Expense management is the structured process businesses use to record, approve, reimburse, and analyse company expenses such as travel, software, vendor payments, and employee reimbursements. It ensures cost control, policy compliance, and accurate financial reporting across the organisation.

Expense management helps companies understand where money is being spent, identify unnecessary or excessive costs, and take timely corrective action. By analysing spending patterns, businesses gain clear insights into budget leakages, policy violations, and recurring expenses that exceed actual requirements. This improves cost control, improves financial discipline, and supports better operational efficiency and profitability of an organization.

This article explains what expense management is, the different types of expense management your business may need, and the benefits of managing expenses through EnKash Expense Management. It also covers the complete expense management process and workflow, helping businesses understand how structured expense control leads to better financial visibility and smarter decision-making.

Expense Management

Expense management refers to the systems and software that organizations use to process, monitor, control, and analyze business expenses which are related to employees. It covers costs such as travel, entertainment, petty cash, reimbursements, and other operational spending incurred during day-to-day activities.

An effective expense management system also provides detailed reports and insights, supporting budgeting, compliance, and financial planning. With structured data and audit trails, organizations can ensure transparency, improve financial control, and make informed decisions based on reliable expense information.

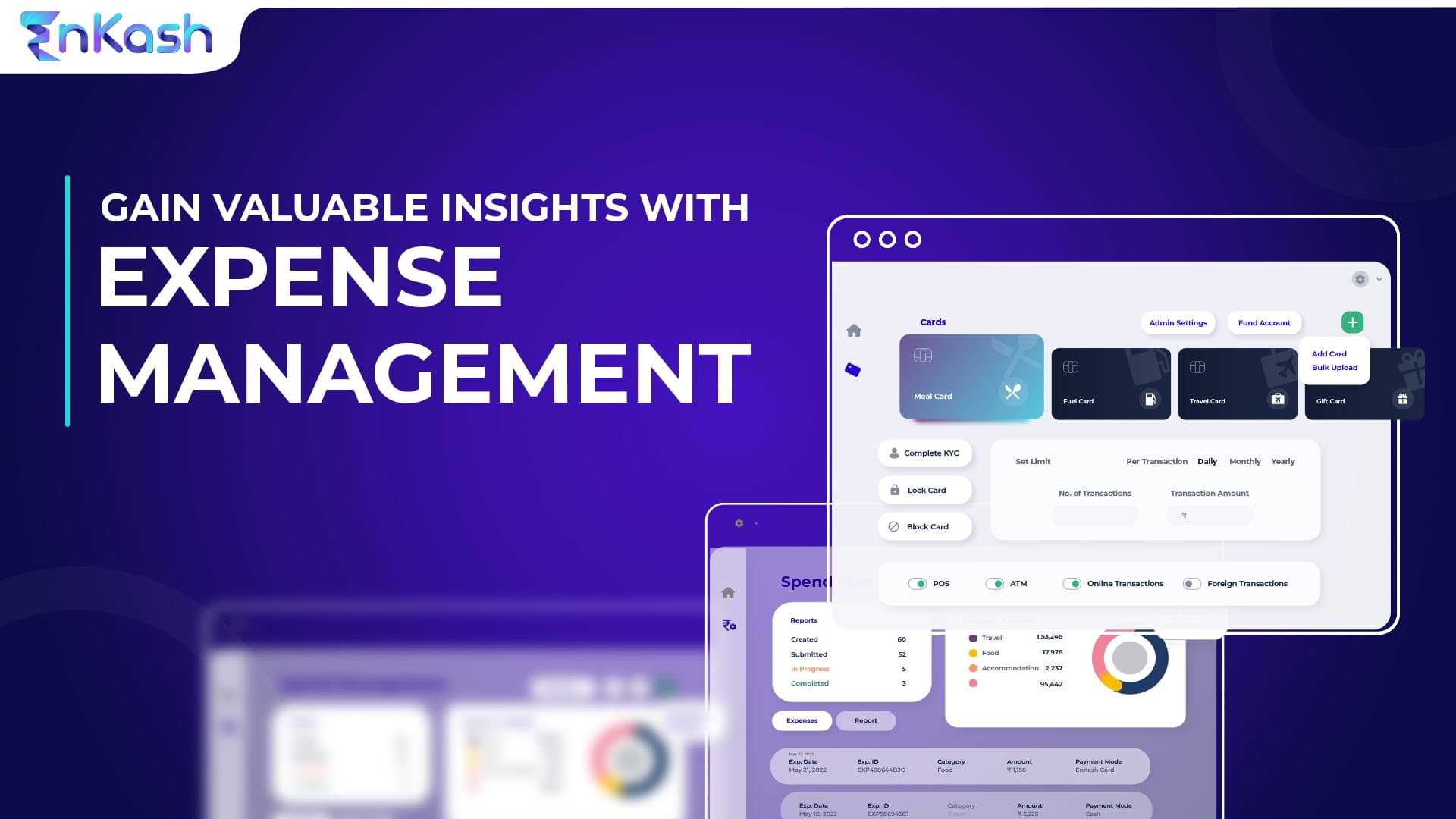

Platforms like EnKash are helping businesses to simplify and strengthen their expense management processes through an integrated financial technology solution. EnKash Expense Management Platform is designed for organizations that need better control over their spending. EnKash combines prepaid cards, payment automation, and expense tracking into a unified system.

Key Components of Expense Management

- Expense Tracking and Categorisation: Records business expenses in real time and classifies them accurately for better spend visibility.

- Expense Policy Creation: Sets clear rules for allowed expenses, limits, and exceptions to ensure policy compliance.

- Approval Workflows: Automates approval routing based on roles, amounts, or departments to speed up reviews.

- Reimbursement Process: Enables timely and accurate reimbursements after expense approval, reducing manual effort.

- Reports and Analytics: Provides actionable insights through dashboards and reports to identify cost patterns.

- Sync with Corporate Cards: Automatically captures card transactions and links them to expenses in real time.

- Custom Expense Categories: Allows businesses to define categories that match their internal reporting structure.

How to Manage Expenses Effectively

Managing business expenses effectively requires a structured system that combines clear policies, digital tools, approval workflows, and financial oversight. A strong expense management process helps organizations reduce wasteful spending, prevent fraud, and maintain accurate financial records.

Below is a step-by-step guide businesses can follow to manage expenses efficiently.

1. Use Expense Management Software

Use EnKash expense management software, which will bring all processes into one platform. It enables:

- Automated capture of expenses

- Creates Expense through OCR and WhatsApp.

- Policy-based approvals

- Integration with accounting systems

- Faster employee reimbursements

- Advanced reporting and analytics

Using dedicated software reduces manual workload and improves financial control across the organization.

2. Set a Clear Expense Policy

The foundation of expense management starts with a well-defined expense policy. This document outlines:

- What types of expenses are allowed

- Spending limits by role or department

- Reimbursement rules

- Required documentation (receipts, invoices)

- Approval hierarchy

A clear policy reduces confusion, prevents unauthorized spending, and ensures compliance across the organization.

3. Digitize Expense Reporting

Manual spreadsheets and paper receipts create delays and errors. Digitizing expense reporting allows employees to:

- Submit expenses through apps or portals

- Upload receipts instantly

- Categorize expenses accurately

Digital reporting improves accuracy, speeds up processing, and creates a searchable audit trail.

4. Automate Approval Workflows

Automated approval systems route expense claims to the right managers based on predefined rules. This helps:

- Reduce approval delays

- Enforce spending policies automatically

- Track approval status in real time

Automation removes dependency on email chains and ensures accountability.

5. Track Expenses in Real Time

Real-time expense tracking provides visibility into company spending as it happens. Businesses can:

- Monitor department-wise spending

- Identify unusual transactions

- Stay within budget limits

Live dashboards and alerts help finance teams take corrective action before overspending occurs.

6. Reconcile and Audit Regularly

Regular reconciliation ensures that recorded expenses match bank statements, corporate card transactions, and accounting entries. Auditing helps:

- Detect duplicate or fraudulent claims

- Correct categorization errors

- Maintain compliance with financial standards

Periodic audits protect the company from financial leakage.

Types of Expense Management in Businesses

Business expenses are not uniform. Different categories of spending require different tracking methods, approval workflows, and control mechanisms. Understanding the types of expense management helps organizations choose the right tools and processes for better financial control and cost optimization.

By using EnKash Expense Management, you can manage the following expenses:

Expense Type |

What It Covers |

Why It is Important |

|---|---|---|

Travel & Expense (T&E) Management |

Travel bookings, meals, local transport, and client meetings |

Controls travel budgets, enforces policies, and ensures timely reimbursements |

Telecom Expense Management (TEM) |

Mobile bills, internet, data plans, and office communication systems |

Reduces billing errors, tracks usage, and prevents unnecessary telecom costs |

Technology Expense Management |

SaaS tools, software licenses, cloud services, and IT hardware |

Prevents SaaS sprawl and optimises IT and subscription spending |

Employee Reimbursement Management |

Employee-paid business expenses, training, and local purchases |

Speeds up reimbursements and improves employee experience |

Petty Cash Management |

Small daily expenses, local travel, urgent purchases |

Improves control over cash spending and prevents misuse |

Vendor & Operational Expense Management |

Vendor invoices, utilities, rent, marketing, services |

Ensures accurate payments, better cash flow, and financial transparency |

Benefits of Using EnKash Expense Management

Expense management software helps businesses automate, control, and optimize company spending while reducing manual workload and financial risks. Modern organizations use these platforms to improve visibility, enforce policies, and streamline reimbursements.

1. Automation of Manual Processes

EnKash Expense management software automates expense reporting, receipt capture, approvals, and reimbursements. This eliminates paperwork, reduces human errors, and speeds up financial workflows across departments.

2. Create Expenses Through WhatsApp

With EnKash, employees can create expenses directly through WhatsApp by simply uploading a receipt. There is no need to log into a separate app or fill out manual forms.

EnKash’s powerful OCR technology automatically scans the receipt, extracts details such as amount, merchant, date, and GST, and itemises the expense in seconds. The captured data is converted into a structured expense entry and synced instantly with the expense dashboard.

This WhatsApp-based expense creation reduces errors, prevents missing receipts, and gives finance teams real-time visibility and accurate spend insights, making expense reporting faster and more compliant.

3. Real-Time Visibility into Business Spending

Finance teams gain instant insights into department-wise and employee-wise spending. Dashboards and reports help track budgets, monitor trends, and detect unusual transactions early.

4. Faster Approvals and Reimbursements

Automated approval workflows route claims to the right managers instantly. Employees get reimbursed faster, which improves satisfaction and reduces finance team bottlenecks.

5. Manage Expenses Using UPI

UPI is the most widely accepted payment method in India and is commonly used for day-to-day business expenses such as travel, meals, utilities, and vendor payments. However, tracking UPI spends manually often leads to missing records and poor visibility.

EnKash Expense Management helps businesses manage expenses paid via UPI by capturing transactions digitally, categorising spends automatically, and linking them to approvals and reports. This brings better control, real-time visibility, and accurate tracking of UPI-based business expenses across the organisation.

6. Seamless Accounting Integration

Expense data syncs directly with accounting and ERP systems, reducing manual data entry and reconciliation errors.

7. Fraud Detection and Audit Readiness

Digital records, receipt storage, and audit trails make it easier to detect duplicate claims, false submissions, and unusual spending patterns.

8. Cost Savings and Budget Optimization

By identifying wasteful spending, duplicate subscriptions, and policy breaches, businesses can significantly reduce unnecessary costs.

Expense Management Process Flow

Its process is a structured workflow that businesses use to record, review, approve, reimburse, and account for company spending. A standardized process ensures financial control, policy compliance, and accurate bookkeeping.

Step 1: Expense Occurs

An employee incurs a business-related expense such as travel, meals, software purchases, telecom bills, or operational costs. At this stage, the employee must retain valid proof, such as invoices or receipts, to meet company policy and audit requirements.

Best Practice: Capture receipts digitally at the time of purchase to prevent loss of documentation.

Step 2: Expense Submission

The employee submits the expense through an expense management system or reporting tool. Required details typically include:

- Expense category

- Date and amount

- Business purpose

- Attached receipt

Digital submission improves data accuracy and creates a time-stamped audit trail.

Step 3: Approval Workflow

The expense claim is routed to the designated approver based on company policy and hierarchy. The approver verifies:

- Policy compliance

- Budget availability

- Accuracy of documentation

Automated workflows reduce delays and ensure consistent policy enforcement.

Step 4: Reimbursement or Payment Settlement

Once approved, the expense is processed for reimbursement or settled directly through corporate cards or vendor payments. Timely reimbursement improves employee trust and maintains operational efficiency.

Compliance Note: Payment cycles should follow internal finance policies and payroll timelines.

Read more: How to use Prepaid cards for employee reimbursement?

Step 5: Accounting Entry and Reconciliation

Approved expenses are recorded in the accounting or ERP system under the correct expense category. Finance teams reconcile expenses with bank statements, corporate card transactions, and general ledger records to ensure financial accuracy.

This step supports:

- Accurate financial reporting

- Budget tracking

- Audit readiness

Conclusion

It is no longer just about reimbursements — it is a core financial control system that directly impacts profitability, compliance, and operational efficiency. As businesses grow, expenses become more frequent, complex, and harder to track without structured processes and automation.

By implementing a clear expense policy, digitizing reporting, automating approvals, and using expense management software, organizations gain real-time visibility into spending, prevent fraud, and maintain accurate financial records. From travel and telecom to technology and vendor payments, each category of expense requires proper monitoring to avoid cost leakage.

A well-defined expense management process improves budgeting accuracy, strengthens audit readiness, accelerates reimbursements, and reduces administrative burden. In today’s data-driven business environment, companies that modernize their expense software achieve stronger financial control, better cash flow planning, and long-term cost optimization.

Frequently Asked Questions (FAQs)

1. What is expense management in simple terms?

Expense management is the process businesses use to track, control, approve, and analyze company spending, including employee reimbursements, travel costs, vendor payments, and operational expenses.

2. Why is expense management important for businesses?

It helps control costs, prevent fraud, ensure policy compliance, improve financial visibility, and maintain accurate accounting records.

3. What are the main steps in the expense management process?

The key steps include expense occurrence, expense submission, approval workflow, reimbursement or settlement, and accounting reconciliation.

4. What types of expenses are covered under expense management?

It covers travel expenses, telecom costs, technology and software spending, employee reimbursements, and vendor or operational expenses.

5. How does expense management software help organizations?

Expense management software automates reporting, approvals, and reimbursements, enforces company policies, integrates with accounting systems, and provides real-time spending insights.

6. What is Travel and Expense (T&E) management?

T&E management focuses on employee travel-related costs such as flights, hotels, meals, and transportation while ensuring compliance with company travel policies.

7. How does expense management reduce fraud?

Digital records, automated policy checks, receipt verification, and audit trails help detect duplicate claims, unauthorized spending, and unusual transactions.

8. What challenges do companies face without an expense management system?

Businesses often experience delayed reimbursements, poor visibility into spending, policy violations, duplicate claims, and accounting errors without a structured expense system.