The way businesses in India handle transactions has seen a rapid shift over the last decade. As digital payments grow across industries, the role of a payment gateway has become more than just a facilitator. It now plays a central part in how businesses receive money, manage their cash flow, and plan day-to-day operations.

Traditionally, once a customer made a payment online, the funds would take a day or two to reach the merchant’s bank account. This delay might seem small, but for businesses that run on tight margins or depend on daily cash flow, it can create challenges. In a competitive market, waiting 24 to 48 hours for money to settle can slow down purchasing decisions, delay supplier payments, or hold back growth.

To solve this, many companies are now turning to instant settlement services. These solutions make it possible for businesses to access their money in real time or within minutes of a transaction being completed. This speed helps them keep things moving and stay agile in an increasingly fast-paced digital economy.

As demand grows, the need for an instant settlement payment gateway has become a priority for both new and established businesses looking for a reliable, real-time solution.

What is Instant Settlement?

Instant settlement is a feature that allows businesses to receive their payments in real time, right after a customer completes a transaction. Instead of following the standard process where funds are transferred in batches after one or two working days, this system enables the transfer of funds within minutes. For businesses that need immediate access to working capital, this solution has become a game-changer.

In the traditional model, most online payments go through a cycle that includes authorization, confirmation, and final settlement. The settlement usually happens on a T+1 or T+2 basis, meaning one or two days after the transaction date. While this works for some industries, it is not ideal for fast-moving businesses that rely on quick cash flow. This is where the instant settlement feature makes a clear difference.

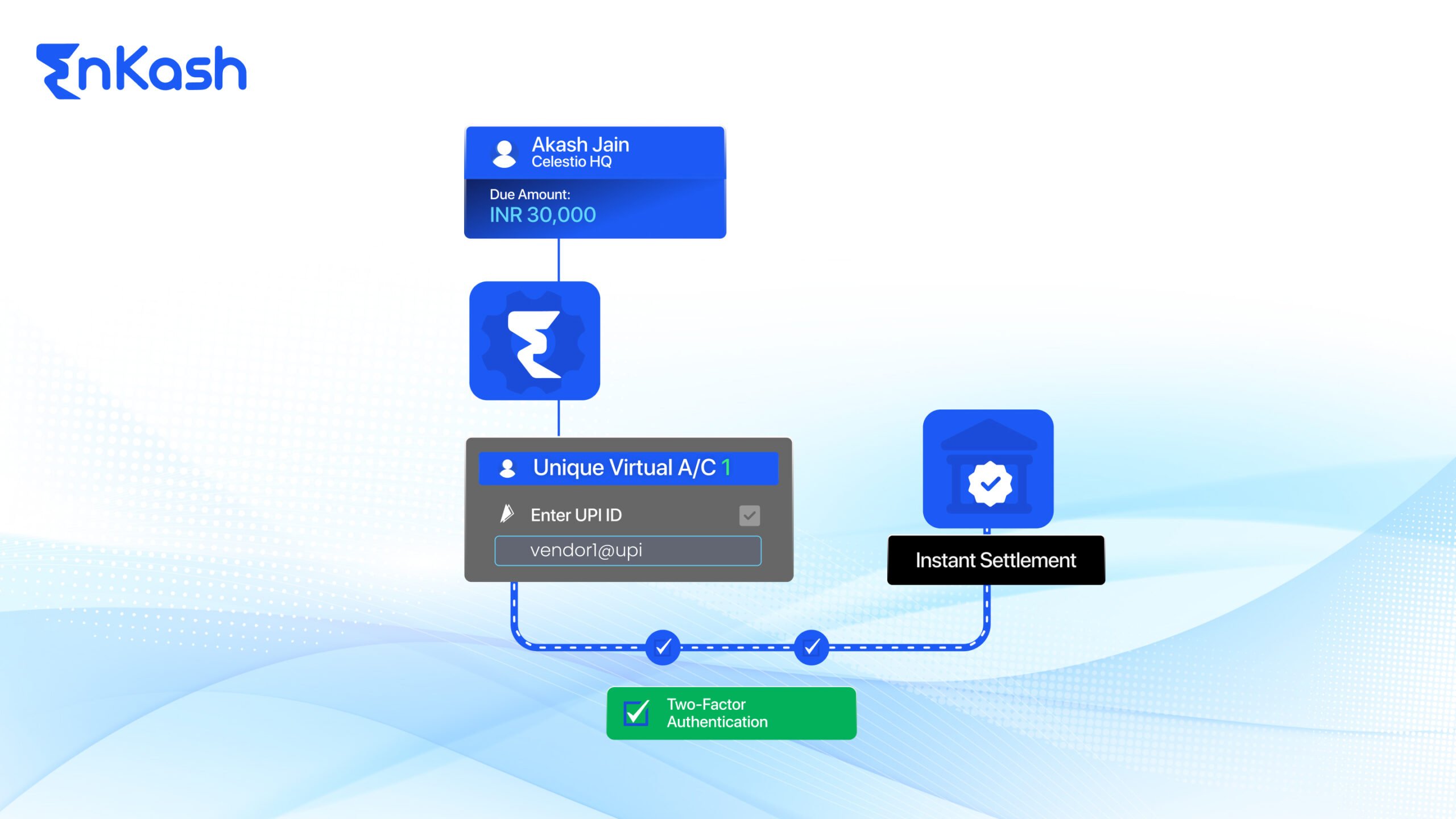

An instant settlement payment gateway processes the payment and releases the amount to the merchant’s bank account almost immediately. The system uses real-time APIs, banking integrations, and a pre-settlement balance system to make this possible. It reduces the waiting time, removes uncertainty, and helps businesses plan their finances more effectively.

This type of system benefits not just large enterprises, but also small vendors, online sellers, and service providers who depend on every transaction to keep operations running smoothly. It makes payments faster, smoother, and more reliable.

The rise of instant merchant settlement has brought a fundamental change to how money moves in the digital economy, making settlements a real-time experience rather than a waiting game.

How a Payment Gateway Enables Instant Settlement

A payment gateway acts as the bridge between a customer making a payment and a merchant receiving it. Its role goes beyond just collecting money. It ensures that transactions are processed securely, quickly, and without error. In recent years, the ability of a payment gateway to offer instant settlement has become a critical factor in business operations.

Once a customer makes a payment, the payment gateway first verifies and authorizes the transaction through the bank or card network. Traditionally, after this step, the settlement would occur at the end of the business day or the next working day. In contrast, an instant settlement payment gateway uses advanced technology to push the funds to the merchant’s account within minutes.

This system relies on real-time banking rails, smart routing, and API integrations with financial partners. The settlement process is triggered automatically once the payment is authorized, skipping the long holding periods that are common with traditional methods.

The instant settlement feature also comes with added transparency. Merchants can track when the funds are expected, view disbursement schedules, and even request manual payouts through on-demand options. Many providers also allow this through mobile dashboards or direct integration with accounting software, improving control and visibility.

By offering an instant merchant settlement solution, modern payment gateway providers are helping businesses meet their immediate cash needs. This functionality allows businesses to maintain continuity, settle supplier payments faster, and make informed decisions backed by real-time cash flow access.

Read more: How Secure Payment Gateways Safeguard Your Business

Key Features of Instant Settlement Payment Gateways

Choosing an instant settlement payment gateway brings multiple advantages beyond just faster payouts. Below are the key features that make these solutions ideal for modern businesses:

- Real-time settlements

- Funds are transferred to the merchant’s bank account within minutes after a transaction.

- Available 24/7, including weekends and public holidays.

- Perfect for businesses that need continuous access to working capital.

- Funds are transferred to the merchant’s bank account within minutes after a transaction.

- Same-day settlements

- Payouts are scheduled at fixed times during the day, such as 9 AM and 5 PM.

- Useful for businesses that prefer structured daily cash flow.

- Helps plan vendor payments, stock purchases, and daily expenses.

- Payouts are scheduled at fixed times during the day, such as 9 AM and 5 PM.

- On-demand settlements

- Merchants can request instant payouts whenever they choose.

- Gives full control over the timing of fund transfers.

- Ideal for urgent needs or unexpected expenses.

- Merchants can request instant payouts whenever they choose.

- Multiple settlement intervals

- Options like 15-minute, 30-minute, or hourly settlements are available.

- Let’s merchants align cash flow with specific business operations.

- Flexible enough to support various industries and business sizes.

- Options like 15-minute, 30-minute, or hourly settlements are available.

- Automated dashboards and controls

- Real-time tracking of payments, settlements, and disbursement status.

- Allows seamless management through a web dashboard or mobile interface.

- Improves financial planning and decision-making.

- Real-time tracking of payments, settlements, and disbursement status.

- Instant settlement feature availability is subject to provider approval, KYC completion, and risk profiling.

- Some platforms may offer it by default, others upon request.

- Some platforms may offer it by default, others upon request.

By offering a full range of instant settlement options, modern gateways ensure that businesses, big or small, never lose momentum due to payment delays. These tools help maintain agility and build financial confidence with every transaction

Difference Between Same-Day and On-Demand Settlements

When businesses opt for instant settlement, they typically choose between same-day settlements and on-demand settlements. Both options offer speed, but each fits different operational styles.

Tabular Comparison

Features |

Same-Day Settlements |

On-Demand Settlements |

Timing |

Fixed times (e.g., 9 AM, 5 PM) |

Flexible, merchant-triggered |

Control |

Set by the provider |

Decided by the merchant |

Frequency |

Once or twice daily |

Anytime, based on need |

Best for |

Structured cash flow |

Immediate or urgent requirements |

Involvement |

Passive (auto-processed) |

Active (manual trigger) |

Use Case-Based Breakdown

- A retail brand running daily online sales might prefer same-day settlements to receive regular payouts without needing to intervene.

- A logistics provider handling last-minute orders could benefit from on-demand settlements to access funds instantly and pay drivers or fuel costs.

- An event ticketing service may need on-demand settlements after a major sale ends, to quickly pay venue partners.

Business Types Suited

- Same-day settlements are well-suited for D2C brands, restaurants, or subscription-based models with predictable volumes.

- On-demand settlements work better for freelancers, repair service professionals, and gig economy platforms where transactions vary day to day.

Each option is offered by an instant settlement payment gateway, allowing businesses to choose based on their financial rhythm.

Read more: Everything You Need to Know About Payment Gateway in India

Benefits of Instant Settlement for Merchants

Merchants using an instant settlement solution gain several practical advantages that improve their financial stability and daily operations. Below are the key benefits:

- Faster access to working capital

- With the instant settlement feature, funds are received within minutes.

- This helps manage cash needs for restocking, salaries, logistics, or unexpected expenses.

- Businesses avoid delays tied to T+1 or T+2 settlement cycles.

- With the instant settlement feature, funds are received within minutes.

- Improved customer experience

- Merchants can process refunds more quickly.

- Immediate access to funds allows for fast dispute resolution.

- Builds trust and increases chances of repeat sales.

- Merchants can process refunds more quickly.

- No dependency on short-term credit

- Reduces the need for borrowing or using high-interest loans.

- Helps maintain a healthy cash flow without added financial pressure.

- Reduces the need for borrowing or using high-interest loans.

- Better supplier relationships

- On-time payments to vendors improve credibility.

- Can lead to better pricing, credit terms, or priority supply access.

- On-time payments to vendors improve credibility.

- Real-time decision-making

- With funds received instantly, businesses can make informed choices on marketing spends, operations, or scaling.

- The liquidity boost helps meet growth opportunities without delay.

- With funds received instantly, businesses can make informed choices on marketing spends, operations, or scaling.

- Flexibility across industries

- An instant merchant settlement is useful in retail, e-commerce, logistics, services, food delivery, and healthcare.

- It allows every transaction to directly support the next stage of business operations.

- An instant merchant settlement is useful in retail, e-commerce, logistics, services, food delivery, and healthcare.

By using an instant settlement payment gateway, merchants ensure that cash inflow aligns with business needs in real time, not just on paper.

Real-Time Settlement Options by Leading Payment Gateways

Businesses seeking efficient cash flow management can leverage the instant settlement feature offered by various payment gateway providers. Below is an overview of leading platforms offering instant settlement solutions:

Paytm

- Provides 24×7 instant settlement, including weekends and holidays.

- Supports multiple payment modes: UPI, cards, net banking, and wallets.

- Merchants can configure preferred settlement times and access detailed transaction histories.

- Suitable for freelancers, small businesses, and app-based platforms.

Razorpay

- Offers instant settlement through API and dashboard interfaces.

- Enables fund transfers within minutes post-payment capture.

- Supports same-day settlements and real-time disbursements, including for marketplace sellers.

- Includes scheduled payouts and bulk settlements with customizable timing.

- Built-in analytics assist merchants in managing and forecasting cash flow.

Cashfree

- Facilitates payouts in as little as 15 minutes with automated settlement cycles.

- Provides options for same-day settlements, hourly settlements, and on-demand settlements.

- Operates on weekends and bank holidays, depending on account configuration.

- Offers detailed payout logs, real-time status tracking, and a user-friendly interface.

- Ideal for businesses requiring immediate access to revenue.

EnKash Payment Gateway

- Supports instant settlement capabilities tailored for corporate payments.

- Offers virtual card solutions and expense management tools.

- Enables real-time fund transfers and automated reconciliation processes.

- Integrates with various financial systems to streamline operations.

- Suitable for enterprises seeking comprehensive financial management solutions.

Easebuzz

- Delivers instant settlement services with high transaction success rates.

- Supports over 150 payment modes, including cards, UPI, net banking, and wallets.

- Provides a unified dashboard for real-time transaction data and customizable reports.

- Offers additional services like subscription management and vendor payouts.

- Ideal for SMEs, educational institutions, and service-based businesses.

Each instant settlement payment gateway offers unique features and benefits. Businesses should assess their specific needs to select the most appropriate solution, ensuring efficient and timely access to funds through instant merchant settlement options.

Risks, Costs, and Eligibility Factors

While the instant settlement feature offers clear advantages, businesses must be aware of the associated risks, fees, and eligibility requirements. These factors vary depending on the instant settlement payment gateway chosen.

- Transaction fees: Most providers charge a small fee for each instant settlement request. The fee can be a flat rate or a percentage of the amount settled. It is important for businesses to compare charges before deciding on a gateway.

- Eligibility checks: Not every merchant is granted access to instant merchant settlement immediately. Providers assess a merchant’s transaction history, risk profile, and industry type before activating this feature.

- Operational risks: In rare cases, technical failures or banking downtimes can cause delays. It is also important to monitor cash flow carefully, as instant access can lead to impulsive spending without proper budgeting.

Read more: Payment Gateway Fees in India

Is Instant Settlement Right for Your Business?

The decision to use an instant settlement solution depends on the structure, scale, and cash flow needs of your business. While this feature offers flexibility and speed, it is most useful for specific types of operations.

Businesses with high daily transaction volumes often benefit the most. These include online retailers, food delivery services, taxi aggregators, and medical supply chains. Access to immediate funds helps manage inventory, pay staff, and respond quickly to demand.

Freelancers, home-based sellers, and consultants may also find value in on-demand settlements when cash needs vary week to week. In these cases, using an instant merchant settlement feature can avoid reliance on credit or delayed payments.

If your business works on long-term contracts or infrequent billing, traditional settlement cycles may still be suitable. However, having the option of an instant settlement payment gateway allows you to scale faster, stay prepared, and maintain better financial control when the need arises.

Final Thoughts: The Future of Instant Settlements in India

As digital payments become more central to everyday business, the demand for faster fund access continues to grow. The introduction of the instant settlement feature has transformed how businesses handle incoming payments, offering greater control, better cash flow, and operational flexibility.

An instant settlement payment gateway no longer serves just as a tool for accepting payments. It has become a strategic part of how businesses plan growth, manage expenses, and stay competitive. Whether you run a large e-commerce brand or a local service business, having instant access to funds can make daily operations smoother and more predictable.

The availability of options like same-day settlements, on-demand settlements, and detailed payout tracking shows that India’s digital payment infrastructure is evolving quickly. With platforms like EnKash, Razorpay, Cashfree, Paytm, and Easebuzz offering reliable instant merchant settlement, the future of real-time business banking is already here.

Instant is no longer optional. It is essential.