Running a business necessitates the creation of a successful spend management strategy. A corporation’s expenses range from start-up costs to sourcing company resources to improvement costs, and while these prices vary depending on the type of organization, keeping track of them is essential to a company’s performance.

Manually carrying out these operations is not only time-consuming and inefficient, but it also frequently leads to errors and inefficiencies. As a result, more companies are stepping into a spend management platform that helps them digitize and streamline the spend management processes and increase efficiency.

5 Steps to Create a Successful Spend Management Strategy

A perfect financial strategy is a must for running any business, which comprises spend management, capital management, audit trails, etc. Once you are all geared up with such a utility that offers all financial solutions in one package, you can easily monitor your business.

Some tips focusing on the spend management strategy are given below; this info will help you smoothly monitor your financial expenses.

1. Identify your company’s requirements

Understanding where your organization stands and what is required to reach your goals is the first step in developing an effective spend management strategy. Here some questions are listed below; answer yourself wisely to judge your company’s potential.

- Are your procedures manual or dependent on paper?

- Is it necessary to evaluate your tech stack if you’ve previously applied solutions?

- Is your process decentralized, and if so, what operational model (hybrid, remote, or office-based) do you have in place or plan to have in place to deal with uncertainty?

- Are you giving your employees the tools they need to make wise spending decisions?

The answers to those questions will reveal efficiency as well as areas where improvements may be made, also it will help pinpoint where the operations are being impacted. This will then point you to deploy a powerful spend management tool that will enhance your business by offering an end-to-end financial expenses solution, including vendor payment, audit trails, and much more.

2. Processes should be automated

Continuous data entry is required in financial processes. These procedures are time-consuming and monotonous; therefore, completing them by hand leaves the possibility of human error. Manual and paper-based systems do not allow for effective oversight, are ineffective in encouraging accountability, and expose your company to the following risks:

- Fraud

- Maverick purchasing

- Overspending

Doing a spend analysis and creating a spend management strategy will provide you an immediate edge by digitizing your processes and acquiring the agility and mobility of cloud technology, which can considerably boost your spend management approach. Likewise, payment to MSME vendors will also become smoother with this utility.

Handling the vendor payment was a tough job in the manual process as it took too much time and effort. The comprehensive process affects work because of late payment, and as a result, the workers go on strike. So, to minimize all those risks at work, spend management software is ideal for you.

Furthermore, the software comprises audit trail software that simplifies your financial transactions and enables you to handle the business efficiently.

3. Examine your expenses

Understanding how your company spends is the only way to fully establish the best course of action for your spending management plan. Gaining proactive control of purchasing and expenditure with customized reporting processes, vendor management processes, and workflows is the first step in spend management. You can collect and analyze expenditure data and company-wide purchase insights when these operations are automated using a single digital platform.

With information about spending behavior to inform your business decisions, a spend management plan is more likely to succeed. If you rely on spreadsheets to obtain and evaluate this data, you’re putting yourself at a disadvantage and risk making rash judgments that could be costly in the long run.

Human error is easy to introduce and skew your data, and the time and resources invested will be taxed from all angles. This technique is not scalable or sustainable if your company is fast expanding.

To create a solid spend management strategy based on reliable and accurate data, make sure you can successfully evaluate and analyze spending by:

- Employee

- Supplier

- Budget

- Financial period

- Transaction (and the processing costs associated with these activities)

These spend analytics will shed light on spending patterns, areas needing more scrutiny and spend control, and improve forecasting, annual financial statements, and uncover saving opportunities.

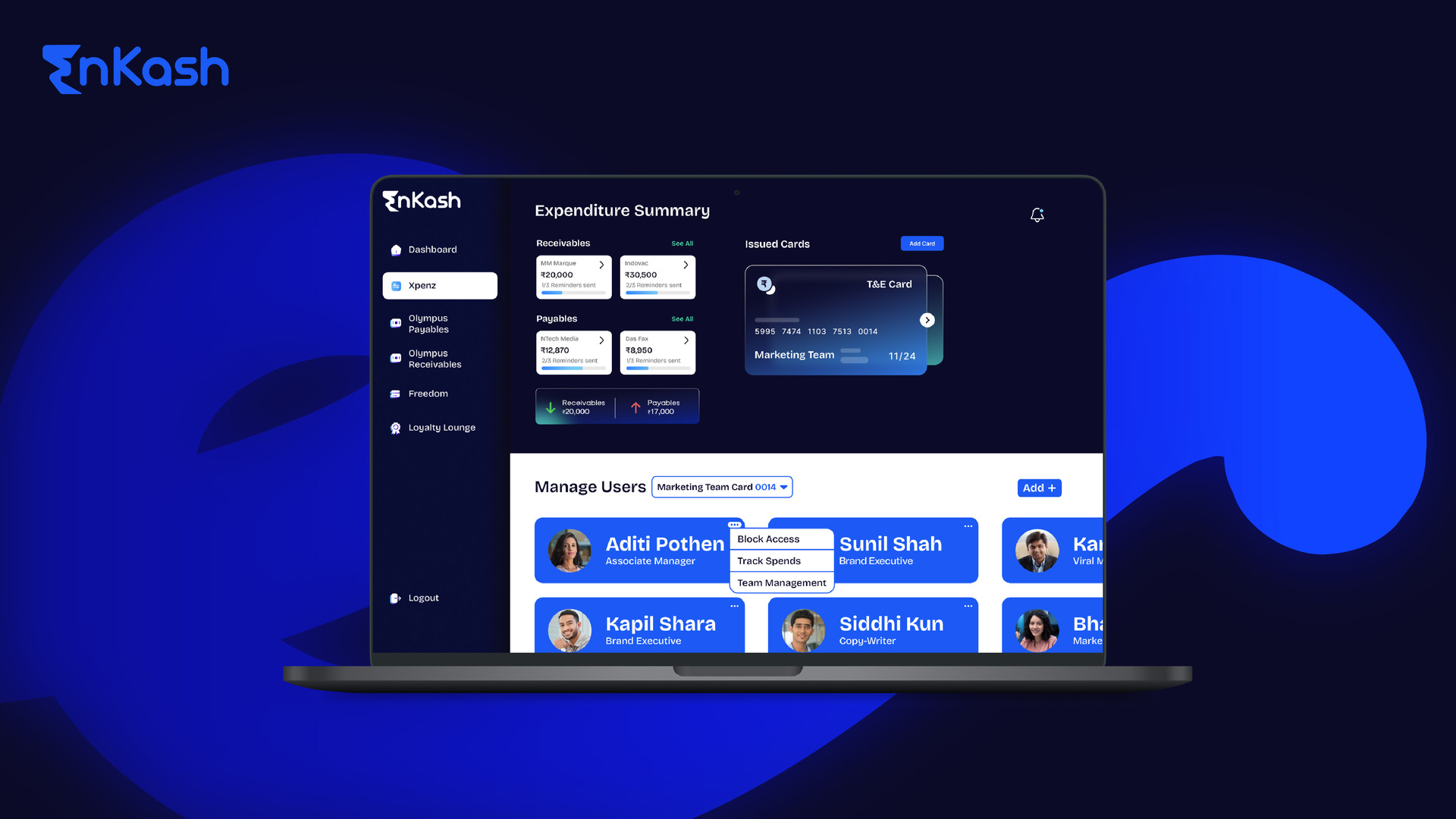

When you get on board with EnKash, you will see how effectively it manages all your expenses in no time with additional details. Don’t believe us?

Let’s see a quick proof here.

4. Evaluate your supplier base

Best procurement practices include the regular undertaking of evaluating your supplier base. This important initiative may be a key component of a successful spend management strategy. Periodic supplier audits are streamlined and simplified with the assistance of solution-driven spend analytics and reporting capabilities.

It’s important to understand how many suppliers your business purchases from, how much you’re spending with them if contracts are in place, and the compliance rate.

5. Create policies and make collaboration possible

Your plan is automated and set in motion by workflows with specified rules, thresholds, approval flow hierarchies, budget checks, and policy controls when you use a spend management solution. Any unlawful or unnecessary expenditure is identified and thwarted. The additional benefit of audit trails providing insight at each stage of a transaction’s lifetime provides accountability and auditability. Furthermore, accounting software with an audit trail maintains the transparency level and helps you examine the financial records smoothly.

Purchasing workflows are routed to suitable people, collaboration is enabled, and all users have access to data for rapid and accurate task completion from any place by centralizing data and employing accessible mobile app-based solutions. Your spend management approach is strengthened and designed to produce value, with collaboration enhancing synergy and productivity and internal controls ensuring compliance.

Bonus Tips – Spending should be approached systematically.

To ensure optimal resource allocation to generate growth and increase profitability, spend management necessitates a strategic approach, best practices, and meticulous planning. Prioritizing spend management is the first step toward achieving your cost-cutting objectives; developing a successful strategy comes next, and how you go about putting that strategy into action is the key to getting results.

Moreover, managing vendor payment is a tedious task, and if you are wondering about the concept ‘what is vendor payment’? Then it is a process of paying the third party (vendor) against the work done through the procurement process or others. So, if you have a big business and a series of vendors, then spend management software is good for you to manage the financial records of all the vendors.

To know more, visit: www.enkash.com. You can also click below on Signup Now and we will reach out to you soon.