What is GST?

GST, or Goods and Services Tax, is a single tax that India uses on the sale of goods and services. It was introduced on July 1, 2017 to replace many earlier taxes like VAT, service tax, and excise duty. Instead of paying different taxes at every step, businesses now deal with only one system.

GST makes things easier because tax is charged only on the value added at each stage. This means people do not end up paying tax on tax, and prices become clearer for everyone.

GST is also a destination-based tax, which means the tax goes to the state where the product or service is finally used. This helps keep the system fair for all states.

Most GST work happens online. Businesses register on the GST portal, file returns, pay tax, and download their GST certificate through the same platform. Small businesses have relaxed limits and can choose simpler filing options if they qualify.

Over the years, the GST Council has updated rates and simplified the structure. After reforms effective 22 September 2025, GST largely uses 5% and 18% rates, with a higher 40% rate for select luxury and sin goods, subject to notified exceptions.

GST creates a common national market, reduces paperwork, and brings more transparency for both businesses and consumers.

Read more: How to Pay GST on Advance Payments

Types of GST and Their Application

The Goods and Services Tax in India is divided into different components to ensure fair distribution of tax revenue between the central and state governments. Each type has a specific role and is applied based on the location of the buyer and seller.

Types of GST

- Central GST (CGST)

Collected by the central government on all transactions happening within a single state. This component helps the centre generate revenue from domestic trade and services. - State GST (SGST)

Collected by the state government on the same intra-state transaction where CGST is applied. Both CGST and SGST are usually charged at equal rates and credited to their respective authorities. - Integrated GST (IGST)

Charged on transactions where goods or services move from one state to another. This tax is collected by the central government and later shared with the destination state. - Union Territory GST (UTGST)

Applied instead of SGST in union territories that do not have their own legislative assemblies. It works similarly to SGST but is managed by the centre.

Also read: What is the difference between CGST, SGST and IGST

Application of Each Type

- Intra-state transactions

Both CGST and SGST apply. For example, if a seller in Gujarat sells to a buyer in the same state, the invoice includes equal percentages of both taxes. - Inter-state transactions

IGST is applied. Suppose a business in Delhi supplies to a client in West Bengal, only IGST is charged, and the destination state later receives its share from the centre. - Supply within union territories

CGST and UTGST apply together. This is relevant for businesses operating in locations like the Andaman and - Nicobar Islands or Daman and Diu.

Businesses must know which tax type applies to their transaction before filing a GST return, as misclassification can lead to penalties and loss of input tax credit. The clarity in classification also helps in seamless credit flow and reduces the chances of disputes between tax jurisdictions.

Read more: How to Register for GST in India

GST Rate Structure: The GST Slabs

GST in India uses different tax slabs to classify goods and services. These slabs help keep essential items affordable while placing a higher tax on luxury and harmful products. After the GST Council reforms effective 22 September 2025, GST has been simplified largely into 5% and 18% rates, with a higher 40% rate for select luxury and sin goods, while essential items may remain exempt.

Here is the updated list of GST slabs in an easy-to-understand format.

0% / Exempt Items

Some goods and services are fully exempt from GST so that basic needs stay affordable. These usually include:

- Fresh fruits and vegetables

- Unprocessed food grains

- Milk and eggs

- Essential healthcare and basic education services

- These items continue to remain tax-free.

5% GST Slab

This slab covers commonly used items that are important in day-to-day life but are not fully essential. Many products that earlier fell under the 12% slab have now been moved to 5%.

Examples include:

- Packaged food items

- Footwear below a notified price

- Some medicines

- Transport services

- Household items used regularly

- This slab is meant to ease the cost burden for consumers.

18% GST Slab

This is the standard GST rate used for most goods and services in India. Many items that were earlier under 18% or 28% have now been rationalised into this slab.

Items usually taxed at 18% include:

- Processed foods

- Consumer electronics

- Appliances

- Branded clothing

- Business-related services

- Industrial supplies

- Most businesses deal with products and services that fall under this rate.

40% GST Slab

A 40% slab has been approved under the GST 2.0 structure for select luxury and sin goods. However, items such as pan masala, gutkha, cigarettes, chewing tobacco, unmanufactured tobacco, and bidi continue at the existing GST rate and compensation cess where applicable, as notified by the GST Council.

Items under the 40% slab include:

- Sin Goods

- Cigarettes, cigars, and other tobacco products

- Gutkha, pan masala, chewing tobacco

- Aerated drinks and high-sugar beverages

- Energy drinks

- Luxury and High-End Goods

- High-end cars and SUVs

- Motorcycles above 350cc

Yachts and private boats - Personal-use aircraft and jets

- Other High-Tax Services

- Casinos

- Betting and gambling services

This slab is designed to tax harmful and ultra-luxury items at higher rates.

Factors That Influence Slab Allocation

Each product or service is carefully placed into a slab based on:

- Its essentiality in daily life

- Its economic importance

- The level of impact it has on the common man

- Revenue potential for the government

The GST Council regularly reviews these categories. Based on market needs, economic factors, or demands from industries, items can be shifted from one slab to another.

Slab Changes Over Time

Since its rollout, there have been several revisions in GST rates. These changes are typically recommended during council meetings and often aim to reduce the tax burden on consumers or help struggling sectors. For instance, the rate on hotels and restaurant services has been changed multiple times to respond to industry needs.

Businesses must be aware of the latest slab rates for the goods or services they deal with. Applying the wrong rate can lead to overcharging customers or underpaying taxes, both of which can result in penalties.

Before generating an invoice, it is helpful to refer to the latest GST slabs list available on the official portal or from verified sources. It ensures accuracy in billing and smooth filing of the GST return.

Read more: How to Search GST Number by PAN

GST Registration: Process, Fees & Limit

GST registration is mandatory for businesses that cross a certain annual turnover or fall under specific categories defined by the tax authorities. The registration process has been designed to be fully online, quick, and transparent to make compliance easier, even for small business owners.

Who Needs GST Registration?

Not every business in India needs to register under GST. However, it becomes mandatory in the following situations:

- Businesses whose turnover exceeds the prescribed GST registration limit. For most regular category states, the current limit is ₹40 lakh for suppliers of goods and ₹20 lakh for service providers. In special category states, the threshold is typically ₹20 lakh for goods and ₹10 lakh for services (as notified for special category states).

- Individuals or entities involved in inter-state supply of goods.

Casual taxable persons and non-resident taxable persons. - E-commerce operators and aggregators.

- Businesses paying tax under the reverse charge mechanism.

Those who are required to deduct tax at source.

It’s also important to note that voluntary registration is allowed. Businesses that fall below the threshold may still register to avail input tax credit and gain a competitive edge.

Step-by-Step GST Registration Process

Registering for GST is a digital procedure and requires access to the GST portal. Here’s how the process works:

- Visit the official portal at gst.gov.in.

- Click on ‘New Registration’ under the Services tab.

- Fill in basic details such as legal name, PAN, email ID, and mobile number.

- Verify the OTPs received on your mobile and email.

- Receive a Temporary Reference Number (TRN).

- Use the TRN to log in again and complete the application with business details, promoter info, principal place of business, bank account information, and upload supporting documents.

- Submit the application using Digital Signature Certificate (DSC) or Aadhaar authentication.

Once approved, the applicant receives a unique 15-digit GSTIN and a digital GST certificate, confirming successful registration.

Understanding Form GST REG 06

When your application is approved, you are issued Form GST REG 06. This document acts as your formal registration certificate. It includes essential details like your GSTIN, business legal name, trade name, constitution of business, and the types of GST you are registered for.

This certificate must be displayed at your place of business, and the GSTIN should be quoted on all invoices and returns.

GST Registration Fees

There is no government charge for GST registration. However, businesses often hire professionals to manage the registration process, especially if they lack time or are unfamiliar with documentation. The GST registration fees in such cases depend on the service provider and can range from ₹500 to ₹2500 or more, depending on complexity and urgency.

Even though there’s no mandatory cost from the government, it’s crucial that the registration is done correctly to avoid errors in future filings or audits.

Why Registration Matters

Once registered, businesses become part of the formal tax system. They can claim input tax credit, expand operations across states, and gain better trust among suppliers and customers. It also ensures timely filing of the GST return, which is mandatory for registered entities.

Read more: Complete GSTIN Registration Guide

GST Certificate and Its Importance

Once a business successfully registers under the GST system, it receives a GST certificate. This document acts as proof of registration and includes important details such as the business name, registration number, constitution of the business, and the types of GST applicable.

The certificate is issued in a digital format by the GST Network. It contains a unique 15-digit GSTIN that must be used on all invoices, returns, and other official documents. The certificate also specifies the date from which the GST is effective, along with the business’s principal place of operations.

Holding a GST certificate is not just a legal formality. It is mandatory for compliance and must be displayed at the place of business where it can be clearly seen by customers or government officials. Failure to do so can lead to penalties or legal complications.

In today’s business environment, being GST-compliant adds credibility. Whether you’re dealing with vendors, applying for loans, or bidding for tenders, having a valid certificate positions the business as structured and transparent. It also allows for seamless input tax credit, provided all invoices are properly issued and documented.

For business owners, it is essential to understand how to download a GST certificate whenever needed. The certificate can be accessed through the official GST portal:

- Log in to gst.gov.in with your credentials.

- Navigate to the ‘Services’ tab, then select ‘User Services’.

- Click on ‘View/Download Certificate’.

- The certificate will open in PDF format, which can then be saved or printed.

There is no need to request a physical copy from any authority. The digital version holds full legal validity and can be presented as required.

It’s also worth noting that if the business undergoes any significant changes, —like a change in address or constitution, the certificate must be updated accordingly. Staying up to date with these details helps ensure that future GST return filings are not flagged for inconsistencies.

Also read: Importance of paying GST

GST Returns: Filing Process and Timelines

Filing GST returns is a crucial part of staying compliant under the tax system. Every business registered under GST is required to report its sales, purchases, input tax credit, and tax liability through periodic returns. These returns help both the government and the taxpayer keep track of transactions and ensure that tax is paid correctly.

What is a GST Return?

A GST return is a document filed by a registered business that contains details of its outward and inward supplies. It includes tax collected on sales, tax paid on purchases, and the net tax payable after adjusting input credits. These details are submitted to the GST portal within the specified deadlines.

The type and frequency of return filing depend on the category of the taxpayer. Regular taxpayers, composition dealers, e-commerce operators, and others all follow different schedules.

Common GST Return Forms

- GSTR-1

This is used to report details of outward supplies of goods and services. It must be filed monthly or quarterly, depending on the turnover. - GSTR-3B

A summary return where taxpayers declare total sales, input tax credit, and final tax payable. It is filed monthly by most regular taxpayers, while eligible small taxpayers can file it quarterly under the QRMP (Quarterly Return, Monthly Payment) scheme. - GSTR-9

The annual return that summarizes the entire year’s tax activity. Businesses with a turnover above the prescribed limit must file this once a year. - CMP-08

For those registered under the composition scheme, this form is used to declare turnover and make a fixed tax payment every quarter.

Filing the correct return on time is essential to claim input tax credit, avoid penalties, and stay in good standing with tax authorities.

Filing Timeline and Late Fees

Returns must be filed by the due dates specified for each form. For monthly filers, GSTR-3B is generally due on the 20th of the following month. For taxpayers under the QRMP scheme, GSTR-3B is due on the 22nd or 24th of the month following the quarter, depending on the state or union territory.

Delayed filings attract a late fee and interest at 18% per annum on the outstanding tax amount until it is paid.

Most businesses use accounting software or consult tax professionals to ensure that the filing process is handled smoothly. The GST portal also offers auto-drafted data that can help reduce errors and save time.

A well-maintained filing history is often required when applying for loans, government tenders, or partnerships. Filing accurate and timely GST return reports is not just about compliance; it also helps build a credible business profile.

Read more: How to Check GST Application Status

How to Calculate GST: Methods & Examples

Calculating GST correctly is important for businesses to charge the right amount to customers and pay the correct tax to the government. Although the GST system may seem complex at first, the calculation itself is quite straightforward once you understand the components.

Basic GST Calculation Formula

There are two ways to calculate GST, depending on whether the tax is added to the base price or already included in it.

- GST Exclusive Calculation (tax added on top):

If the base price does not include GST, use the formula:

Final Price = Base Price + (Base Price × GST Rate / 100)

Example:

If a product is priced at ₹1,000 and the applicable rate is 18%,

GST = 1000 × 18 / 100 = ₹180

Final Price = ₹1000 + ₹180 = ₹1180

- GST Inclusive Calculation (tax included in price):

If the price already includes GST, the formula is:

Tax Amount = (Price × GST Rate) / (100 + GST Rate)

Example:

For an item priced at ₹1180 including 18% GST,

GST = (1180 × 18) / 118 = ₹180

Base Price = ₹1180 − ₹180 = ₹1000

Both methods are commonly used depending on how the business displays prices to customers.

CGST, SGST, and IGST Breakdown

For intra-state transactions, the GST rate is split equally between CGST and SGST. In inter-state transactions, the full rate is applied as IGST.

Example (intra-state):

If GST is 18%, then 9% is CGST and 9% is SGST.

Example (inter-state):

The entire 18% is charged as IGST.

Accurate calculation is also essential when issuing invoices or filing returns. Businesses often use billing software or online tools to automate this step, especially when multiple rates are involved for different products or services.

Knowing how to calculate GST helps avoid undercharging or overcharging customers. It also ensures that the tax reported to the government matches what is collected, reducing the chances of penalties or mismatches during audits.

Read more: What Businesses Should Know About GST Invoice Rules

GST Refunds: Eligibility and Process

Under the Goods and Services Tax framework, eligible taxpayers can claim refunds in cases where excess tax has been paid or where input tax credit remains unused. These GST refunds are vital, especially for exporters and businesses operating with inverted duty structures, as they help maintain cash flow and reduce financial strain.

Who Can Claim a Refund?

Refunds are allowed in several common scenarios:

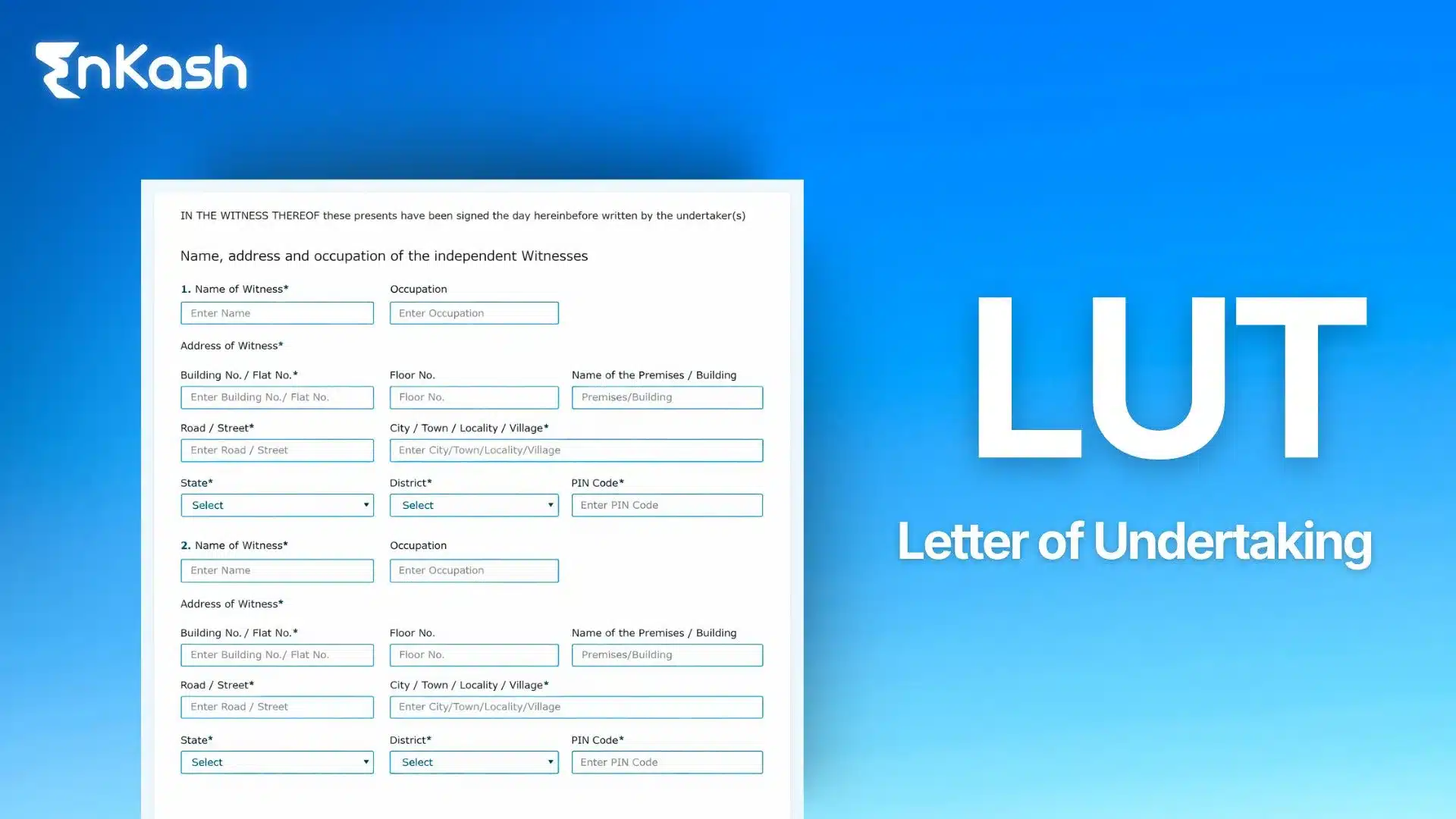

- Export of goods or services without the payment of tax under a bond or Letter of Undertaking.

- Accumulated input tax credit when the rate of tax on inputs is higher than the output tax rate.

- Tax paid by mistake or during the cancellation of a supply after issuance of the invoice.

- Refund of balance in the electronic cash ledger after offsetting liabilities.

- Tax paid under provisional assessment when the final tax due is lower.

- Refunds are applicable due to judgments or orders by appellate authorities or courts.

To be eligible, the claim must be backed by proper records, and all related GST return filings must be complete and accurate. The claim period and type must also match what has been reported earlier to avoid mismatches during verification.

Refund Application Process

Claiming a refund is done online through the GST portal:

- Log in at gst.gov.in with your credentials.

- Go to ‘Services’ → ‘Refunds’ → ‘Application for Refund’.

- Select the reason for refund from the dropdown list.

- Fill in the refund amount and the relevant tax period.

- Upload supporting documents such as invoices, bank statements, and reconciliation reports.

- Submit the application with Aadhaar verification or a digital signature.

Once the refund application is filed, an acknowledgment is generated. If approved, the refund must be sanctioned within 60 days from the date of a complete application, after which interest becomes payable.

Filing on time and keeping proper documentation helps avoid delays or rejection. Understanding your eligibility under the Goods and Services Tax rules ensures that valid refund amounts are not missed or blocked unnecessarily.

Role of the GST Council

The GST Council plays a central role in shaping and updating the Goods and Services Tax framework across India. It ensures the system remains balanced, fair, and responsive to the changing needs of businesses and the economy.

Key Functions of the GST Council

- Formulation of Tax Rates

Recommends and revises GST slabs for goods and services.

Regularly moves items across slabs based on economic relevance and consumer impact. - Return Filing Guidelines

Frames rules for filing various types of GST return.

Sets timelines and formats for monthly, quarterly, and annual returns. - Refund Policies

Proposes improvements in the process of claiming GST refunds. Addresses industry feedback related to refund delays and documentation. - Registration Thresholds

Decides the GST registration limit for different business categories. Adjusts limits periodically to reduce compliance burden for small businesses. - Certificate and Documentation Standards

Standardises the format of the GST certificate issued post-registration. Guides how businesses can download GST certificates from the official portal. Clarifies the function of form GST REG 06, which acts as official proof of registration. - Policy and Rulemaking

Issues clarifications, amendments, and notifications to improve transparency. Responds to changing market needs and feedback from industries and state governments.

Importance for Businesses

- Any change made by the Council affects how businesses operate under the Goods and Services Tax regime.

- Decisions related to rates, registration, and compliance directly impact pricing, documentation, and tax planning.

- Staying informed about Council updates helps avoid errors and ensures smooth GST return filing.

The GST Council acts as the backbone of India’s indirect tax system. Through regular meetings and collaborative discussions, it ensures that GST stays relevant, efficient, and aligned with the country’s economic goals.

Read more: The Importance of Timely Payment of Tax Under GST

Common Issues and Solutions in GST Compliance

Despite the improvements the Goods and Services Tax system brought, businesses still face a number of day-to-day challenges when managing their tax responsibilities. Most of these issues are related to filings, system glitches, or procedural confusion.

Common Issues Faced by Taxpayers

- Mismatch in GST return data: One of the most frequent problems is mismatches between GSTR-1 and GSTR-3B filings. These errors can delay input credit and create compliance risk.

- Portal-related errors: Technical issues on the GST portal, such as downtime or failed submissions, can make it difficult to file returns on time or generate reports.

- Errors in invoices: Incorrect invoice details can affect the validity of transactions and block the buyer’s input credit.

- Delayed refunds: Many businesses, particularly exporters, report delays in receiving GST refunds, often due to pending document verifications or discrepancies in submitted forms.

- Registration complications: Errors in the registration process or outdated details on form GST REG 06 may lead to compliance issues or rejection of input claims.

Practical Solutions

- Regular reconciliation of returns: Match GSTR-1, GSTR-2A, and GSTR-3B every month to catch and correct mismatches early.

- Timely filing of returns: Use reminders and GST software to avoid missing GST return deadlines and reduce late fee exposure.

- Use verified invoicing templates: Ensure invoices include accurate GSTIN, HSN/SAC codes, and taxable values.

- Monitor refund applications: Track refund status online and respond to notices promptly to speed up processing.

- Keep documents updated: Make sure business information is current on the portal and correctly reflected in your GST certificate.

Following these practices helps businesses stay compliant, reduce audit risk, and avoid penalties or disruptions in operations.

Future of GST: Reforms and Expectations

The Goods and Services Tax system has come a long way since its launch, but it continues to evolve in response to feedback from businesses, changing market conditions, and advancements in technology. Several reforms are expected to further simplify compliance and improve efficiency.

One major area of focus has been the reduction in the number of tax slabs. Earlier, the government and the GST Council discussed merging the 12% and 18% slabs, and recent reforms have already moved many items into the core 5%, 18%, and 40% structure.

The earlier proposal for a new single return system was withdrawn. The GST framework continues with GSTR-1 and GSTR-3B, with improvements like auto-population and QRMP.

Technology will continue to play a key role. Automation in invoicing, AI-based compliance tracking, and integration of e-invoicing for all taxpayers could improve accuracy and reduce manual errors.

Lastly, efforts are ongoing to ensure faster processing of GST refunds, which will help exporters and working capital –sensitive businesses.

These expected reforms reflect the government’s goal of making GST simpler, more transparent, and better aligned with India’s growing digital economy.

Read more: Simplifying GST Payments

The Role of Input Tax Credit in the Goods and Services Tax Framework

Input Tax Credit (ITC) is one of the key features of the Goods and Services Tax system in India. It allows businesses to claim credit for the tax paid on purchases (inputs) used in the course of business. This mechanism ensures that tax is applied only on the value added at each stage of the supply chain, thereby eliminating the cascading effect of taxes.

For example, if a manufacturer pays GST on raw materials, they can deduct that amount while paying GST on the finished goods they sell. The difference is what they owe the government. This credit can be claimed on goods, services, or both, provided they are used for business purposes and not for personal consumption.

To avail ITC, the taxpayer must be registered under GST, possess a valid tax invoice, and the supplier must have filed the corresponding GST return. The input credit must be reflected in the GSTR-2A or GSTR-2B form for it to be claimable.

Maintaining proper documentation and timely reconciliation of purchase and sales returns is essential for smooth ITC claims. Misuse or ineligible claims may lead to penalties or the reversal of the claimed credit during audits or scrutiny.

Read more: Steps to Pay GST Challan Payment Online

Conclusion

The implementation of the Goods and Services Tax has reshaped India’s indirect tax system by creating a unified structure that benefits both the economy and businesses. From simplified compliance to transparent pricing, GST has eliminated the cascading effect of taxes through provisions like input tax credit, reducing the overall cost burden on end consumers.

Understanding how to file a GST return, calculate taxes accurately, and use appropriate GST slabs is essential for every registered business. Whether it’s knowing the GST registration limit, claiming GST refunds, or accessing your GST certificate, staying compliant helps avoid penalties and ensures operational continuity.

The role of the GST Council remains central in driving changes, from rate revisions to rule simplification. Businesses must also stay familiar with forms like form GST REG 06 and portal procedures like how to download a GST certificate, which are integral to daily compliance.

India’s GST journey is still evolving, with upcoming reforms promising to simplify filing, consolidate rates, and expand automation. For businesses, this is not just a tax—it’s a system that demands awareness, discipline, and regular engagement. Staying updated ensures your business not only complies but thrives in the GST framework.

FAQs

1. What is the penalty for not filing a GST return on time?

If you miss the due date, a late fee of ₹50 per day (₹25 CGST + ₹25 SGST) applies for normal GSTR-1 and GSTR-3B, and ₹20 per day (₹10 + ₹10) for nil returns. Interest at 18% p.a. is also charged on any unpaid tax until it is cleared.

2. Can I amend a GST return after filing?

Yes. You can correct a previously filed GST return, but not by editing the original return. You must adjust it in a later return period. It’s important to track such changes carefully to maintain consistency in GST return data and avoid discrepancies during assessments.

3. Is GST applicable to freelancers and consultants in India?

Yes, freelancers and consultants offering services and earning above the threshold must register under Goods and Services Tax. GST is applicable even if services are provided online or to overseas clients. For exports, filing under the zero-rated supply provision helps claim GST refunds on input services.

4. How do I get a duplicate copy of my GST certificate?

You can download a GST certificate at any time by logging into the GST portal. Go to ‘User Services’ → ‘View/Download Certificate’. The document is legally valid in its digital form and can be printed as needed. Keeping a soft copy ensures quick access during audits or vendor verifications.

5. What is the composition scheme under GST?

The composition scheme lets small taxpayers pay GST at a lower fixed rate with simpler returns but no input tax credit. It is generally available up to ₹1.5 crore turnover for goods (lower in some special-category states) and ₹50 lakh for eligible service providers, who pay tax through CMP-08 on a quarterly basis.

6. What documents are needed for GST registration?

To register under GST, you need PAN, business address proof, bank account details, identity proof, and photographs. After verification, a form GST REG 06 certificate is issued. This certificate must be displayed at your business premises and used on invoices to ensure valid compliance.

7. What is an HSN code and why is it required in GST?

HSN (Harmonized System of Nomenclature) codes classify goods under a global system. These codes are mandatory in invoices and returns. They determine applicable GST slabs and ensure uniform tax treatment across states and industries, reducing confusion in supply chains.

8. Are GST returns mandatory for a newly registered business with no sales yet?

Yes, even if there are no sales or purchases, a newly registered entity must file NIL returns from the effective registration date. Failing to file can attract penalties and restrict access to the GST certificate functions, such as e-way bill generation or refund claims.

9. Can GST registration be cancelled or surrendered?

Yes, businesses can apply for cancellation if they discontinue operations or fall below the GST registration limit. The request must be filed online, and final returns need to be submitted. Once approved, the GSTIN becomes inactive, and the business can no longer collect or pay GST.

10. What happens if my GSTIN is suspended?

If your GSTIN is suspended due to non-compliance, you cannot issue invoices or collect tax. You must resolve the reason for suspension, such as non-filing of GST return, and file the required documents. Once reviewed by authorities, the suspension may be revoked, and normal operations can resume.