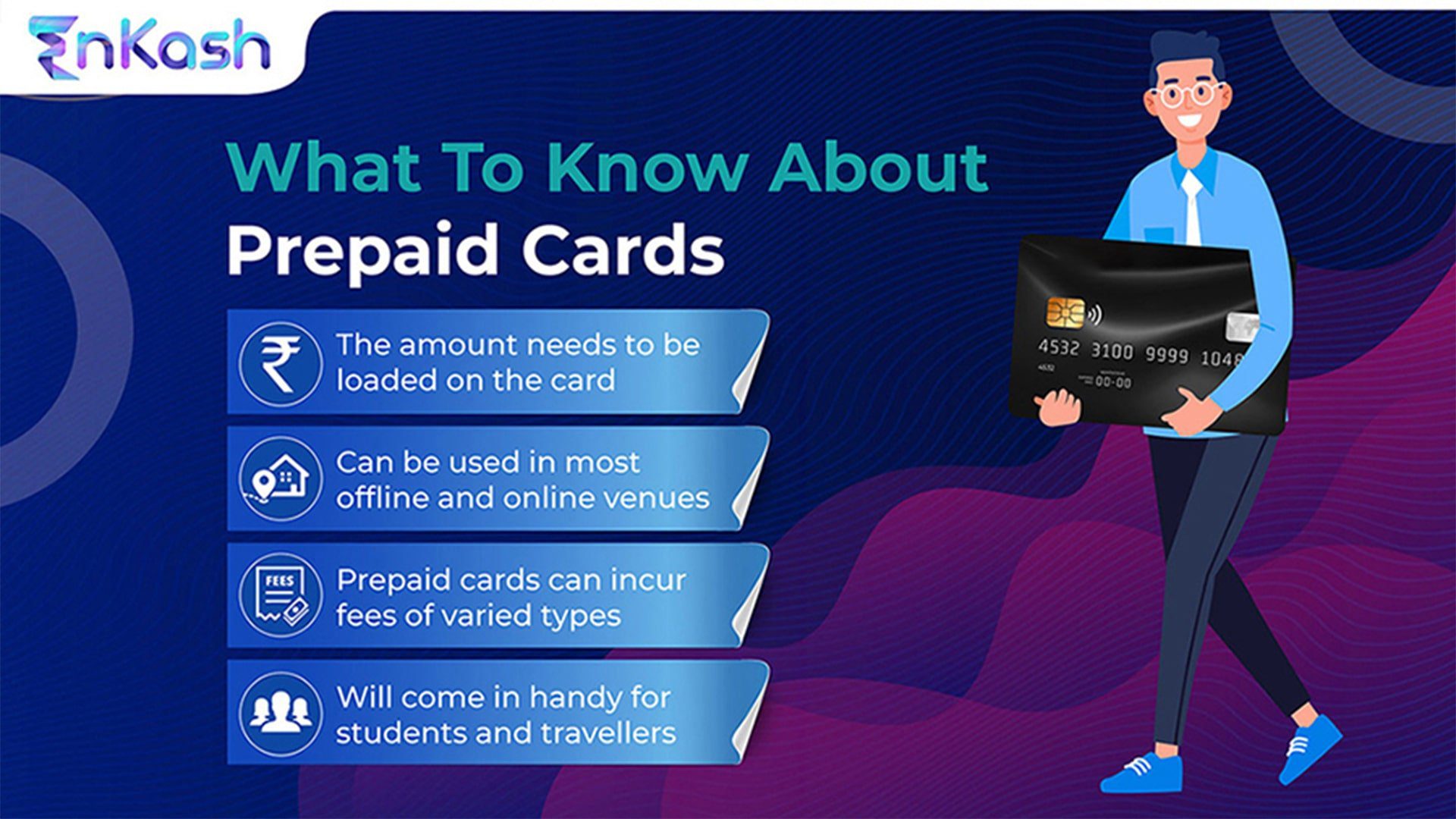

Also, corporate credit card is easy to use and functions exactly like a standard credit card. But compared to regular credit cards, a corporate card is more secure and convenient to use. Additionally, it allows the company to set limits on the withdrawal amount irrespective of the available balance amount on the card. However, firstly, a corporate credit card must be loaded with funds by the company to make transactions possible. As a next step, employees must be informed about the corporate credit card policy that highlights the usage rights to avoid accidental or deliberate malpractices.

What is Corporate Credit Card Policy?

A corporate credit card policy is all the listed regulations that employees must abide by as these are complaisant rules for responsible and fair usage of the corporate card. The policy holds the power of accountability, responsibility and usage rights applicable to the cards issued by the company to the employees to make authorized business expenses.

The company formulates the corporate credit card policy and procedures to protect itself in case of any unauthorized or unfair use of the card. In addition, the card protects the employees in case of phishing, as a corporate credit card is a highly secured financial instrument.

Importance of Corporate Credit Card Policy and Procedures

Having strict corporate credit card policy guidelines enables the business to avoid the risk of misuse by employees. The guidelines are binding to the employees and ensure fair and authorized usage.

The purpose of the corporate credit card is defined in the policy to help the employees understand their contractual agreement for making payments on behalf of the company. The company expense process and policy educates the employees on their role and responsibility with regard to the corporate card issued to them.

The business credit card policy guidelines clearly define who is eligible to use the card and under what circumstances to restrict employees from sharing the cards with other employees who are not entitled to use them.

Furthermore, the company also gets complete control over the spending limits on every corporate credit card, which complies with the policies and guidelines to avoid deliberate or accidental overspending by employees.

A company-provided credit card policy document is available to the employees to ensure they completely conform to the policies stated to avoid causing any unintentional accounting lapses.

Corporate Credit Card Policy Best Practices

For companies that deal with multiple vendors, issuing a corporate credit card to their employees simplifies the accounting procedure just like credit policy makes lending easier. It also reduces the efforts required to apply and approve funds between the management and the employees for the use of business expenses.

But issuing corporate cards to various employees can also lead to problems like accidental or unauthorized spending by the employees. That is why the company needs to set firm corporate credit card guidelines before handing out the cards to ensure fair use of the corporate card.

Below are some of the foundational corporate credit card best practices to ensure the employees understand and comply with them.

- Stating clear and concise responsibilities that come with holding a corporate credit card. The employees should know the repercussions of misuse and the benefits of proper usage of the corporate cards beforehand

- Corporate credit card spending limits should be informed to the employees to ensure they take strategic financial decisions on whether or not the expense is a top priority at the moment

- Authorized expenses should be listed in the policy clearly to make sure the employees avoid instances of personal spending using the corporate credit card in India

- Additionally, the business credit card policy guidelines should mention steps to take in case the card gets stolen or lost

To know more, visit EnKash. You can click on Book A Demo and fill in the details required; we will reach out to you.