In this technology-driven era, a fast workflow is what we all look for to ease working, like quick payment collection for corporate payments and rentals. However, payment collection or monetary transactions from clients has been the most crucial part of the business. So, speeding up the collection process is the need of the hour.

Payment collection refers to the process of collecting payments from customers or clients. It can be done through various methods, including invoicing, manual payment collection, and online payment methods. Now you might be thinking about what can be done to pace up the payment collection method. One of the solutions is payment links. They quicken the collection or payment process and access to pay from anywhere without hassle.

Payment links are a convenient way for businesses to collect payments from customers. They allow businesses to send a link to their customers via email, invoices, or text messages, which customers can then use to make a payment directly from their preferred payment method. In addition, it can be faster and more convenient than traditional methods, such as invoicing or manual payment collection. Let us learn more about how they benefit businesses, and what they can do for you. Read on!

What Are Payment Links?

Payment links are typically used in conjunction with a payment gateway, which is a secure platform that enables businesses to accept payments online. There are several benefits to using these for businesses. They can be faster and more convenient than traditional payment methods, such as invoicing or manual payment collection.

Payment links also offer a high level of security, as they use secure payment gateways to process transactions. In addition, these links can be integrated with accounting software and automated payment reminder systems, which can help businesses stay organized and reduce the time and effort required to collect payments. As a result, links requesting payment are a valuable tool for businesses to streamline their payment collection process and improve their cash flow.

What Can They Do for Your Business?

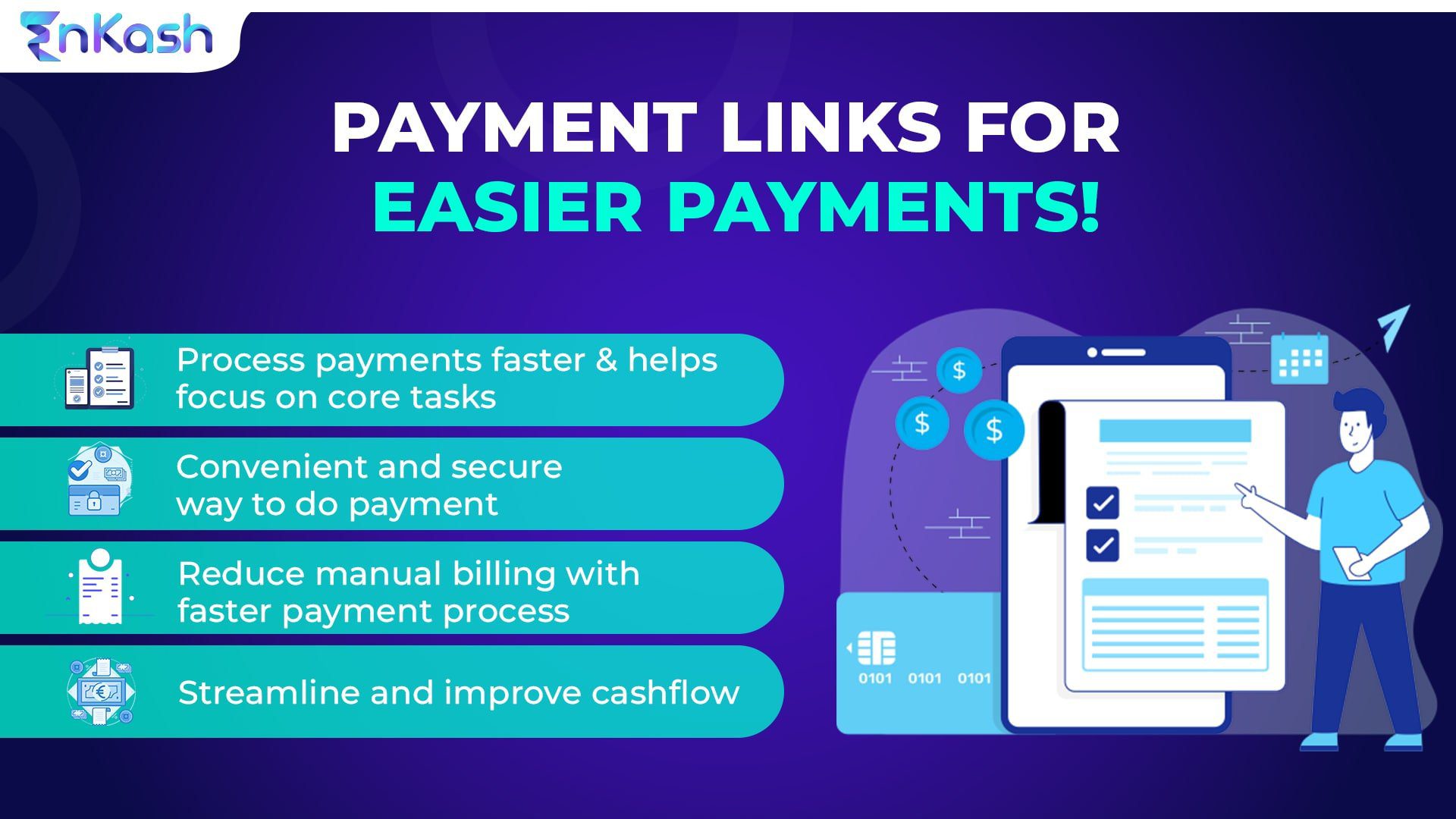

Payment links can be embedded in the invoices and let customers pay with plenty of options available in just one click. You might be worried about the security and accessibility issues of such links, but they are completely secure and can be accessed anywhere without any hassles. Here are some key benefits of using payment links:

Convenience

Makes it easy for customers to make payments from their preferred payment method making it more convenient that traditional payment methods.

Speed

Payment links enable fast payment processing, which can help businesses receive payments more quickly resulting in improved cash flow.

Security

Such links use secure payment gateways to process transactions, which reduces the risk of fraud or error and gives both businesses and customers peace of mind

Automation

Payment links can be integrated with accounting software and automated payment reminder systems, which can help businesses stay organized and reduce the time and effort

Efficiency

Payment links allow businesses to automate their payment process, reducing the need for manual billing and payment processes

Flexibility

Payment links can be customized to fit the needs of the business and can be used in various payment scenarios, such as one-time or recurring payments

Overall, payment links are valuable for businesses looking to improve their payment collection process and maintain strong cash flow.

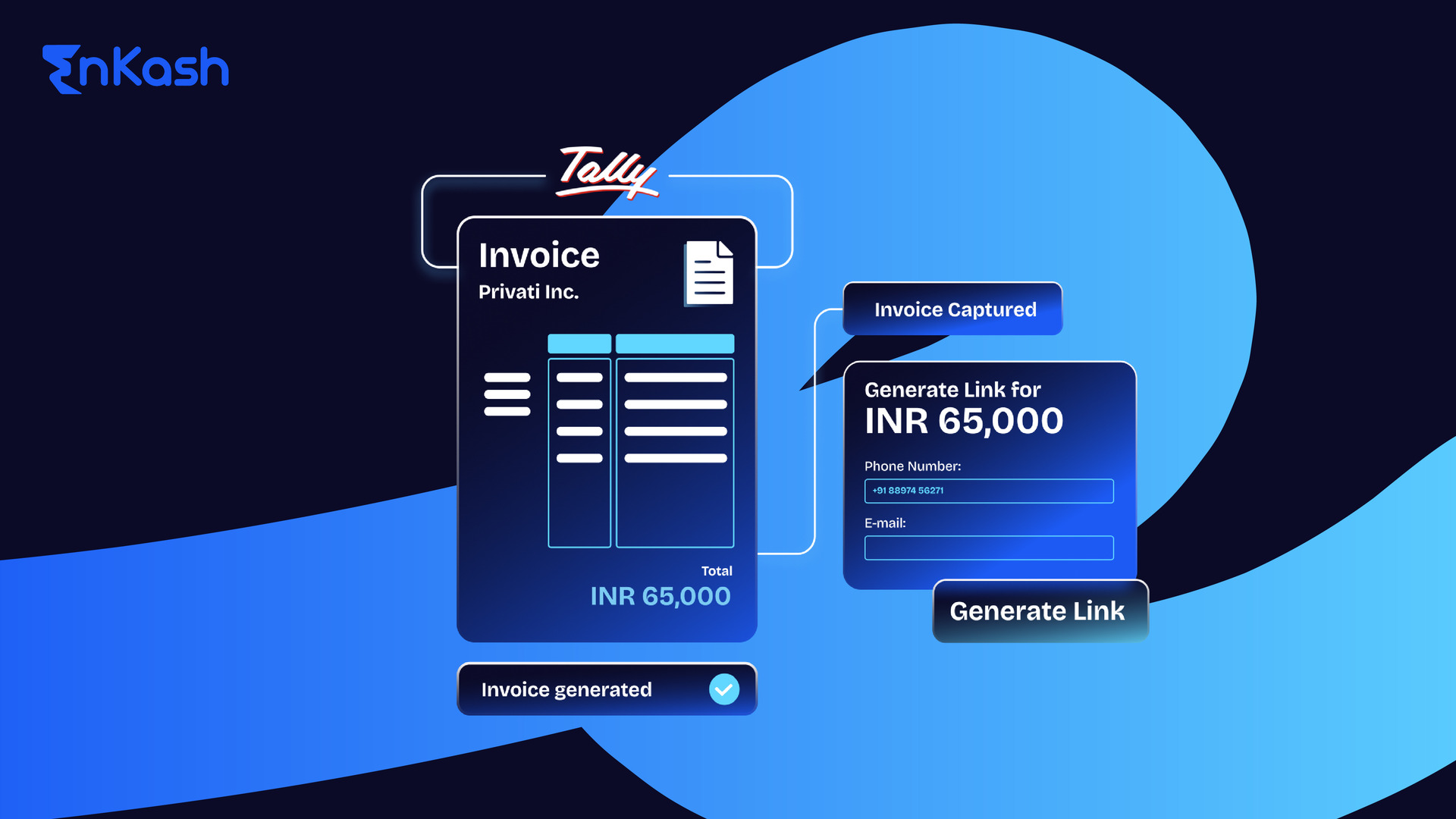

How to Generate Payment Link

There are several ways to create a payment link, depending on your payment gateway or service. However, here are some general steps you can follow to create a payment link:

- Sign up for a payment gateway or service that allows you to create links

- Follow the instructions provided by the payment gateway or service to create a link which may involve setting up an account and configure settings

- Determine the amount and currency for the payment

- Customize the link with additional options or settings, such as the payment description, return URL, or notification preferences

- Generate the link by clicking a button or using an API or other provided method

- Share the payment link with your customers by sending it via email or embedding it on your website

It is important to note that each payment gateway or service may have specific steps and requirements for creating a payment link. Be sure to consult the documentation or support resources provided by the service you are using for more detailed instructions.

Why Using Payment Links is a Smart Choice in Today’s Scenario?

In today’s digital age, payment links can be a smart choice for businesses that want to offer their customers a convenient and secure way to make payments online. With more and more people conducting transactions and making payments online, payment links provide an easy and secure way for businesses to request and receive payments from their customers.

Payment links can be especially useful for businesses that operate primarily online or customers who prefer to make payments online. They can also be useful for businesses that request payment for invoices or other types of transactions, as they provide a quick and secure way to receive payment. Overall, payment links can be a valuable tool for businesses looking to streamline their payment process and provide a convenient and secure payment option for their customers.

Payment links can be used in various payment scenarios, such as one-time or recurring payments, and can be customized to fit the needs of the business. Automate the payment process and reduce the need for manual billing and payment processes. They also provide customers with a convenient and secure way to make payments online

Generate Payment Links with EnKash

In today’s digital age, payment links can be a smart choice for businesses that want to offer their customers a convenient and secure way to make payments online. Moreover, EnKash is a spend management platform that helps businesses manage transactions to improve their financial performance. To know more about how payment links can improve the ease of the business process, check EnKash’s solution.