Introduction

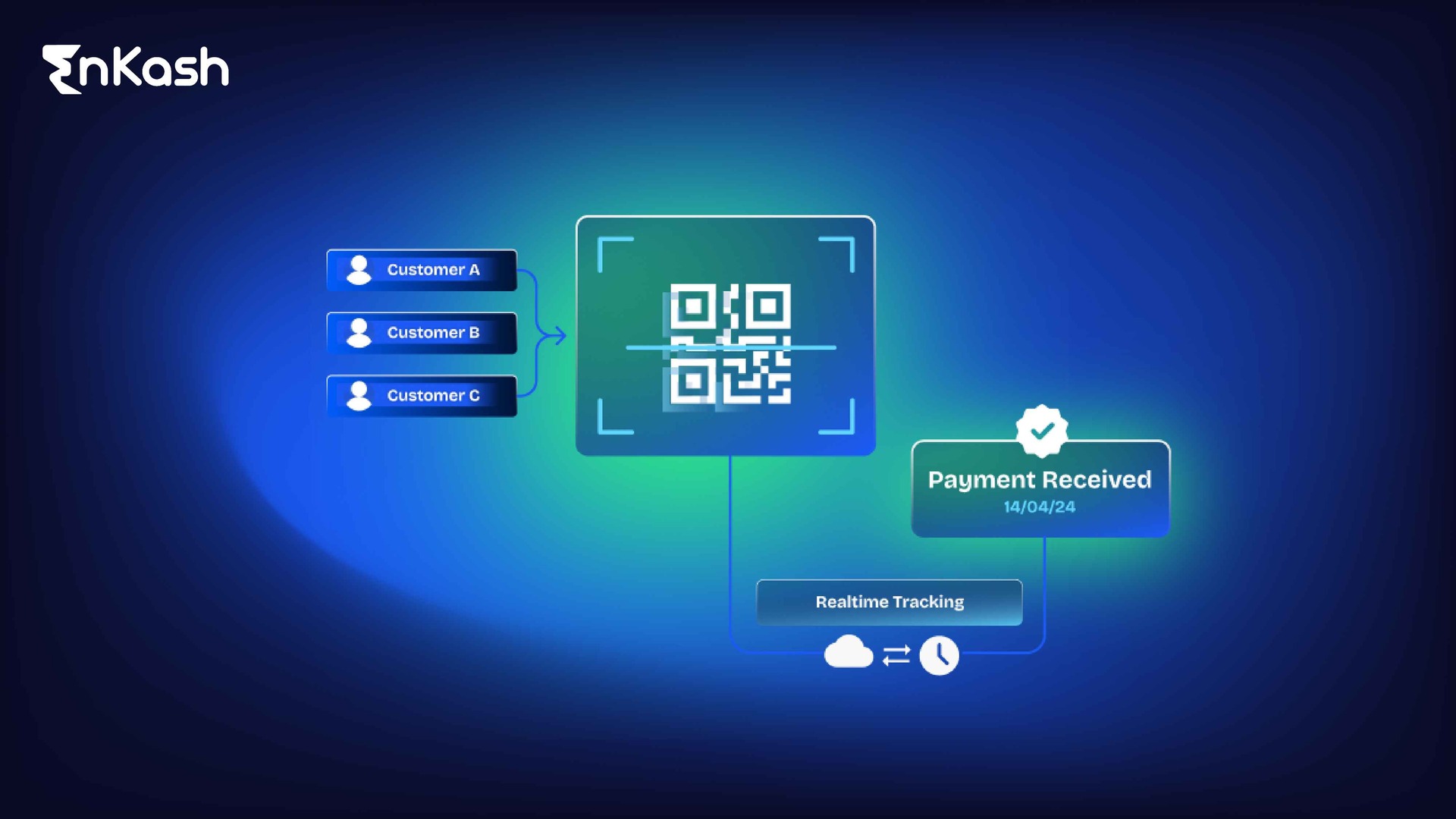

In recent years there’s been widespread adoption of digital payment processes in India seen across all tiers of cities. Carrying cash has become a hassle for both consumers and businesses alike. Among the popular digital payment methods, QR codes have gained significant traction. Today, QR codes can be found everywhere from small street vendors to large malls, offering seamless payment experiences.

What is a QR Code?

QR stands for Quick Response. A QR code is a two-dimensional barcode that encodes information. Unlike the linear barcodes you see on grocery products, QR codes can store a significant amount of data, including text, URLs, and even payment details.

These codes are readily scannable by most smartphones using the built-in camera app or a dedicated QR code scanning app. Once scanned, the information encoded in the code is instantly displayed on the user’s phone, allowing them to take action, be it visiting a website, downloading a file, or in our case, initiating a payment.

How to Generate QR Codes?

QR codes are versatile tools that encode information, they can be used for several purposes. Here’s a common scenario: imagine you run a restaurant. Traditionally, you might provide physical menus for customers. However, QR codes offer a touchless alternative. You can create a QR code that links to your digital menu.

Creating a QR code for this purpose is generally free and straightforward. Here’s what you need to do:

Choose a QR Code Generator: There are numerous free and paid QR code generators available online.

Select Data Type: When generating the QR code, specify that you want to encode a URL.

Enter the Link: In the URL field, enter the link of the data you want to provide.

Customize (Optional): Many QR code generators allow you to customize the appearance of your code with different colors and logos.

Download and Print: Once satisfied with the design, download the QR code and use it wherever needed.

Generating QR Codes for Payments

If you want to use QR codes for payment purposes, the creation process is different. There’s a choice to consider: static QR codes or dynamic QR codes.

The good news is that generating QR codes for your accounts receivable is also a very quick and hassle-free process.

Static QR Code & Dynamic QR Code

QR codes can be broadly categorized into two types: static and dynamic.

Static Codes: These are permanent codes that encode a single piece of information, such as a website URL or a specific text message. Once generated, the data within a static code cannot be changed. They’re ideal for situations where the information remains constant, like directing customers to your general payment page or directing users to an information catalog be it company pages/menus/event pages, etc.

Dynamic Codes: As the name suggests, dynamic codes offer greater flexibility. They can be programmed to store and display different information each time they’re scanned. This makes them perfect for applications like generating unique invoice-specific payment links. With dynamic codes, you eliminate the need to create individual QR codes for every invoice, saving you time and effort.

Benefits of QR Codes for Business Collections

Integrating QR codes into your accounts receivable process offers a multitude of benefits for both your business and your customers. Here are some key advantages to consider:

Faster Payments: QR codes eliminate the need for manual data entry, which can be a time-consuming and error-prone process. Customers simply scan the code on your invoice and are directed to a secure payment page where their invoice details are pre-populated. This translates to faster and more convenient payments for your clients, ultimately accelerating your cash flow.

Reduced Errors: Manual data entry mistakes are a common pain point in accounts receivable management. QR codes eliminate this problem completely. Since customers scan the code and the payment details are automatically populated, the chances of errors are significantly reduced.

Improved Customer Experience: QR codes offer a user-friendly and convenient way for customers to make payments. By offering this seamless option, you’re enhancing the overall customer experience, fostering loyalty and trust.

Increased Accessibility: QR codes don’t require any special downloads or logins. As long as a customer has a smartphone, they can scan the code and initiate a payment. This caters to a wider audience, particularly those who may not prefer traditional online payment methods.

Enhanced Data Tracking: QR codes, when integrated with a powerful accounts receivable platform like EnKash, can provide valuable data on payment behavior. You can track scan rates, analyze payment patterns, and gain insights into customer preferences. This data can be used to optimize your collection strategies and further improve efficiency.

Start Accepting Business Payments with Olympus QR Codes

EnKash provides a comprehensive platform designed to empower businesses with efficient AR management. By integrating QR code functionality, Olympus enables you to accept payments digitally in a quick and efficient manner and enhances the payment experience for both your business and your customers, leading to higher customer retention and improved cash flow.

Ready to Get Started?

Visit EnKash’s website or contact our support team to learn more about Olympus QR code integration and explore how this innovative solution can revolutionize your accounts receivable process.

FAQs

Q. How to scan QR code online and make a payment?

Here’s the general process:

- You’ll need an online scanner QR code functionality within a mobile payment app like Google Pay, PhonePe, Paytm, etc. These apps are downloadable from your phone’s app store.

- Launch the payment app and locate the QR scan function (usually an icon). Allow the app to access your camera and then point it at the QR code to scan it

- Once scanned, the app will decode the information and display the payment details, including the merchant name, the amount due, and any additional data

- Verify the information and confirm the payment using your UPI PIN or the specific method required by your payment app

Q. What apps can I use to scan QR codes?

Most smartphones have built-in QR code scanners within their camera apps. Alternatively, you can download dedicated QR code scanner apps from app stores.

Q. Are QR code payments safe?

Yes, QR code payments can be safe when used with reputable payment providers. The QR code simply acts as a link to the payment page, and the actual payment transaction happens through secure channels.

Q. What happens if I scan a QR code that looks suspicious?

If you suspect a QR code might be malicious, it’s best to avoid scanning it. Reputable businesses will display QR codes that are clearly linked to their payment processes. If you’re unsure, you can always contact the business directly to verify the legitimacy of the QR code.