If you have ever made an online payment through NEFT, RTGS, IMPS, or UPI, you may have been asked to provide a UTR number to confirm the transaction’s success.

A UTR Number (Unique Transaction Reference Number) is a unique code assigned to every banking transaction. It acts like a digital fingerprint for payments, making it easy to track, verify, and resolve payment-related queries. Whether you are a business tracking vendor payments or an individual confirming a refund, knowing your UTR number can save you time and help you avoid disputes.

In the world of digital banking, where millions of transactions are processed daily, the UTR number ensures transparency, security, and accurate reconciliation.

Quick Fact: In India, a UTR number is generated for every NEFT and RTGS transaction and is also used as a reference for UPI and IMPS transfers.

What is the UTR Number Full Form & Meaning

Whenever you transfer funds, your bank generates a UTR number, which is then used to track, verify, and confirm the transaction status. If you ever face issues like “payment debited but not credited”, the UTR number becomes the first point of reference for both you and your bank.

UTR Number Full Form

Full Form: Unique Transaction Reference Number

This code is crucial for resolving disputes, reconciling accounts, and ensuring that your payment is processed correctly.

UTR Number Format & Digits

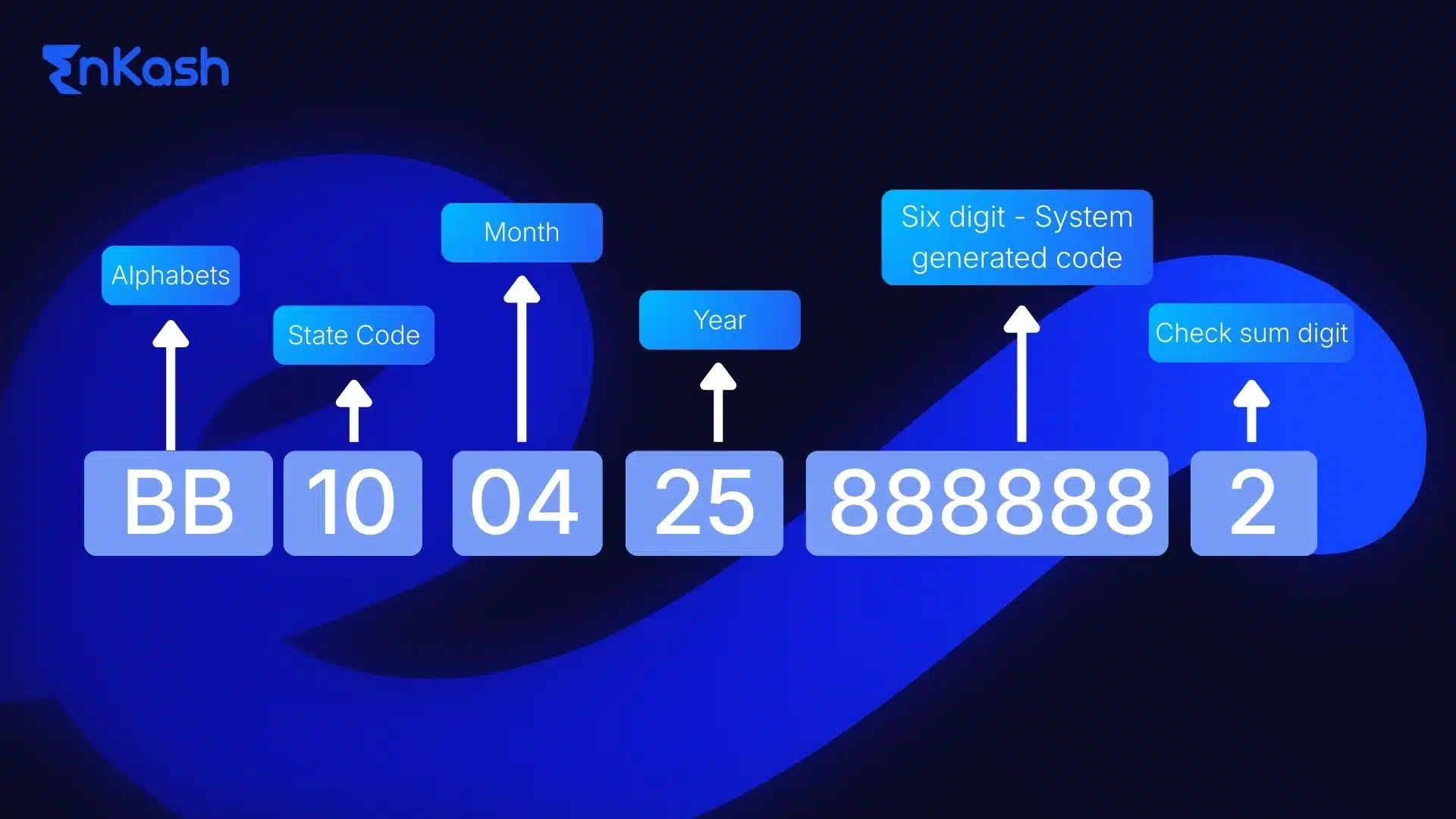

While the exact UTR number format can differ slightly between NEFT, RTGS, and UPI transactions, it generally looks like this:

- NEFT/RTGS Format Example: HDFC123456789012

- First 4 characters – Bank code (e.g., HDFC, SBIN)

- Next 2 characters – Transaction type (N/E/R)

- Remaining digits – Unique transaction reference number

- UPI / IMPS Format Example: 312904567890 (RRN – Reference Retrieval Number, used as UTR)

- Number of Digits:

- NEFT/RTGS – 16 characters (alphanumeric)

- UPI/IMPS – 12 digits (numeric)

UTR Number Structure, Examples

Now that we know what a UTR number is, let’s understand how it looks and why its format matters.

The UTR number format differs by payment type—bank transfer, mobile app, or real-time settlement. Here’s a breakdown:

1. NEFT UTR Number

When money is sent using NEFT, you get a 16-digit UTR number. This is a mix of numbers and letters. The format often looks like this:

Example: ABC01234567891234

This UTR number example includes the bank code, branch, and a unique ID for the transaction. The purpose is to ensure each NEFT transaction has its own identity.

2. RTGS UTR Number

For RTGS transactions, the code is longer. It typically includes 22 characters. It starts with the bank code, then the transaction date, followed by a series of unique numbers.

Example: BANKRYYMMDD123456789012

Here, the RTGS UTR number helps trace high-value transfers that are settled in real-time. These are time-sensitive, so the UTR number tracking becomes even more useful.

3. UPI UTR Number

When money is transferred through UPI apps like PhonePe or Google Pay, the UPI UTR number is usually 12 digits.

It looks simpler than NEFT or RTGS codes, but it still works the same way for tracking.

- UPI UTR number in PhonePe, UTR number in Google Pay, and UTR number in Paytm can be easily seen under the transaction details inside the app.

- The UTR number for a UPI transaction might not always say “UTR,” but it acts as the same unique ID.

Read More: UPI transaction limit per day

How to Find UTR Number?

Finding your UTR Number (Unique Transaction Reference Number) is simple once you know where to look. Whether you made a payment through NEFT, RTGS, IMPS, or UPI apps like Google Pay, PhonePe, or Paytm, here’s how you can locate it:

1. Finding UTR Number for Bank Transfers (NEFT/RTGS/IMPS)

Via Net Banking or Mobile Banking:

- Log in to your net banking portal or mobile banking app.

- Go to “Transaction History” or “Payment History”.

- Select the transaction you want to track.

- Look for a field labeled “UTR Number”, “Reference Number”, or “Transaction ID” — usually a 12-16 character code.

Via Bank Statement or Passbook:

- Download your latest bank statement (PDF).

- Locate the transaction entry.

- Most banks list the UTR number under “Reference No.” or “Transaction Remarks.”

Via Customer Support:

- Call your bank’s customer care and provide the date, amount, and beneficiary details.

- Ask them to share the UTR number for that transaction.

2. Finding UTR Number in UPI Apps (Google Pay, PhonePe, Paytm, BHIM)

UPI App |

Steps to Find UTR Number |

Google Pay |

Open Google Pay → Tap “Show transaction history” → Select the payment → Scroll down to “UPI Transaction ID” (this is your UTR/RRN number). |

PhonePe |

Open PhonePe → Tap “History” → Select the transaction → Look for “UTR” or “Transaction ID.” |

Paytm |

Open Paytm → Go to Passbook → Select the transaction → Tap “View Details” → UTR will be visible under Bank Reference Number. |

BHIM UPI |

Open BHIM App → Go to Transaction History → Select the payment → Look for Reference Number (RRN/UTR). |

How to Identify a UTR Number Quickly

- It is usually 12 to 16 characters long (for NEFT/RTGS) or 12 digits (for UPI/IMPS).

- Always appears on the transaction receipt, SMS, email confirmation, or statement.

- Sometimes labeled as RRN (Reference Retrieval Number) in UPI payments, this is your UTR number.

Read more: Online Money Transfer – A Guide to the Dos and Don’ts

How to Track UTR Number?

Check Payment Status via Net Banking or Mobile Banking

- Log in to your bank’s Net Banking portal or Mobile Banking App.

- Navigate to “Transaction History” or “Track Payment/Track NEFT/RTGS.”

- Enter your UTR Number (found on your SMS, email, or bank statement).

- View the real-time status – it will show as Success, Pending, or Failed.

Pro Tip: If you are tracking a NEFT or RTGS transaction, check during banking hours (usually 8 AM to 6 PM) as settlement happens in batches.

2. Check Payment Status Using UPI Apps

If you paid via Google Pay, PhonePe, Paytm, or BHIM, the status can be checked inside the app:

- Google Pay: Open → Show Transaction History → Tap on payment → View UPI Transaction ID (UTR) → Status appears as Success or Failed.

- PhonePe: Open → History → Select transaction → View UTR & status.

- Paytm: Open Passbook → Select payment → Tap View Details → Status shows with Bank Reference Number (UTR).

3. Contact Customer Support (When Status Is Pending or Stuck)

If your transaction remains pending for more than a few hours:

- SBI: Call 1800 1234 or visit your branch with the UTR.

- HDFC Bank: Call 1800 1600 or raise a ticket via NetBanking.

- ICICI Bank: Call 1800 1080 and share the UTR.

- Axis Bank: Call 1800 209 5577 or use “Track Payment” on their website.

Banks can trace the payment using the UTR and confirm whether it’s credited to the beneficiary account or needs reversal.

4. Alternative: Track Payment via RBI NEFT/RTGS Inquiry

- For NEFT or RTGS delays exceeding 2 hours, you can complain to the RBI Complaint Management System (CMS) by providing your UTR number and transaction details.

- The bank is legally required to respond and update you within a fixed timeline.

How to use UTR Number in Real Life?

If you have the UTR number, it becomes much easier to follow what happened during a money transfer. This code is not just for record-keeping. It plays a big role in solving problems and confirming payments.

Here are some real situations where this number is used every day.

Tracking a Stuck or Delayed Payment

Sometimes, money leaves your account but doesn’t reach the other person. This can happen due to slow processing or technical delays.

If this happens, use the UTR number for tracking. Share the code with your bank, or ask the receiver to speak with their bank using the same number. It helps both banks trace the payment and find out where it is.

For example, in NEFT transactions, banks can use the NEFT UTR number tracking system to find out if the money is in process or if it bounced back.

This simple step avoids confusion and gives peace of mind.

Confirming a Payment to Someone

When you send money to someone, and they say they didn’t get it, you don’t always have to send the money again. Just share the UTR reference number with them.

They can give this code to their bank, and the bank will check if the amount came in. This makes the process faster and avoids double payments.

This method works well for personal payments, bill transfers, or business transactions.

Using It for Refunds or Chargebacks

Let’s say you paid for something online, but the order got canceled. You expect a refund. The company may ask you for proof of the original payment.

In that case, the UTR number acts as proof. It tells them the payment happened, how much was sent, and when. Once they have that, they can match it in their system and send the refund.

This also helps when you request a chargeback from your bank.

UTR Number Helps in UPI Too

The UTR number for UPI transactions works the same way. Apps like PhonePe, Google Pay, and Paytm show this code under payment details.

Each UTR number example in UPI is usually 12 digits long and helps you confirm your transfer quickly.

Knowing these uses makes it easier to handle any money issue with clarity and confidence.

Read more: The Basics You Need to Know about Online Payment Processing

Difference Between UTR Number, Transaction ID, and Reference Number

Term |

Full Form / Meaning |

Where You Find It |

Purpose / Use Case |

Key Insight |

|---|---|---|---|---|

UTR Number |

Unique Transaction Reference Number – a 16 or 22-character unique identifier for NEFT, RTGS, IMPS, and UPI transactions. |

SMS/Email from bank, bank statement, UPI apps. |

Used for official payment tracking, dispute resolution, and confirmation of credit/debit. |

The most reliable number for tracking payments in banking systems. |

Transaction ID |

A system-generated identifier used by apps or gateways to track transactions internally. |

Payment apps like Google Pay, PhonePe, Paytm, and e-commerce receipts. |

Used to track payments within the app ecosystem, it may differ from a bank-generated UTR. |

Not always accepted by banks for payment dispute resolution. |

Reference Number |

A generic number used by banks, merchants, and payment processors for any transaction. |

Payment receipts, invoices, POS slips, and online transaction confirmations. |

Used for record-keeping and reconciliation by merchants and customers. |

May refer to UTR or Transaction ID, depending on the payment type. |

Read more: Best Payment Gateways in India

Best Practices for Using and Managing UTR Numbers

A UTR number might look like a string of letters and numbers, but it carries a lot of value. It tells the complete story of a money transfer. Whether you send money to a friend, a business, or a service provider, the UTR reference number helps you stay in control.

Mentioned below are some smart ways to use and manage this number well.

Save the Number After Every Transaction

Right after a payment, do a quick UTR number check. Copy or note it down in your phone or email. This makes it easy to retrieve later.

Most apps show the UTR number in the transaction details. If you ever need to show proof, this number will save time and effort. For bank transfers, you can also take a screenshot of the confirmation page.

Use It to Track Money Instead of Guessing

Many people panic when money doesn’t show up right away. Instead of waiting or guessing, use the UTR number tracking online to check what happened. You can do a UTR number search through your banking portal or ask your bank to trace the payment.

This works much faster than calling customer care or waiting for a reply from the receiver.

Keep It Safe and Private

The UTR number means your transaction details are open for tracking. So be careful about where you share it. Only give it to trusted people or services when needed.

If you are wondering how to get a UTR number, just complete a digital transfer. The number is generated automatically. You don’t need to apply for or request it separately.

Read more: Can Technology Make the Collect and Track Payment Process Easier?

Mistakes About UTR Numbers You Should Avoid

Many people use UTR numbers every day, but still get confused about what they really do. Let’s clear up some common mistakes that often cause delays, confusion, or failed follow-ups.

Mistaking UTR Number for Order ID or Merchant Code

This happens a lot during online shopping. People think the order number or merchant code is the same as the UTR number. These codes are for tracking your product, not your payment. The UTR number means something very different. It is a bank-level code that traces the money.

If you are ever asked to confirm a payment, do a proper UTR number check instead of copying the wrong code.

Deleting Payment Messages Too Soon

After making a payment, many people delete the message or email right away. Later, when they need the UTR number, it’s gone. Always keep that message until the payment is confirmed on both sides. That small code can save you from a lot of stress.

Sharing UTR Number with Untrusted Sources

The UTR number tells the story of your payment. It includes when and where your money moved. It’s better to share it only when needed, and only with someone you trust. Avoid sharing it in public chats or with unknown support numbers.

Believing Only Banks Can Track It

Many still believe that UTR number tracking online is possible only through banks. But apps like Google Pay, Paytm, and PhonePe also show it. You can check it in the app right under the transaction details. No need to call customer care every time.

Using the Wrong Platform to Search

People often try to do a UTR number search on merchant sites or in emails. The right way is to go through your bank or payment app. That’s where the real payment code is stored.

Avoiding these small mistakes can make your payment experience smoother and easier to manage.

Conclusion

Now you understand what a UTR number is and how it fits into everyday payments. This number is like a tracking slip for your money. It shows where the money went, when it was sent, and if it reached the right place.

The key benefit of a UTR number is that it allows you to track payments accurately. If a transfer is stuck or delayed, just do a UTR number check and give that number to your bank. It helps them trace the payment much faster.

Each type of transfer has its own format. A UTR number example for UPI has 12 digits. For NEFT, the number has 16 characters. For RTGS, it goes up to 22. These are called UTR number digits, and they help identify the type of payment.

Always save the UTR reference number after you send money. It can be found in your app, on your bank’s website, or in the message you receive after payment.

Next time someone asks you what UTR number is, you’ll be able to explain it clearly. It’s simple, useful, and helps keep your payments on track.

FAQs

1. Is a UTR number the same for the sender and the receiver?

Yes, the UTR number stays the same for both the sender and the receiver. It helps both parties track the transaction and confirm that the money was successfully transferred.

2. How long does a UTR number stay valid?

A UTR number doesn’t expire. It remains permanently linked to that transaction and can be used for tracking or verification anytime in the future through your bank or app.

3. Can I use a UTR number to reverse a transaction?

No, a UTR number is used only for tracking, not for reversing payments. However, it can help the bank trace the transaction if a refund or investigation is needed.

4. Is a UTR number generated for failed transactions?

Usually, UTR numbers are created only when money leaves your account. If the transaction fails before that, there won’t be a UTR code linked to it.

5. Does every UPI payment have a UTR number?

Yes, every UPI transfer has a UTR number. You can find it under the transaction details in apps like PhonePe or Paytm. It usually contains 12 digits.

6. Can I find the UTR number in my SMS alert?

Yes, most banks and apps include the UTR number in the SMS sent after a successful transaction. It’s usually labeled as “Reference No” or “Transaction ID.”

7. What if I lose my UTR number?

If you lose the UTR number, you can still find it by checking your bank statement or mobile app. A simple UT number search will bring it up again.

8. Do international transactions have UTR numbers?

No, UTR numbers are generally used for domestic fund transfers. International transactions use different tracking codes depending on the country and payment system.

9. Can I track someone else’s transaction with their UTR number?

No, banks do not allow you to track someone else’s transaction using their UTR number unless you are directly involved in the transfer as a sender or receiver.

10. Is the UTR number required for filing a payment complaint?

Yes, having the UTR number makes it much easier to file a complaint. It helps the bank or payment app locate the transaction quickly and take action faster.

11. How to Get a UTR Number?

A UTR number is a unique identifier, consisting of 16 characters for NEFT, 22 characters for RTGS, and 12 digits (RRN) for IMPS/UPI transactions. You can get it:

- Transaction receipt – displayed after completing payment online.

- SMS or email – sent by your bank after the transaction.

- Bank statement – listed for all processed transactions.

- Bank support – contact your bank if you can’t find it.

Always keep your UTR for tracking or resolving payment issues

12. What is a UTR ID?

A UTR ID is a unique 22-character code given to every NEFT, RTGS, or IMPS transaction in India. It helps track, verify, and reconcile payments and can be found in transaction receipts, SMS/email alerts, or bank statements.