The digital payment space has evolved rapidly in the last few years. Businesses no longer look at a payment gateway as just a tool to accept online payments. Today, it is expected to offer control, clarity, and real-time insights. As customer expectations grow and transaction volumes scale, businesses need smarter tools to manage every step of the payment process. This is where the payment gateway dashboard becomes essential.

Traditional payment gateway systems focused purely on transactions. But modern businesses now demand more than just a success or failure status. They want to see the entire customer journey, identify patterns, track declines, and spot cashflow trends without delay. A dashboard helps businesses do exactly that. It acts as a control center where data meets decision-making.

For merchants dealing with multiple payment modes and fluctuating transaction volumes, dashboards bring clarity. Whether it’s tracking the source of failed payments or understanding how different payment options perform, a payment gateway dashboard makes it easier to act, not just react.

Above all, the dashboard directly improves the merchant experience. It gives merchants the visibility and flexibility they need to stay on top of operations, make quicker decisions, and improve customer satisfaction.

What is a Payment Gateway Dashboard and How Does It Work?

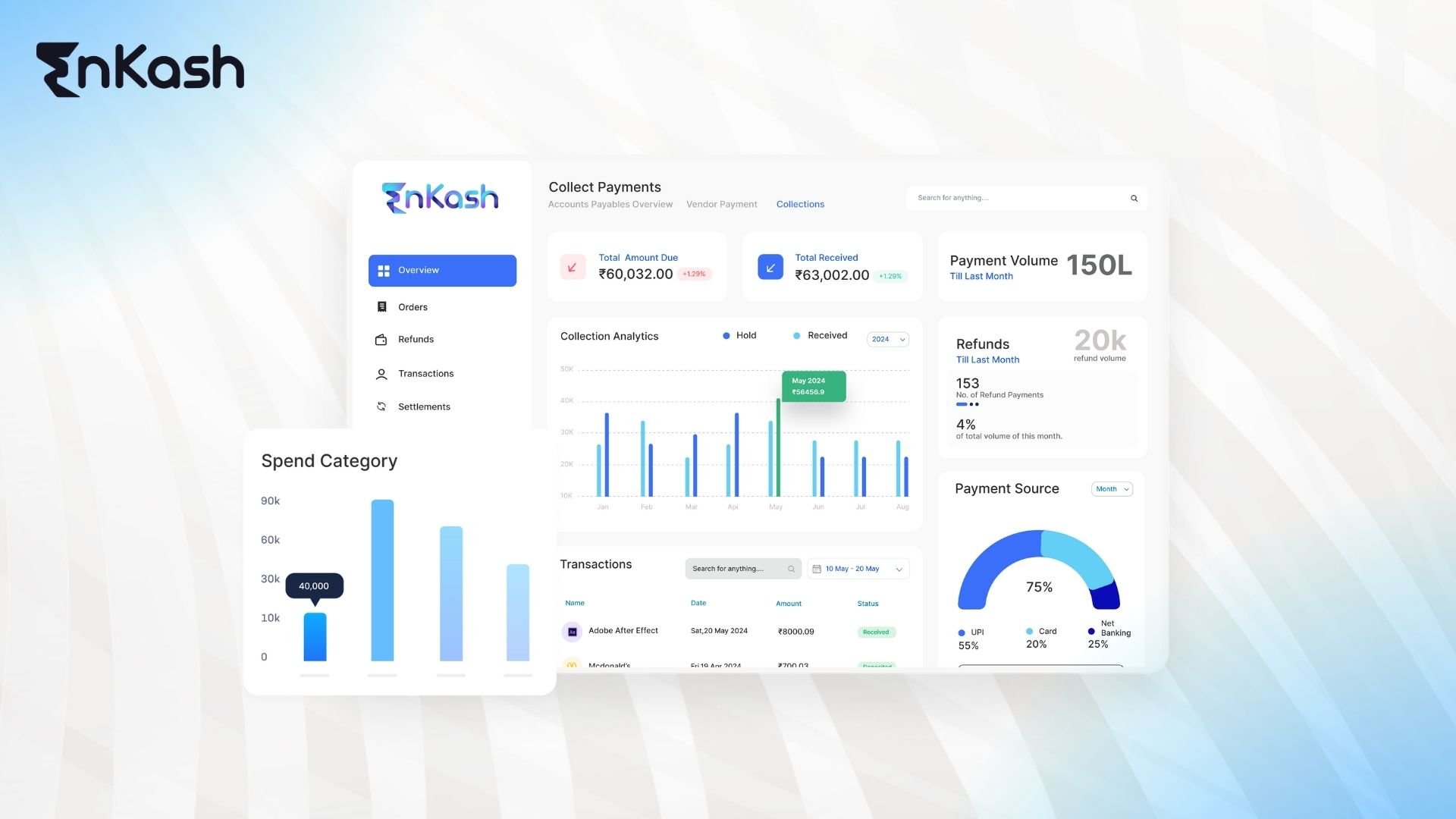

A payment gateway dashboard is a central interface that gives businesses full control over their payment operations. It goes beyond basic transaction monitoring. Instead of logging in just to check if a payment was successful, merchants now use the dashboard to analyze trends, issue refunds, monitor settlements, and detect unusual activity in real time.

The dashboard connects the technical layer of the payment gateway with a visual layer that presents data in an understandable and usable format. It translates complex backend information into clear, actionable insights. For example, a merchant can log in and instantly see how many payments succeeded today, how many failed, which banks or methods underperformed, and what the settlement timelines look like.

The payment gateway dashboard is also built to adapt. Businesses can filter transactions based on date, payment method, customer location, or amount. This kind of flexibility becomes crucial when reconciling revenue or identifying the source of issues during high-volume periods.

Another important aspect is the seamless integration with the merchant login system. Merchants can access all tools from a single place. There is no need to toggle between platforms or run manual reports. With everything accessible through one secure login, the merchant experience improves significantly.

More importantly, the dashboard is designed to help merchants use data, not just collect it. By enabling smarter, faster actions, the payment gateway dashboard becomes a vital part of day-to-day business management.

Read more: Payment Gateway Integration Guide

Core Features That Power Modern Dashboards

A payment gateway dashboard is designed to simplify how businesses manage and interpret payment data. It brings together everything a merchant needs in one place, with a focus on clarity, speed, and usability. Below are the key features that define an effective dashboard:

Real-time Transaction Tracking

Merchants can monitor every transaction as it happens. Successful, failed, and pending payments are updated instantly, giving full visibility into daily operations.

Refund and Chargeback Management

The dashboard allows merchants to issue full or partial refunds easily. It also provides immediate access to chargeback details, improving response time and reducing manual effort.

Advanced Filters and Search Tools

Users can sort and filter data based on date, payment method, customer ID, transaction size, and more. This helps in quickly identifying anomalies or understanding trends.

Customizable Reports

Merchants can generate detailed reports based on their specific needs. This supports internal audits, financial reviews, and daily reconciliations.

Settlement Tracking

Dashboards include a breakdown of settlement timelines and amounts, helping businesses stay updated on when and how they will receive their funds.

Cashflow Forecasting

With integrated cashflow analytics, businesses can predict inflows based on transaction history, reducing the risk of shortfalls or delays.

Mobile Accessibility

Many dashboards are available on mobile, allowing merchants to manage transactions even when they are away from the office.

Read more: Mobile Payment Solutions: How Mobile Payment Gateways Facilitate Easy Payments

Business Benefits: Why a Dashboard Is No Longer Optional

What used to be an added feature is now a necessity. A payment gateway dashboard gives businesses the control they need to track payments, manage cash flow, and stay ahead of financial issues. Here are the key benefits that make it essential for every merchant:

Instant Access to Real-time Data

The dashboard gives merchants a live view of every transaction as it happens. Whether it’s a successful payment, a failure, or a refund request, the update is visible immediately. This real-time monitoring removes the need to wait for daily summaries or Excel exports. It becomes especially useful during high-traffic periods, allowing businesses to act fast and keep operations running smoothly.

Lower Support Dependency

With access to full transaction records, merchants no longer rely on backend teams for updates. Refund statuses, chargebacks, and settlement progress are all available directly through the dashboard. This reduces the back-and-forth with support, speeds up daily workflows, and allows more self-sufficiency.

Smarter Decisions with Payment Insights

Built-in payment gateway analytics offer insights into transaction performance. Merchants can identify which payment methods perform better, which times of day see the most failures, and where customer drop-offs happen. These insights guide better decisions for optimizing the payment experience.

Improved Revenue Visibility

Using cashflow analytics, businesses can see how much money is expected, what has been settled, and what is still pending. This ongoing visibility helps prevent surprises and allows better financial planning, especially for businesses with tight cash cycles.

Faster Issue Resolution

When all payment data is in one place, it’s easier to handle refund requests or disputes. With full visibility, the team can take action immediately without digging through reports or contacting support.

Stronger Financial Planning

The dashboard enables easy generation of daily, weekly, and monthly reports. These reports help businesses track progress, analyze trends, and plan budgets more accurately.

Better Control during High-Volume Periods

During sales, campaigns, or new launches, the payment gateway dashboard becomes a live control center. Merchants can monitor payment spikes, spot failures instantly, and take corrective action without delays.

Enhanced Merchant Experience

A clean, central dashboard gives merchants peace of mind. It simplifies oversight, reduces confusion, and frees up time to focus on business growth instead of problem-solving.

Industry Applications: Who Gains the Most from Dashboards?

A payment gateway dashboard serves different purposes depending on the industry. While the core features remain the same, how businesses use them varies based on their structure, transaction flow, and customer expectations. Here is how different industries benefit:

E-commerce Businesses

Dashboards help e-commerce merchants monitor success rates across cards, wallets, and UPI. They also use payment gateway analytics to track refund trends, identify peak failure times, and adjust offers or checkout flows in response.

SaaS Platforms

For subscription-based models, dashboards are used to track renewals, missed payments, and churn. Businesses can monitor which payment modes are most reliable and where users drop off in the billing process.

Marketplaces and Aggregators

These businesses deal with split payments, multi-vendor settlements, and higher dispute volumes. Dashboards offer real-time oversight into disbursals and refunds, making it easier to manage cash flow and ensure timely payments to vendors.

Edtech and Digital Services

These platforms rely on time-sensitive payments. Dashboards help ensure minimal delays and allow for live tracking of student or client transactions through a secure merchant login interface.

Each of these industries depends on speed, reliability, and real-time insight. A strong merchant experience starts with a clear and responsive dashboard that supports their operational rhythm.

Analytics in Action: Turning Data into Smarter Payment Moves

The true strength of a payment gateway dashboard lies in its ability to make raw data useful. With built-in payment gateway analytics, businesses no longer need to guess what went wrong or why a certain method is underperforming. Instead, they can act based on patterns, trends, and real-time insights.

Here’s how analytics within the dashboard supports better decisions:

- Understanding customer behavior

Merchants can track when users are most active, what devices they use, and which payment methods they prefer. This helps in adjusting campaigns or checkout options for higher conversions.

- Reducing payment failures

With failure reasons listed and categorized, merchants can identify recurring issues linked to specific banks or gateways. This data helps in resolving problems before they impact revenue.

- Improving conversion through payment optimization

By observing which payment modes result in higher success rates, businesses can highlight or promote them during checkout to improve customer satisfaction and reduce drop-offs.

- Region-wise performance tracking

Analytics can show how payment behavior varies across cities or countries. This is especially useful for businesses operating across multiple locations or currencies.

- Quick access through merchant login

All reports, charts, and data filters are available through a single merchant login, making it easy to access insights without navigating multiple systems.

Choosing the Right Dashboard: Features That Matter

Not all dashboards are created equal. While most payment gateway solutions offer a dashboard, only a few provide the depth, clarity, and flexibility that businesses truly need. If you are evaluating a solution, here are the features that make a real difference:

- User-friendly merchant login

A clean, intuitive interface matters. The merchant login should allow access to reports, filters, and settings without confusion or long loading times.

- Customizable reporting

The dashboard should allow merchants to generate custom reports based on date, transaction type, customer ID, and more. These reports should be exportable and easy to share internally.

- Automated alerts and notifications

Look for dashboards that offer alert systems for unusual payment trends, failed transaction spikes, or settlement delays. Timely updates allow faster intervention.

- Seamless third-party integrations

The ability to connect the dashboard with accounting tools, CRM systems, or ERP platforms ensures smoother workflows and better financial tracking.

- Mobile compatibility

A responsive mobile view or dedicated app lets merchants track payments, issue refunds, and view settlements even when they are not at their desks.

The right payment gateway dashboard should work around the needs of the business, not the other way around. These features directly affect the merchant experience and ensure better control over daily operations.

Read more: What Are The Different Types of Payment Gateways? – A Complete Guide

Best Practices for Leveraging Your Payment Gateway Dashboard

To get the most from a payment gateway dashboard, follow these practical steps. They will improve insights, speed up action, and enhance overall performance.

- Set Up Custom Alerts

Configure notifications for high failure rates, unexpected refund volumes, or settlement delays. Early warnings help you intervene before small issues become large problems. - Regularly Review Cashflow Reports

Schedule weekly checks of cash flow analytics to verify incoming funds and compare them against forecasts. This habit keeps your budgeting accurate and prevents surprises. - Segment Transactions for Deeper Analysis

Use filters to group transactions by region, payment mode, or customer segment. This level of detail makes it easier to spot trends and tailor offers based on actual behavior. - Train Your Team on Dashboard Features

Ensure that everyone who accesses the merchant login understands how to use search tools, generate reports, and interpret data visuals. Training reduces errors and speeds problem resolution. - Integrate with Other Business Tools

Connect your dashboard with accounting software or customer relationship management platforms. Unified data flows eliminate duplicate work and keep all teams aligned. - Review Analytics to Guide Strategy

Leverage payment gateway analytics to decide which payment methods to promote or discount. Data-driven adjustments help boost conversion rates and customer satisfaction.

Conclusion: Smarter Dashboards, Stronger Merchant Control

A modern payment gateway dashboard is no longer a technical extra. It has become an essential part of how businesses manage payments, reduce errors, and make informed decisions. From real-time tracking to in-depth cashflow analytics, dashboards bring unmatched visibility into every transaction and every payout.

For merchants, this means fewer delays, better planning, and more confident actions. The ability to log in, view all metrics in one place, and respond to issues without delay transforms the overall merchant experience. It saves time, reduces dependence on support, and creates a stronger grip over finances.

Whether you’re a startup, a growing e-commerce brand, or a high-volume platform, investing in the right payment gateway dashboard will strengthen how you run your business. When powered with the right features and backed by smart payment gateway analytics, the dashboard is more than just a tool. It becomes your everyday command center.