Facebook has become an essential platform for startups in India to reach their target audience. With over 320 million active users, the social media giant offers an incredible opportunity to connect with potential customers. Facebook Ads can provide startups with a cost-effective and targeted way to promote their products and services. However, creating effective Facebook Ads that maximize benefits can be a daunting task for startups.

In this guide, we will explore the benefits of Facebook Ads, understand how to use Facebook Ads Manager, create effective Facebook Ads, optimize them for maximum benefits, measure success and ROI, and avoid common mistakes.

What are the benefits of Facebook Ads for Startups?

Facebook Ads are a powerful tool for startups to reach their target audience and promote their products or services. The benefits of Facebook Ads for startups are numerous and include:

Cost-effective advertising

Advertising on Facebook is relatively inexpensive compared to other forms of advertising, such as TV or print ads. Startups can set up a Facebook Ads campaign with a minimal budget and still reach a large number of potential customers.

Targeted advertising

Startups can define their target audience and create ads that are relevant and appealing to them. This precision targeting helps startups to maximize their advertising budget and reach the right audience.

Increased brand awareness

Facebook Ads can help startups to increase brand awareness and reach a wider audience. By creating engaging and memorable ads, startups can create a lasting impression on their target audience and build brand recognition.

Lead generation

Facebook Ads can be used to generate leads and drive traffic to a startup’s website or landing page. By creating ads with a clear call-to-action, startups can encourage potential customers to take action and sign up for a newsletter, download a white paper, or request a demo.

Measurable results

Facebook Ads provide startups with measurable results. Startups can track the performance of their ads, and monitor clicks, impressions, conversions, and other metrics to determine the success of their campaign. This data can help startups to optimize their ads and improve their ROI.

What are the advantages of Facebook Advertising?

In addition to the benefits of Facebook Ads, there are several advantages to using Facebook Advertising for startups in India.

Large user base

Facebook has over 320 million active users in India, making it the largest social media platform in the country. This large user base provides startups with a massive audience to target.

Diverse ad formats

Facebook offers a variety of ad formats, including video ads, carousel ads, slideshow ads, and more. Startups can choose the format that best suits their advertising goals and create engaging ads that resonate with their target audience.

Mobile-friendly

Over 90% of Facebook users in India access the platform on their mobile devices. Facebook Ads are designed to be mobile-friendly and can be optimized for mobile devices, ensuring that startups can reach their target audience on the go.

Customizable targeting

Facebook Ads Manager allows startups to customize their targeting and reach specific audiences based on demographics, interests, behaviors, and location. This customization ensures that startups can reach the right people with the right message.

Creating effective Facebook Ads

Creating effective Facebook Ads is essential for startups to maximize their benefits. Startups need to create ads that are engaging, relevant, and memorable.

- Use high-quality images or videos: Visual content is essential for creating engaging Facebook Ads. Startups should use high-quality images or videos that are relevant to their ad’s message.

- Keep it simple: Facebook Ads should be simple and easy to understand. Startups should focus on a single message and avoid cluttering their ad with too much information.

- Use a clear call-to-action: Facebook Ads should have a clear call-to-action that encourages potential customers to take action. Startups should use action words like “Sign Up,” “Buy Now,” or “Learn More” to encourage clicks.

- Test and optimize: Startups should test different ad formats, images, and targeting options to determine what works best for their audience. They should also monitor their ad’s performance and optimize them for better results.

Ad formats available on Facebook

Facebook offers several ad formats that startups can use to reach their target audience.

- Image Ads: Image Ads are simple ads that use a single image to convey a message. They are easy to create and can be used to promote products, services, or events.

- Video Ads: Video Ads are a powerful way to engage potential customers. Startups can use video ads to tell a story, showcase their products, or provide a demonstration.

- Carousel Ads: Carousel Ads allow startups to showcase multiple images or videos in a single ad. They are ideal for promoting multiple products or showcasing different features of a single product.

- Collection Ads: Collection Ads allow startups to showcase their products in a mobile-optimized format. They are ideal for promoting e-commerce products and can encourage potential customers to make a purchase.

Optimizing your Facebook Ads for maximum benefits

Optimizing Facebook Ads is essential for startups to maximize their benefits.

- Monitor performance metrics: Startups should monitor the performance metrics of their ads, such as clicks, impressions, and conversions. This data can help startups to optimize their ads for better results.

- Test different ad formats: Startups should test different ad formats, such as images, videos, and carousel ads, to determine what works best for their audience.

- Use retargeting: Retargeting allows startups to target users who have interacted with their website or social media pages. This targeting option can help startups to reach potential customers who are already interested in their products or services.

- Adjust targeting: Startups should adjust their targeting options to reach a wider audience or improve the relevance of their ads. By optimizing their Facebook Ads, startups can improve their ROI and maximize their benefits.

Measuring success and ROI of your Facebook Ads

Measuring the success and ROI of Facebook Ads is essential for startups to determine the effectiveness of their campaign. Startups should monitor the following metrics:

- Clicks: Clicks measure how many users clicked on the ad to visit the website or landing page.

- Impressions: Impressions measure how many times the ad was viewed by users.

- Conversions: Conversions measure how many users completed the desired action, such as signing up for a newsletter or making a purchase.

- Cost per click (CPC): CPC measures the cost of each click on the ad.

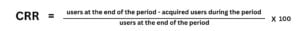

- Return on investment (ROI): ROI measures the profitability of the campaign by comparing the cost of the campaign to the revenue generated. By monitoring these metrics, startups can determine the success of their Facebook Ads campaign and make adjustments to improve their results.

Conclusion: Maximize Your Benefits with Facebook Ads for Startups

Facebook Ads are a powerful tool for startups in India to reach their target audience and promote their products or services. By understanding the benefits of Facebook Ads, using Facebook Ads Manager, defining their target audience, creating effective ads, and optimizing them for maximum benefits, startups can improve their ROI and reach a wider audience.

Also Read: Digital Marketing for Startups: Advantages and Opportunities

Measuring success and ROI, avoiding common mistakes, and learning from case studies can help startups to create successful Facebook Ads campaigns and maximize their benefits.