Reconciliation of accounts, whether it is bank versus cash or collections and receivables or anything else is an ongoing process. When done manually, the process of reconciliation can be time-consuming and prone to errors. In this article, we will look at vendor reconciliation, why it is essential, and how to simplify it to ensure continuity and consistency.

Vendors are the lifeline to your business by ensuring quality supplies in a timely manner. As a startup with numerous priorities, it is important to manage your vendor network in the best possible manner. This will ensure that not only do you get quality supplies from vendors but also get good rates and maintain a positive market reputation.

What does the vendor management process entail?

To understand this better, let’s start by looking at the vendor payment cycle. The vendor onboarding process in general, has the following steps:

- Identification of the product or service that you require from the vendor, the frequency, the quantity, and quality parameters defined in clear terms

- Then the procurement department calls for quotations from a list of vendors who can meet these parameters

- Once the quotations are received, they are evaluated, and a vendor is finalized with the issuance of purchase order (PO)

- The vendor supplies the product or service and raises an invoice as per the terms agreed asking for payment

- The finance department forwards the invoice to the relevant department to confirm if the supply was made as per the agreed terms

- Once the concerned department checks and confirms this, then the department head approves the invoice for payment

- The invoice is taken up by the finance department along with approvals to make the final payment

- The process repeats itself without the first three steps, which is the procurement process

Sounds simple enough, doesn’t it? While the process is fairly straightforward it can get complicated and error-prone, it becomes time-consuming when you add numerous vendors, different payment cycles, and the needs of various departments and branch offices. And that is the case with most businesses.

What is the vendor reconciliation process?

Vendor reconciliation is the process by which the finance department confirms that

- The supply of products or services is as per agreed terms

- Whether the pricing is correct or not

- If rebates and discounts have been applied for on-time payments

- Payments have been made or not and from which bank account

What happens if vendor reconciliation is not handled properly?

Vendor reconciliation is an important step in the process of vendor management. The reconciliation process throws light on various aspects, which include the following.

Meeting business requirements

The vendor reconciliation process highlights whether vendors are supplying as per the quality parameters and quantities agreed upon at the right price. This, information in turn, helps you determine if you need to continue with the same vendor or change the vendor.

Price reconciliation

The process of reconciling also helps you determine whether the vendor is charging the right pricing and giving you rebates for making payments on time. You can also determine that factors like taxes are in the right order.

Supply continuity

Reconciling details of the vendor supplies and ensuring payments go on time also helps ensure that the vendor continues to supply as agreed. The continuity of vendor support ensures that you can meet customer demands.

Avoid double or missed payments

Vendor reconciliation helps ensure that you have not paid the same vendor for a single invoice twice by mistake or missed paying an invoice entirely. Tracing these details can make it easier to manage vendors in the long run and keep your financial records updated.

How to make vendor reconciliation process simpler?

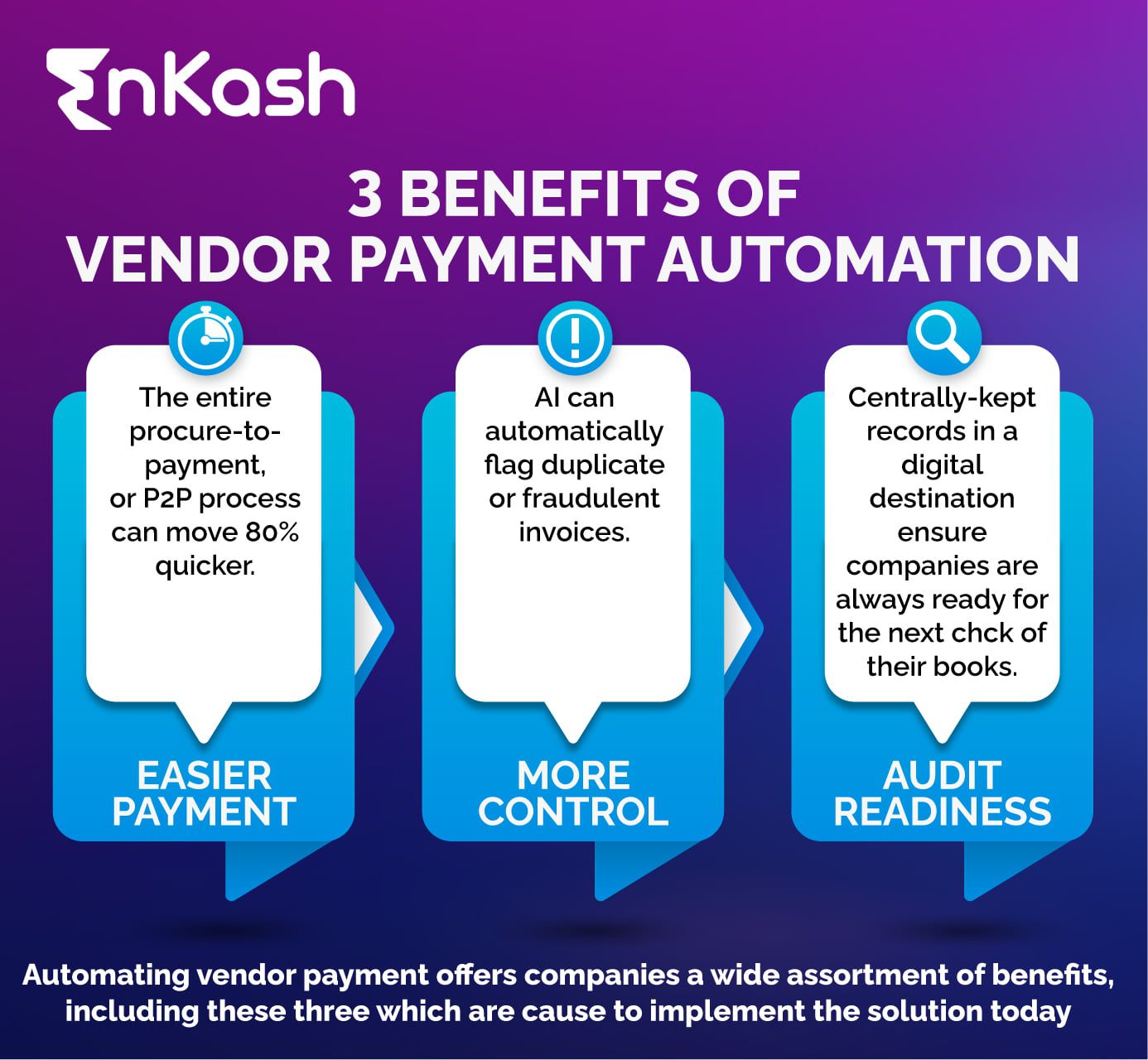

Fortunately, today we have the advantage of advanced technology to help us manage the entire process with ease. A smart spend management platform like EnKash, will help you with various aspects of vendor reconciliation. Onboarding vendors becomes easier with the digitization of the KYC (know-your-customer) process. Once all the details are recorded on the portal, it is easy to have an overview of the spend against each vendor.

Also Read: What is Vendor Payment, and How Does It Work?

The invoices asking for payment can also be digitized and viewed on the system. The details can be matched with the PO with ease, sent for checking and approvals from within the system. Once the payment has been made, the requisite entries can be made in real-time. In fact, you even have the option to generate reports and analytics to delve deeper into the spend and optimize spends when required.