Olympus |

GST Payments

Make GST payments with complete

visibility and approvals

Enable quicker GST challan payment on time every time with an optimized process and easy approvals via EnKash

3 Easy Steps to

Get Started with EnKash

Sign Up

Complete KYC Process

Get Started

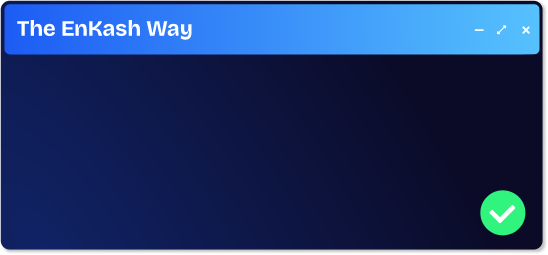

The EnKash way is

the better way

Switch to EnKash today!

Timely

Payments

Approval

Process

Payment

Method

Record

Keeping

Leverage EnKash for

automatic and easy

GST payments

Easy

Payments

Set and manage a simple and intuitive process to ensure that all aspects are checked and payments are quick and easy

Easy Monitoring

Benefit from centralized view and control over all GST bill payments across your company on a single platform

Digital

Challans

Auto read the challans and convert them into paper records for audits and other purposes

Approval

Flow

Ensure checks and approvals are in place for valid spending, the proper audit trail, and close books quickly. This will help you prevent errors, unauthorized payments and reduce the risk of fraud

Paying GST has never been this

easy and convenient

How does it work?

1/5

Login to EnKash using your registered mobile number/email and complete your KYC

Learn how GST payments can revolutionize the way you work!

Read Blogs

Steps to Pay GST Challan Payment Online

Jan 09, 2023

Goods and Services Tax or GST is an indirect tax levied on the supply of goods and services in India. GST is a comprehensive tax that subsumes various indirect taxes previously levied by the central and state governments...

Read More

Simplifying GST Payments: How to Pay GST Online

Jun 13, 2023

Do you face difficulty in managing tax payments for your business? Don’t worry, we are here for all your GST-related questions and concerns. Goods and Service tax, also known as GST, has become an integral part of our tax system...

Read More

How to Pay GST on Advance Payments

Feb 22, 2023

Advance payments are transactions or parts of transactions done in advance. These payments are recorded as assets on the business sheet and made before exchanging goods and services. They are also known as prepaid expenses...

Read More

Got Questions?

Don't worry! Our FAQs section will help you learn about gst payments in detail

What is a GST payment?

GST payment denotes the amount of Goods and Services Tax that a business owes against its transactions that needs to be paid on a regular basis. Every entity with GST registration must remit the payment on or before the due date.

How do I make a GST payment?

Making a GST payment is simple and involves the following steps:

Log in to the official GST portal and navigate to the payments tab under 'Services'

Click “Create Challan”, enter amounts under sections like CGST, IGST, CESS, etc, and choose the NEFT/RTGS options and select AXIS bank as the remitting bank

Upload the created challan on EnKash portal for audit team verification

Confirm the amount, request OTP, and complete payment

What are CGST, SGST, and IGST?

Central Goods and Services Tax (CGST) is the tax implemented on intrastate sales of goods and services by the central government. State Goods and Services Tax (SGST) is the tax imposed on the intrastate sales of goods and services by the state government. Integrated Goods and Services Tax (IGST) is the tax levied on interstate sales of goods and services. This is shared between the state and central governments.

How do I check my GST payment status?

To check your GST payment status, start by visiting the official GST payment portal. Click on the Dashboard. On this, go to Services, then Payments, and Track Payment Status. Enter the CPIN and GSTIN to check the status of your payment. Please note that you do not need to log in to do this.

What is the link for GST payment?

You need to click on this link for GST payment - https://services.gst.gov.in/services/quicklinks/payments

What is EnKash GST payment?

The tax payment module helps you deal with business-related taxes like GST without going through repetitive and manual processes. You can easily fetch the challan from the government portal, create challan for payment, get maker and approver approvals on record. You have the option to use a prepaid card, debit card, NEFT, or connected banking option to make the payment. Once the payment is completed, the payment proof will be scanned and filed digitally in your records for future reference.

Why is tax payment critical for my business?

Tax payments are mandatory by law, and the government requires businesses like yours to pay taxes on time to reap the benefits associated with it, avoid penalties, and keep the business going. Olympus’ tax payment module facilitates the whole process and reduces manual errors and makes a record trail for future audit/reference.

Does the tax payment module help improve the finance team’s performance? If yes, how?

Olympus’ tax payment module improves the efficiency of your finance team by ensuring that the payments are not missed, the approval process is clear and fast, and by ensuring that the digital records for tax payments are stored in the right place. Olympus’ tax payment module ensures that your business meets compliance and audit-related requirements.

Why should a startup consider GST payment?

Tax Payment is critical for a startup because it helps them with the following aspects:

Ensure timely tax payments to avoid penalties

Have a seamless trail of approvals and the relevant paperwork in place

Enable the finance team to concentrate on more strategic work

Improve the overall efficiency of all the related teams

How does the GST payment online module help create clear records?

With Olympus’ tax payment module, much of the process is online with a transparent process laid out. This ensures that the payments are made on time with the right people checking the details and giving their approvals. Once the payment is made, a digital record is created for future reference in case it is required to provide proof of payment or answer audit-related questions.

x

xSeeking further understanding of GST payment online?

GST, or Goods and Services Tax, is an indirect tax implemented to consolidate many excise duties, VAT, and other indirect taxes. GST is applicable at every level at which the sale occurs.