India’s Unified Payments Interface (UPI) continues to dominate the country’s digital payments landscape, processing a record of over 21.6 billion transactions in December 2025 alone, according to data from the National Payments Corporation of India. This volume highlights how deeply UPI is embedded in everyday transfers, bill payments, merchant settlements, and person-to-person money movement across the country.

In a system with such massive scale, every transfer needs a unique identifier that both users and banking systems can reference. The UPI reference number serves this purpose. It acts as a definitive trail for a transaction, enabling users to confirm status, banks to trace and settle payments, and support teams to resolve disputes accurately.

Understanding these identifiers, including how to find and use your UPI transaction ID, is essential for anyone who uses digital payments in India today.

What Is a UPI Reference Number?

A UPI reference number is the system-generated identifier that tags every UPI payment as it moves through India’s banking network. Each transfer passes through several checkpoints: your UPI app, the issuing bank, NPCI’s switching layer, and the receiving bank. This number ensures all parties are looking at the same transaction, even when thousands are processed every second.

You’ll find this code in your transaction history, SMS alerts, or bank statements entries. It doesn’t describe the transaction; it simply anchors it in the backend so the system can validate status, match settlement records, or troubleshoot delays. When users raise a support ticket for a pending or failed payment, this is the first detail banks ask for because it points directly to the transaction’s record in their ledger.

This identifier stays linked to the payment from initiation to settlement. If a refund or reversal takes place, the same number helps the bank trace the flow. For users who need quick clarity, checking the UPI transaction ID alongside the reference number makes it easier to confirm where the payment stands and whether it has completed its journey.

How a UPI Reference Number Works in the Backend

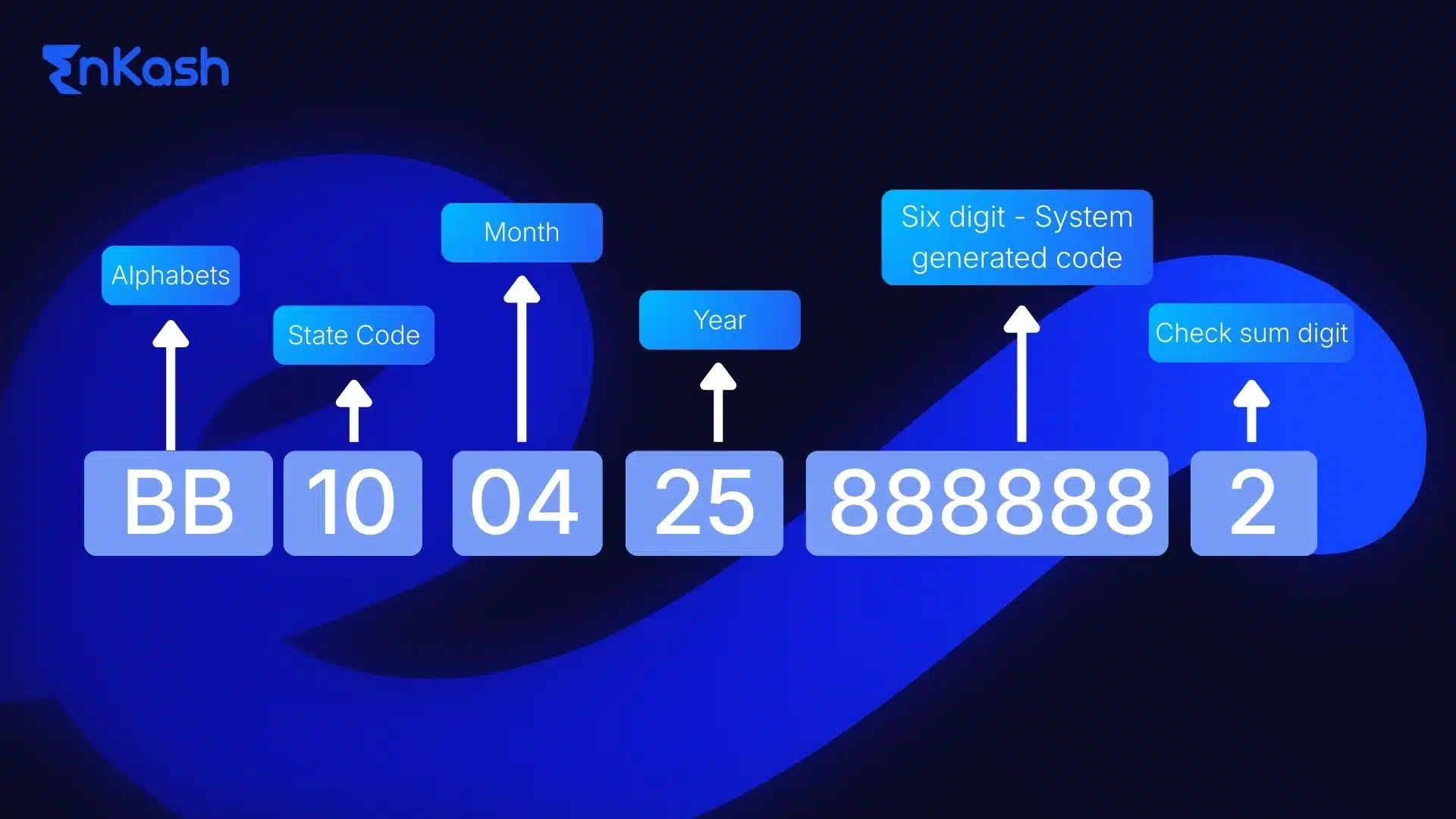

Structured Format Behind the Identifier

A UPI reference number follows a predictable layout designed for fast recognition inside banking systems. Each segment of the code signals when the payment was created and which bank initiated it. The structure may look random to users, but it gives backend systems the clarity needed to classify the transaction instantly.

How Banks Generate and Read the Number

The issuing bank assigns the reference number the moment a request enters its system. This identifier then travels with the payment through NPCI’s switching layer and reaches the receiving bank. Both banks rely on the same value to match entries during reconciliation and settlement.

How Uniform Referencing Keeps Payments on Track

UPI processes millions of transfers at peak hours, and a uniform format helps avoid mismatches or delays. When a bank searches its logs, this identifier acts as a fixed point that leads directly to the transaction’s record. It also supports dispute checks because the system can retrieve the exact entry without scanning unrelated transfers.

Link to Other Identifiers in the System

Although users may also see a UPI transaction ID, the backend leans on the reference number for deeper verification. Its structured nature makes it easier for banks to compare timestamps, settlement batches, and routing details without confusion.

Uses of a UPI Reference Number

Helps Users Confirm Payment Status

A UPI reference number is the first detail users check when they want clarity on a payment. It shows whether the transfer has reached the receiving bank or is still in transit. When a transaction appears stuck, this identifier becomes the quickest way to validate progress without relying on assumptions. Support teams ask for it because it leads them directly to the transaction’s ledger entry. This avoids long conversations, reduces back-and-forth, and ensures the response is based on verified records rather than app-side indicators.

Supports Merchant Verification and Order Matching

Merchants depend on accurate payment confirmation, especially when order fulfilment or service delivery is time-sensitive. With the reference number, they can match a customer’s payment to the correct order in their dashboard or settlement report. This reduces confusion when multiple transactions occur within minutes. It also protects both sides from disputes where receipts don’t align with the merchant’s system due to network delays. The identifier acts as a precise marker that confirms whether the amount has actually reached the merchant’s bank account.

Plays a Critical Role in Refunds and Reversals

Refunds rely heavily on accurate tracking. When a transaction is reversed due to failure or a user-generated request, banks use the same identifier to trace the path of the refund. This ensures that funds are credited back to the right account and that both banks maintain consistent records. For users, this creates a transparent journey: the reference number confirms the refund has been processed and shows where the amount is in the settlement cycle. Checking this alongside the UPI transaction ID provides additional clarity in cases where timelines feel uncertain.

Used in Dispute Resolution Across Banks

Banks and apps treat this identifier as a single source of truth during disputes. It eliminates guesswork and directs teams to the exact transaction file, making resolution faster and far more accurate.

The Role of Reference Numbers in Maintaining UPI Integrity

Ensures Clear Identification Across Systems

UPI connects banks, payment apps, and settlement layers. Each transaction passes through these checkpoints, and without a stable identifier, systems would struggle to recognise the same payment at every stage. The UPI reference number gives banks a reliable marker that remains unchanged throughout the transaction’s life cycle.

Reduces Uncertainty During Delays or Pending Status

When a transfer takes longer than usual, users need clarity. The reference number helps support teams trace the exact file in their logs instead of reviewing unrelated entries. It removes guesswork and leads them straight to the record tied to the user’s report, making troubleshooting faster and cleaner.

Supports Merchants Handling High-Volume Transactions

Merchants experience traffic spikes during sales, bill payments, and peak hours. In such situations, credits may reflect with a delay. The reference number helps their systems match a customer’s payment accurately, even if it arrives later. This prevents mismatches and keeps order processing smooth.

Maintains Accuracy in Bank Reconciliation

Banks reconcile millions of incoming and outgoing transfers daily. The reference number works as the permanent link between both sides of the transaction. It prevents ambiguity during settlement and helps resolve mismatches quickly. When paired with the UPI transaction ID, the system gains an added layer of traceability that strengthens backend accuracy.

Benefits of a UPI Reference Number

Faster Issue Resolution for Users

The reference number reduces the time it takes to resolve payment concerns. When a user reports a delay or an unexpected status, banks can pull the exact transaction file immediately. This shortens investigation time and avoids repeated questions, making the support journey smoother for both sides.

Reliable Proof for Successful Transfers

For users and merchants, the reference number acts as a straightforward confirmation that a payment was initiated and processed. It helps verify the legitimacy of a transfer during order fulfilment, refunds, or account updates. Having this single identifier removes the need to share screenshots or multiple details.

Stronger Traceability Across Banks

UPI transactions move through several systems before they settle. The reference number creates a clear audit trail that both banks can follow without confusion. When two banks need to compare records, this identifier becomes the anchor that ensures each side is looking at the same entry.

Better Transparency in Refund and Reversal Cycles

When payments fail or require reversal, the reference number helps track the refund from start to finish. Users can confirm that the refund is being processed, and banks can check whether the credit has been issued. This transparency reduces uncertainty and improves trust in digital payments.

Lower Risk of Record Mismatch

Payment mismatches are rare but possible during high-traffic periods. The reference number helps systems separate one transaction from another, reducing the chance of mix-ups. It ensures clean reconciliation and lowers the workload for backend teams handling settlements at scale.

Read more: UPI Transaction Limit: SBI, HDFC, ICICI, & PhonePe

How to Track a UPI Reference Number

Check Status Inside Your UPI App

Most UPI apps offer a direct way to track a payment using the reference number. When a transfer seems delayed, users can open their transaction history, select the payment, and view the current status. The app reads this information from the bank’s backend and updates the page accordingly. This gives a quick snapshot without needing external support.

Use Your Bank’s Official Channels

Banks also allow users to track a transaction through net banking or mobile banking. Entering the reference number in the payment-tracking section helps the system pull the exact record from the bank’s transaction logs. This is helpful when the UPI app and bank records show different timestamps or statuses.

When Tracking a Payment Fails

Sometimes the system may show “record not found” or “status unavailable.” This usually means the receiving bank has not updated its record yet, or the transaction is still moving between internal checkpoints. Tracking again after a short interval often resolves this. If the status remains unchanged, support teams can check their internal logs using the same reference number.

Why Tracking Helps During Delays

Tracking gives clarity during periods of network congestion or high-volume activity. Instead of waiting without information, users can confirm whether the payment is pending, completed, or reversed. It also helps banks trace the payment faster because the reference number leads directly to the exact ledger entry associated with the transaction.

How to Check a UPI Transaction ID and Link It to the Reference Number

Finding the Transaction ID in Your UPI App

Every UPI payment carries two identifiers: a reference number and a transaction ID. The transaction ID is usually shown on the payment confirmation screen and inside the detailed view of a completed transfer. Users can open their history, tap the transaction, and locate this ID above the timestamp or payment method. It serves as a second layer of identification within the app.

Why Both Identifiers Are Useful

Banks rely on the reference number for deeper backend checks, but UPI apps use the transaction ID to present a clean, user-friendly record. When both match correctly, it becomes easier to confirm that the payment appearing in the app aligns with the transaction stored in the bank’s ledger. This prevents confusion when users compare app records with SMS alerts or statement entries.

How to Match the Transaction ID and Reference Number

Most apps display both values in the same section. Users can compare them to ensure they belong to the same payment before contacting support. When a payment seems stuck, sharing both details helps banks verify the record from multiple angles. The transaction ID points to the app-side trail, while the UPI reference number anchors the backend file.

When to Use Each Identifier

Users rely on the transaction ID when they want a quick confirmation inside the app. The reference number becomes more important when banks need to search deeper into logs or review a settlement mismatch. Together, they create a complete view of the transaction, making checks easier and more reliable across systems.

What Is a Bank Reference ID?

A bank reference ID is an internal code created by a bank to record and track a transaction within its own system. It is separate from the UPI reference number and helps the bank identify when the payment entered its network, which account processed it, and how it should be matched during reconciliation. Users can find this ID in SMS alerts, passbook entries, or net banking statements under labels like “Ref No.,” “Bank RRN,” or “Reference ID.” It confirms that the bank has officially logged the transaction, even if the UPI app is still updating.

Unlike the network-generated UPI identifier, the bank reference ID is created solely for internal tracking. It helps support teams locate the correct transaction quickly in their logs. Banks depend on this identifier to verify entries, resolve mismatches, and maintain accurate records during high transaction volumes.

Security and Fraud Awareness Around UPI Reference Numbers

Why You Should Be Careful When Sharing Transaction Details

UPI reference numbers are safe on their own, but scammers sometimes ask for them to create a sense of trust or to trick users into sharing additional information. While the number itself cannot move money, it can be used to frame fake narratives, which makes caution important.

How Fraudsters Try to Manipulate Users

Common fraud cases involve callers pretending to be from a bank, delivery service, or merchant support team. They ask users to share the reference number for “verification” and then guide them into approving a collect request or sharing sensitive data. Understanding this pattern helps users avoid social engineering attempts.

What You Should Never Share

Banks never ask for OTPs, PINs, passwords, or remote access. If someone requests these along with the reference number, it is a clear red flag. Users should avoid opening links or installing apps sent by unknown sources, even if the request seems related to a recent UPI payment.

How Banks and NPCI Improve Safety

Banks monitor unusual patterns and block suspicious transactions to protect users. NPCI also adds safeguards such as real-time alerts and transaction limits to reduce misuse. When users report fraud attempts, these systems help trace the originating account and prevent further incidents.

Steps Users Can Take to Stay Secure

Keeping personal banking details private, using official apps, and reviewing transaction history regularly help maintain safety. The UPI reference number can be shared only with verified bank support when raising a complaint. Staying alert and following basic digital hygiene goes a long way in preventing financial loss.

Final Thoughts

A clear understanding of UPI identifiers helps users navigate digital payments with confidence. As transactions move across banks and apps, these codes create a dependable trail that simplifies tracking, refunds, and dispute resolution. The UPI reference number anchors the payment in the banking system, while the UPI transaction ID helps users verify details within their app. Together, they provide a complete view of a transfer’s movement. With UPI continuing to expand across India, knowing how to read and use these identifiers ensures faster clarity, fewer errors, and smoother interactions with both banks and merchants.

FAQs

1. Can a UPI reference number help confirm if a payment will auto-reverse?

A UPI reference number provides a reliable way to understand whether a stuck transaction is moving toward reversal. Banks use this identifier to check if the amount is held, queued, or already marked for return. This helps users know when the refund has been initiated and what stage the reversal is currently passing through.

2. Why does the reference number sometimes appear different across apps and bank statements?

Variations occur because UPI apps often display a simplified or UI-friendly version, while banks show the internal code used in their ledger. Even if the formats look different, both point to the same transaction. Matching timestamps, sender details, and the debit amount helps confirm that the identifiers belong to a single payment.

3. Can a failed payment still be tracked using the reference number?

A failed transaction retains its reference number in the bank’s internal logs. This gives support teams enough detail to check whether the debit occurred, where the break happened, and whether a refund has been initiated. Users gain clearer visibility into the refund timeline even when the UPI app shows failure instantly.

4. Does every UPI payment generate a unique reference number?

Each UPI transaction receives its own identifier, which helps the system maintain a clean audit trail. The high volume of daily payments makes uniqueness important for preventing mix-ups. A distinct reference number helps banks trace the exact record without conflicting with transactions processed around the same time.

5. Can two people ever receive the same UPI reference number?

UPI’s design ensures that each transaction is paired with a single identifier that cannot overlap with another user’s payment. This structure allows banks to process millions of daily transfers without confusion. A unique number ensures faster reconciliation and eliminates the risk of one transaction being mistaken for another.

6. Why do some banks request the reference number instead of screenshots?

Screenshots reflect the app view but don’t show backend status. A reference number directs support teams to the exact ledger entry, allowing them to verify settlement, pending states, or technical errors. This simplifies investigation and reduces misinterpretation, leading to faster and more accurate responses.

7. How long do banks retain records tied to a UPI reference number?

Banks store UPI records for several years to meet audit rules and regulatory obligations. The reference number helps retrieve these entries quickly, even after long intervals. This archival depth supports statement retrieval, tax documentation, dispute checks, and customer queries linked to older transactions.

8. How does a reference number help confirm the correct beneficiary?

The reference number lets banks trace the transaction to the exact account that received the credit. When users are unsure about the beneficiary details, such as when paying new contacts or merchants, this identifier helps support teams validate the destination and confirm whether the transfer reached the intended account.

9. What does it mean if a reference number shows no record in the bank’s system?

A missing record typically indicates that the transaction is still traveling between internal checkpoints or that the receiving bank has not updated its log. Re-checking after some time can resolve it. If the entry remains unavailable, banks can use the transaction ID alongside the reference number to search alternate logs.

10. How does a reference number help prevent false payment claims?

Merchants and banks use reference numbers to verify the authenticity of incoming payments. When someone presents a screenshot or claims a transfer, the identifier allows support teams to confirm whether the transaction exists in the system. This prevents disputes based on incorrect or fabricated information and protects both parties from fraudulent claims.