What is a Fake Payment Screenshot Scam?

A fake payment refers to a fraudulent transaction where scammers create false payment confirmations, fake screenshots, or misleading messages to make it appear that money has been paid when no real transaction has occurred. Fake payments are commonly used in UPI frauds, online shopping scams, and business payment fraud, and can involve fake bank alerts, edited receipts, or phishing links. Always verify payments directly in your bank or payment app before delivering goods or services.

Digital payments have made everyday transactions faster and simpler. At the same time, scammers have found ways to misuse this trust. A fake payment screenshot scam is when a person shows a payment proof that looks real, but in reality, no money has been transferred. The goal is to trick shopkeepers, service providers, or even individuals into believing that the transaction is complete.

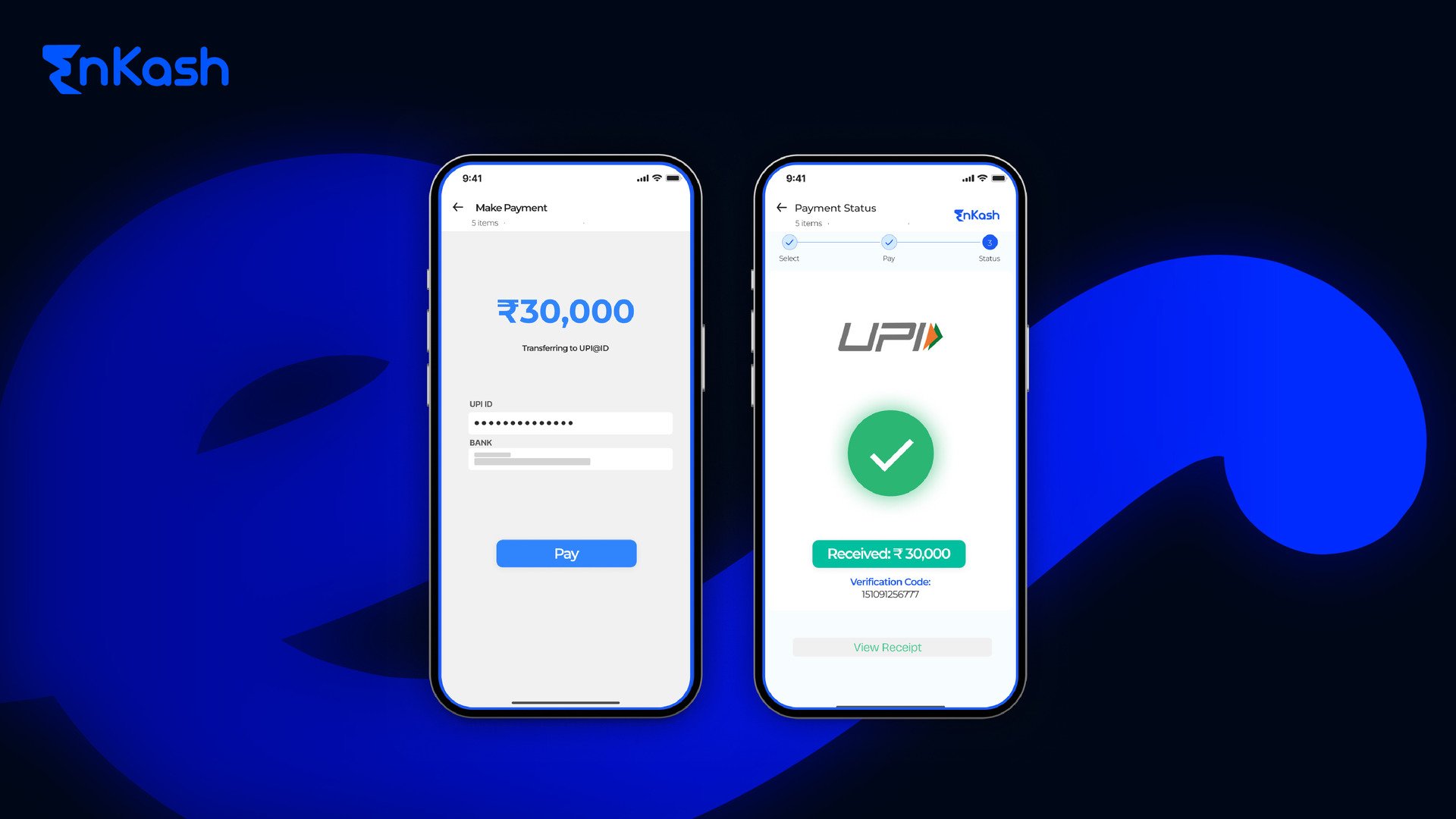

These scams usually involve edited images or apps that generate a fake confirmation screen. The scammer flashes the screen, claims the transfer is successful, and leaves with the goods or services. The victim later realizes that the amount never reached their account. This trick works because many people still rely on screenshots instead of checking their own payment application or bank statement.

A fake screenshot can be created in many ways. Some use photo-editing tools to alter genuine receipts, while others use prank payment apps that mimic real interfaces. In some cases, the fraud goes further with fake transaction histories or forged payment screenshot messages. All these methods create the illusion of a successful transfer.

It’s important to understand that a screenshot is not valid proof of money received. Only your bank account balance or your verified UPI app history can confirm that funds have actually been credited. Without this check, businesses and individuals leave themselves open to fraud.

Common Fake Payment Methods

Scammers use different tricks to create the illusion of a successful transfer. Most of these methods are designed to look convincing at first glance, which is why many people fall into the trap. Knowing the common approaches helps you stay alert.

Edited or Manipulated Screenshots

One of the simplest methods is editing an existing receipt. Fraudsters take a genuine transaction slip and alter the amount, date, or transaction ID. With easy-to-use editing tools, a fake payment screenshot can be made to look real. Since many shopkeepers are busy handling customers, they might not notice small details like mismatched fonts or distorted numbers.

Prank and Spoof Apps

A prank payment is a fake or misleading payment attempt where no real money is transferred. It often involves edited payment screenshots, fake UPI success messages, or spoof/prank apps that generate false payment notifications to make a transaction look successful. While some users treat this as a joke, prank payment apps and spoof tools can cause confusion, trust issues, and may be considered digital payment fraud. Always confirm payments directly in your bank or UPI app before proceeding.

Some scammers use prank payment apps or spoof tools that mimic genuine UPI platforms. These fake interfaces create fake PhonePe payments, fake Paytm screenshots, or even fake GPay receipts that look almost identical to the original apps. The app shows a “payment successful” message on the fraudster’s phone, but no money actually moves. To an untrained eye, the screen appears authentic.

Fake UPI IDs and Transfer Requests

Fraudsters also mislead by sharing fake UPI IDs. A victim sends money believing the ID belongs to the seller, but the transfer goes to someone else entirely. In some cases, fraudsters generate fake UPI transfers and show a “pending” or “processing” message, pretending that funds are on their way.

Fabricated Payment Histories

Cloned or tampered apps sometimes display a full fake Paytm history or fake online payment records. These screens are used to convince merchants that the user has paid on multiple occasions. In reality, the entries do not exist in the banking system.

Social Engineering with Screenshots

The fraud is not always about technology. Many scammers apply social pressure. They flash a payment screenshot, act hurried, and insist that the money has gone through. In crowded places or during busy hours, merchants may feel pressured to complete the deal without checking their own app.

Risks of Fake Payment Scams

Fake payment tricks may look harmless on the surface, but the damage runs deeper than a single lost sale. They put individuals, businesses, and even the larger digital payment systems at risk.

Direct Financial Losses

The most obvious impact is losing money or goods without receiving actual payment. For small merchants, even a single fake UPI payment can cut into daily earnings. In peer-to-peer sales, like second-hand items or services, the loss hits individuals directly.

Reputational Harm

When fraud happens repeatedly, customers lose confidence. A shop or service provider known for being tricked by fake payment claims may face trust issues. People might assume the business is careless with digital transactions, which hurts long-term credibility.

Legal Complications

Handing over products or services based on a fake screenshot can lead to disputes. If a merchant tries to recover the loss later, it may involve police reports, legal processes, or long banking complaints. All of this consumes time and resources.

Operational Disruption

Fraud is not just about money – it disrupts operations too. It slows down business operations. Staff have to manage disputes, explain situations to genuine customers, and record complaints. This wasted time could otherwise be used to serve paying clients.

System-Wide Risks

On a larger scale, repeated incidents of fake online payment scams erode trust in digital platforms. If users start doubting apps like UPI, PhonePe, or Paytm due to prank payment apps or Paytm spoofing cases, it weakens confidence in the entire ecosystem.

Step-by-Step: How to Detect a Fake UPI Payment in Seconds

The best defense against fraud is learning how to detect a fake UPI payment before handing over your product or service. Scammers rely on speed and distraction, but a few careful checks can expose a fake payment instantly.

Look Closely at the Screenshot

If someone shows you a payment screenshot, do not treat it as final proof. Edited images usually have small errors: blurred text, uneven alignment, or fonts that don’t match the official design. Even if the screenshot looks perfect, remember it proves nothing unless your account reflects the transfer.

Rely on Your Own UPI or Bank App

A genuine transfer always appears in your UPI app or bank statement. Open your own device and confirm the credit. If you cannot see the entry, it means the money has not arrived, regardless of what the payer’s phone shows. This simple step filters out fake UPI transfers and fake Paytm screenshots.

Check Transaction Details

Every real transaction carries a unique reference number. Compare the number in your app with what the payer is showing. In many fake GPay receipts or fake PhonePe payments, the numbers are either repeated, missing, or don’t match standard formats.

Be Cautious of Fake UPI IDs

Fraudsters sometimes ask you to send money to a fake UPI ID while claiming it belongs to the business. Always verify the payee name shown in your app before completing a transfer. If the name looks suspicious or unrelated, cancel immediately.

Do Not Trust SMS or Sound Alerts Alone

A text notification can be delayed or even forged with spam tools. Soundbox devices may announce a payment, but there have been cases where merchants did not actually receive the credit. Always double-check in your own app.

Watch for Social Pressure

Scammers frequently act rushed, claiming they are late, or urging you to “trust the screenshot.” Take your time. A delay of thirty seconds to verify a fake online payment can save hours of stress later.

How Merchants Can Protect Themselves from Fake Payment

Merchants are the most common targets for fake payment scams. The good news is that a few simple practices can make it extremely hard for fraudsters to succeed. Prevention depends on discipline, staff training, and clear rules at the point of sale.

Adopt a “No Screenshot” Policy

Set a clear rule: goods or services will only be handed over once the payment reflects in your own app or bank account. A fake payment screenshot may look convincing, but your app’s transaction history is the only real proof. Displaying this policy on a signboard helps customers understand it’s non-negotiable.

Verify Every Transaction Yourself

Always check your own merchant app or bank statement before completing an order. Do not rely on the customer’s device. This single step blocks most fake UPI transfers.

Train Your Staff Regularly

If employees handle payments, train them to stay calm under pressure. Scammers often act rushed, insisting that the money is “already sent.” Role-play these scenarios during staff briefings so your team is prepared.

Use Payment Soundboxes Wisely

Soundboxes are useful, but they are not foolproof. There have been cases where merchants trusted the chime without checking their app and lost money to fake online payment attempts. Use sound notifications as an alert, not as final proof.

Communicate Clearly with Customers

Polite but firm communication reduces conflict. A short line such as “We release the product only after the payment shows in our account,” makes your process transparent. Most genuine customers respect this rule.

Keep Records of Transactions

Maintain receipts, digital confirmations, and notes of disputed cases. If you ever face a Paytm spoof or a fake Paytm history scam, detailed records will help when filing a complaint with your bank or the cybercrime portal.

Explore Fraud Insurance or Protection Tools

Some financial institutions and payment service providers offer protection plans for merchants. These can provide coverage against digital fraud, including prank payment apps that generate false confirmations.

Legal and Regulatory Aspects in India

Digital payment frauds have grown rapidly, and regulators have stepped in with rules to protect both merchants and users. A fake payment may look like a small trick, but under the law, it is treated as a serious offence.

Laws That Apply to Fake Payment Scams

Cheating someone with a fake payment screenshot falls under sections of the Indian Penal Code dealing with fraud and deception. The Information Technology Act also applies, as it covers electronic records and online transactions. Depending on the case, charges may include forgery, impersonation, and financial fraud.

The Cybercrime Helpline and Reporting Portal

Victims can immediately call the national cybercrime helpline number 1930 or submit a complaint through the official cybercrime reporting portal. Quick reporting improves the chances of tracking a fake UPI payment and freezing suspicious accounts before the scammer withdraws funds.

Guidelines from RBI and NPCI

The Reserve Bank and NPCI have issued multiple guidelines to make UPI safer. Rules include mandatory two-factor authentication, device binding, and limits on risky flows. These steps reduce misuse, but the biggest safeguard is still user awareness. No rule can protect a merchant who releases goods only on the basis of a fake Paytm screenshot.

Recent Updates in the Payment Ecosystem

New policies require the payee’s name to be shown before a transfer is made. This helps prevent fraud using fake UPI IDs or misdirected payments. Collect request features, which were once misused, are being phased out to further tighten the system. These updates aim to close gaps that fraudsters once used.

How to Report and Handle a Fake Payment Incident

Even with precautions, there may be times when a scammer slips through. In such cases, acting quickly makes all the difference. The faster you report a fake payment, the better your chances of recovering funds or preventing further misuse.

Act Immediately Within the First Hour

If you realize you have handed over goods or services after a fake payment screenshot, call the national cybercrime helpline 1930 right away. The system is designed to alert banks and freeze suspicious accounts before the scammer withdraws the money.

File a Complaint on the Cybercrime Portal

Visit the official cybercrime reporting portal and register your case. Provide complete details, including the payer’s fake VPA, the amount claimed, and any screenshots or chat logs. This creates an official record that investigators and banks can act upon.

Contact Your Bank or Payment Service Provider

Inform your bank or UPI app support team as soon as possible. Share the transaction reference you were shown and explain that it was fraudulent. Even if funds cannot be traced, reporting helps flag accounts that use prank payment apps.

Preserve Evidence Carefully

Do not delete messages, screenshots, or CCTV footage. Save the payment screenshot shown by the fraudster, note down the phone number, and record the time and place of the incident. Detailed evidence strengthens your complaint and helps investigators track repeat offenders.

Escalate Through the Dispute Process

Most UPI apps and banks have a dispute redressal system. Raise a ticket and follow up regularly. Escalation through NPCI channels is possible if the issue remains unresolved.

Common Myths Around Fake Payments

Many people lose money because they believe in common assumptions about digital transfers. These myths make scammers’ jobs easier. Clearing them up is key to staying safe.

“If the customer’s phone shows success, the money is in my account.”

This is false. A fake payment screenshot or even a real success screen on the payer’s phone does not prove anything. The only proof is the credit appearing in your own app or bank account.

“SMS alerts are enough to trust.”

Messages can be delayed, duplicated, or even spoofed. Fraudsters have used fake notifications to convince shopkeepers of a fake UPI payment. Always confirm through your official app.

“Soundbox chimes mean the money is settled.”

Soundboxes are helpful but not final proof. There have been cases where merchants trusted the chime and later found no credit. Never release goods without checking your own record of the transaction.

Final Thoughts

Digital transactions have made life simpler, but they have also given rise to scams like fake online payment tricks and fake UPI transfers. Fraudsters rely on trust, quick exchanges, and the habit of accepting a fake payment screenshot as proof. The rule is simple: never hand over goods or services unless the money reflects in your own app or bank account. Merchants, service providers, and individuals can protect themselves by training staff, setting clear policies, and verifying every transaction carefully. Quick reporting to the cybercrime helpline and preserving evidence further strengthens your case. With awareness and consistent checks, you can close the door on scams and keep digital payments safe.

FAQs

1. What is a fake payment app?

A fake payment app is a tool designed to look like a genuine UPI platform, such as Paytm, PhonePe, or Google Pay. It creates fake receipts, payment histories, or confirmation messages without transferring money. Scammers use these apps to trick merchants and individuals into believing a payment has gone through.

2. How do scammers use fake Paytm or PhonePe apps?

Fraudsters download spoofed or cloned versions of popular wallets. They open the app during a purchase, enter the transaction details, and generate a fake “success” screen. This makes it appear as though money has been sent. Since no actual transfer occurs, the merchant loses goods or services if they do not verify in their own app.

3. How can I identify a fake UPI transfer?

A fake UPI transfer will not reflect in your own transaction history. Scammers may show you a screenshot with a green tick or reference number, but unless the amount is visible in your UPI app or bank account, no payment has taken place. Always match time, amount, and transaction ID on your own device.

4. Is using fake payment screenshots illegal in India?

Yes. Presenting a fake payment screenshot amounts to cheating and forgery under the Indian Penal Code and can also fall under provisions of the Information Technology Act. This makes it a criminal offense. Offenders may face fines, police cases, and even imprisonment, depending on the scale of the fraud and the evidence presented.

5. How can merchants protect themselves from fake payment fraud?

Merchants should adopt a strict “no screenshot” policy and verify payments only through their own apps or bank statements. Staff training is critical to resist social pressure. Keeping proper signage, maintaining clear records, and reporting incidents quickly to the cybercrime helpline are effective ways to protect against fraudsters using fake receipts or spoofed apps.

6. What should I do if I receive a fake payment receipt?

Do not release the product or service. Open your own app or bank account and confirm whether the amount is credited. If the payment does not appear, politely refuse the transaction. If you have already handed over goods, call the cybercrime helpline 1930, file a report on the cybercrime portal, and preserve all evidence for investigation.

7. Are prank payment apps safe to use?

No. While they may be marketed as “fun” tools, prank payment apps are risky and often misused for fraud. Many are illegal, carry malware, or access sensitive phone data. Using them can expose you to legal trouble, compromise your privacy, and even link you to financial scams if they are employed for fake transactions.

8. What evidence should I collect if scammed by a fake payment?

Gather as much information as possible. Save the fake receipt or screenshot shown to you, note the payer’s mobile number and UPI ID, preserve CCTV footage if available, and take screenshots of your own transaction history showing no credit. Submitting detailed evidence with your complaint increases the chances of action against the scammer.

9. Can banks recover money lost to fake UPI payments?

Recovery is difficult once the scammer withdraws the money. However, quick reporting through the 1930 helpline and the cybercrime portal allows authorities to freeze suspicious accounts. Banks and payment apps have dispute systems, but success depends on how early the fraud is flagged and the cooperation of all parties in the payment chain.

10. How do fake online payments affect trust in digital transactions?

Repeated cases of fake receipts, spoof apps, and manipulated transfers reduce trust among users and merchants. When people doubt the safety of UPI, they may hesitate to accept digital payments. This not only hurts small businesses but also slows the adoption of cashless systems. Awareness and strict verification practices help restore confidence.