If you run or manage a business in India, you have seen how billing quietly shapes everyday operations. An invoice is often the first document a customer looks at after a sale and the first record a finance team checks during reconciliation. When the structure is clear, everything else tends to fall into place. When it is not, small gaps turn into repeated follow-ups, audit questions, and filing stress.

Over time, we have seen businesses adopt many ways of issuing bills. Some still rely on printed invoice books at the counter. Others use Excel sheets, Word templates, accounting software, or online billing tools. Each setup reflects how the business works day to day. What remains common across all of them is the need to follow GST rules without confusion or guesswork.

In this blog you will learn how a GST bill format works, why its structure matters, and how different formats fit into business workflows.

What is a GST Bill Format? Components and Structure Explained

A GST bill format is a structured invoice layout used to record a sale under India’s Goods and Services Tax system. It shows who sold the goods or services, who bought them, what was supplied, the taxable value, and the tax charged.

If you issue invoices regularly, you have likely noticed how a clear format reduces questions later. GST bill helps you show the full breakdown of a transaction in one place, including price, quantity, and tax. This makes it easier to review records, file returns, and respond during audits.

A GST invoice includes the invoice number and date, seller and buyer details, item or service descriptions, taxable amount, and the applicable tax breakup. Invoices without these tax fields suit non-GST businesses, but GST billing follows a defined structure. When you use the right format consistently, your billing stays clear, compliant, and easy to manage.

Types of GST Bill Formats Used in India

Businesses issue different types of GST Bill formats based on the transaction. Each layout serves a distinct purpose, and the structure varies depending on the tax treatment, the nature of the item or service, and the documentation required for compliance. A clear understanding of these formats helps a business choose the right approach for daily billing needs across goods, services, retail, exports, or specialised sectors.

GST Tax Invoice

A GST tax invoice is used when a registered business sells taxable goods or services. It carries all required fields such as supplier details, buyer details, GST Identification Numbers when applicable, HSN or SAC codes, and the tax breakup. The structure supports smooth return filing and provides customers with a transparent view of the final payable amount.

Bill of Supply for Exempt Supplies and Composition Scheme

A bill of supply is issued by a registered person when supplying exempt goods or services, or by a taxpayer under the composition scheme, since tax is not collected on such supplies. It avoids tax fields and presents a simple layout showing value, description, and quantity. Businesses registered under the composition scheme also use this format. It aligns well without the GST Bill format requirements.

Revised Invoice

A revised invoice is created when a business needs to update an earlier invoice due to delayed registration or incorrect entries. The revised version links clearly to the original invoice, which helps both parties maintain accurate documentation.

GST Sale Bill Format for Retail and Wholesale

A GST sale bill format helps retailers and wholesalers present clear item-wise billing for counter sales or bulk orders. It lists price, quantity, tax applied, and the final amount. The layout supports fast billing and reduces confusion during physical or digital sales.

Debit and Credit Notes

Debit and credit notes adjust the value of a previous invoice when quantity, rate, or tax details require correction. These structured notes keep sales records aligned with returns and prevent mismatches during audits.

Export Invoice Format

An export invoice supports transactions made outside India. It includes the buyer’s location, shipping details, currency used, and export-related fields. This format helps the seller maintain the documentation required for international compliance.

Gold GST Bill Format for Jewellery Businesses

Jewellery stores use a customised gold GST bill format that shows purity, weight, making charges, and the tax applied. This level of detail helps customers understand the breakup clearly and keeps the invoice aligned with sector-specific norms.

Read more: Simplifying GST Payments: How to Pay GST Online

GST Bill Format Requirements Under Indian Government Rules

Clear GST billing depends on a structured layout that follows the rules created for registered businesses in India. These rules govern the fields that must appear on an invoice and the information required for accurate records. A well-arranged layout reduces filing errors and supports a clean audit trail across different types of transactions.

Latest Government Guidelines

Government guidelines list the essential fields such as seller details, buyer details, invoice number, date of issue, HSN or SAC codes, taxable value, and the tax breakup. This structure keeps invoices uniform across sectors. A format that aligns with these rules helps a business maintain compliance and avoid disputes. Templates such as the GST bill format and the GST bill book format follow this pattern to support smooth recordkeeping.

Rule-Based Structure Under the Central Goods and Services Tax Framework

The structural rules guide where each field appears on the invoice. They ensure that every invoice clearly presents item details, the tax applied, and the final totals. A business that uses the GST bill format in Excel or the GST bill format in Word can follow these rules by placing all fields in predictable locations. This clarity supports both the seller and the buyer during checks and reconciliations.

B2B and B2C Invoice Differences

B2B invoices carry GST Identification Numbers when required and include fields that help the buyer claim input credit. B2C invoices do not include these fields because input credit does not apply. The purpose of each invoice type shapes the layout, and the structure remains aligned with the rules set for both formats.

Goods and Services Billing Differences

Goods-based invoices show quantity, weight, and units. Service-based invoices focus on service descriptions and value. These small adjustments help the invoice reflect the nature of the transaction. The structure remains compliant with GST rules and stays clear for customers and auditors.

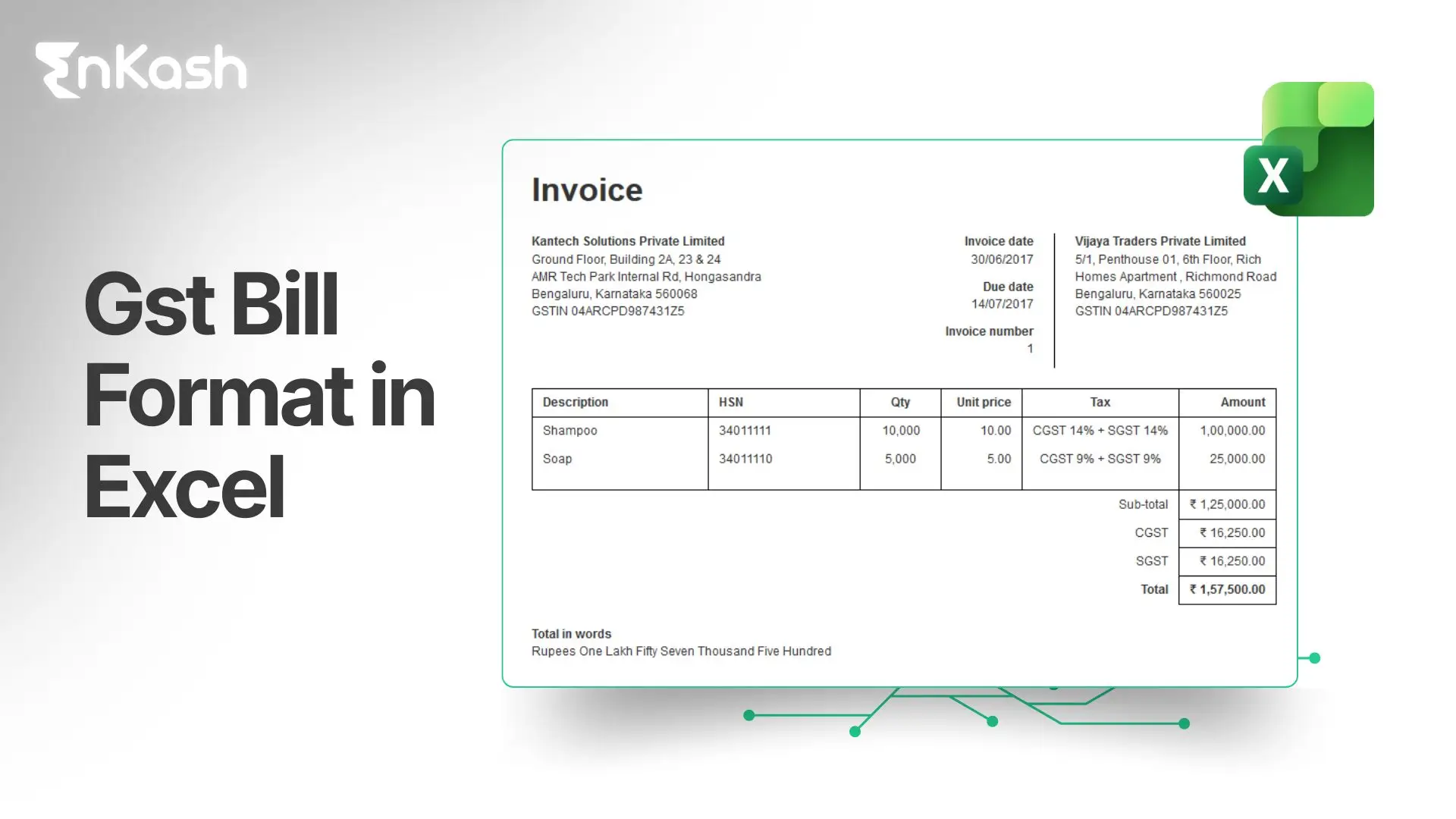

GST Bill Format in Excel

A GST bill format in Excel gives the user a sheet where every field is placed in a fixed cell block. Sellers enter values only in unlocked cells, while formulas calculate taxable value and the Central Goods and Services Tax and State Goods and Services Tax, or Integrated Goods and Services Tax breakup. HSN or SAC codes are usually stored in a dropdown list, which reduces typing errors.

Most businesses keep a hidden sheet that holds their invoice series, customer list, and item catalog. The main sheet pulls this data using simple references, which keeps every new invoice consistent. A layout aligned with the GST bill format or GST sale bill format allows clean export to monthly registers, helping maintain a reliable audit trail without manual re-entry.

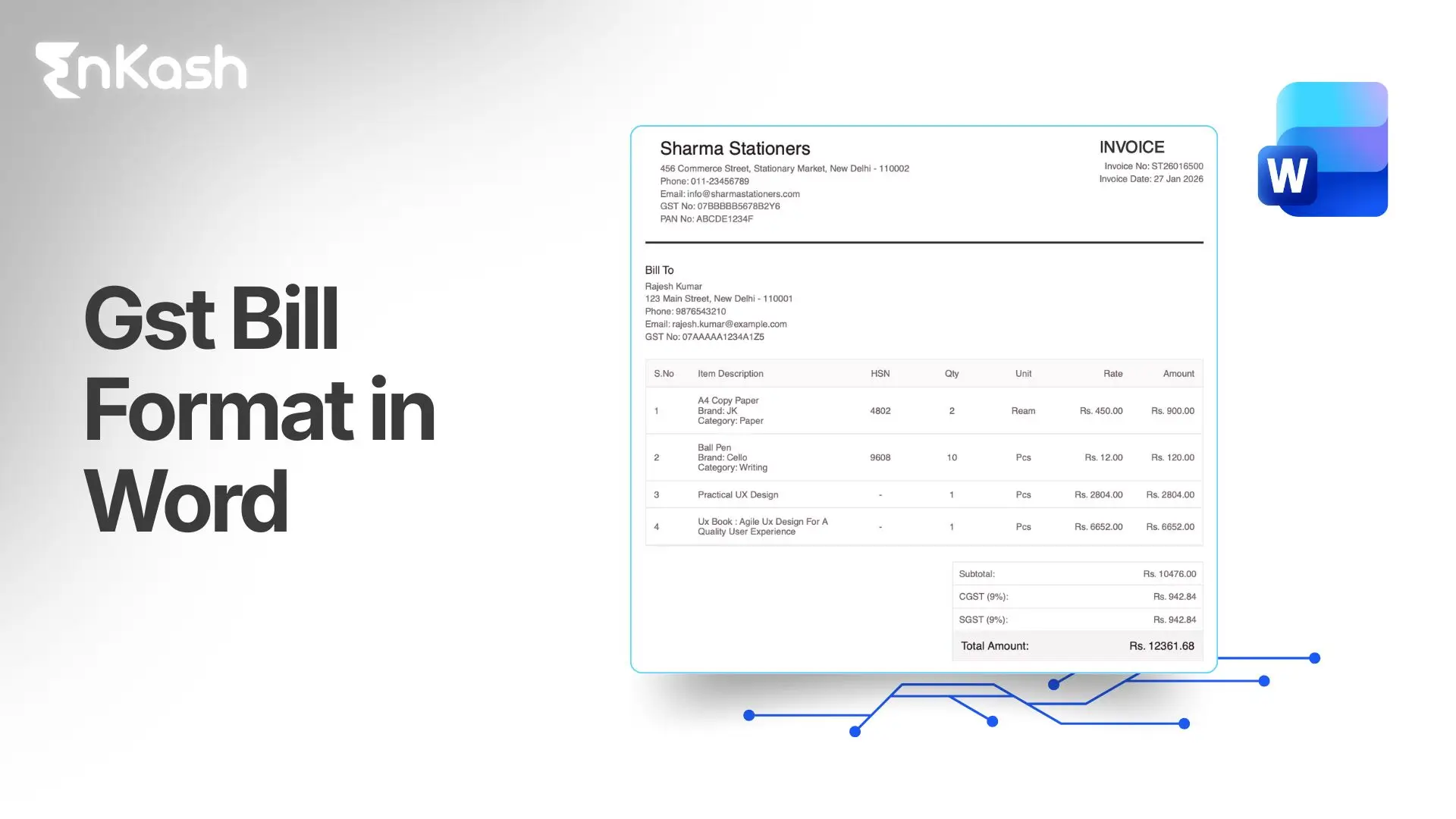

GST Bill Format in Word

A GST bill format in Word suits businesses that need a clean, fixed layout for every invoice. A Word template keeps the structure stable, which helps the seller present details in a clear order. Fields such as seller information, buyer information, invoice number, item value, and tax breakup stay easy to place and review. This format works well for service providers and retailers that prefer a straightforward document without formulas or complex tools.

A template aligned with the GST Bill format supports quick edits and consistent printing. It helps the user control spacing, headings, and alignment so each invoice remains readable during checks. Some businesses pair this layout with a GST bill book format to maintain a physical record alongside digital copies.

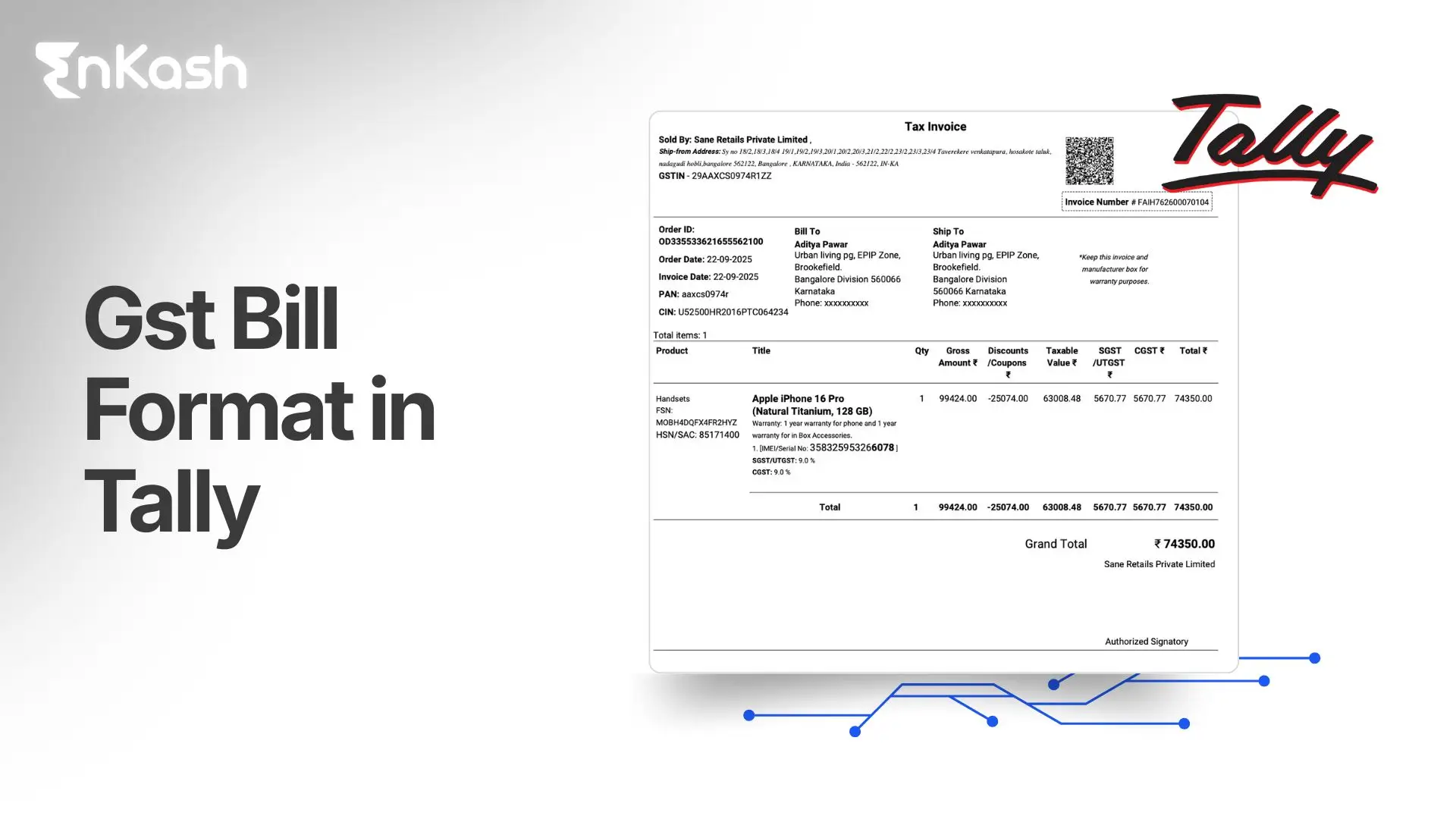

Tally GST Bill Format

A Tally GST bill format provides the user with a predefined structure that adheres to all rules governing GST billing in India. The software automatically fills key fields, reducing the risk of manual entry errors. When an item is selected from the inventory list, Tally automatically adds the HSN code, tax rate, and taxable value to the invoice without extra steps. This helps a seller maintain accuracy during fast billing.

Tally also generates a continuous invoice sequence, preventing gaps in the records. The format supports multiple tax scenarios, including intra-state and inter-state sales, and applies the correct breakdown based on the buyer’s location. This approach keeps the invoice aligned with GST Bill format requirements and prepares clean data for return filing.

Also read: GST Calculator

Online GST Bill Format

An online GST bill format uses a structured form where each field maps directly to the data required under GST rules. The platform pulls saved business information such as address, GST Identification Number, and invoice sequence, then auto-fills these details whenever a new bill is created. Item selection triggers stored HSN or SAC codes, preset tax rates, and linked descriptions, eliminating repeated entries.

Most tools generate the correct tax breakup for intra-state and inter-state sales based on the customer’s location. They also lock key fields to prevent changes after the invoice is issued, which protects audit trails. The layout remains aligned with the GST Bill format guidelines, and the system stores every invoice as a searchable, time-stamped record.

GST Bill Book Format

A GST bill book format uses pre-printed fields that match GST requirements, which means the seller only fills in data that changes with each sale. The book usually carries fixed sections for GST Identification Number, invoice series, place of supply, and HSN or SAC codes linked to the business’s regular items. The printer sets the serial range in advance, and the seller cannot alter the sequence, which protects the audit trail.

Most bill books include a tax matrix with preset Central Goods and Services Tax and State Goods and Services Tax rates to prevent wrong entries during manual billing. Duplicate or triplicate pages record the same information through pressure sheets, allowing the business to store a physical copy that matches the customer’s original.

How to Create a GST Sale Bill

- Add Core Invoice Details

A GST sale bill format begins with the correct invoice number from the approved series. The seller adds the invoice date, place of supply, and the buyer’s name, address, and GST Identification Number when required. These fields must comply with the rules linked to the Goods and Services Tax structure so the invoice remains valid during checks. - Enter Item and Value Information

Items are selected from a list that already holds HSN or SAC codes and the linked tax rate. The seller records quantity, unit value, and any discount. This step determines the taxable amount, which serves as the basis for calculating the tax breakup. - Apply the Correct Tax Structure

The invoice must show the Central Goods and Services Tax, the State Goods and Services Tax, or the Integrated Goods and Services Tax, depending on the buyer’s location. A clear breakup confirms how the total amount was derived. - Complete and Authenticate the Invoice

A signature or digital confirmation finalises the GST Bill format. The completed bill is stored for recordkeeping, which supports later filing and reconciliations.

GST Billing Rules: Updated Government Guidelines

Mandatory Invoice Fields

A valid invoice must show the supplier’s name, address, and GST Identification Number, along with a unique invoice number, invoice date, and place of supply. Buyer details appear when registered. The bill must include item descriptions, quantity, unit price, total value, taxable value, and the HSN or SAC code. The tax breakup for Central Goods and Services Tax, State Goods and Services Tax, or Integrated Goods and Services Tax must stay visible. A reverse charge note appears when required, and the seller must sign the invoice. Formats aligned with the GST Bill format help maintain this structure.

Additional Requirements

For unregistered recipients where the invoice value exceeds ₹50,000, the invoice should include the recipient’s name and address, delivery address, and state name and state code. The invoice number must follow a clear yearly sequence and be no more than 16 characters.

Timing Rules

For goods, invoices are issued before or at the time of removal, where the supply involves movement. In other cases, they are issued before or at delivery or when goods are made available to the recipient.

Common GST Billing Mistakes and How to Avoid Them

- Missing or incorrect HSN or SAC codes that affect tax classification.

- Wrong tax breakup for Central Goods and Services Tax, State Goods and Services Tax, or Integrated Goods and Services Tax due to incorrect place of supply.

- Invoice numbers that break the yearly sequence or exceed the character limit.

- Missing buyer details when the recipient is registered.

- Taxable value calculated without applying discounts correctly.

- Manual totals that do not match the system value.

- Using a layout that fails to follow GST Bill format guidelines creates gaps during audits and during monthly filing.

Conclusion

A clear GST bill format helps a business maintain accurate records, reduce filing errors, and comply with the rules governing the Goods and Services Tax. A well-organised invoice makes tax calculations transparent and ensures every transaction is ready for audit checks. Businesses can choose templates in Excel, Word, Tally, or online platforms, as long as the required fields stay in place. Regularly reviewing invoice sequences, tax breakups, and item-level details helps prevent compliance issues. A simple internal checklist keeps the billing process consistent and supports smoother reporting throughout the financial year.

FAQs

1. How can a business decide which GST billing tool is suitable for daily operations?

A business can review its billing volume, item complexity, and the level of automation needed. Smaller setups may use simple templates, while larger teams benefit from systems that store customer data and apply tax rules automatically. The layout should still follow a clear GST bill format for compliance.

2. Why does invoice serial control matter in GST billing?

Serial control prevents gaps in invoice records, which protects the audit trail. When numbers follow a clean yearly sequence, businesses avoid mismatches during reconciliations and filing. This structure also helps identify missing bills quickly, reducing disputes during checks and keeping all entries aligned with the tax framework.

3. Can a business customise invoice layouts without affecting GST compliance?

A business can adjust colours, spacing, and branding as long as the required fields stay visible and unchanged. Custom layouts work well when the core structure remains intact. This approach lets the seller present a professional bill while still meeting the rules expected from a compliant GST invoice.

4. What should a business check before issuing a GST invoice to a new customer?

The seller should confirm the customer’s GST Identification Number, place of supply, and delivery address. These details guide the tax breakup and help classify the transaction correctly. A quick verification prevents errors in later returns and ensures that the buyer receives a valid invoice that supports their records.

5. How does digital storage improve GST billing accuracy?

Digital storage keeps every invoice searchable, time-stamped, and easy to retrieve. It helps prevent duplicate entries and missing bills. The business can match invoices with returns, payments, and stock records. Clear digital logs reduce manual tracking and support a steady compliance process throughout the financial year.