If you own a business, you’d know how hard it is to stay in check when it comes to business expenses. Even if you plan each expense down to a single rupee, you still find yourself struggling to manage a steady budget at the end of a quarter. So, if you want to manage the cash flows of your business, then best accounting software is required. And here, you will find everything related to the EnKash budget management tool – A Must Have Tool For Your Business Productivity.

Impact of cash mismanagement on Business and Solution

Overspending on purchases, not leveraging early payments deals and rewards, poor management of travel and entertainment spends, unchecked maverick spending by employees, late payment fines, unexpected purchases- these are some of the numerous reasons that can throw your budgets off balance and set you back from achieving your financial goals. Nightmarish enough? Chuck away all your woes because the answer to your prayers is here! EnKash- an all-in-one spend management suite for all your business spending and budget management.

EnKash offers a powerful self-service platform that could be tailored to fit all your business needs. Automate your payables, speed up your receivables, track your spends and manage your business promotion expenses- do it all with EnKash spend management platform. With EnKash, never go over budget again!

Let’s take a look at the salient features of the EnKash Spend Management Platform that make it one of the leading corporate spend management tools in India.

Best Features of EnKash Business Expenses & Spend Management Tool

Industry-first Transaction Control Dashboard

EnKash offers a never-seen-before interface that acts as a single point of information visibility. You can keep an eye on all the financing activities cash flow as they happen, the cards you have issued, the policies you’ve enforced- see it all as it happens. And not just monitor, you can also control the spending liberty on the go.

Centralized Control, Decentralized Spending Liberty

One of the many benefits of the EnKash platform is that it allows you to offer spending liberty to your employees and teams spread across the branches and still retain complete control over how the spending can happen. The brilliance of this feature is that you can keep maverick spending in check while empowering your employees to make independent decisions regarding purchases.

Proactive Policy To Manage Budgets

The best part about the EnKash Spend Management platform is that it gives you scope to set cash flows constraints in place and set company-wide spend policies that could be communicated to each employee that is plugged in on the interface. With a centralised system, adherence to policies can be maintained effortlessly.

Saves Time, Money, and Effort

Automation is the best tool to eliminate redundant manual tasks. Digitizing your spend management can help your workforce focus more on revenue-generating tasks rather than spend time and energy on boring work. It also helps in saving hidden costs associated with enforcing third-party spend management practices and hiring extra personnel to oversee operations.

Real-Time Spend Visibility

With a centralized spend management platform, financing activities cash flow can be easily monitored. You can keep track of which employees spend what amount at which merchant, keep a record of the transaction history, and maintain digital receipts of all expenses- all on a single platform. With such a high level of visibility, you can think ten steps ahead to strategize your cash flows to best utilize your business’s working capital to the optimum level.

Easy Reporting

With digital transaction receipts, it gets simple to generate an audit trail for your business expenses. Storage and retrieval of data are super-fast and easy because of expenses being stored on the platform. Maintain a full audit trail of requests, approvals, reviews, and exports. You can also back up the financial data on the cloud to eliminate the chances of data loss.

Effortless Integration

EnKash Spend Management platform integrates flawlessly with your existing HRMS, Accounting, and other in-house systems. Such collaborative architecture boosts your business without compromising existing data.

Reduced Risk

Eliminate the possibility of expense fraud to the maximum level with the EnKash Spend Management platform. Generate single-use, capped virtual cards for one-off purchases on digital or on-road POS. These cards come with pre-approved budgets and approvals so you can save precious time and make decisions faster.

See the power of EnKash – A Seamless Money Management Tool.

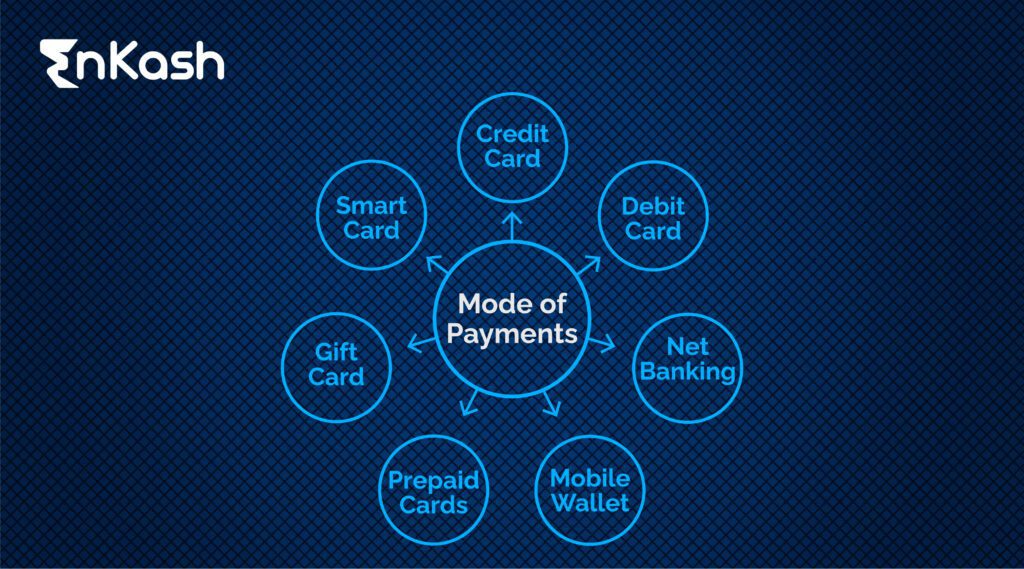

EnKash offers a host of other corporate expense cards that can sort out all kinds of business expenses by enabling card payments even where cards are not accepted. The power of the EnKash Spend Management platform can be fully understood only when you become a part of the EnKash family and experience it yourself. Take your business to newer heights with EnKash. Call us for a free demo to see what your business is missing!