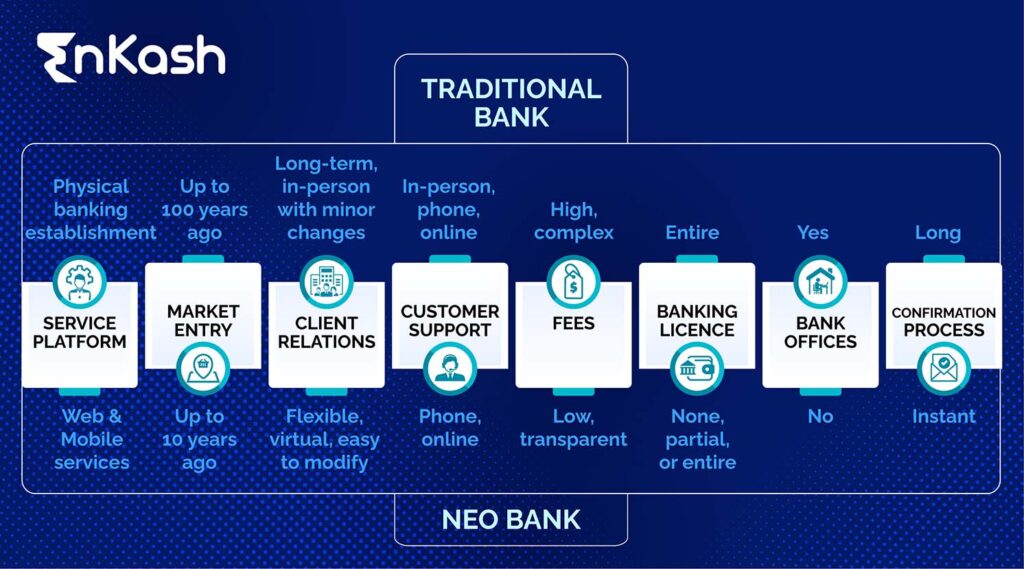

The evolution of the country’s banking sector has transformed the way transactions take place today. With technology and digitization disrupting the traditional functionality of the banking system; convenience, speed, security, and transparency have set in. Neo-banking is a part of one such technological revolution that has changed the banking industry.

If you’re wondering what exactly is neo banking, then you’re in the right place to get all the information.

What is neo-banking in India?

Neo banks are digital payment banking without any physical presence. This implies there is no physical branch to make transactions. Instead, you can make cashless payments from anywhere.

Neo stands for new and these new-age banks have innovation and perks in reserve for their users. The neo-banks provide banking services that traditional banks do not, and the use of technology is what makes them an exciting and popular option in the digital Indian payment system.

These modern banks have tried to differentiate themselves from online banking services and have expanded their focus from providing digital banking services to providing an exceptional customer experience.

How Does Neo Banking In India Work?

The biggest strength of neo-banks is that they cater to people who find difficulty going to traditional banks. That segment of people includes students, teenagers, and freelancers. And while these people are often digital savvy, opening an account in a neo-bank in India makes much more sense to them because they are offered perks that traditional banks do not give.

Moreover, opening an account in a neo-bank is fairly simple without the hassle of submitting too many documents.

Neo banking in India does not own a banking license directly from RBI, but no need to be worried about that. This is because neo-bank in India partners with traditional bank allies to offer their services. As Becoming a 100% digital payment banking is not allowed by the RBI.

What makes neo-banking so popular?

Cost

Opening an account is completely free. Since these banks do not own any physical branches, there is no labor cost involved. There are no annual fees or monthly minimum balance requirements as well, which is not the case in traditional banks.

Convenience

Traditional banks require you to fill and sign multiple forms, wait a few days for account activation and then wait some more to receive your debit card. Neo banking in India reduces all that process. You can create a banking account within 10 mins of signing up.

Personalization

Curated offers specially for you. Cards with personalized style are meant to stand out. These little things matter to the user.

Banking Options

All your credit, loans, banking, and investments in one place. One tap on the mobile screen, and you can see your assets and liabilities in one place. Traditional banks do offer similar services, but they are not as seamless.

Neo-banking Advantages And Disadvantages

One of the best things about digital payment gateways or the neo bank in India is that it is constantly evolving. These banks use the latest innovations and tech to enable effortless and safe banking transactions while allowing the user to receive perks at the same time.

That’s a win-win for both the customer and the bank. All of their banking is done through mobile, and that means you’re not limited to a particular city. The convenience is unparalleled. Paperless transactions, virtual international cards, and access to various opportunities and features are just the topping of this global phenomenon.

However, the only cons of neo banking in India are; that the traditional banks will face fewer footfalls at their branches with less cash in their drawers.

Challenges For Emerging Neo-Bank In India

There are numerous benefits of cashless payment via neo-banks in India. However, one of the biggest challenges that they face is customer trust.

Traditional banks have been there for a long time, and it’s easier for people to go to them all the time. Neo-banks in India, being new, does not have the same luxury. While neo-banking can be used for small to medium transactions, most people are skeptical of doing large-scale business transactions simply because they are not well known.

For traditional banks, the user always has a place to go to for their worries and queries, but since all neo-banks are online, the only way to reach them is either digitally or via phone.

Other than that, the Reserve Bank of India does not recognize neo-banks in India as full-fledged banking institutions. As such, these digital payment institutions or the neo-banks in India have to engage with other regulated financial banks and institutions to carry out their services.

Despite these limitations, neo banking in India is growing at an exponential rate and is fast becoming the go-to option because of the plethora of services and benefits they offer. With India going digital at a break-neck pace, the scope for neo-banking is far and wide.

Future of Neo Banking In India

Neo banks have the potential to add value to the banking system. They can change the dynamics by expanding the reach of financial services and solving the challenges of financial inclusion.

Services like opening bank accounts, facilitated via innovative onboarding procedures to providing instant credit facilities, these banks could assist in realizing the larger financial inclusion vision.

These banks provide offerings such as accessibility, cost-effectiveness, and access to financial and non-financial functionalities with customer-centric approaches.