PREPAID CARDS

Prepaid Cards Built for Smarter Business Spending

Issue cards instantly. Set limits in seconds. Track every rupee in real time. No reimbursements, no surprises, no cash advances.

Why Businesses Choose EnKash Prepaid Cards

<0

seconds to issue cards

0%

real-time spend visibility

ZERO

employee reimbursements

0 Million+

merchant acceptance points

Everything You Need to Manage Business Spending

Issue Cards Instantly

Create physical or virtual cards in seconds from your dashboard. No paperwork. No bank branch visits. Issue cards to employees, vendors, or departments immediately. Cards are accepted nationwide for online and offline business spends.

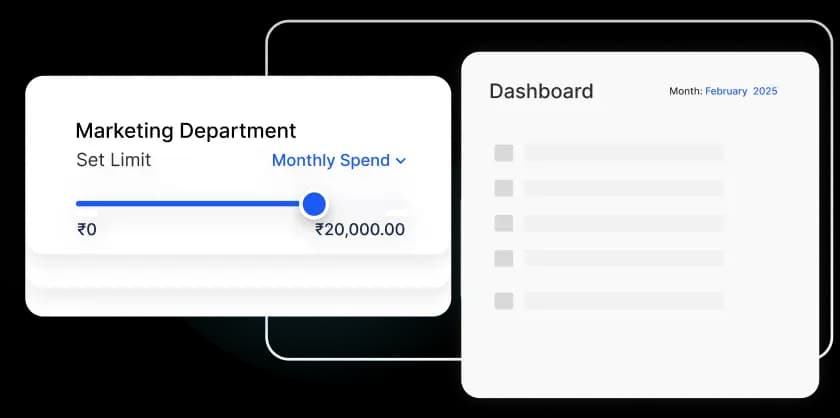

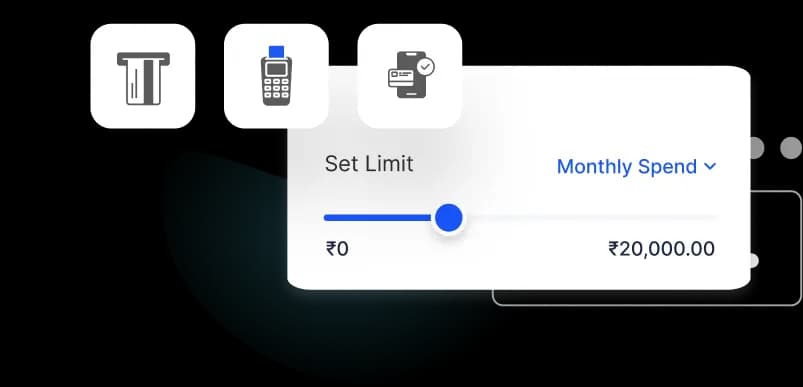

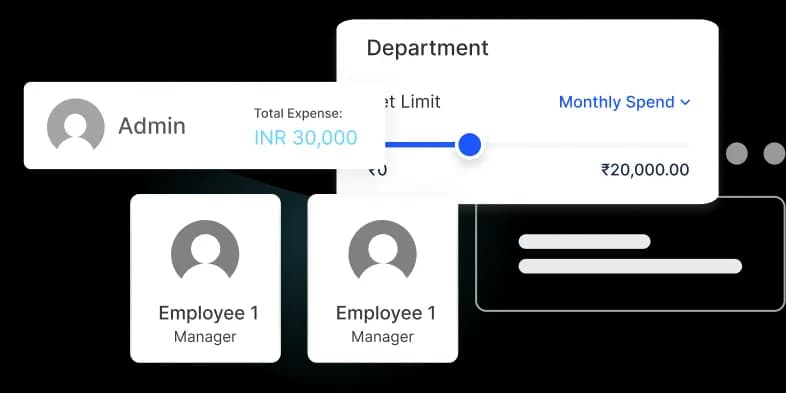

Set Precise Spending Limits

Set daily, weekly, or monthly limits. Block merchant categories like alcohol, entertainment, or cash withdrawals. Restrict usage to POS, online, or contactless only. Apply geo-fencing to control where cards can be used. Freeze or cancel cards instantly.

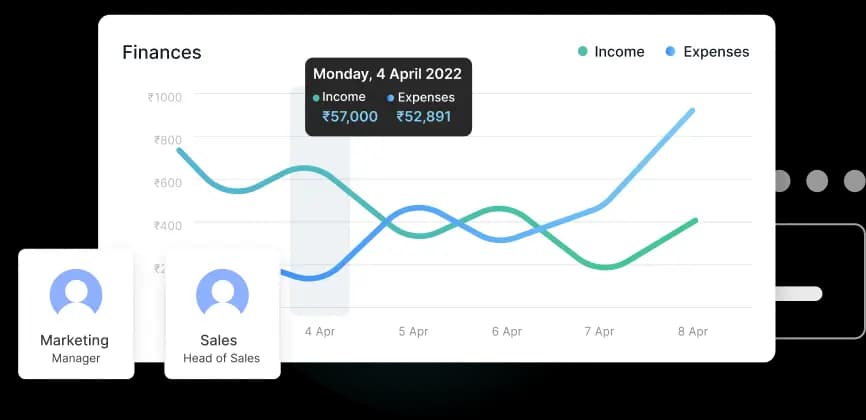

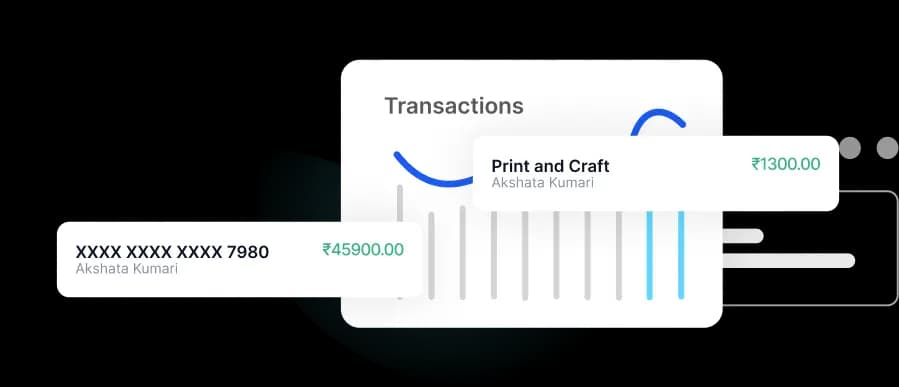

Track Every Transaction in Real Time

Every swipe shows up immediately on your dashboard. Track spends by employee, department, location, or category. Get instant notifications for all card activity and policy exceptions.

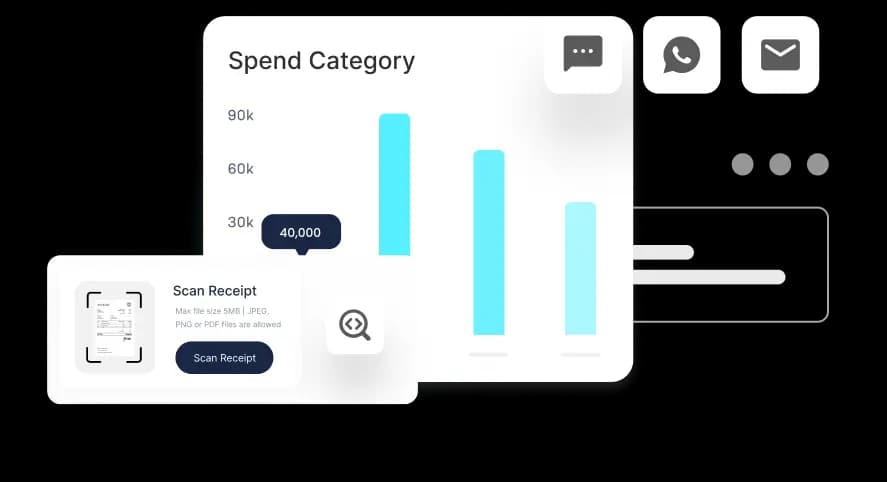

Reconcile Automatically

Match transactions to invoices automatically. Sync with Zoho Books, Tally, QuickBooks, SAP, and other accounting systems. Close your books faster without manual matching.

Get 360° Spend Visibility

Filter by team, location, merchant, or time period. Export custom reports for audits or month-end reviews. See budget utilization across departments in real time.

Enforce Approval Workflows

Set up approval chains based on amount, card type, or department. Maintain full audit trails. Keep finance teams in control while giving employees flexibility.

Built to Be Secure and Compliant

All prepaid cards operate on an RBI-compliant PPI framework and PCI-DSS certified infrastructure. Maintain regulatory compliance while keeping every transaction secure, traceable, and audit-ready.

Prepaid Cards, Natively Connected to Expense Management

With EnKash, prepaid cards feed directly into expense management, eliminating the need to match transactions, receipts, and approvals across different systems.

One Platform. Every Business Spending Need.

Fleet & Logistics Cards

Pay for fuel, tolls, repairs, and parking without cash. Give each driver their own card with spending limits you control. Track all fleet expenses in one place.

Payroll Cards

Load salaries, bonuses, or incentives directly onto cards. Perfect for gig workers, contract staff, or employees without bank accounts. Instant, secure, zero paperwork.

Getting Started with Prepaid Cards

Configure

Define merchants, limits, and usage policies for your closed loop cards.

Issue Cards

Issue physical or virtual cards to employees, partners, or teams.

Track and Manage

Monitor transactions in real time and reconcile automatically.

Let's Build Your Prepaid Card Program

Get a custom quote.

See the platform.

Go live in days.

Frequently Asked Questions (FAQs)

Have more questions?

01. What is a prepaid card?

A prepaid card is a reloadable payment card preloaded with a fixed amount. It works like a company wallet for employees to make approved business purchases. Once the balance is spent, the card stops working until you reload it.

02. How are prepaid cards different from debit or credit cards?

Credit cards provide a line of credit, which creates repayment obligations. Debit cards are linked directly to a bank account. Prepaid cards are loaded with a fixed amount in advance, are not linked to a bank account, and involve no credit risk. Once the balance is used, the card simply stops working until it is reloaded.

03. Can I set spending limits and restrictions?

Yes. Set daily, weekly, or monthly limits. Block specific merchant categories like alcohol or ATMs. Restrict cards to POS, online, or contactless usage. Pause or cancel cards instantly.

04. Who can use EnKash prepaid cards - employees, vendors, or contractors?

All of the above. You can issue cards to full-time employees, freelancers, vendors, gig workers, or fleet personnel. The cards are customizable based on the use case—travel, rewards, payroll, marketing, and more.

05. Are EnKash prepaid cards physical or virtual?

Both options are available. Issue virtual cards for online transactions and physical cards for in-person payments. Each can be configured with individual rules and spend controls.

06. Can I integrate EnKash cards with my accounting or ERP system?

Yes. EnKash supports seamless integration with leading accounting tools and ERP platforms, making reconciliation, reporting, and audit trails easier and faster.

07. How do I load or reload funds onto a prepaid card?

Funds can be loaded or topped up in just a few clicks through the EnKash dashboard. You can even automate recurring loads or set up approval workflows.

08. Are prepaid cards compliant with tax and financial regulations?

Yes. EnKash prepaid cards are PCI-DSS certified and fully compliant with RBI guidelines, making them safe, auditable, and tax-efficient, especially for benefits like meals or reimbursements.

09. Is there a minimum balance requirement?

There is no minimum balance required to keep a prepaid card active. However, a minimum available balance of ₹250 is required on the card to complete a transaction. You can load funds as needed and top up cards at any time based on usage.

10. What happens to the unused balance on a prepaid card?

Unused balances are carried forward. Funds remain available on the card until they are spent, reallocated, or the card is closed, subject to applicable regulatory guidelines.

11. Can I issue prepaid cards with my company’s branding?

Yes, company-branded prepaid cards can be issued as part of a co-branded card program. Standard prepaid cards are issued with EnKash branding.

12. What happens if a card is lost or stolen?

You can instantly block, freeze, or hotlist the card from your EnKash dashboard. All funds remain secure, and you can reissue a replacement card easily.

13. Can prepaid cards be used for employee benefits like meals and rewards?

Yes. EnKash provides dedicated prepaid meal cards and prepaid gift cards that support tax-saving meals, employee rewards, festival gifting, and incentive payouts. These cards are accepted across online and offline merchants in India, making them easy for employees to use for food, dining, shopping, and other eligible spends. Companies also gain better control, instant issuance, and real-time visibility compared to traditional voucher or reimbursement-based benefit programs.

14. How do EnKash prepaid cards help reduce expense fraud or leakage?

With real-time tracking, merchant restrictions, policy enforcement, and analytics, EnKash cards eliminate manual processes and unauthorized spending, improving governance across all spending categories.