What is a Prepaid Payment Instrument (PPI)?

A Prepaid Payment Instrument, or PPI, is a digital tool that lets you pay, transfer, or store money in advance for future use. Instead of linking directly to a bank account each time, you load money into the wallet, card, or app once and use it whenever you need.

PPIs make everyday payments simple and cash-free—whether you’re shopping online, paying bills, booking travel, or managing employee and business expenses. Both individuals and businesses widely use them because they offer speed, security, and flexibility in handling money digitally.

Types of Prepaid Payment Instruments (PPIs)

Prepaid Payment Instruments are classified by the Reserve Bank of India (RBI) based on how and where they can be used. These instruments range from closed-loop wallets to open, bank-issued cards that allow wider access and flexibility.

- Closed System PPIs

Closed system PPIs are issued by a single company and can only be used to purchase goods or services from that specific issuer. They cannot be used for third-party payments, fund transfers, or cash withdrawals.

Example: Wallet balances or gift cards that can only be used on the issuing company’s website or app.

- Semi-Closed System PPIs

Semi-closed PPIs are the most common in India. They can be used for payments to multiple merchants and service providers that have an agreement with the issuer. However, users cannot withdraw cash or transfer funds to a bank account.

Example: Digital wallets are used for online shopping, bill payments, travel bookings, and food delivery across partnered merchants.

- Open System PPIs

Open system PPIs offer the highest level of flexibility. These are issued only by banks or authorized entities working with banks. They can be used for purchases at any merchant, fund transfers, and even cash withdrawals from ATMs.

Example: Bank-issued prepaid cards or travel cards that can be used anywhere debit or credit cards are accepted.

- Other Sub-Categories (Under RBI Guidelines)

RBI has also defined specific-purpose PPIs to meet targeted use cases such as gifting, employee benefits, and transport payments.

- Gift Cards: Semi-closed PPIs issued for gifting purposes, typically with a fixed value, spending limit, and validity period.

- Meal Cards: Issued by employers to provide meal or food allowances to employees. These can be used only at approved food outlets and online delivery platforms.

- Mass Transit System Cards: Designed for fare payments in metro, bus, or similar transport networks.

Example: Delhi Metro Card. - Foreign Travel Cards: Issued for international travel and loaded with one or more foreign currencies. Useful for payments, hotel bookings, and ATM withdrawals abroad.

- Reloadable Cards: These can be topped up multiple times and are commonly used for business, travel, or recurring employee expenses.

- Non-reloadable Cards: Used for one-time payments, refunds, or gifting; once the value is exhausted, they cannot be reloaded.

Difference Between Small PPI and Full KYC PPI

The Reserve Bank of India (RBI) divides Prepaid Payment Instruments (PPIs) into two types based on the level of Know Your Customer

(KYC) verification: Small PPI (Minimum KYC) and Full KYC PPI.

Here’s how they differ:

Feature |

Small PPI (Minimum KYC) |

Full KYC PPI |

KYC Requirement |

Basic details like mobile number and OTP verification |

Full KYC as per RBI’s KYC guidelines (ID and address verification) |

Who Can Issue |

Banks and non-bank PPI issuers with RBI approval |

Banks and authorized non-bank PPI issuers |

Maximum Balance Allowed |

₹10,000 at any point |

₹2,00,000 at any point |

Reload Limit |

₹10,000 per month, ₹1,20,000 per financial year |

No specific limit within the ₹2,00,000 cap |

Permitted Usage |

Purchase of goods and services only |

Purchases, fund transfers, and card-based transactions |

Cash Withdrawal |

Not allowed |

Allowed (subject to RBI and issuer terms) |

Transfer to Bank Account |

Not allowed |

Allowed |

Validity |

Up to 24 months or as specified by the issuer |

Minimum 5 years, renewable thereafter |

Example Use |

Small-value digital wallets for quick payments |

Full-service wallets and corporate prepaid cards |

PPI License and Who Can Issue PPIs

To issue any Prepaid Payment Instrument (PPI) in India, the issuer must first obtain authorization from the Reserve Bank of India (RBI) under the Payment and Settlement Systems Act, 2007.

What is a PPI License?

A PPI License is an approval granted by the RBI that allows a company or bank to issue prepaid wallets, cards, or vouchers for digital payments. The license ensures that the issuer follows all RBI PPI Guidelines, including rules around security, KYC, fund management, and customer protection.

Who Can Apply for a PPI License?

The following entities are eligible to apply for a PPI License in India:

- Banks: Scheduled banks can issue PPIs directly after obtaining RBI approval.

- Non-Bank Entities: Companies registered under the Companies Act, 2013, can apply for authorization to operate as PPI issuers. They must have:

- Minimum paid-up capital of ₹5 crore

- Minimum positive net worth of ₹1 crore at the time of application

- A proven track record of managing payment systems or technology operations

Role of PPI License Holders

A PPI License holder in India can issue:

- Prepaid wallets for small or large-value transactions

- PPI cards for corporate or retail users

- Gift cards, meal cards, or prepaid vouchers for consumer and business use

These license holders must maintain the funds collected from customers in an escrow account with a partner bank to ensure fund safety and enable seamless refunds in case of service discontinuation.

Compliance and RBI Oversight

Every PPI issuer must comply with How PPI Transactions Work:

- RBI PPI Guidelines

- RBI KYC Directions, 2016

- Cybersecurity and data storage norms under RBI circulars

RBI also conducts regular audits and inspections to ensure that PPI in banking remains safe, transparent, and customer-friendly.

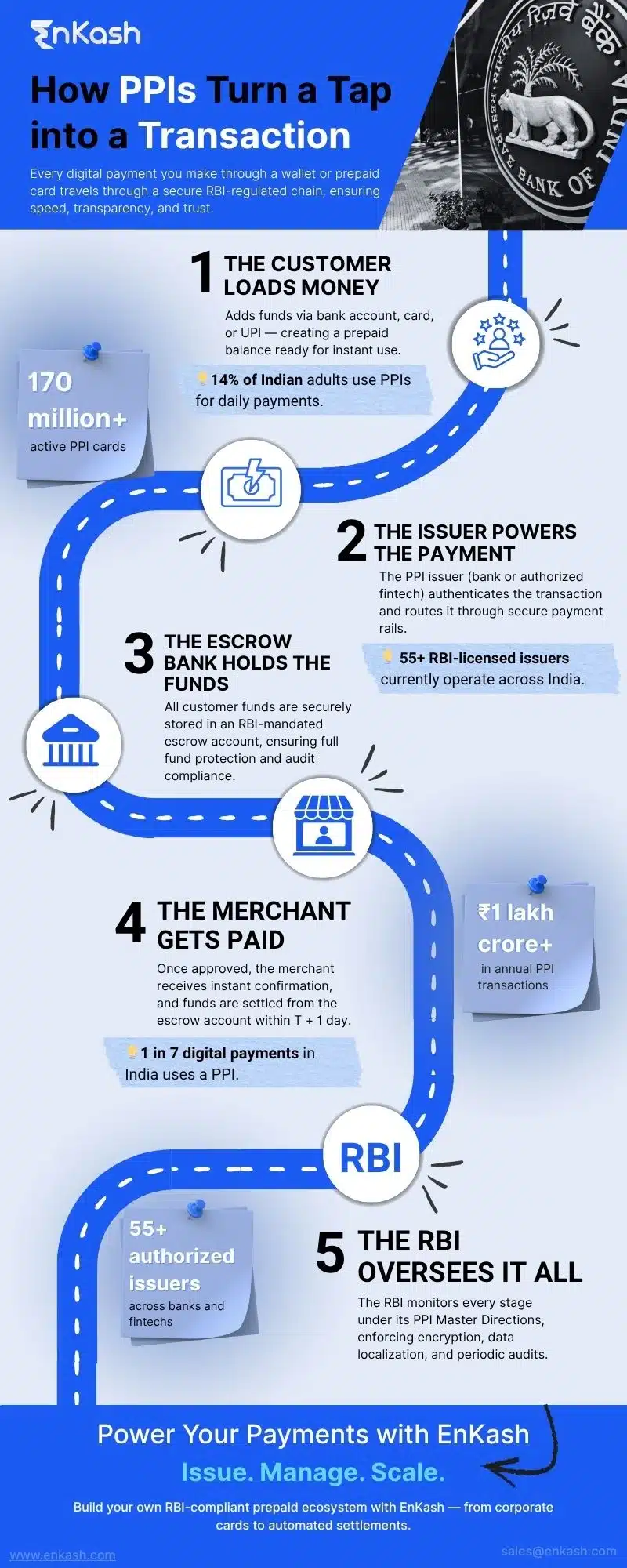

How PPI Transactions Work

Every time you make a payment using a Prepaid Payment Instrument (PPI), whether through a wallet or a card, there’s a simple yet structured flow behind the scenes. The process is regulated under RBI PPI Guidelines to ensure secure and traceable transactions.

1. Loading Money

- Users add money into a prepaid wallet or PPI card using a bank account, debit card, credit card, or UPI.

- The amount is stored in the wallet or card balance.

- For non-bank PPI issuers, the money is kept in an escrow account with a partner bank, as mandated by the RBI.

2. Making a Payment

When the user pays a PPI merchant, the transaction passes through the PPI issuer’s system and payment network.

- The PPI balance gets debited from the user’s account.

- The corresponding merchant receives a payment confirmation in real time.

- The issuer records all details for compliance and audit.

3. Merchant Settlement

- Merchants that accept PPIs are called PPI merchants. They could be online stores, retail outlets, or service platforms linked with the PPI issuer.

- At the end of the day or settlement cycle, the issuer transfers the collected funds from its escrow account to the merchant’s bank account.

- The merchant gets credited after applicable fees or commissions, if any.

4. Role of RBI and Security

- The Reserve Bank of India (RBI) regulates every step in this process through the RBI PPI Master Direction.

- Transactions are protected using encryption, OTP-based authentication, and real-time monitoring.

- Issuers must comply with data localization, ensuring all transaction data stays within India.

- Regular audits and reconciliation ensure the safety of customer and merchant funds.

Benefits of PPIs

Prepaid Payment Instruments (PPIs) have become an essential part of India’s digital payment ecosystem. Whether it’s an individual paying bills or a company managing employee expenses, PPIs offer a fast, safe, and flexible way to handle money.

1. Convenience and Accessibility

- Prepaid wallets and prepaid cards let users make payments instantly without needing to share bank details every time.

- They are accepted by a large network of PPI merchants both online and offline, making everyday transactions effortless.

- For users without regular bank access, PPIs provide an easy digital alternative.

2. Enhanced Security

- Every PPI in banking operates under RBI-regulated systems with encryption, OTP-based authentication, and data-storage norms.

- Funds are stored safely in an escrow account with a partner bank, ensuring protection even if an issuer discontinues service.

3. Controlled Spending

- Businesses use prepaid cards to set spending limits, manage reimbursements, and track expenses in real time.

- Individuals use them to control personal budgets, spending only what’s loaded in the wallet or card.

4. Rewards and Flexibility

- Many PPIs offer cashback, brand vouchers, and loyalty points that enhance user experience.

- Corporate users can issue PPI cards for different purposes, like travel, marketing, or petty cash.

Interoperability Mandates and Their Impact on Users

To promote uniformity and wider adoption, the Reserve Bank of India has made it mandatory for Full-KYC PPIs to support interoperability effective from 31 March 2022, as per the RBI circular. This means users can make payments across platforms, merchants, and networks without being tied to one provider.

How Interoperability Benefits Each Stakeholder

- For Users:

Freedom to pay anywhere, one wallet or card can be used across multiple merchants and platforms. - For Merchants:

Simplified acceptance setup; they can receive payments from customers using any interoperable PPI, reducing integration costs. - For Banks:

Creates a level playing field with non-bank issuers and expands digital acceptance across UPI and card networks. - For Non-bank Issuers:

Encourages compliance with RBI’s standards and allows their wallets or cards to work across card networks like RuPay, Visa, or UPI. - For the Payment Ecosystem:

Increases trust, reduces fragmentation, and ensures seamless digital access for everyone.

Use Cases: Where Are PPIs Being Used in India?

A prepaid payment instrument is more than just a tool for digital transactions. It serves different purposes across many sectors in India. From daily needs to organised services, PPI in India has found its place in both cities and smaller towns.

Let’s look at some of the practical ways people and businesses use these instruments:

- Retail payments: Customers use PPIs to shop at local stores, supermarkets, and shopping malls. These cards and wallets help speed up the checkout process and reduce the need for cash.

- Online services: Many users pay for food delivery, ride booking, and streaming platforms using prepaid instruments. Wallet-based payments are quick and do not require direct access to a bank account.

- Public transport: In several Indian cities, metro cards and smart travel cards are issued as closed PPIs. These help commuters avoid standing in long queues for tickets.

- Education and schools: Some schools and colleges offer prepaid ID cards. These are used for cafeteria payments, library services, and internal transport.

- Gift and reward cards: Companies use PPI cards to give bonuses, rewards, or meal allowances to employees. These can be used at selected outlets, based on how they are set up.

- Health and wellness: Clinics and pharmacies now accept PPI transactions, which makes it easier for people to manage health-related expenses.

- Small traders and street vendors: Many small businesses now accept wallet payments, which gives them access to more customers and smoother payments.

- Freelance workers and gig platforms: Earnings from short-term jobs or task-based platforms are sometimes credited to PPI wallets, which can then be used directly for purchases.

Each of these examples shows how prepaid payment instruments are helping India move closer to digital inclusion. They give people more control and add speed to daily transactions without depending on traditional banking at every step.

RBI Guidelines: KYC, Audit, Reporting, and Escrow Compliance

Every licensed PPI issuer in India must operate under strict RBI regulations to ensure safety, transparency, and consumer trust. These rules cover the entire payment lifecycle from customer onboarding to fund settlement.

1. KYC Compliance

All PPI users must complete identity verification (Know Your Customer) before unrestricted use. This includes verifying documents and confirming basic personal details.

2. Record Keeping & Reporting

Issuers must maintain complete records of every transaction, including time, amount, and source, and share data with the RBI upon request. They must also submit periodic reports on user activity, fund balances, and complaint resolution.

3. Escrow Account Management

All customer funds are kept in a separate escrow account with a scheduled bank. These funds cannot be mixed with the issuer’s business income and must always be available for refunds or settlement.

4. Audits and Risk Monitoring

Each PPI license holder must undergo regular internal and external audits to confirm financial integrity and operational compliance. Any fraud, system failure, or data breach must be reported to RBI immediately.

5. Consumer Protection

Issuers must provide accessible grievance redressal systems, follow fair disclosure practices, and ensure data privacy under RBI’s cyber and data-storage mandates.

These regulations ensure that India’s prepaid ecosystem remains transparent, reliable, and accountable to both users and regulators.

Conclusion:

A prepaid payment instrument gives people and businesses a safe and simple way to manage money. It works well for daily use, offers clear spending limits, and supports India’s digital growth. The rules set by the Reserve Bank make the system fair and secure for everyone. As more people choose digital payments, using PPIs in India will continue to grow.

With clear RBI PPI Guidelines and licensed issuers ensuring compliance, PPIs are set to remain a cornerstone of India’s cashless future.

FAQs

1. What is PPI?

PPI stands for Prepaid Payment Instrument. It is a digital tool that allows users to load money in advance and use it for payments, transfers, or purchases. Instead of being directly linked to a bank account, a PPI stores prepaid value that can be used anytime.

2. What is a PPI Wallet?

A PPI Wallet is a type of prepaid account where users can add money and use it for quick, cash-free payments. It’s ideal for daily expenses such as bills, shopping, fuel, or travel. Many fintech companies and banks offer RBI-authorized PPI wallets.

3. What is a PPI Card?

A PPI Card is a prepaid card loaded with a fixed or variable amount of money. It works like a debit card but is not linked to a bank account. These cards are commonly used for corporate expenses, travel, or employee benefits.

4. Is cash withdrawal available from a Prepaid Payment Instrument?

Cash withdrawal is only allowed from Open System PPIs that are issued by banks or authorized entities working with banks. Wallet-based or semi-closed PPIs do not allow cash withdrawals under the current RBI PPI Guidelines.

5. What is a PPI License?

A PPI License is the authorization granted by the RBI under the Payment and Settlement Systems Act, 2007, to issue prepaid payment instruments in India. It ensures that the issuer follows RBI’s rules for KYC, fund security, and customer protection.

6. Who are PPI Merchants?

PPI merchants are businesses that accept payments made using prepaid wallets, cards, or vouchers. They could be online stores, restaurants, travel apps, or retail outlets connected to a PPI issuer’s network.

7. What are Prepaid Payment Instruments (PPIs) used for?

PPIs are used for a wide range of purposes everyday payments, online shopping, bill payments, travel expenses, employee reimbursements, and gifting. They provide a flexible, reloadable way to manage money digitally.

8. Are PPIs linked to bank accounts?

Not always. Many PPI wallets and cards function independently of a bank account, though funds are ultimately stored with a partner bank in an escrow account as per RBI rules.

9. Can PPIs be reloaded multiple times?

Yes. Most semi-closed and open PPIs are reloadable, up to limits prescribed by the RBI PPI Guidelines. Some, like gift cards, are single-use and cannot be reloaded.

10. Are PPIs safe for businesses?

Yes. Businesses use corporate PPI cards or wallets to manage employee spending, vendor payments, and reimbursements. RBI regulations ensure fund safety, transaction traceability, and strong KYC controls.