What is Google Pay (GPay)?

Google Pay (GPay) is a digital payment platform developed by Google that allows users to send and receive money, pay merchants, and manage transactions securely through their mobile devices. In India and several other markets, Google Pay primarily operates on the Unified Payments Interface (UPI) system, enabling instant bank-to-bank transfers without the need for card details or account numbers.

At its core, Google Pay acts as a payment facilitator that connects users’ bank accounts to a secure digital interface, making everyday transactions faster, paperless, and more convenient.

Google Pay – Key Information

Attribute |

Details |

|---|---|

Developer |

Google |

Initial Launch |

2011 (as Google Wallet) |

Rebranded As |

2015 – Android Pay |

Current Name Since |

2018 – Google Pay |

Operating Systems |

Android 9+, Wear OS 2.18+, Fitbit OS |

In-Store Payments |

Android phones & Wear/Fitbit devices with NFC |

Online/Web Compatibility |

Android, ChromeOS, Windows, macOS, iOS, iPadOS, Linux |

Supported Browsers |

Chrome, Edge, Firefox, Opera, Samsung Internet, Safari |

Global Availability |

Available in over 100 countries worldwide |

License Type |

Proprietary |

Official Website |

How Does Google Pay Work?

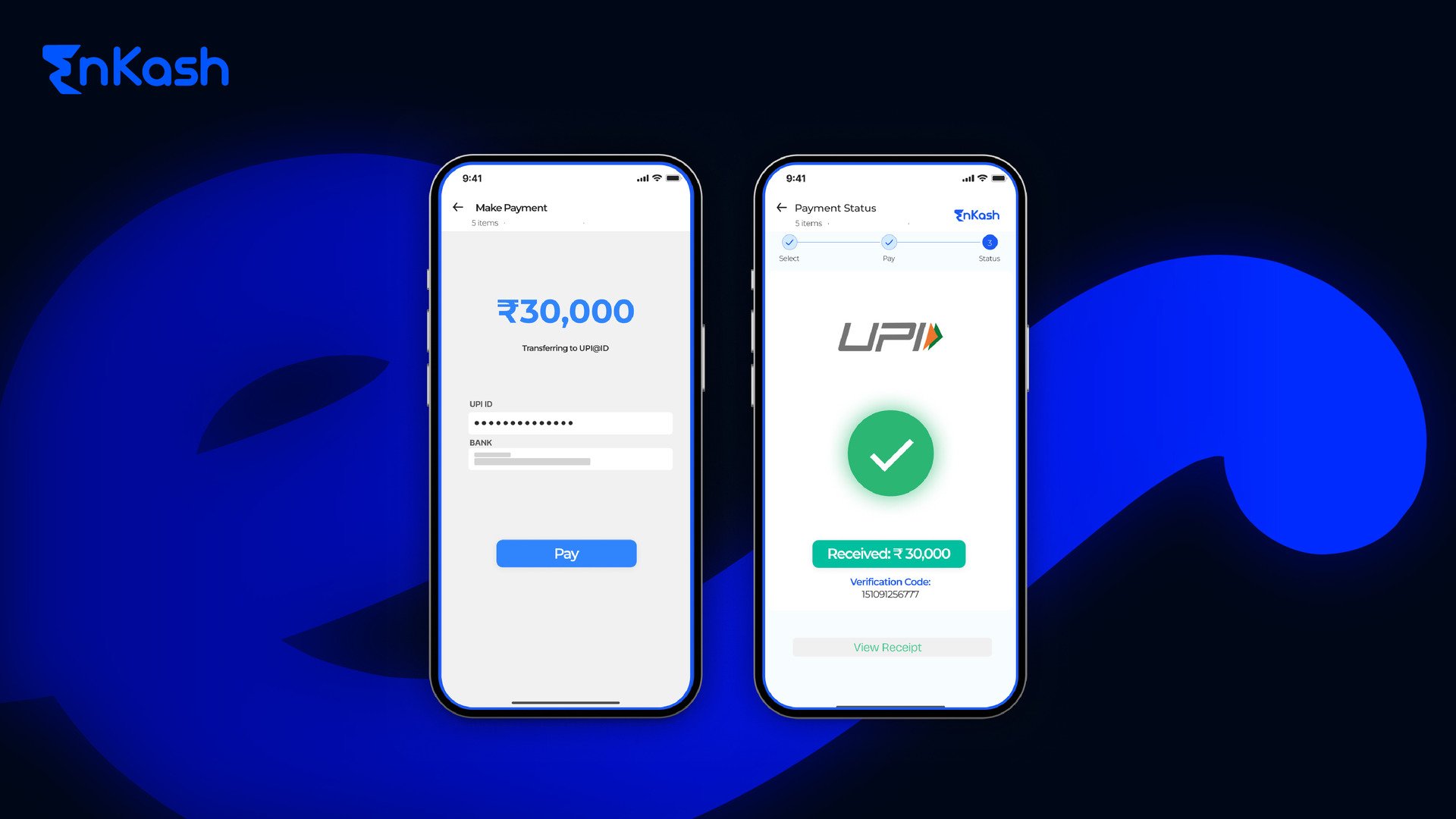

Google Pay acts as a secure bridge between you, your bank or card, and the person or business you are paying. It does not store money like a traditional wallet in most countries. Instead, it uses existing payment rails like UPI, bank accounts, and cards to move money in real time.

1. How Google Pay works in India (UPI-based)

In India, Google Pay is built on UPI (Unified Payments Interface):

- In India, you link your bank account to Google Pay using your mobile number.

- A UPI ID and UPI PIN are created or linked to your bank account.

Whenever you pay:

- You enter the amount and select the person or business (UPI ID, QR code, mobile number, or bank account).

- You confirm the payment using your UPI PIN.

- UPI moves the money directly from your bank account to the recipient’s bank account in real time.

- There is no separate wallet balance in the Indian version of Google Pay for UPI-based payments.

So, in India, Google Pay is essentially a UPI app with a clean interface, rewards, and integrations, sitting on top of your existing bank account.

2. How Google Pay works in other countries (cards + NFC)

Outside India, Google Pay functions primarily as a digital card wallet:

- You add your debit or credit card to Google Pay.

- The app creates a secure virtual token for your card and stores that instead of the actual card number.

When you tap your phone on an NFC-enabled POS machine or pay online:

- Google Pay sends the tokenised card details to the merchant, not the real card number.

- Your bank/card network (Visa, Mastercard, etc.) processes the payment in the background.

This makes Google Pay a safer way to use your physical card for contactless (tap-to-pay) and online payments.

How to Set Up Google Pay

1. Download and Install

- Install Google Pay from the Google Play Store or Apple App Store.

- Open the app and sign in with your Google account.

2. Verify Your Mobile Number

- Enter the phone number linked to your bank account.

- Enter the OTP sent by your bank.

3. Add Your Bank Account

- Select your bank from the list.

- Your account will be detected automatically through your mobile number.

If you don’t have a UPI PIN, set it by entering your debit card details.

4. Enable Security

Turn on fingerprint, face unlock, or phone screen lock for approving payments.

How to Set Up Autopay in Google Pay

1. Open Google Pay

Go to the home screen and ensure you are logged in.

2. Choose Your Biller or Subscription

Tap Bills, Subscriptions, or open the specific merchant inside Google Pay, and then select the service you want to enable Autopay for.

3. Tap Set Up Autopay

Choose the Autopay option shown for that biller or merchant.

4. Select Frequency

Pick Monthly, Weekly, or As per bill cycle.

5. Set Maximum Amount

Enter the highest amount Google Pay is allowed to deduct automatically.

6. Authenticate Using Your UPI PIN

Enter your UPI PIN once to activate the Autopay mandate.

Autopay is now active, and the amount will be deducted automatically on the due date.

How to Use NFC in Google Pay

Google Pay also supports contactless payments through NFC in countries where tap-to-pay is available. This allows users to make quick in-store payments by simply tapping their phone on an NFC-enabled payment terminal.

1. Ensure Your Device Supports NFC

- To use tap-to-pay, your smartphone must have an active NFC feature.

- You can check this in your device settings and enable NFC before making a payment.

2. Add a Supported Card to Google Pay

- NFC payments work only when a supported debit or credit card is added to Google Pay.

- In regions where Google Pay offers card tokenization, users can add their card inside the app and complete a one-time verification.

3. Enable Contactless Payments

- After adding your card, open Google Pay settings and ensure that Contactless Payments or Tap-to-Pay is turned on.

- This allows your device to communicate with the merchant’s payment terminal securely.

4. Make a Contactless Payment

To pay using NFC:

- Unlock your phone

- Hold it close to the NFC-enabled POS machine

- Wait for the terminal to detect your device

- Complete authentication if required

Once the payment is processed, you will receive an instant confirmation on your screen.

How to Pay Using Google Pay

Google Pay allows users to make quick and secure payments across stores, apps, websites, and peer-to-peer transfers. The process is straightforward and follows a consistent authentication flow to keep every transaction safe.

1. Paying at Stores

You can pay at physical stores using either UPI or contactless tap-to-pay (where supported).

For UPI payments:

- Open Google Pay and tap Scan QR Code

- Scan the merchant’s UPI QR

- Enter the amount and confirm using your UPI PIN

For NFC tap-to-pay (outside India):

- Unlock your phone

- Hold it near the NFC-enabled POS Machine.

- Authenticate if required

- Receive instant confirmation

2. Paying Online or In Apps

Many apps and websites support Google Pay as a checkout option.

To pay online:

- Select Google Pay during checkout

- Verify the payment request in Google Pay

- Approve the transaction using your UPI PIN or device authentication

The payment is completed instantly, and a confirmation appears both in the app and on Google Pay.

3. Sending Money to Individuals

Google Pay makes peer-to-peer transfers simple and instant.

To send money:

- Open Google Pay → tap Pay

- Select the contact or enter their UPI ID / phone number

- Enter the amount

- Confirm using your UPI PIN

Benefits of Google Pay

Google Pay has become a preferred digital payment option because it brings together convenience, speed, and strong security for everyday transactions. Its features support a wide range of payment needs, making it suitable for both individuals and businesses.

1. Simple and Fast Payments

Google Pay enables quick payments through UPI, QR codes, and supported cards. Users can complete transactions with just a few taps, whether they are paying at stores, sending money, or completing online purchases.

2. Strong Security Framework

Security remains a core advantage of Google Pay.

The platform uses tokenization, encryption, UPI PIN verification, and biometric authentication to ensure that sensitive card and bank details are never exposed during transactions.

3. Wide Acceptance Across Merchants

Google Pay is accepted by millions of merchants for both in-store and online payments. This includes supermarkets, restaurants, small businesses, e-commerce platforms, and utility service providers, enabling extensive usage across daily spending categories.

4. Seamless Integration With Google Services

Google Pay works smoothly with Google’s ecosystem.

Users can make payments through Google Play, Chrome, and Google Assistant, ensuring a connected and convenient experience across devices.

5. Rewards and Cashback Offers

Eligible transactions may provide cashback, rewards, and promotional benefits. These incentives increase user engagement while lowering the cost of digital transactions.

6. Real-Time Payments Through UPI

In India, Google Pay’s integration with UPI ensures real-time transfers directly between bank accounts. This eliminates the need for maintaining wallet balances or relying on traditional payment methods.

7. Business Support

For merchants, Google Pay offers faster collections, reduced cash handling, and easier financial tracking. Businesses can use QR codes, UPI payments, and NFC-based methods (where supported) to accept payments efficiently.

Security Features of Google Pay

Google Pay is built on a multi-layer security framework designed to keep payments protected across all devices and transaction types. The platform combines authentication, tokenisation, and real-time monitoring to ensure safe digital payments.

1. Tokenisation of Card Details

For card transactions, Google Pay never shares the actual card number. Instead, it uses a unique digital token, making transactions safer than traditional card swipes.

2. Encrypted Transactions

All data transferred through Google Pay is encrypted.

This prevents unauthorized access and protects sensitive financial information.

3. UPI PIN Verification

In India, every payment requires the user’s UPI PIN.

Google Pay does not store this PIN and cannot access bank credentials at any point.

4. Biometric and Device-Level Security

Users can enable:

- Fingerprint unlock

- Face unlock

- Phone PIN or screen lock

This adds an extra layer of protection.

5. Fraud Detection and Alerts

Google Pay uses Google’s AI-driven fraud monitoring to identify unusual activity. Real-time notifications alert users immediately after every transaction.

6. Google Play Protect

Google Play Protect scans the app continuously for security threats, malware, or unauthorized access.

7. Remote Device Safety

If a device is lost, users can lock or erase their phone using Find My Device, ensuring Google Pay cannot be misused.

How to Set Up a Google Pay Business Account

Google Pay for Business enables merchants to accept digital payments through UPI, QR codes, and supported cards. The setup process is simple and designed for quick onboarding.

1. Download Google Pay for Business

Install the Google Pay for Business app from the Play Store.

2. Sign In With Your Business Number

Enter the mobile number linked to your business or banking account.

3. Verify the Number

A one-time password (OTP) will be sent for verification.

4. Add Business Details

Provide:

- Business name

- Business category

- Address

- GST details (optional)

5. Add Your Bank Account

Select your bank and link the account using the same mobile number.

6. Start Accepting Payments

Once verified, you receive:

- A UPI QR code

- A business profile

- Access to your transaction history and settlement details

- Businesses can collect payments instantly and track everything through the dashboard.

Resolving Disputes and Transaction Issues

Occasionally, users may face transaction failures, double deductions, or incorrect payments. Google Pay offers several ways to resolve disputes efficiently:

- Identify the Issue: Check your transaction history to confirm whether a payment is pending, failed, or completed.

- Wait for Automatic Resolution: In cases of minor technical issues, failed transactions are usually reversed automatically within 24-48 hours.

- Contact the Recipient: If money was mistakenly sent to the wrong person, users can request a refund through GPay.

Raise a Dispute:

- Navigate to the specific transaction in the app.

- Select ‘Report a Problem’ or ‘Get Help.’

- Choose the reason for the dispute and provide necessary details.

- Follow Up with the Bank: If the issue is related to bank processing, contacting the bank’s customer service may help speed up the resolution.

Contacting Google Pay Support

For issues that require direct assistance, users can contact Google Pay’s customer support. Methods include:

- In-App Help Center: Tap on the ‘Help & Support’ section in the app for FAQs and troubleshooting guides.

- Chat Support: Access Google Pay’s customer support chat for real-time assistance.

- Phone Support: Google Pay provides customer service numbers that vary by country.

- Email Support: For complex issues, users can submit an inquiry via email through Google’s support page.

- Social Media Assistance: Google Pay’s official Twitter and Facebook pages often provide quick responses to user concerns.

By actively managing their Google Pay account, users can track spending, enhance security, resolve disputes efficiently, and seek help when needed, ensuring a smooth digital payment experience.

Business Perspective: Accepting Google Pay in India

This section explores the key benefits for merchants and developers, providing insights into how GPay can be effectively integrated into different business models to maximize digital payment potential.

For Merchants

Benefits of Accepting Gpay Payments

- Increased Customer Convenience: Accepting Gpay allows customers to make quick and hassle-free payments, reducing checkout times and improving sales.

- Wider Reach: Gpay is widely used in India, with millions of active users, making it a valuable addition for businesses targeting a broad audience.

- Enhanced Security: Transactions are encrypted, tokenized, and require authentication, ensuring secure payments for both businesses and customers.

- Cashless and Contactless Payments: Gpay supports UPI and NFC tap-to-pay transactions, reducing the need for cash handling and improving hygiene standards.

- Integration with Business Tools: Google Pay offers transaction reports, analytics, and integration with accounting tools, making financial tracking easier for merchants.

Setting Up Gpay for Your Business

- Register as a Merchant: Visit the Google Pay for Business website and sign up using your business details and bank information.

- Verify Business Details: Google Pay verifies business credentials to ensure compliance with financial regulations.

- Start Accepting Payments: Once approved, merchants can generate UPI QR codes, enable NFC payments, and accept online payments via GPay.

Integration with Existing POS Systems

Merchants can integrate Google Pay with their existing point-of-sale (POS) systems through:

- UPI QR Codes: Businesses can generate a QR code linked to their bank account, allowing customers to scan and pay instantly.

- NFC-Enabled POS Terminals: Retailers with NFC-supported payment terminals can accept tap-to-pay transactions.

- Online Payment Gateway Integration: E-commerce platforms can integrate Gpay with existing payment gateways to accept online transactions

For Developers

Integrating GPay into Apps and Websites

Developers can enhance their apps and websites by enabling GPay as a payment method. This offers users a secure and familiar way to complete transactions without manually entering card or bank details.

- Google Pay API Integration: Developers can use Google Pay APIs to embed payment options into their apps and websites.

- Seamless Checkout Experience: Gpay enables one-tap payments, reducing cart abandonment rates and improving conversions.

- Multiple Payment Methods: Users can pay via linked bank accounts, UPI, or saved cards, offering greater flexibility.

APIs and Developer Resources

Google provides extensive developer tools, including:

- Google Pay API for Android & Web: Allows businesses to integrate Gpay into mobile apps and websites.

- UPI Integration SDK: Enables businesses to accept UPI-based payments directly within apps.

- Developer Documentation & Support: Google offers guides, tutorials, and technical support to assist developers in integrating GPay smoothly.

Read more: Best Payment Gateway in India

Conclusion

Google Pay is a trusted digital payment platform in India, enabling instant UPI transfers, e-bill payments, and seamless online and in-store purchases. With end-to-end encryption, tokenization, biometric authentication, and fraud detection, it ensures safe transactions.

Users can track spending, download statements, and receive alerts, while businesses benefit from QR code and NFC payments, reducing cash dependency. Rewards and cashback offers make Google Pay a preferred choice, driving India’s cashless Payments economy.

FAQs

1. What does GPay payment processing involve in India?

GPay uses UPI to enable instant bank-to-bank transfers without needing a wallet. Users can send money, pay merchants, scan QR codes, and complete secure online transactions in real time.

2. What makes GPay different from traditional payment methods?

GPay relies on UPI PIN instead of OTPs, does not expose card details, and supports instant payments through QR, VPA, and contactless methods (in supported countries), making it faster and more secure.

3. Can I send money internationally using Google Pay India?

As of now, the Indian version of Google Pay (UPI-based) does not support outward international remittance. In other regions, the app integrates with Western Union/Wise for transfers abroad.

4. Is Google Pay accepted internationally?

Yes, but the features vary by country. In India, only UPI. Outside India: NFC tap-to-pay, card payments, PayPal (in some countries), online payments

5. Does Google Pay charge any fees in India?

No, UPI transactions on Google Pay are free.

Card-based payments may attract bank or processor charges depending on the card and issuing bank.

6. What is the transaction limit on Google Pay?

UPI transfer limits vary by bank and account type. For many users, the cap is around ₹1 lakh per transaction/day, but check with your bank for your specific limits.

7. What should I do if a Google Pay transaction fails?

Most failed UPI transactions are reversed automatically within 24–48 hours. If the amount is deducted but not received, contact Google Pay support or your bank.

8. Can I use Google Pay on multiple devices?

Yes, but the SIM and mobile number linked to your bank must be active on the primary device.

9. Do I need a debit card to use Google Pay?

You need a debit card only once—to set or reset your UPI PIN. After the PIN is created, you can continue using GPay without the card.

10. How long do refunds take on Google Pay?

- UPI refunds: Instant to 48 hours

- Card refunds: 3–5 business days