Invoice processing is a critical component of any organization’s financial operations. However, the traditional manual method of processing invoices can be time-consuming and error-prone. In today’s fast-paced business environment, where every minute counts, manual processing can lead to significant delays and costs. Therefore, many companies are looking for ways to modernize their invoice processing workflow by automating the process. This shift from manual to automation saves time, reduces errors, and helps in increasing productivity.

Automating invoice processing workflows can significantly improve financial operations’ efficiency, accuracy, and visibility. Automating the process involves using specialized software to extract data from invoices, match them with purchase orders, and then route them to the appropriate approver for payment. The software can also send notifications and reminders to ensure timely approval and payment. Moreover, automation can provide valuable insights into invoice processing, such as the number of invoices processed, approval times, and payment cycles.

This article will discuss invoice processing, invoice OCR processing, streamlining your workflow, choosing the best automation software for your business needs, and staying compliant with automated processing regulations.

What do you mean by invoice processing?

Invoice processing is managing and recording payments a business owes its customers. This process involves creating and sending customer invoices, tracking payment due dates, recording payments received, and following up on overdue payments. Invoice processing is an integral part of a business’s financial management, as it helps ensure that payments are collected promptly and accurately. This helps in maintaining cash flow and financial stability for the business.

Importance of streamlining your invoice processing workflow

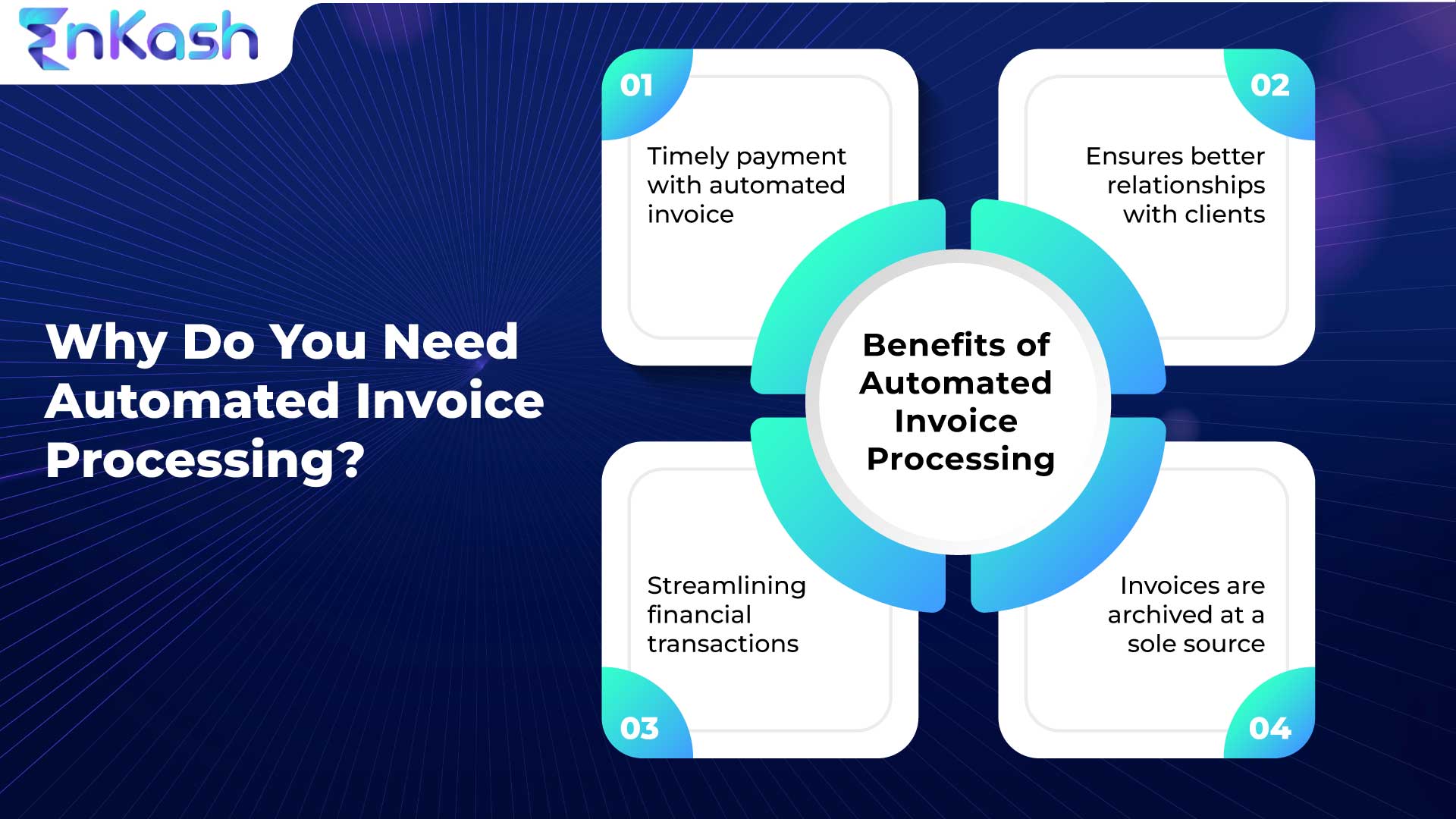

- Faster payments: By streamlining your invoice processing workflow, you can reduce the time it takes to generate and send invoices to your customers. This can result in faster payment cycles and improved cash flow for your business

- Fewer errors: Manual invoicing processes are prone to errors, leading to payment delays, disputes, and even lost revenue. By streamlining your invoicing process, you can reduce the risk of errors and ensure that invoices are accurate and complete

- Improved customer experience: It can improve the customer experience by making it easier for customers to pay their bills on time and reducing the likelihood of disputes or misunderstandings. This can help build stronger relationships with your customers and improve customer loyalty

- Increased efficiency: This helps you save time and resources by automating repetitive tasks like data entry and invoice generation. This can free up your accounts receivable team to focus on more strategic tasks, such as collections and customer service

- Better data management: You can track and manage your invoicing data more effectively, allowing you to identify trends, analyze payment patterns, and make more informed decisions about your business

How to choose the best invoice automation software for your business needs?

Choosing the right invoice automation software for your business needs is crucial for streamlining your workflow and increasing efficiency. Below mentioned are some key factors to consider when selecting invoice automation software:

- Compatibility and Integration: It’s essential to select an invoice automation software that is compatible with your existing accounting software or ERP system. Please make sure the software can integrate seamlessly with your system

- Features and Capabilities: Look for software for automatic data entry, real-time analytics, and customizable invoice templates. The software should also handle the different types of invoices you may have, such as recurring, one-time, and international invoice

- User-Friendliness: The software should be user-friendly and intuitive for every user, regardless of their limited accounting or technical proficiency. Moreover, it should be easily reachable from any location with an internet connection, as remote work is progressively gaining acceptance

- Security and Compliance: As invoices often contain sensitive financial information, choosing software with high-security measures and compliance with data protection laws, such as GDPR or CCPA

- Customer Support: The software provider should offer excellent customer support, including training, implementation assistance, and ongoing technical support

How to stay compliant with automated invoice processing regulations?

Staying compliant with automated invoice processing regulations is crucial to ensure your organization avoids penalties or legal issues. Adhere to the steps mentioned below to remain compliant:

- Stay up-to-date on regulations: Ensure you are aware of any new rules or changes to existing ones related to automated invoice processing. This includes laws related to data privacy, security, and other compliance requirements

- Choose a reputable invoice processing software: Select a software provider that complies with the latest regulations and standards. Ensure your chosen software has secure data storage and encryption, access controls, and audit trails

- Implement appropriate controls: Controls should be established within the automated invoice processing system to prevent fraudulent activity. This can be achieved by requiring user two-factor authentication and setting up alerts for suspicious activity

- Verify the accuracy of invoices: Review the accuracy of invoices processed by the system to ensure no errors or discrepancies. This includes checking that invoices match purchase orders and that pricing and quantities are correct

- Keep detailed records: Maintain records of all invoices processed through the system. This includes invoices, purchase orders, receipts, and any communication related to the transaction

EnKash is one of the best fintech companies in India, offering businesses a complete payment and invoicing platform. One of its key features is its power to automate and modernize invoice processing workflows. With EnKash, businesses can upload invoices to the forum and use its AI-powered technology to automatically extract relevant data from the invoices. This significantly reduces manual data entry and eliminates errors that may occur during the process.

EnKash also offers features such as invoice approval workflows, payment tracking, and payment reminders, further streamlining the invoicing process. By automating and modernizing the invoicing workflow, businesses can save time and resources, improve accuracy and efficiency, and ultimately enhance their overall financial management.