If you deal with billing, compliance, or business payments in India, understanding the different types of GST isn’t just theory; it directly affects how you charge tax, file returns, and claim Input Tax Credit (ITC). The Goods and Services Tax (GST), introduced on 1 July 2017, brought multiple indirect taxes under one system, making taxation more structured, transparent, and business-friendly.

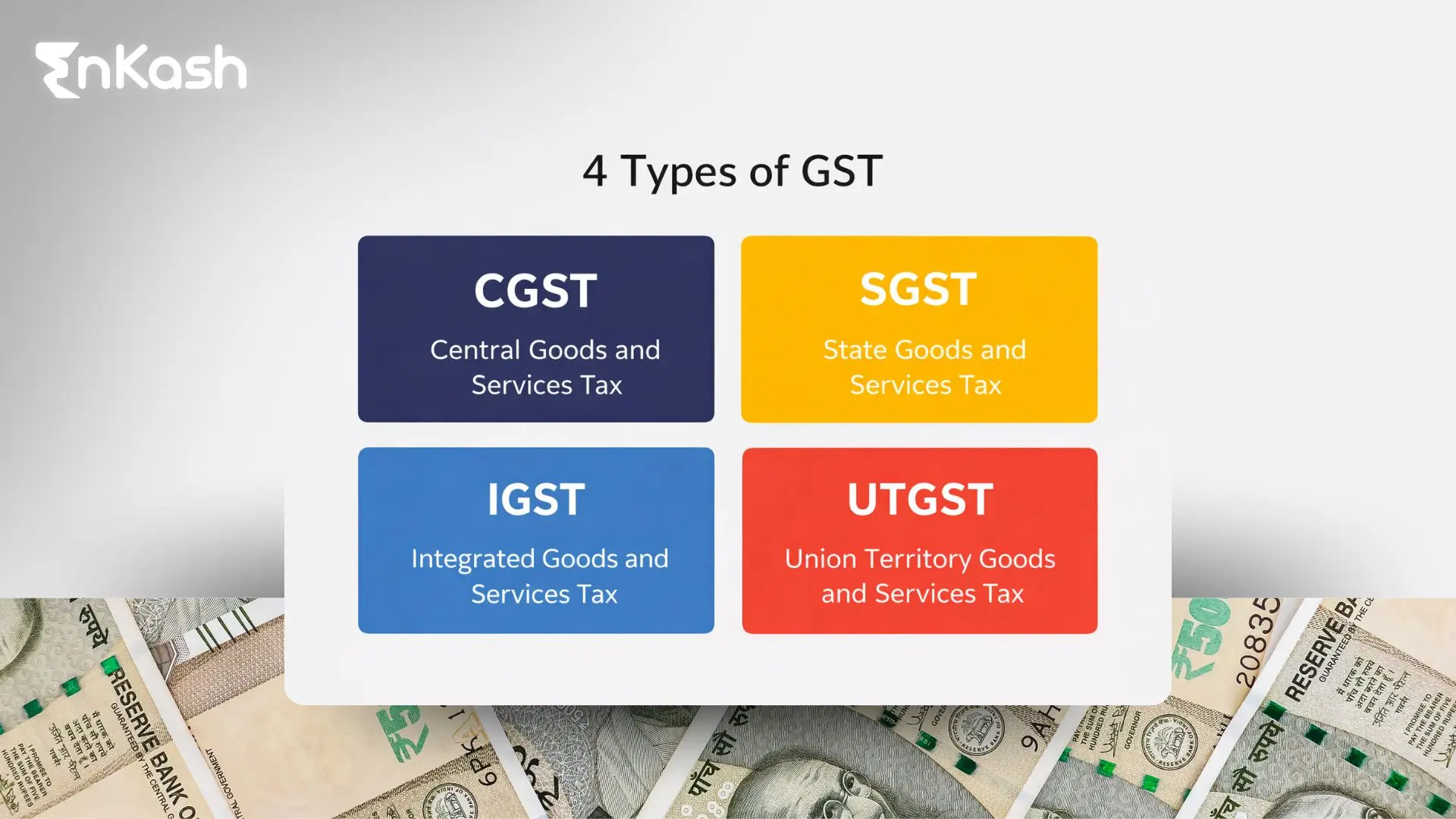

India uses a GST model, in which both the Central and State Governments apply tax. Depending on whether a sale happens within a state or across state borders, GST is divided into CGST, SGST, IGST, and UTGST. Each type exists to ensure fair revenue sharing and smooth interstate trade without tax overlap. For businesses, knowing these GST categories is essential for accurate invoicing, compliance, and avoiding costly errors in tax filings.

Types of GST in India

There are four main types of GST categories, which include Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UGST), and Integrated Goods and Services Tax (IGST).

There are four main types of GST categories, which include Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UGST), and Integrated Goods and Services Tax (IGST).

GST Type |

Description |

Applicability |

Collected By |

|---|---|---|---|

Central Goods and Services Tax (CGST) |

Imposed by the central government on the sale of goods and services within a single state. |

Applies within a state |

Central Government |

State Goods and Services Tax (SGST) |

Levied by the state government on intrastate transactions of goods and services |

Applies within a state |

State Government |

Union Territory Goods and Services Tax (UTGST) |

Functions similarly to SGST, but is applicable within Union Territories. |

Applies within a union territory |

Union Territory Government |

Integrated Goods and Services Tax (IGST) |

Levied on interstate transactions of goods and services, and also applies to imports and exports |

Applies between states or for import/export |

Central Government |

Central Goods and Services Tax (CGST)

Central Goods and Services Tax (CGST) is the portion of GST collected by the Central Government on intra-state supplies of goods and services in India. It is governed by the Central Goods and Services Tax Act, 2017, which lays down the legal framework for levy, collection, compliance, input tax credit, and enforcement.

CGST forms one-half of the tax charged on transactions that take place within the same state, with the other half being SGST (or UTGST in certain Union Territories).

When is CGST Applicable?

CGST applies when the location of the supplier and the place of supply are in the same state or Union Territory. In this scenario, the total GST rate is divided equally between the Centre Government and the State Government.

Example:

If a business operates in Haryana and sells goods worth ₹1,00,000 within Haryana, and the GST rate is 18%:

- 9% CGST → ₹9,000 (paid to the Central Government)

- 9% SGST → ₹9,000 (paid to the Karnataka State Government)

CGST is an important pillar of India’s dual GST model, which is designed to create a balanced tax-sharing system between the Centre and State governments while ensuring a destination-based tax regime. For businesses operating within a single state, CGST compliance directly affects cash flow, credit eligibility, and audit risk, making accurate classification and financial reporting essential.

State Goods and Services Tax (SGST)

State Goods and Services Tax (SGST) is the state component of India’s dual GST system, levied by the respective State Government on the intra-state supply of goods and services. It is governed by the individual State GST Acts, 2017, which operate in coordination with the CGST Act to ensure a unified but dual tax structure across India.

SGST represents the share of GST revenue that belongs to the state where the goods or services are consumed, reinforcing the destination-based taxation principle of the GST regime.

When is SGST Applicable?

State Goods and Service Tax (SGST) is charged when the supplier and buyer are located in the same state, and the place of supply is within that state. In such transactions, GST is divided equally between CGST and SGST.

Example:

A supplier in Tamil Nadu sells goods within Tamil Nadu at an 40% GST rate:

- 20% CGST → Paid to the Central Government

- 20% SGST → Paid to the Tamil Nadu State Government

SGST is not just a tax component; it is a critical part of India’s fiscal federal structure under GST. Businesses operating within a single state must manage SGST carefully to maintain credit efficiency, ensure regulatory compliance, and avoid working capital blockages caused by incorrect tax classification.

Union Territory Goods and Services Tax (UTGST).

Union Territory Goods and Services Tax (UTGST) is the Union Territory–level component of India’s GST system, levied on intra-Union Territory supplies of goods and services in Union Territories without a legislative assembly. It is governed by the Union Territory Goods and Services Tax Act, 2017.

UTGST functions similarly to SGST but applies specifically to certain Union Territories, ensuring tax revenue is allocated to the respective UT administration under India’s destination-based GST framework.

Where is UTGST Applicable?

UTGST applies in Union Territories without a legislature, currently including:

- Andaman and Nicobar Islands

- Lakshadweep

- Dadra and Nagar Haveli and Daman and Diu

- Chandigarh

In these territories, GST on intra-UT transactions is split into:

- CGST (Central share)

- UTGST (Union Territory share)

Union Territories with legislatures, such as Delhi, Puducherry, and Jammu & Kashmir, follow the SGST model, not UTGST.

UTGST revenue collected from intra-UT supplies is assigned to the respective Union Territory administration, forming an important source of indirect tax revenue for governance and public services in those territories.

Integrated Goods and Services Tax (IGST)

Integrated Goods and Services Tax (IGST) is the GST component levied on inter-state supplies of goods and services, as well as on imports and exports. It is governed by the Integrated Goods and Services Tax Act, 2017, which enables seamless taxation and credit flow across state borders under India’s destination-based GST regime.

IGST ensures that tax revenue ultimately goes to the state where goods or services are consumed, not where they originate.

When is IGST Applicable?

IGST is charged when:

- The supplier and buyer are located in different states

- The transaction occurs between two Union Territories

- The supply takes place between a state and a Union Territory

- The transaction involves imports or exports

Unlike intra-state supplies, IGST is not split at the time of sale into CGST and SGST/UTGST; it is charged as a single tax.

IGST is the structural pillar that makes India’s “One Nation, One Tax” system function smoothly across state boundaries. By allowing cross-utilization of credits and central settlement, IGST removes tax barriers between states, simplifies interstate commerce, and supports the creation of a unified national market.

GST Tax Comparison: Intra-State vs Inter-State

Feature |

CGST / SGST / UGST (Intra-state) |

IGST (Inter-state / Import-Export) |

|---|---|---|

Taxing Authority |

Central (CGST) + State/UT (SGST/UGST) |

Central only (IGST shared with State as per destination) |

Applicability |

Within the same State or UT |

Between States, or State ↔ UT, imports/exports |

ITC Utilisation |

Separate CGST & SGST/UGST credits |

IGST credit usable across CGST & SGST/UGST liabilities |

2025 Key Changes |

Hard-locking of GSTR-3B, e-Way Bill 2.0, MFA, and ISD mandates |

Auto tax-split via GSTN, stricter place of supply compliance |

The payment of GST on time is of great importance to any business. Failure to do so can result in penalties and statutory compliance issues. Often, companies face issues retrieving the amount to be paid from the portal and then going through the process of making the challan, checking it, and getting the approvals internally to make the payment.

That is where a platform like the one we offer to our customers at EnKash helps you. You can set maker, checker, and approver levels within the tax payments module so that once you retrieve the amount to pay, you can get the requisite approvals in place.

Moreover, you also have various payment options to complete the payment via the portal. Once the payment is completed, your finance system is updated automatically.

Objective of GST

The Goods and Services Tax (GST) was introduced in India in 2017 with the primary objective of simplifying the indirect tax system. It aimed to:

- Reduce Cascading Effect: Previously, several indirect taxes were levied at different stages of production and distribution, leading to a cascading effect that inflated the final price of goods and services. GST eliminates this by having a single tax point

- Promote Tax Compliance: A simpler tax structure with fewer exemptions makes GST easier for businesses to understand and comply with

- Boost Economic Growth: GST aims to encourage economic activity and growth by streamlining tax processes and reducing compliance burdens

- Create a Unified Market: GST facilitates the seamless movement of goods and services across states by eliminating inter-state tax barriers.

Taxes Replaced with GST

1. Central Taxes Replaced

Before GST, the Central Government collected multiple indirect taxes, which are now subsumed into GST:

- Central Excise Duty (on manufacture of goods)

- Service Tax (on services)

- Additional Duties of Excise (on special goods like textiles)

- Additional Customs Duty (CVD – Countervailing Duty)

- Special Additional Duty of Customs (SAD)

- Central Surcharges & Cesses related to supply of goods/services

2. State Taxes Replaced

The State Governments also had various indirect taxes, now merged into GST:

- Value Added Tax (VAT) (on sale of goods within the state)

- Central Sales Tax (CST) (on inter-state sale, collected by the Centre but assigned to states)

- Octroi & Entry Tax (on goods entering a state/local area)

- Purchase Tax

- Luxury Tax

- Entertainment Tax (except taxes by local bodies)

- State Surcharges & Cesses related to the supply of goods/services

Earlier Tax |

Levied By |

Merged Into GST |

|---|---|---|

Central Excise Duty |

Central Govt |

CGST / IGST |

Service Tax |

Central Govt |

CGST / IGST |

Additional Customs Duty (CVD) |

Central Govt |

IGST |

Special Additional Duty (SAD) |

Central Govt |

IGST |

Central Sales Tax (CST) |

Central Govt |

IGST |

State VAT |

State Govt |

SGST / IGST |

Octroi & Entry Tax |

State Govt |

SGST / IGST |

Purchase Tax |

State Govt |

SGST / IGST |

Luxury Tax |

State Govt |

SGST / IGST |

Entertainment Tax |

State Govt |

SGST |

Conclusion

The introduction of GST categories in India, with its four distinct types – CGST, SGST, UGST, and IGST – has been a game-changer for the country’s tax system. The consolidated tax system under GST removed the cascading tax effect, created a unified market, and encouraged economic growth while improving tax compliance. While challenges remain, continuous efforts by the government and stakeholders are addressing these issues, ensuring that GST achieves its full potential as a transformative tax reform. As businesses and consumers adapt to the GST regime, the benefits of a simplified, transparent, and efficient tax system are becoming increasingly evident.

FAQs

1. What is GSTIN?

It is the unique identification number that is assigned to each taxpayer. It consists of 15 digits and is assigned to business entities or individuals at the time of registration completion under the regime.

2. What is the full form of CGST?

The full form of CGST is the central goods and services tax, which has been brought to replace several indirect taxes that the central government had in place. These taxes applied to goods and services that were moved intrastate.

3. What is the full form of IGST?

IGST stands for integrated goods and services tax, which is one of the 3 components that form the goods and services tax (GST). It is applicable when goods or services move interstate.

4. What is the full form of SGST?

This translates to state goods and services tax, which is part of the state goods and services tax. The tax applies to goods and services traded within the state and is deposited in the state government’s account.

5. Who is liable to pay GST?

A person or business must register under GST if their aggregate turnover exceeds ₹20 lakh, except in special category states where the limit is ₹10 lakh. For the supply of goods, the threshold is ₹40 lakh in some states.

6. What goods are exempt from GST payment?

Certain essential items like fruits, vegetables, milk, bread, and certain agricultural products are exempt from GST. You can find a comprehensive list of exempted goods and services on the official GST website.

7. What is input tax credit (ITC)?

The input tax credit is the credit available to a registered taxpayer for the GST paid on the purchase of goods or services used in the course of business.

8. Can the input tax credit be claimed for all GST paid?

No, input tax credit can be claimed only for GST paid on purchases that are used for business purposes.

9. What will happen if I don’t pay GST on time?

Delays in GST payment can result in penalties and interest charges imposed by the tax authorities.

10. What is the GST rate in India?

The applicable Goods and Services Tax (GST) rate in India varies based on the nature of goods or services. They are categorized into four main slabs: 5%, 12%, 18%, and 40%. Some essential items may be exempted or subject to lower rates, while luxury items may attract higher rates.