Under India’s GST framework, exports are classified as zero-rated supplies. This means exporters are not required to bear the final tax burden, but they must still follow prescribed compliance routes to avail this benefit. One such route is the use of LUT, which allows eligible exporters to supply goods or services without paying integrated tax at the time of export.

From a compliance standpoint, LUT in GST is not a relaxation of the law but a formal undertaking given to the tax authorities. By filing it, an exporter commits to meeting specific conditions, such as completing exports within the prescribed timelines and realising foreign currency proceeds in the case of services. When these conditions are met, GST does not need to be paid upfront, eliminating the need to claim refunds later.

For exporters handling regular overseas transactions, the proper use of an LUT certificate plays a direct role in managing cash flow, reducing reliance on refunds, and maintaining clean GST records. The sections ahead clarify how LUT is applied in GST exports, identify the scenarios in which it is permitted, and detail the obligations that continue after filing.

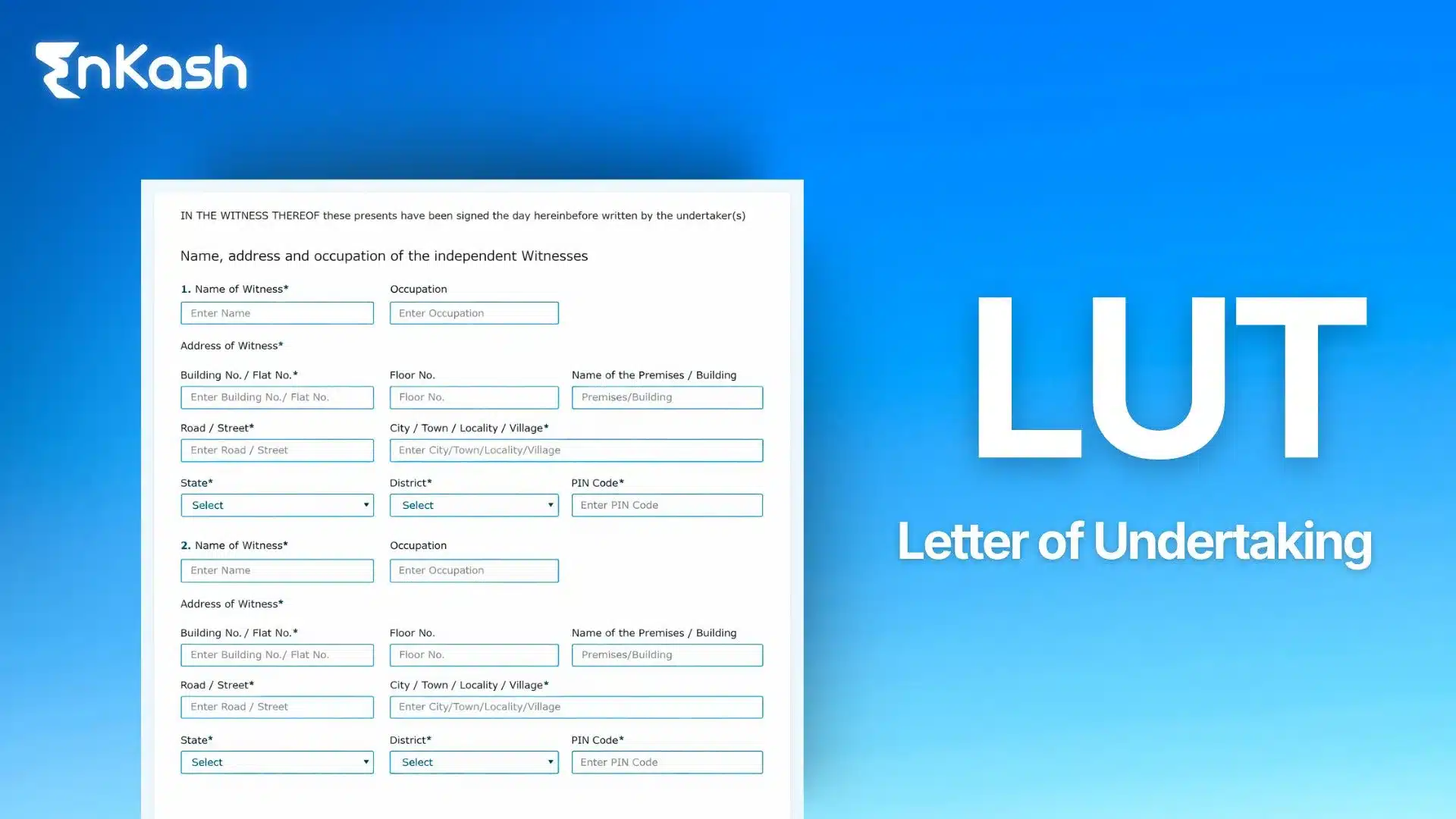

What Is LUT in GST?

LUT Full Form in GST

LUT stands for Letter of Undertaking. Under GST, it is a prescribed declaration submitted by a registered exporter under Rule 96A of the CGST Rules. Through this declaration, the exporter formally assures the tax department that exports will be carried out in accordance with the GST, without payment of integrated tax at the time of supply.

Legally, LUT in GST is recognised as a binding undertaking. It is not an approval, exemption, or licence. Once filed and accepted electronically, it becomes the basis for the exporter to make zero-rated supplies without payment of tax.

LUT Meaning in GST

The LUT’s meaning in GST is rooted in enforcement rather than facilitation. By filing an LUT, the exporter accepts responsibility for completing exports within the stipulated period and for fulfilling post-export conditions defined under GST. If these conditions are breached, the law allows the tax authorities to recover the applicable tax along with interest.

In effect, LUT shifts the point of tax enforcement. Instead of collecting tax upfront, GST relies on the exporter’s undertaking and monitors compliance after the supply has been made.

Why Is LUT So Important for Exporters?

Reduces Dependence on the Refund Route

Under GST, exports are zero-rated, but the law still offers two distinct compliance paths. An exporter can either pay IGST at the time of export and later apply for a refund, or export without paying tax by using LUT. The refund route is procedural by nature. It involves system validations, document matching, and processing timelines that are not always predictable. During this period, the tax amount remains blocked.

By exporting under LUT in GST, this blockage is avoided entirely. Since no IGST is paid upfront, there is no refund to wait for. For exporters with frequent shipments or recurring service invoices, this directly improves cash availability and reduces reconciliation workload.

Improves Cash Flow Predictability

Export businesses typically operate on tight working capital cycles. Funds are required for procurement, logistics, compliance, and vendor payments well before export proceeds are realised. When IGST is paid upfront, even temporarily, it disturbs this cycle.

Using an LUT certificate keeps export transactions tax-neutral at the execution stage. This allows exporters to plan cash flows more accurately, without factoring in refund delays or follow-ups. From a finance and accounting standpoint, this also simplifies month-end closing and aligning GST returns.

Simplifies Ongoing GST Compliance

Exporting with LUT brings consistency to GST filings. Since tax is not paid on export invoices, there is no need to track refund claims, reconcile sanctioned amounts, or manage refund rejections. Returns such as GSTR-1 and GSTR-3B reflect exports as zero-rated supplies without tax outflow, making compliance cleaner and easier to audit.

For service exporters in particular, the LUT for export creates a clear compliance path, provided payment is received within the permitted timeframe. As long as conditions are met, there is no downstream tax adjustment.

Provides Regulatory Clarity and Control

LUT also sets clear expectations. The exporter knows the conditions that must be fulfilled and the timelines that apply. This reduces ambiguity and limits exposure to unexpected tax demands. Instead of reactive compliance through refunds, exporters operate within a defined framework that is easier to monitor and control.

When Can LUT Not Be Used?

Cases Involving Serious GST Violations

The use of LUT is restricted where an exporter has been involved in serious GST offences. If prosecution has been initiated for tax evasion beyond the monetary threshold prescribed under GST law, the option to export under LUT under GST is not available. In such situations, the tax authorities do not accept an undertaking as sufficient assurance of compliance.

This restriction is not discretionary. It is system-driven and applies automatically based on the exporter’s compliance history recorded under GST.

Failure to Meet Export Timelines

Another situation where LUT cannot be used arises when exports are not completed within the time limits specified under GST. If goods are not exported within the prescribed period after issuing the invoice, the exporter becomes liable to pay the applicable tax along with interest. Repeated failures of this nature can lead to withdrawal of the LUT facility.

Once withdrawn, future exports cannot be made under LUT until the conditions are regularised.

Non-Realisation of Export Proceeds for Services

For service exporters, eligibility to use LUT depends on receiving payment in convertible foreign exchange within the permitted timeframe. If export proceeds are not realised within this period, the conditions of LUT are considered breached. This can result in tax liability and suspension of the LUT route for subsequent exports.

Mandatory Shift to Bond in Restricted Cases

When LUT is disallowed, exporters do not have the flexibility to continue using it. GST rules require exports to be made either by paying IGST upfront or by furnishing a Bond with applicable security. This ensures that tax exposure is adequately safeguarded in higher-risk cases.

Read More: Types of GST in India.

How to File an LUT Online?

Filing LUT under GST is a fully digital process and does not involve any physical submission. The filing is done once for each financial year and applies to all eligible exports made during that period.

Where LUT Is Filed

The LUT is filed through the GST portal by logging in with valid credentials. It is available within the services section under user services. The form is financial year–specific, so exporters must ensure they select the correct year before proceeding.

Key Declarations Involved

While filing LUT in GST, the exporter is required to confirm a set of standard declarations. These declarations relate to completing exports within prescribed timelines and complying with conditions applicable to zero-rated supplies. The system does not ask for transaction-level details at this stage, as LUT operates as a blanket undertaking for the year.

Verification and Submission

Once the declarations are confirmed, the LUT must be authenticated using either a Digital Signature Certificate or electronic verification, depending on the type of taxpayer. After submission, the acknowledgement is generated instantly, and the

LUT becomes effective immediately.

There is no separate approval workflow or waiting period. As long as the exporter is eligible, the system accepts the filing without manual intervention.

Practical Filing Considerations

Exporters should ensure that the LUT is filed at the beginning of the financial year or before issuing export invoices. Filing it after exports have already taken place can create compliance gaps. It is also important to refile the LUT every year, as it does not carry forward automatically.

Documents Required to File an LUT

Unlike many GST processes, filing LUT does not involve uploading a set of supporting documents. The system is designed to rely on declarations and digital authentication rather than paperwork.

No Physical Documents Required

When filing LUT under GST, exporters are not required to attach invoices, contracts, shipping bills, or bank certificates. The undertaking is accepted based on the exporter’s GST registration details and compliance history already available in the system.

This makes the process faster and reduces documentation burden, especially for exporters with frequent or recurring transactions.

Digital Authentication Requirement

Although documents are not uploaded, the LUT filing must be authenticated digitally. Depending on the type of taxpayer, this is done using a Digital Signature Certificate or electronic verification. This step confirms that the undertaking is legally binding.

Information That Must Be in Place

Before filing LUT in GST, exporters should ensure that core registration details such as legal name, authorised signatory, and contact information are updated on the GST portal. Any mismatch here can cause filing or verification issues later.

Validity of an LUT

An LUT filed under GST is not an open-ended permission. Its validity is clearly time-bound and linked to the financial year for which it is submitted.

Financial Year–Based Validity

LUT is valid only for the specific financial year selected at the time of filing. Once filed, it applies to all eligible exports made during that year, starting from 1 April and ending on 31 March. It does not automatically extend into the next year, even if the exporter’s business details remain unchanged. This makes LUT a periodic compliance requirement rather than a one-time filing.

When LUT Expires

The LUT expires automatically at the end of the financial year. No separate cancellation or closure is issued by the GST system. From the first day of the new financial year, exports cannot be made under the old LUT. If exports continue without filing a fresh LUT for the new year, the exporter may be required to pay IGST on such supplies or face compliance queries later.

Renewal Requirement

To continue exporting without upfront tax payment, exporters must file a new LUT at the beginning of each financial year. Most businesses do this before issuing their first export invoice of the year to avoid gaps in compliance.

LUT vs Bond

When exporting under GST without paying integrated tax upfront, exporters are allowed to choose between LUT and a Bond only when the law permits it. These two mechanisms serve the same regulatory objective but operate very differently in practice.

Nature of LUT and Bond

An LUT is a declaration-based undertaking. It relies on the exporter’s compliance history and a formal promise to meet export conditions. No financial security is attached to it. Once filed, it applies to all eligible exports for the financial year.

A Bond, on the other hand, is a security-backed instrument. It requires the exporter to furnish a bond value equal to the tax involved, often supported by a bank guarantee. This makes it a more stringent compliance route.

When Bond Replaces LUT

GST rules mandate the use of a Bond in cases where an LUT under GST is not permitted. This typically applies to exporters with serious compliance issues or those who do not meet eligibility conditions. In such cases, exporting under LUT is not an option, and Bond becomes compulsory.

The choice is not preference-driven. It is determined by the exporter’s compliance profile.

Compliance and Cost Differences

From an operational perspective, LUT is simpler. There is no need to arrange guarantees, monitor bond values, or renew securities. Bond-based exports involve additional documentation, coordination with banks, and ongoing tracking of bond utilisation.

For most compliant exporters, LUT is the preferred and default route because it keeps compliance lighter and costs lower.

Also read: What Is the GST Bill Format in India? Types and Templates

Common Mistakes While Using LUT

Filing LUT for the Wrong Financial Year

A frequent mistake exporters make is filing LUT under the incorrect financial year. Since LUT is strictly year-specific, selecting the wrong year renders it ineffective for current exports. This usually happens when the filing is done close to the year-end or at the start of a new financial year without checking the selected period.

Assuming LUT Auto-Renews

Many exporters assume that once filed, LUT under GST continues indefinitely. This is incorrect. LUT expires automatically at the end of each financial year and must be refiled. Continuing exports without renewing LUT can expose the exporter to IGST liability on those transactions.

Issuing Export Invoices Before Filing LUT

Another common error is raising export invoices before filing LUT for the year. Even if LUT is filed later, exports already invoiced may be treated as non-compliant. The LUT must be active on the date the export invoice is issued.

Ignoring Payment Timelines for Service Exports

For service exporters, delayed receipt of foreign currency is a critical compliance risk. If payment is not realised within the permitted timeframe, the conditions of LUT in GST are breached, leading to tax and interest exposure.

Incorrect Invoice Endorsement

Export invoices must clearly mention that the supply is made under LUT without payment of IGST. Missing or incorrect endorsement can create issues during audits or assessments.

Conclusion

For exporters, compliance under GST works best when the rules are understood and applied with precision. LUT is not a shortcut or concession. It is a structured undertaking that allows exports to move without upfront tax, provided conditions are followed strictly. When used correctly, it aligns export operations with regulatory expectations and reduces avoidable friction in tax reporting. What matters is timing, accuracy, and consistency across invoices, filings, and payment realisation. A clear understanding of LUT in GST helps exporters stay compliant, predictable, and audit-ready, without relying on corrective actions later.

FAQs

1. Can LUT be filed after exports have already started?

LUT is expected to be in place before export invoices are issued. If exports are made first and LUT is filed later, those transactions may not qualify for zero-rated treatment without tax payment. In such cases, authorities may treat the exports as taxable and ask for IGST along with interest, depending on facts and timelines.

2. Is LUT required for every export invoice separately?

LUT is not filed per invoice or per shipment. It is a single undertaking filed for an entire financial year. Once active, it covers all eligible export invoices issued during that year, as long as the conditions attached to exports of goods or services are followed consistently.

3. Can a newly registered GST exporter file LUT immediately?

A new GST registrant can file LUT as soon as the registration is active and credentials are available. There is no mandatory waiting period. However, eligibility still depends on compliance history and the absence of disqualifying factors such as prior prosecution under GST or earlier tax laws.

4. Does LUT apply to exports made through e-commerce platforms?

Exports made through e-commerce platforms can be covered under LUT, provided the supply qualifies as an export under GST and the exporter is the one raising the invoice. The method of order placement does not change LUT applicability. Compliance depends on documentation, export completion, and payment realisation.

5. What happens if export proceeds are received after the allowed time?

If payment for exported services is received beyond the permitted timeframe, the export may lose zero-rated treatment. In such cases, tax liability can arise along with applicable interest. Exporters may also face restrictions on using LUT for future transactions until compliance gaps are addressed.

6. Is LUT applicable to partial exports or advance payments?

LUT applies to export supplies, not to advances by themselves. For goods, the focus is on the actual export of goods. For services, advance receipts do not automatically complete export conditions. The relevant factor is whether the service is supplied and payment is realised within the permitted period.

7. Can LUT be cancelled voluntarily by the exporter?

There is no separate voluntary cancellation process for LUT. If an exporter chooses not to use it, they can export by paying IGST and claiming refunds instead. However, once filed, LUT remains valid for the year unless withdrawn by the authorities due to non-compliance.

8. Does LUT need to be mentioned in GST returns?

LUT itself is not reported as a separate entry in GST returns. Its effect is reflected through zero-rated export entries in GST returns like GSTR-1 and GSTR-3B. Authorities verify LUT compliance indirectly through export declarations, timelines, and payment records.

9. Can LUT be used for supplies to foreign branches or related entities?

Supplies to foreign branches or related entities can qualify under LUT only if they meet the definition of export under GST. This includes conditions related to the place of supply, recipient location, and foreign currency payment. Relationship alone does not disqualify the use of LUT.

10. How do authorities verify compliance after LUT is filed?

Post-filing verification is done through return data, shipping bills, bank realisation details, and timelines. Authorities do not approve each export in advance. Instead, compliance is checked during audits or assessments, where failures can result in tax recovery and restriction on future use.