Does your company have its very own credit card? If not, how do you make and track all the expenses for your business? Well, are you aware of the fact that credit card for company have become an essential tool for businesses of all sizes?

The best corporate credit cards provide a convenient way to make purchases, manage expenses, and track spending. With the right credit card, companies can earn rewards and cash back on their purchases, which can help to reduce costs and improve the bottom line. However, managing credit card spending can be a challenge, and it requires careful planning and attention to detail.

In this blog, we will discuss the importance of managing credit card for company and its spending. We will also talk about the tips and strategies to help businesses make the most of their credit cards. We will also discuss the best practices for managing company credit card spending and how to manage credit card rewards and incentives.

Importance of managing credit card spending

Credit card for company and its spending is a critical area for businesses to manage. If not managed correctly, it can lead to overspending, cash flow problems, and even fraud. By managing credit card spending, companies can avoid these issues and ensure that their expenses are under control.

One of the most significant advantages of using a credit card for company expenses is the ability to track and categorize expenses. Many credit cards provide detailed statements that break down expenses by category, making it easy to see where the company is spending its money. This can be helpful for budgeting and planning, as well as for identifying areas where the company may be overspending.

Another advantage of managing credit card for company and its spending is the ability to take advantage of rewards and incentives. Many credit cards offer cash back, points, or miles for purchases, which can help to reduce expenses and improve the bottom line. However, to make the most of these rewards, it is essential to manage credit card spending effectively.

Apply for a business credit card with EnKash.

Best practices for managing company credit card spending

Managing credit card spending for a company can be a challenging task, but there are some best practices that businesses can follow to make the process easier and more effective.

- Set spending limits: One of the best ways to manage credit card spending is to set spending limits for each cardholder. This can help to ensure that employees are not overspending or making unnecessary purchases. Businesses can set spending limits for each cardholder based on their role and responsibilities, and they can adjust these limits as needed

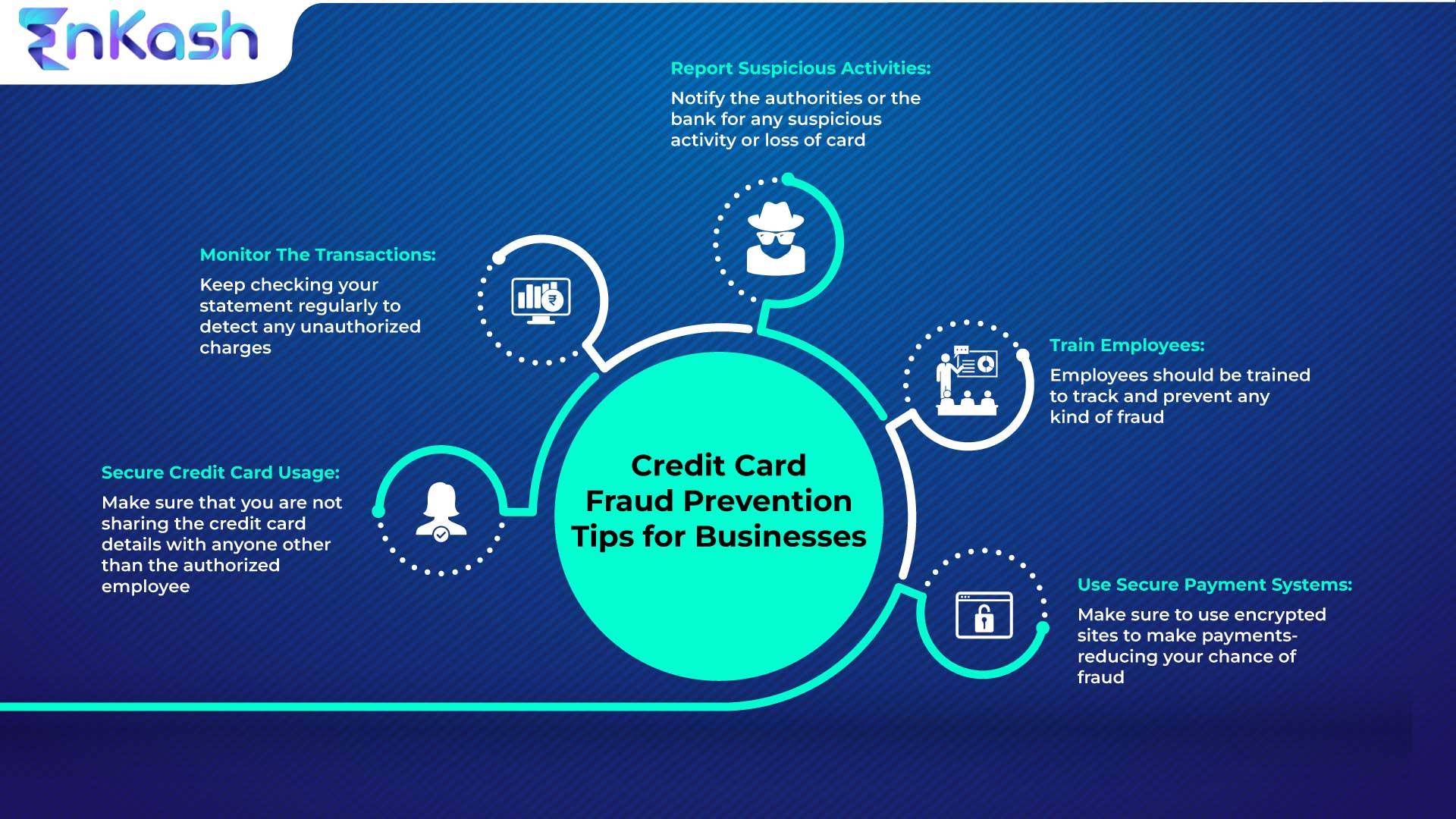

- Monitor transactions: Monitoring credit card transactions is critical for managing expenses and identifying potential issues. Businesses should review credit card statements regularly to ensure that expenses are legitimate and to identify any unusual or unauthorized transactions. Many credit card companies offer fraud protection services that can alert businesses to suspicious activity

- Use expense management software: Expense management software can help to streamline the process of managing credit card spending. This software can automate expense reporting and categorization, making it easier to track expenses and identify trends. Many expense management tools also integrate with credit card companies, making it easy to import transactions and monitor spending

- Encourage responsible use: Encouraging responsible credit card use among employees is critical for managing expenses and maintaining good credit. Businesses should provide training and guidelines for credit card use, including how to make purchases, when to use the card, and how to track expenses. Employees should also be encouraged to report any issues or concerns regarding credit card spending

Managing credit card rewards and incentives

Managing credit card for company’s rewards and incentives is an essential part of managing credit card spending for a company. To make the most of these rewards, businesses should consider the following strategies:

- Choose the right credit card: Choosing the right credit card is critical for earning rewards and incentives. Businesses should consider the types of purchases they make most frequently and select a credit card that offers rewards for these purchases. For example, if the company frequently travels, a credit card that offers rewards for airline miles may be a good choice

- Maximize rewards: To maximize rewards, businesses should use their credit cards for as many purchases as possible, including recurring expenses like utility bills and office supplies. It is also important to pay the credit card bill on time and in full each month to avoid interest charges and late fees

- Redeem rewards wisely: Businesses should carefully consider how to redeem their credit card rewards to get the most value. Some credit cards offer cash back, while others offer points or miles. Businesses should choose the reward that provides the most value and consider the redemption options available

- Keep track of rewards: Keeping track of credit card rewards is critical for managing expenses and maximizing rewards. Businesses should track their rewards and ensure that they are being credited properly. Many credit card companies provide online tools to help businesses manage their rewards

Conclusion

Credit card for company is an essential tool for managing expenses and improving the bottom line for businesses. However, managing credit card spending can be a challenge. By following the best practices for managing company credit card spending and taking advantage of credit card rewards and incentives, businesses can ensure that they are making the most of their credit cards.

Apply for a business credit card today with EnKash, the spend management platform that deserves for your business. You can also enjoy the perks that you and your business deserve!

Choosing one of the best corporate credit cards and applying for a business credit card with suitable rewards and incentives can significantly impact the financial health of a company. You can do that with EnKash, your very own fintech solution provider. By paying attention to credit card spending and rewards, EnKash can help your business to save money and improve their overall financial health.