Managing business expenses has always been a challenge for companies, especially when employees need to spend out of pocket and wait for reimbursements. From collecting receipts to filing claims and getting multiple approvals, the entire process often becomes slow, inefficient, and frustrating for both employees and finance teams.

Corporate credit cards have changed this experience completely. They allow companies to streamline spending, eliminate manual reimbursement processes, and empower employees to make business purchases without using their own funds. As more Indian businesses adopt digital financial tools, corporate credit cards have become one of the most valuable solutions for managing expenses with ease, control, and transparency.

But before we go in-depth, let’s first understand the corporate credit card meaning and how it is different from a normal credit card.

What is a Corporate Credit Card?

A corporate credit card is a type of credit card issued by a bank to a company, but given to selected employees to use for business-related expenses. These cards are meant only for official spending, such as travel, client meetings, hotel stays, office purchases, or team events. Unlike a personal credit card, the financial responsibility for repayment lies with the company and not the employee using the card.

Corporate credit cards help businesses streamline their expense process by removing the need for employees to spend from their own pocket and wait for reimbursements. They also give companies better visibility, spending control, and simplified accounting through detailed statements and category-wise tracking.

Who is Eligible for a Corporate Credit Card in India?

When it comes to obtaining credit from banks, certain requirements and eligibility criteria must be met for your application to be considered and accepted. Banks are very strict about these criteria. These criteria are usually divided into two categories: company eligibility and individual (applicant) eligibility.

For the Company:

- Business Type:

Most banks offer corporate credit cards to various business entities, including: - Registered Companies

- Limited Liability Partnerships (LLPs)

- Sole Proprietorships

- Partnership Firms

- Trusts (in some cases)

- Government bodies

- Non-profit organisations (with limitations)

- Business Age:

Many banks require the company to be operational for a minimum period as the longer the business operates the more beneficial it’ll be for the bank. This can range from one year to two years or more, depending on the bank and card tier. - Turnover:

To provide a corporate credit card, banks require proof that your business has growth potential, typically through revenue and profit figures. The business should ideally show an upward growth trajectory. To demonstrate this, companies usually submit documents such as bank statements and financial reports.

Banks often set a minimum annual turnover requirement, which can vary significantly depending on the bank and the credit limit you require. - Credit Score:

A good business credit score establishes trust and reflects your borrowing and repayment habits. The higher your credit score is, the more likely you are to get corporate credit cards with your required credit limit from any of your desired banks.

Individual (Applicant) Eligibility:

- Citizenship and Age:

The applicant must be a resident Indian citizen, usually between 21 and 70 years old. - Designation:

Typically, the applicant should hold a senior position within the company, such as Director, CEO, CFO, or authorised signatory. - Creditworthiness:

While corporate cards are not based solely on the applicant’s credit score, a good credit history can strengthen the application.

What Documents are Needed to Apply for a Corporate Credit Card?

Getting a corporate credit card in India requires a specific set of documents to prove your business’s legitimacy and the applicant’s authority.that are absolutely required by the bank. Here’s a list of the documents that are commonly required by the bank. This list of required documents may extend depending on your bank’s specific requirements.

- Basic Documents: You may have to submit your company’s registration or incorporation certificate, Memorandum of Association (MOA), Articles of Association (AOA), and partnership deed (if applicable and depending on the bank). All these documents serve as primary proof that your business is a legally registered entity

- GST Certificate and Number: A valid GST certificate and number are mandatory for tax-paying businesses in India. If you do not have this GST certificate, it can be downloaded from the official GST portal. You can also read our detailed guide on how to search GST numbers to understand the process

- CIN (Company Identification Number): The CIN or Corporate Identification Number is a unique number assigned to your business during registration, this serves as an identification code for your company

- Proof of Business Address: This can be a rental agreement, utility bill (electricity, water), property tax receipt, or ownership documents for the business premises

- Latest Bank Statements (3-6 months): Banks use these to assess your company’s financial health and spending patterns.

Points to Remember:

- Different banks have different requirements, so it is best to confirm the full document list with your bank beforehand.

- Ensure all documents are clear, legible copies and not originals

- Some banks might accept soft copies submitted online, while others might require physical copies submitted at a branch

- To avoid losing any important documents at the last moment, it is best if you maintain an organized online or offline folder for easy access.

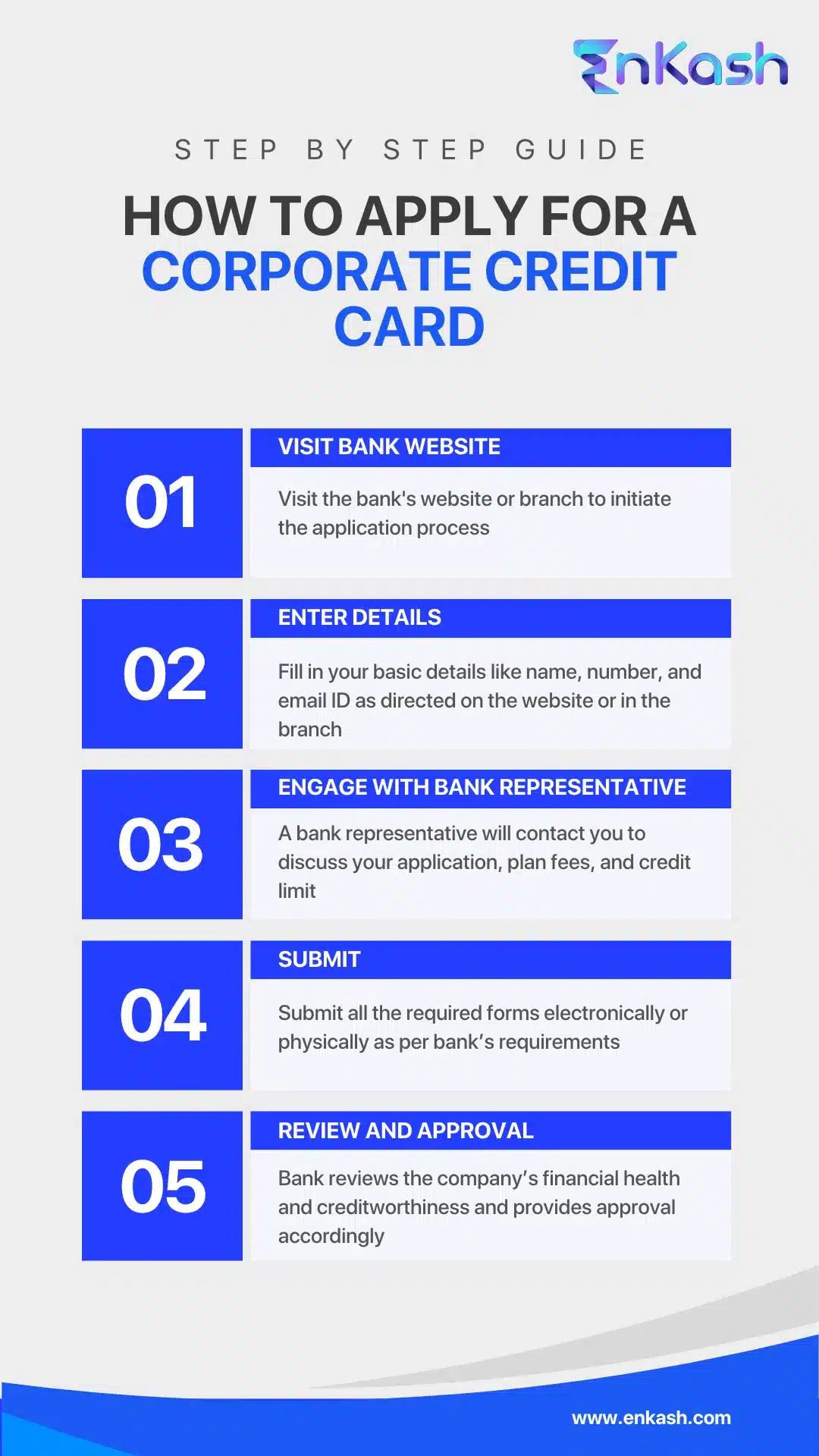

Step-by-Step Guide: How to Apply for a Corporate Credit Card in India

In most cases, your company initiates the corporate credit card application for you. Here is how the process usually works:

- Visit the bank’s website or branch to initiate the application process

- Fill in your basic details like name, number, and email ID as directed on the website or in the branch

- A bank representative will contact you to discuss your application, plan fees, and credit limit

- You will also need to fill out some forms and gather some documents. Once everything is arranged, submit all this paperwork electronically or physically, depending on the bank’s instructions

- The bank will review your application and make a decision based on your company’s financial health and creditworthiness

Disclaimer: The steps above may vary slightly from company to company and bank to bank, depending on internal policies and the card provider’s requirements.

Experience the benefits of Corporate Card Solutions

Key Things to Consider Before Applying for a Corporate Card

- Credit Limit: Carefully evaluate your business credit limit needs and apply for the same. While opting for a higher credit limit than needed might seem appealing, it can negatively impact your approval chances and lead to unnecessary interest costs.. So be very careful while considering how much credit your business will realistically require.

- Spending Categories: Before applying for a corporate credit card, review your business spending patterns and identify the main expense categories. This makes it easier to choose a card solution that aligns with how your company actually spends. For example, if your employees travel frequently, a card with travel rewards might be ideal.

- Number of Cards: Determine how many cards your company needs and who will be authorised users. Make sure to assign these cards only to those employees who have a legitimate business purpose for using the card.

- Annual Fees: You should also keep in mind that you can be charged yearly fees by some card providers, so you must compare the annual fee against the potential rewards and benefits offered by the card to ensure that you get a good deal.

- Rewards Programs: Choose a corporate card solution with a flexible rewards program, so that higher business spends can translate into more cashback or reward points.

- Additional Benefits: Consider perks like airport lounge access, purchase protection, or extended warranty coverage that might be valuable for your business.

- Negotiate: The key to getting good deals always comes down to the ability to negotiate better terms and conditions. Do not hesitate to negotiate terms such as interest rates or annual fees, especially if your business has a strong financial profile. This often gives you leverage to secure more favourable terms, funds and wait for reimbursements. Corporate cards eliminate the need for expense reports.

- Read the Fine Print: It is always advised that you should do your own research before entering into any sort of commitment, and so even in this case, before applying, thoroughly review the card’s terms and conditions to understand any potential charges or limitations.

Advantages of Corporate Credit Cards

Corporate credit cards offer a multitude of advantages for both businesses and employees. Here’s how:

- Expense Tracking & Management: Corporate cards provide detailed transaction records, eliminating the need for employees to collect and submit paper receipts. This simplifies expense reporting, allowing companies to easily categorize and track business spending

- Spending Control: Companies can set spending limits for individual cards and categories, preventing unauthorized or excessive expenditures. This fosters better financial discipline and reduces the risk of fraud

- Reimbursement Process: Employees don’t need to use their personal funds and then wait for reimbursements. Corporate cards significantly reduce manual reimbursement cycles and simplify expense reporting, saving companies time and resources

- Rewards and Cashback: Many corporate cards offer reward programs that allow businesses to earn points or cashback on business purchases. These rewards can be redeemed for travel, office supplies, or other business-related expenses, effectively reducing overall costs

- Building Business Credit: Responsible use of corporate credit cards can help establish a positive business credit history. This credit history will be beneficial for the business in the long run when applying for loans or other forms of credit in the future.

How Can EnKash Help?

While there are many corporate credit card options available in the market, choosing EnKash corporate cards gives businesses an added layer of control, transparency, and security. Traditional corporate credit cards may offer convenience, but they also come with risks like overspending, misuse, delayed visibility, and rigid banking processes. EnKash solves these gaps with a smarter, more controlled card solution built for modern businesses.

Benefits of EnKash corporate cards:

• No Overspending

Each card comes with predefined limits and category controls, ensuring employees can spend only within approved budgets. This prevents unnecessary or unplanned expenses.

• Better Expense Visibility

EnKash gives real-time tracking of every card transaction, allowing finance teams to monitor spending instantly instead of waiting for monthly statements.

• Custom Spend Controls

Businesses can enable or restrict specific merchant categories, set per-transaction limits, time-based limits, or even freeze a card instantly when needed.

• Zero Personal Liability for Employees

Employees don’t have to use their own money for business expenses, and reimbursements become effortless for both sides.

• Flexible Issuance

Issue virtual or physical cards instantly to team members, freelancers, departments, or project teams based on business needs.

• Faster Reconciliation

Every transaction automatically syncs into expense reports, simplifying bookkeeping and reducing manual effort.

• Works Without a Credit Line

Unlike traditional corporate credit cards that require strict bank approvals, EnKash corporate cards can be issued in models that do not depend on traditional bank-defined credit lines, based on your business setup.

• Enhanced Security

Tokenised transactions, controlled access, and instant card blocking ensure complete financial safety.

With EnKash corporate cards, businesses get the flexibility of card-based spending without the risk of uncontrolled expenses, making it a smarter alternative to conventional corporate credit cards.

Explore Expense Management Platform

Conclusion

Corporate credit cards have become a valuable tool for businesses in India, streamlining expense management and offering a range of benefits. By understanding the eligibility criteria, application process, and key considerations, you can choose a corporate card solution that best suits your company’s needs.

Frequently Asked Questions

1. What is the main difference between a corporate credit card and a personal credit card?

A corporate credit card is issued to a company for business expenses, and the company is responsible for repayments. A personal credit card is issued to an individual who is personally liable for the dues.

2. Who pays the bill for a corporate credit card?

The company pays the bill, not the employee. Employees only use the card for approved business expenses.

3. Can any employee get a corporate credit card?

No, only authorised employees selected by the company usually frequent travellers, managers, and department heads, get corporate cards.

4. Does an employee need a good credit score to get a corporate credit card?

Not necessarily. Corporate cards are issued based on the company’s financial profile, not the employee’s. However, a clean personal credit record may strengthen approval.

5. What expenses can be paid using a corporate credit card?

Corporate credit cards can be used for travel, client meals, hotel stays, office supplies, software subscriptions, and other approved business expenses.

6. Do corporate credit cards offer rewards and cashback?

Yes. Most banks offer reward points, cashback, travel benefits, and other perks for business-related spends.

7. Is it mandatory for a business to have high turnover to get a corporate credit card?

Not always. Requirements vary from bank to bank. Some banks accept lower turnover for basic corporate cards, while premium cards need higher turnover.

8. How long does approval for a corporate credit card take?

Depending on the bank and documentation, it may take a few days to a few weeks.