In India’s GST system, every digital filing moves through a structured review cycle, and the ability to monitor that progress is now part of routine compliance. Businesses rely on transparent updates to plan returns, manage refunds, and respond to verification requests without delay. This is where tracking identifiers, such as the ARN Number, and tools that help users check ARN status make a measurable difference. They provide a real-time view of what the system has received, what is under examination, and when action is required from the taxpayer. For companies managing high transaction volumes, clear visibility reduces uncertainty and prevents processing bottlenecks. As GST workflows continue to scale, understanding how tracking works is no longer optional. It supports timely decisions, cleaner documentation, and a smoother compliance experience for both smaller entities and large enterprises operating across India.

What is an ARN Number?

An ARN Number, or Acknowledgement Reference Number, is the unique code generated by the GST system whenever a taxpayer submits an application. This may include registrations, return filings, amendments, or refund requests. The number works as a digital receipt, confirming that the system has accepted the submission and logged it for further review. It also creates a verifiable trail that businesses can rely on during audits, reconciliations, or follow-up checks.

The ARN’s meaning is tied to traceability. It assigns your filing a unique reference so you can follow its journey from submission to completion. The ARN status linked to this number shows whether the application is received, under review, approved, or needs clarification. For Indian businesses managing fast-moving compliance cycles, the ARN Number simplifies monitoring and ensures every submission is accounted for from the moment it enters the system.

How to Check ARN Status?

Using the GST Portal’s Tracking Tool

The GST platform provides a built-in tracker that displays the latest update linked to your filing. You start by visiting the portal, opening the Services menu, and selecting the application status option. This tool accepts the ARN Number as input and retrieves the status stored in the system. It shows whether the submission is in the queue, under officer review, or waiting for clarification. Since the data is pulled directly from the workflow, it provides users with reliable insight without requiring external verification.

Entering and Validating the ARN Number

Once the tracker loads, you only need to enter the ARN exactly as displayed in your acknowledgement. The system checks its structure and verifies whether it exists in the database. If the number is valid, the current stage appears instantly. If it doesn’t match any record, the portal flags an error. This validation step is important for businesses that manage multiple submissions because it prevents reviewing incorrect or outdated references.

Understanding Status Messages Returned by the System

Each status message indicates how far the filing has progressed. Terms such as “Pending for Processing,” “Assigned to Officer,” “Clarification Required”, or “Approved” reflect distinct stages in the GST workflow. These updates help users determine whether they need to respond, wait, or prepare supporting documents. For fintech-led operations that depend on predictable compliance timelines, this clarity reduces uncertainty and improves internal planning.

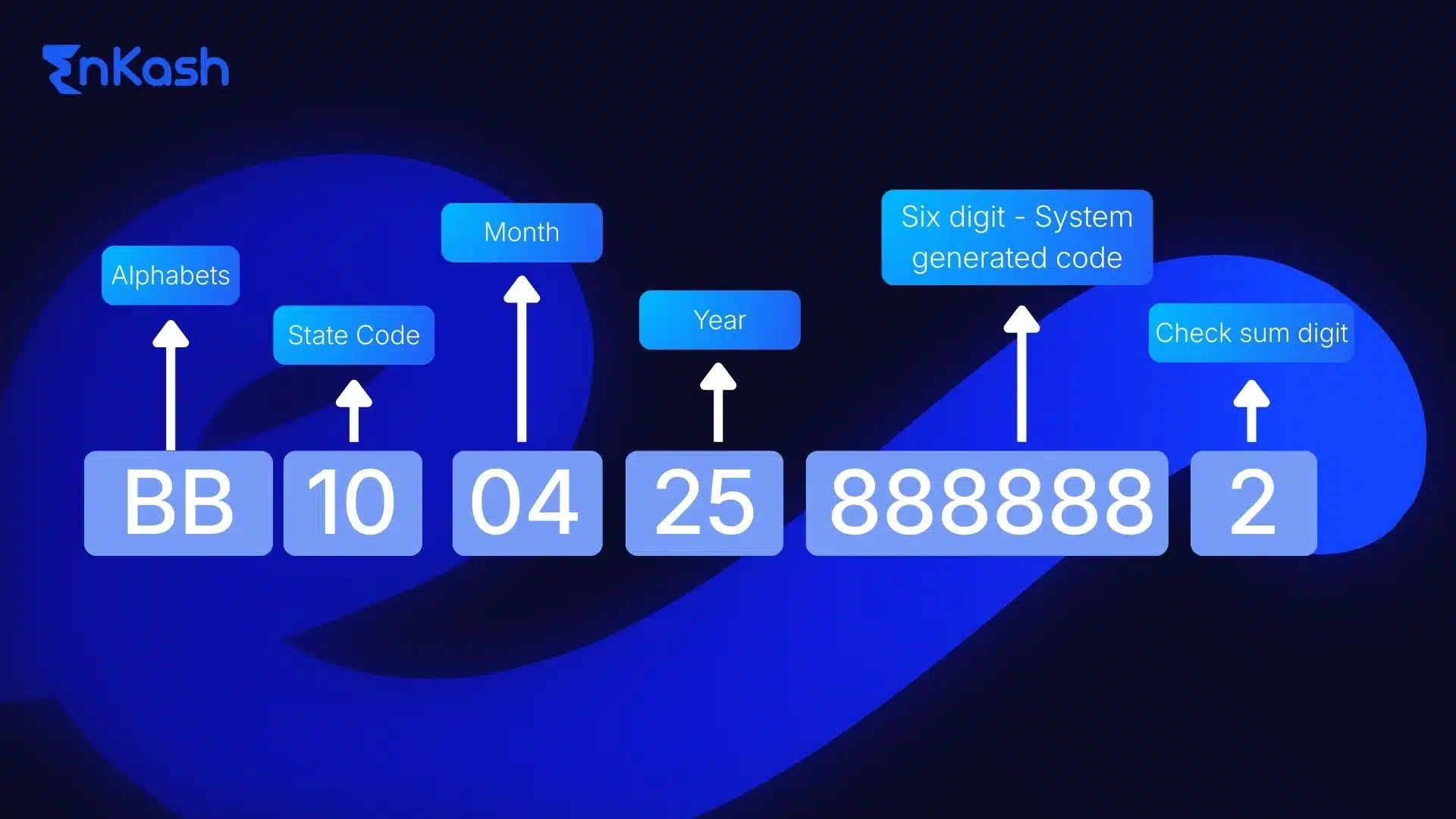

ARN Number Format

ARN Number follows a set pattern, and each part of that pattern tells the GST system something important about your submission. This structure helps the system sort applications correctly and gives businesses a quick way to understand what a particular ARN refers to.

How the ARN Structure Is Organised

The ARN usually includes a mix of letters and numbers that indicate the state code, the year of filing, and the type of application submitted. When the GST system generates this number, it uses these elements to place your request into the right processing path. This reduces delays and helps large volumes of filings move smoothly through the system.

Why the Format Matters to Businesses

Knowing the structure helps finance and compliance teams identify which filing the ARN belongs to without opening multiple records. If a business submits registrations, amendments, and refunds at the same time, the format makes it easier to separate them and track each one correctly. This improves internal record-keeping and keeps audits more organised.

Using the Components to Understand Processing Flow

The components can also signal how your submission may be handled. Certain application types follow automated checks, while others need officer review. Reading the ARN correctly gives you a sense of what to expect and when to follow up.

ARN Number Tracking

Tracking an ARN Number is not just about viewing a status update. It is a compliance practice that helps businesses maintain control over every submission made on the GST system. For companies handling registrations, amendments, monthly filings, or refunds, each ARN acts as a reference point that can be monitored over time. This gives teams a structured way to ensure that nothing is missed, overlooked, or delayed.

Why Tracking Supports Better Compliance Planning

Financial teams in India work with strict GST timelines. By maintaining a clear record of ARNs and reviewing them periodically, they can identify filings that may require follow-ups or supporting documents. This avoids last-minute issues during audits or reconciliations and ensures every submission aligns with internal deadlines.

How Tracking Improves Operational Transparency

- It gives teams a central record of all filings, making it easy to see what has been completed and what is still pending.

- It reduces confusion across branches or departments by ensuring everyone works with the same reference data.

- It limits duplicate submissions, since every filing can be matched to its unique ARN Number before action is taken.

- It helps compliance teams maintain an organised log that can be reviewed at any time for internal audits.

- It improves coordination between finance, tax, and operations teams by providing a shared view of submission history.

- It supports better decision-making because teams always know the exact stage of each filing without relying on manual follow-ups.

Why ARN Tracking is important for Refund-Focused Entities

For exporters, D2C brands, and businesses with recurring refund claims, maintaining a tracking list helps monitor expected inflows and plan cash flow better. Even without reviewing status messages, the ability to reference each claim through its ARN number provides clarity during financial reporting.

How to Check GST Status Using an ARN Number?

Using the GST Portal Search Tool

The GST portal provides a clear method to review the status linked to your ARN Number. You begin by opening the Services menu and choosing the application tracking option. The tool accepts the reference code and shows the most recent update recorded in the system. This helps users confirm whether a filing has been received, moved for verification or sent for officer review, without waiting for manual updates.

Entering and Validating the ARN Code

To check ARN status, you must enter the number exactly as it appears on the acknowledgement. The system checks the format, verifies the entry against its database, and then displays the valid status. Any incorrect or outdated entry triggers an error, which prevents teams from tracking the wrong filing.

Viewing GST Status by ARN for Different Filing Types

When checking GST status by ARN, the portal matches the reference to the correct filing category, such as registration, return, amendment, or refund. Each category has its own status messages, so reading the update in context helps users understand what action, if any, is required.

ARN Number for Refund

An ARN Number is central to how GST refund requests move through the system. Refund filings rely on additional checks, supporting documents and officer verification, which makes a traceable reference essential. The ARN attached to each refund claim helps finance teams understand the position of their request and manage cash flow expectations with greater accuracy.

Role of ARN in Refund Filing

Each refund claim receives its own ARN that connects the submission to the GST system’s verification stages. This reference keeps the claim organised and ensures the supporting documents, statements and acknowledgements all tie back to the correct filing.

Impact on Cash Flow Planning

Refunds influence working capital, particularly for exporters and businesses with recurring credit accumulation. By reviewing updates linked to the ARN Number, teams can estimate when a refund may be processed and make informed financial decisions.

Error Prevention Through ARN Tracking

Refund requests often pause due to documentation gaps, validation mismatches or pending clarifications. Tracking the ARN helps identify the exact point where the claim requires attention so the issue can be resolved without delay.

Why Refund Tracking Has Its Own Workflow

Refunds follow a more detailed review path compared to standard GST filings. The ARN acts as the anchor reference that keeps this multi-step process transparent from submission to final sanction.

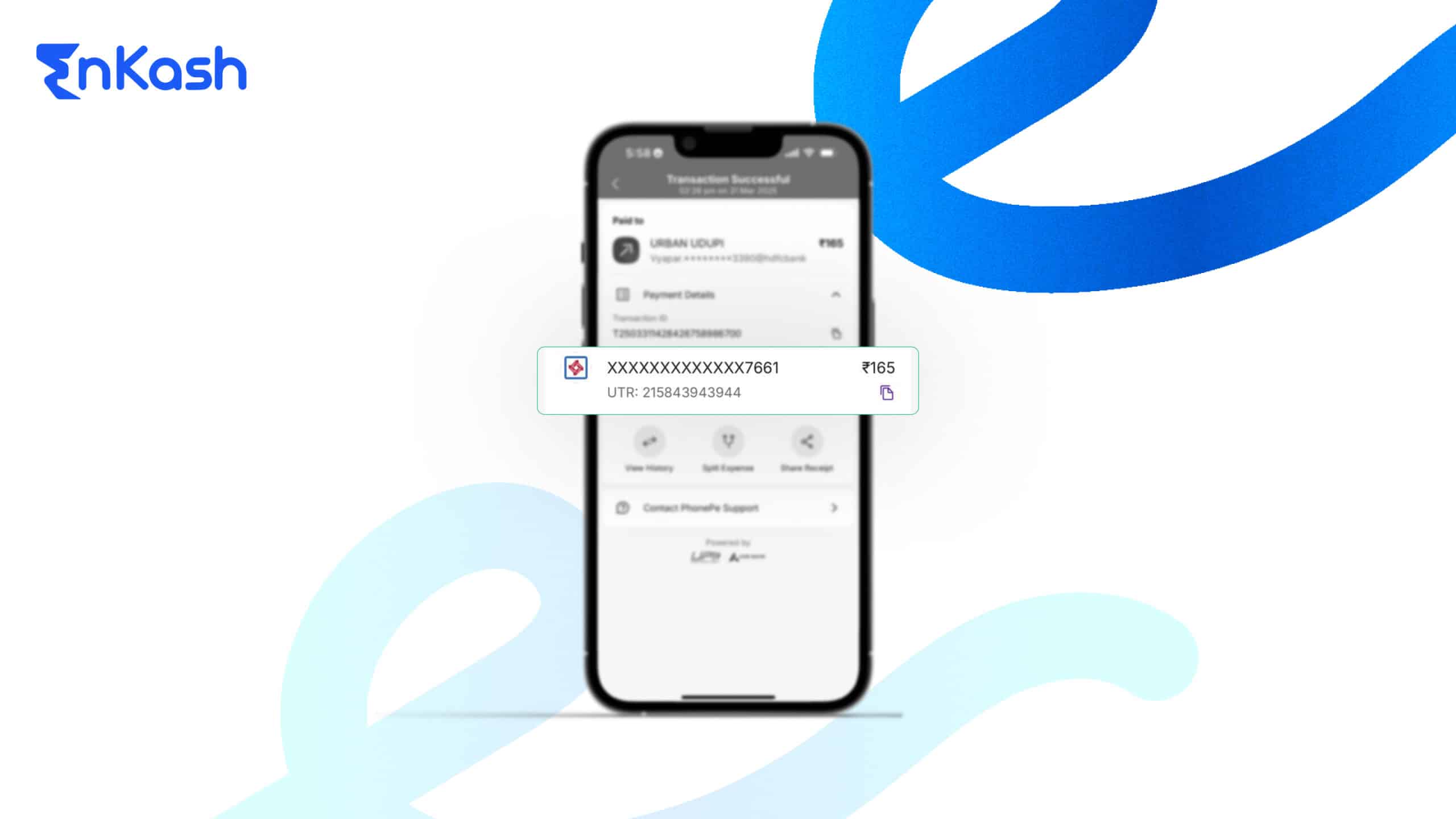

Understanding the Bank ARN Number

A Bank ARN Number refers to a reference code generated by banks or payment intermediaries when certain financial transactions are processed. This identifier is used to trace activities such as UPI settlements, card transactions, payout batches, or automated clearing operations. Although it shares the term ARN, it has no connection to the GST system and does not track any tax-related filing.

Role of Bank ARN in Financial Processing

Banks use this reference to map a transaction to its settlement cycle. It helps reconcile movement between issuing banks, acquiring banks, and payment networks. For fintech platforms that manage high transaction volumes, the Bank ARN supports smooth reconciliation and dispute resolution.

Why Bank ARN Is Not the Same as GST ARN

A GST ARN tracks a taxpayer’s submission within the GST portal. A Bank ARN tracks a financial movement inside the banking ecosystem. Mixing the two leads to errors in compliance logs and delays in reviewing GST filings.

Avoiding Confusion During Internal Reviews

Some businesses mistakenly enter a Bank ARN while checking GST status. Ensuring that teams treat these as separate identifiers prevents incorrect tracking and maintains accuracy in both finance and compliance workflows.

Read more: Complete Guide on How to Search GST Number

Common Issues While Tracking ARN and How to Fix Them

Tracking Errors Caused by Incorrect ARN Entry

A large number of tracking failures happen because the ARN Number is entered with a missing character or incorrect sequence. Even a small error forces the system to return an invalid result. Copying the reference exactly as issued, including letters and digits, ensures accurate tracking and prevents unnecessary troubleshooting.

Mismatch Between ARN and Internal Compliance Records

When multiple filings are created within a short period, teams sometimes label records incorrectly. This leads to confusion when the ARN does not match the filing type or tax period. Maintaining a centralised filing log with timestamps helps avoid mix-ups and supports smoother audits.

Delayed Updates on the GST Portal

During peak filing cycles, the GST system may update statuses with a delay. This creates uncertainty for users expecting immediate progress. Reviewing the last known update and allowing reasonable buffer time helps differentiate between a system delay and a genuine processing issue.

Clarification Requests Left Unaddressed

If the GST officer issues a clarification request, the ARN will not move forward until the response is submitted. Teams that track filings regularly can identify these pauses quickly and resolve them by uploading the required details on time.

Issues Created by Multiple Amendments or Resubmissions

When businesses submit several corrections in a row, earlier ARNs may still appear active. This complicates tracking. Identifying the most recent ARN associated with the updated filing ensures that the correct version is monitored.

Internal Review Delays Within Finance Teams

In some cases, the problem is not with the portal but with internal processing. Ensuring timely review of acknowledgement emails and auto-notifications helps avoid missed updates.

Difference Between ARN, Application Number and Reference ID

Identifier |

When It Is Generated |

What It Represents |

Where It Is Used |

Can It Be Tracked? |

Who Uses It Internally |

Notes That Prevent Confusion |

|---|---|---|---|---|---|---|

Application Number |

Created when a user starts filling out a GST form, but has not submitted it |

Indicates an in-progress application that is saved but not final |

Used while editing or completing the draft before final submission |

No. It cannot show the status because the filing has not yet submitted |

Finance teams preparing registrations, amendments, or LUT updates |

Exists only during the draft stage. It disappears once the ARN is generated |

Reference ID (RID) |

Generated when a partial request, validation or data save occurs inside the portal |

Acts as a temporary identifier for backend checks or saved sections |

Used for verifying saved data or resuming partially completed actions |

No. The system does not map processing stages to a Reference ID |

Users making changes to existing applications or uploading specific documents |

Not a submission record. Cannot be used for audits or tracking |

ARN Number |

Created only after the form is fully submitted on the GST portal |

Serves as the official acknowledgement that the system has received the filing |

Used for tracking registrations, returns, amendments and refunds |

Yes. ARN shows full progress updates such as pending, review, clarification or approval |

Compliance and finance teams managing monthly and event-based GST filings |

Only identifiers accepted for tracking. Must be used for audits, reconciliations and follow-ups |

How Long Does the ARN Status Take to Update?

The time taken for an ARN status to update depends on the type of filing and the verification workload on the GST system. Registrations may move within a few hours or take a couple of working days if officer checks are required. Returns usually update quickly because they are automatically validated. Refunds take longer, since they involve document review and approval workflows. During peak filing periods, status updates may reflect a delay. Regularly monitoring the ARN helps teams understand movement patterns and take timely action when clarification or resubmission is needed.

The Bottom Line

A disciplined approach to monitoring your ARN Number gives businesses the clarity needed to manage GST responsibilities without uncertainty. It provides structure for registrations, returns, and refunds by showing exactly where a submission stands and what action is required next. When teams review ARN status consistently, they avoid missed clarifications, reduce turnaround time and maintain smoother documentation across all compliance activities. This level of visibility is especially valuable for companies handling multiple filings or operating across several locations. With reliable tracking in place, GST workflows become more predictable and decision-making becomes sharper.

FAQs

1. Can an ARN Number expire if the application is not processed on time?

An ARN Number does not expire on its own. It remains valid until the GST system completes the review of your submission. If the filing requires clarification and you do not respond within the specified window, the application may be rejected, but the ARN stays linked to that attempt. Keeping track of timelines avoids unnecessary resubmissions.

2. Why is my ARN showing no movement even after several days?

Lack of movement can happen during system load, officer backlog or when supporting documents require verification. It may also occur if a clarification request has been issued but not reviewed by your team. Checking the communication tab, ensuring documents are correctly uploaded and monitoring during non-peak hours usually helps identify the reason.

3. Can two different GST submissions generate similar-looking ARN Numbers?

While ARN Numbers follow a common structure, no two valid submissions receive the same identifier. The system embeds details such as year, state and sequence to ensure uniqueness. If two codes appear similar, it usually indicates multiple filings from the same period. Maintaining proper logs helps avoid mistakes during tracking.

4. Does an ARN guarantee that my GST filing is approved?

No. An ARN only confirms that the system has received your submission. Approval depends on validations, officer checks and supporting documents. The ARN allows you to track these steps, but the final decision is based on whether all requirements are met. Regular monitoring helps you respond quickly to any clarification requests.

5. Why does my refund-related ARN show a different timeline compared to other filings?

Refund claims follow a more detailed verification path, which includes document checks, eligibility review and officer approval. This makes their timelines naturally longer than registrations or return filings. The ARN helps you understand each stage of the refund cycle so you can adjust cash flow plans and respond to queries without delay.

6. Can I track an ARN without logging in to the GST portal?

Yes. The GST portal allows ARN tracking from the public search section. You only need the ARN Number to view the current status. This is useful for teams that need quick updates without accessing full account credentials. However, detailed communication or clarification notes still require login access.

7. What should I do if the ARN status shows “clarification required”?

This means the GST officer needs additional information or documents to complete the review. You should log in, open the notice, review what is requested, and submit the response within the provided timeline. The faster you complete this step, the sooner the filing moves to the next stage. Waiting too long may lead to rejection.

8. Why does my ARN not match the filing I expected?

This usually occurs when multiple submissions happen around the same time, or when draft applications create confusion. It can also occur if different team members handle filings without a central log. Cross-checking the ARN with the acknowledgement receipt ensures you track the correct application and avoid incorrect follow-ups.

9. Can an ARN Number be used during audits to confirm submission history?

Yes. Auditors rely on ARN Numbers as proof that a filing was submitted on a specific date. The ARN serves as a timestamped record that helps validate compliance timelines. Keeping all ARN acknowledgements organised supports smoother audits and reduces the chance of disputes regarding filing dates or submission activity.

10. What does it mean if my ARN status is stuck at “received but pending”?

This indicates the system has accepted your submission, but validation or officer review has not started yet. It may happen due to processing load or document checks in the queue. The status will update once the filing moves to examination. Monitoring at regular intervals helps ensure that no clarification request goes unnoticed.