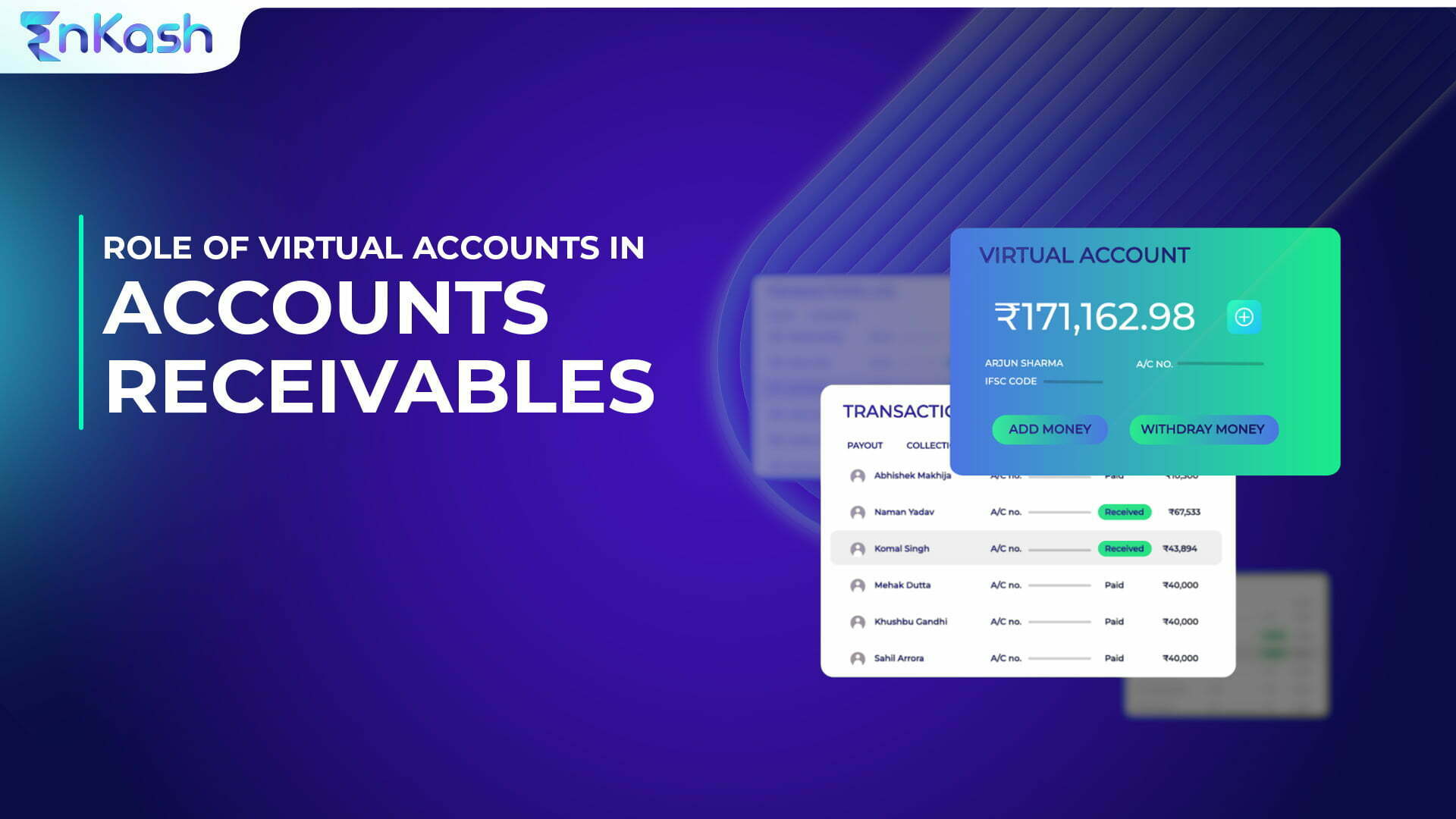

What is a virtual account?

A virtual account is a unique identifier assigned to a customer or a group of customers within a company’s banking system. It allows businesses to segregate and manage funds efficiently, enhancing visibility and control over their receivables. Each virtual bank account can be associated with a specific purpose, such as a particular project, department, or even individual customers.

What are virtual account numbers (VANs)?

Virtual account numbers (VANs) are alphanumeric codes generated for each virtual account. These numbers act as identifiers for transactions associated with a particular virtual account. VANs enable businesses to track incoming payments accurately, as each transaction can be linked to its respective virtual account.

How is a virtual account different from a regular bank account?

Unlike regular bank accounts, virtual accounts do not require the establishment of physical bank branches or additional documentation. They can be set up quickly and easily through digital platforms, making them a more accessible option for businesses.

Here are five key differences between a virtual bank account and a regular bank account:

Virtual bank account |

Regular bank account |

|

Account Setup |

Quick and digital process |

Requires physical presence and documentation |

Access |

Managed online or through a digital platform |

Physical branch or ATM access |

Cost |

Lower operational costs |

May involve maintenance fees and charges |

Account Segregation |

Can create multiple virtual accounts for specific purposes |

Typically one account per customer |

Reconciliation |

Automated reconciliation of payments |

Manual reconciliation required |

Please note that while virtual bank accounts generally have these characteristics, there can be variations based on the specific virtual bank account provider or regular bank.

How to collect payments via virtual accounts?

EnKash provides a seamless and user-friendly platform for businesses to collect payments through their virtual accounts. Here’s a step-by-step guide on how to collect payments via EnKash’s virtual accounts:

Sign up and set up your account

Visit EnKash’s website and sign up for an account. Provide the necessary information and complete the registration process. Once your account is set up, you can start creating virtual accounts tailored to your specific needs.

Generate virtual accounts

Within your EnKash dashboard, you can easily generate virtual accounts for different customers, projects, or departments. Assign each virtual account a unique identifier or Virtual Account Number (VAN) to facilitate accurate tracking of payments.

Share virtual account details

Communicate the virtual account details to your customers or clients. This includes providing them with the specific VAN, along with any other relevant information required for payment processing.

Receive payments

Customers can initiate payments by transferring funds to the designated virtual account associated with their transactions. They can do this through various payment methods, such as bank transfers, online payment gateways, or mobile wallets.

Automated reconciliation

EnKash’s platform automates the reconciliation process by matching incoming payments with the respective virtual accounts. This eliminates the need for manual intervention and reduces the chances of errors or discrepancies.

Real-time monitoring

Monitor the status of incoming payments in real-time through the EnKash dashboard. Gain visibility into payment receipts, pending transactions, and any other relevant information related to your virtual accounts.

Generate reports and analytics

EnKash provides robust reporting and analytics features that allow you to generate comprehensive reports on your accounts receivables. Analyze payment trends, track outstanding payments, and gain valuable insights to inform your financial decision-making.

Cash flow management

With EnKash’s virtual accounts, you can efficiently manage your cash flow by segregating funds into different virtual accounts. This provides you with a clear view of your receivables, making it easier to allocate funds and plan your finances effectively.

Integration with existing systems

EnKash’s virtual accounts seamlessly integrate with your existing financial systems, making it convenient to incorporate them into your existing workflows. You can leverage EnKash’s APIs to integrate virtual account payment collection into your website, application, or billing systems.

Can I collect recurring payments via virtual accounts?

Yes, virtual accounts are particularly useful for collecting recurring payments. By associating a virtual account with a specific customer or subscription, businesses can automate the collection of payments at regular intervals, reducing manual effort and ensuring timely payments.

Do virtual accounts need KYC completion?

While virtual accounts offer a streamlined onboarding process, they still require Know Your Customer (KYC) compliance. KYC ensures that businesses maintain regulatory compliance and helps prevent fraudulent activities.

What is a virtual current account?

A Virtual Current Account (VCA) is an advanced form of virtual account that simulates the functionalities of a traditional bank account, such as making and receiving payments, managing cash flow, and conducting financial transactions. VCAs provide businesses with a comprehensive banking experience without the need for physical bank branches.

How are virtual accounts helpful for businesses?

Virtual accounts offer numerous benefits for businesses, including:

- Efficient tracking of funds from multiple sources or customers.

- Streamlined reconciliation processes, reducing manual effort and errors.

- Simplified cash flow management and improved visibility into receivables.

- Enhanced security measures to mitigate the risk of unauthorized transactions.

- Cost savings through reduced administrative and operational expenses.

What kind of companies can benefit from using virtual accounts?

Companies across various industries can benefit from utilizing virtual accounts, including e-commerce platforms, subscription-based businesses, financial institutions, educational institutions, and healthcare providers. Any business that deals with multiple payment sources or requires efficient cash flow management can leverage virtual accounts to streamline their receivables.

How can EnKash’s virtual account help businesses?

EnKash offers a comprehensive virtual account solution that caters to businesses’ unique requirements. With EnKash’s virtual account services, companies can seamlessly collect payments, automate reconciliation, and enhance their overall accounts receivables management.

How to create virtual accounts with EnKash?

Creating virtual accounts with EnKash is a simple process. Businesses can reach out to EnKash and explore their offerings to understand how their virtual account solution can be customized to meet specific needs.

What is virtual account management?

Virtual Account Management (VAM) is the practice of effectively managing and optimizing virtual accounts. It involves activities such as monitoring account activity, tracking cash flows, reconciling transactions, and generating reports for analysis. VAM helps businesses maximize the benefits of virtual accounts and ensure smooth financial operations.

On a final note!

Virtual accounts have emerged as a powerful tool for businesses to streamline their accounts receivables processes. By leveraging the benefits of virtual accounts, companies can enhance transparency, improve cash flow management, automate payment reconciliation, and reduce costs. With the rise of innovative platforms like EnKash, businesses can unlock the full potential of virtual accounts and revolutionize their financial operations. Embracing virtual accounts is a step towards optimizing financial processes and staying ahead in today’s rapidly evolving business landscape.

Processing Invoices in Sap | Business Bank Account | GST Invoice Rules | Accounts Receivable | Spend Management Software | Expense Management System | Payment Collection | How to Generate Payment Link | Invoice OCR Processing | Invoice Processing | Payment Link Generator | Generate Online Bill | E Invoicing Under GST | Automated Invoice Processing | Virtual Account Number | Budgeting in Financial Management | Accepting Payments Online | Budget Management | Days Sales Outstanding | Best Accounting Software in India