Introduction

A Balance Sheet is one of the most important financial statements used to understand a company’s overall financial position at a specific point in time. It provides a clear summary of what the business owns, what it owes, and the net worth of the company.

It matters because it helps business owners, investors, lenders, and analysts to evaluate the liquidity, solvency, and long-term financial strength of the company. By reviewing assets, liabilities, and equity, stakeholders can make decisions whether a business is financially stable, over-leveraged, or positioned for growth.

In Financial reporting, it plays a very important role in decision-making. It supports budgeting, management of risk, evaluations of credits, and investment decisions.

What is a Balance Sheet?

Definition

A Balance Sheet is a financial statement that shows a company’s assets, liabilities, and equity on a specific date. In simple terms, a balance sheet helps to ascertain what a business owns (assets), what it owes (liabilities), and the owner’s claim on the business (capital)

A standard Balance Sheet includes three core elements:

- Assets – resources owned by the business

- Liabilities – obligations or debts owed

- Equity – the owner’s or shareholders’ claim after all liabilities are paid

The Balance Sheet is expressed in terms of the accounting equation:

Balance Sheet Formula:

Assets = Liabilities + Equity

This formula ensures the statement always remains in balance, making it one of the most reliable tools for financial analysis.

A clear understanding of the it helps business owners, investors, and students to ascertain financial stability, assess risks, and evaluate long-term potential for growth of the company or any business.

Components of a Balance Sheet: What does a Balance Sheet include?

It consists of three essential components that reveal a company’s complete financial position: Assets, Liabilities, and Equity. These elements help businesses and investors understand how money flows within an organization and whether the company is financially stable.

Assets

A company’s assets are valuable items that can be converted into cash. All the assets are listed in the order of their liquidity, based on how easily they can be converted into cash.

Assets represent everything a business owns.

- Current Assets – cash, bank balance, inventory, receivables

- Non-Current Assets – property, equipment, investments, long-term assets

Assets highlight the company’s ability to meet short-term and long-term needs.

Liabilities

The amount that a company owes to other parties is a liability. It could be recurring payments, loan expenses, and any other forms of debt. Usually shown on the right side of the balance sheet, liabilities are of two types: current liabilities and non-current liabilities.

- Current Liabilities: These include accounts payable, short-term borrowings, the current portion of long-term debt, and notes payable due within a year.

- Non-current Liabilities: These include long-term debt, deferred tax liabilities, bonds payable, and notes payable in the long term.

Equity (Owner’s / Shareholders’ Funds)

Equity reflects the owner’s claim after all liabilities are deducted from the assets. It includes:

- Capital or share capital

- Retained earnings

- Reserves and surplus

Equity shows the net value of a company and its long-term financial strength.

Why is a balance sheet important?

It is a vital financial tool that plays a central role in evaluating a company’s financial health and supporting critical business decisions. This section highlights the key reasons why a balance sheet is so important.

- It helps evaluate a company’s net worth and creditworthiness

Businesses often seek loans from banks for expansion. Banks, suppliers, and other creditors depend heavily on the balance sheet to determine how much credit to extend. Analysing current and non-current liabilities and the company’s liquidity helps them assess its ability to meet debts and obligations. It helps businesses to analyze a company’s net worth and creditworthiness by showing what the business owns (assets), what it owes (liabilities), and the remaining value for owners. By comparing these figures, lenders and investors can understand the company’s financial strength, ability to repay debts, and overall stability.

- It helps investors make informed decisions

It is used in the computation of the net worth of the company, which is then used to assess the security and the financial structure of the investment by the investor. Investors look at the company’s balance sheet to determine their financial status, paired with other vital factors, and then decide to invest their money. - It helps evaluate risk & return

A business owner can use it to know the funds available to meet short-term obligations and also keep a check on the business liabilities. The management can leverage the balance sheet to assess the allocation of resources, areas of strength, and improvement. Thus, enabling them to make strategic decisions and take calculated risks. - It helps in financial analysis

A well-maintained balance sheet gives a clear picture of the liquidity of the company. This information can be used by the company to know its cash flow, working capital, trade receivables, and fund availability for daily operations. - It helps with performance benchmarking

Management can use it to ascertain how successfully the organization has fared in keeping up with its financial position. This allows management to formulate goals in which improvements are needed and helps to identify any gaps in the performance of the organization.

Types of Balance Sheets

It comes in several formats, tailored to different analysis needs and organizational types. Common kinds of balance sheets include the following:

Classified Balance Sheet:

This balance sheet format organizes assets and liabilities into current and long-term categories. By segmenting accounts, a classified balance sheet illustrates the liquidity, mobilization, and operations of the company with minimal difficulties. It aids the audience in easily separating short-term assets and liabilities from long-term ones.

Comparative Balance Sheet:

It sheet reveals changes in financial position, growth in assets, liabilities, and equity, and can highlight patterns in profitability or debt management.

Read More: What is a Comparative Balance Sheet?

Common Size Balance Sheet:

In this type, every item is made as a fraction of total assets. This kind of presentation is ideal for allowing a comparison of the organization’s performance against that of competitors within the same industrial sector, as it eliminates the size factor. Such balance sheets facilitate the understanding of the relative size of the company’s total assets to its total debts.

Consolidated Balance Sheet:

It is prepared for holding companies with subsidiaries will include all the holding company’s financials along with its subsidiaries. It presents more details concerning the organization as a whole by indicating the aggregate assets and liabilities, and equities of the entire group.

Trial Balance:

A trial balance is not a type of it. A trial is a separate internal report prepared before final accounts to ensure that total debits equal total credits in the ledger. Once the trial balance tallies, the balance sheet and other financial statements are prepared. This helps the accountant ensure that there are no mistakes in the entries leading to the final figures.

Read more: What is a Trial Balance?

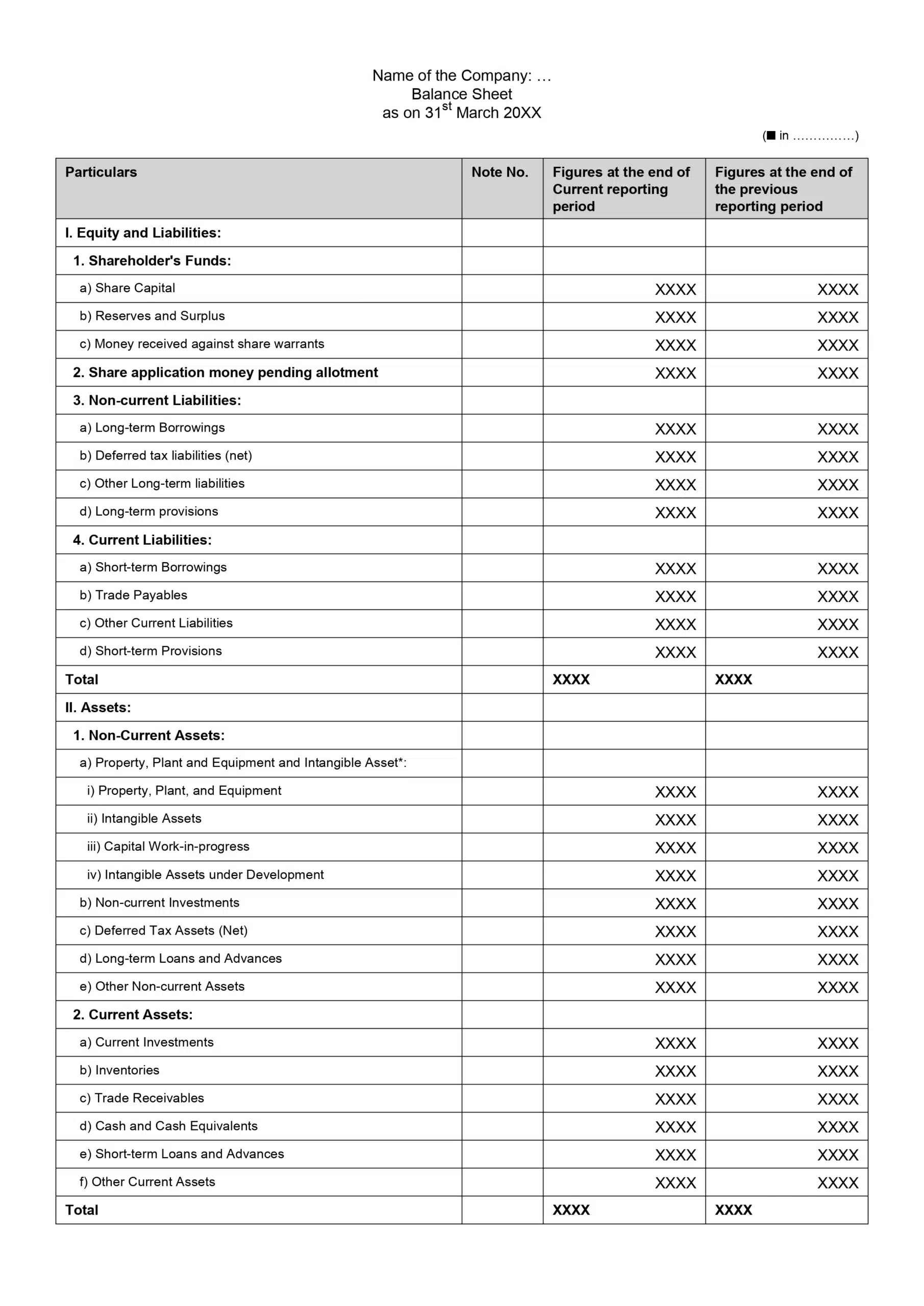

Accounting Balance Sheet Format

The Accounting Balance Sheet Format provides a clear and simplified way to represent the financial position of a company. A standard balance sheet format helps businesses, accountants, and students understand how assets, liabilities, and equity are arranged for accurate reporting of the finances of the company.

Standard Heading

It always begins with a clear, professional heading that includes:

- Name of the company

- Title: “Balance Sheet”

- Specific date (e.g., as on 31st March 2025)

This heading confirms the financial period and ensures the document is compliant with accounting standards.

Horizontal Balance Sheet Format (T-Format)

| Liabilities | Amount (₹) | Assets | Amount (₹) |

|---|---|---|---|

| Capital / Equity | Non-Current Assets | ||

| Share Capital | 10,00,000 | Property, Plant & Equipment | 8,50,000 |

| Reserves & Surplus | 3,00,000 | Long-Term Investments | 2,50,000 |

| Intangible Assets (Patents) | 50,000 | ||

| Long-Term Liabilities | |||

| Long-Term Loans | 4,00,000 | ||

| Debentures / Bonds | 1,50,000 | ||

| Current Liabilities | Current Assets | ||

| Creditors | 1,20,000 | Cash & Bank Balance | 1,80,000 |

| Bills Payable | 80,000 | Inventory | 2,20,000 |

| Outstanding Expenses | 50,000 | Trade Receivables | 1,40,000 |

| Short-Term Loans | 1,00,000 | Short-Term Investments | 90,000 |

| Total Liabilities | 22,00,000 | Total Assets | 22,00,000 |

Vertical Balance Sheet Format:

How to Create a Balance Sheet?

Here is a step-by-step guide to making of it:

Step 1: Decide the tenure for which the balance sheet has to be prepared.

Step 2: List down all the assets of the company and categorize them into current and non-current assets.

Step 3: Total the value of all the assets to determine their total value.

Step 4: List down all the company’s liabilities and categorize them into current and non-current liabilities.

Step 5: Add the value of all the liabilities to determine their total value.

Step 6: Deduct the total liabilities from the total assets and get the equity value.

Step 7: Mention the assets on one side of the balance sheet and the liabilities and equity on the other side. Make sure that the assets total equals the total liabilities and equity.

Step 8: Check the accuracy of the balance sheet and use it further to evaluate the financial health of the company.

Balance Sheet Analysis

Balance sheet analysis helps evaluate a company’s financial strength, short-term stability, and long-term sustainability. Whether you’re a student learning finance, a business owner tracking performance, or an investor assessing opportunities, these core insights matter:

Liquidity Analysis

Liquidity analysis measures a company’s ability to meet short-term obligations using metrics like Current Ratio, Quick Ratio, and Cash Position. Strong liquidity indicates smoother operations and lower financial risk.

Solvency Analysis

Solvency analysis examines long-term stability through indicators such as Debt-to-Equity Ratio and Interest Coverage Ratio. It shows whether a business can comfortably manage its liabilities over time.

Working Capital Insights

Working capital reveals operational efficiency. Understanding current assets vs. current liabilities helps determine if the business can fund daily activities, manage inventory, and handle unforeseen expenses.

What are the Limitations of a Balance Sheet?

If it can provide a certain understanding of a company’s financial position, there are limits to its utility that each user must note:

- Particular Point in Time:

The balance sheet states the financial position of the organization as of a date, which is usually the end of a certain fiscal quarter or year. Accordingly, it is not able to provide trends or variations in the business for the duration given, and seasonal or other variances in finances may be ignored. - Historical Costs:

In practice, most of the assets presented under the balance sheet are at the historical cost of acquisition and not replacement cost or current market valuation. Historical cost accounting, for example, can lead to gross understatements of the long-term values of such assets as investment properties and plant fixtures when these assets have appreciated in worth over the period. - Intangible Assets:

Intangible assets such as brand reputation, internally generated intellectual property, or goodwill do not appear on the balance sheet unless they are acquired and paid for. This can skew the reported valuation of the company, especially for firms where intangible assets form a significant part of their true economic value. - Excludes Non-Financial Measures:

A balance sheet does not capture other crucial qualitative measures, such as the morale of employees, their innovation levels, and even whether the firm is ahead of its competitors. These are vital, especially to the performance and growth prospects of a given firm, but very hard to measure and therefore normally left out. - Impact of Accounting Policies:

Differences in accounting policies, such as depreciation methods or cost of goods sold valuation (e.g., FIFO or LIFO), can change the reported values of assets and profit margins. Such variations also make it difficult to compare financial statements across different companies or periods.

How can EnKash help in managing expenses?

EnKash, an expense management platform, enables companies to track every expense in real time and generate analysis to support better decision-making.

By integrating expense data with financial reporting, EnKash helps internal teams and external stakeholders gain a clearer view of the company’s spending patterns, cash flows, and overall financial position.

FAQs

1. What is a balance sheet?

A balance sheet is a financial statement that shows a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

2. Why is a balance sheet important?

A balance sheet helps the stakeholders understand the company’s financial details like liquidity, solvency, and overall financial stability.

3. How is the balance sheet structured?

The balance sheet is structured into two main sections: assets and liabilities plus shareholders’ equity. In a horizontal (T-format) balance sheet, assets are shown on the left and liabilities and equity on the right. In a vertical format, assets are listed first, followed by liabilities and equity below.

4. How are retained earnings calculated?

Retained earnings can be calculated by adding net income to the retained earnings balance and then subtracting dividends paid to shareholders.

5. How does a balance sheet tell us about liquidity?

A balance sheet showcases the relationship between current assets and current liabilities. The higher the ratio of current assets to current liabilities, the higher the liquidity.

6. How does a balance sheet help in assessing financial risk?

A balance sheet compares the liabilities to equity and analyzes the debt-to-equity ratio, using which a stakeholder can assess the financial position of the company.

7. How does the balance sheet interact with other financial statements?

It complements the income statement and cash flow statement. Any changes in the balance sheet lead to changes in the cash flow statement. The income statement showcases the details of the profitability, which affects the retained earnings on the balance sheet.

8. Why is a Balance Sheet Prepared?

A balance sheet is prepared to provide a snapshot of a company’s financial position, showing what it owns (assets), what it owes (liabilities), and the net worth (equity). It helps stakeholders understand financial stability, liquidity, and long-term solvency.

9. How to Read a Balance Sheet?

To read a balance sheet, start by reviewing assets, then compare them with liabilities and equity. Focus on key indicators like current assets, debt levels, working capital, and net worth to understand financial health and performance.

10. What Is a Consolidated Balance Sheet?

A consolidated balance sheet combines the financials of a parent company and its subsidiaries into a single statement. It shows total assets, liabilities, and equity as if they belong to one entity, giving a complete view of the group’s financial strength.

11. What Is “Chip” in a Balance Sheet?

Chip is not a standard accounting term used on balance sheets. In some informal contexts, people may casually use ‘chip’ to refer to an owner’s contribution or share in the business, similar to share capital. However, official financial statements will use terms such as share capital, equity, or owners’ funds instead.

12. What Is Netback in a Balance Sheet?

Netback is mainly an income statement metric, not a balance sheet item. It refers to the net amount a company earns after deducting specific expenses from revenue (commonly used in oil, gas, or commodity sectors). While it is not shown directly on the balance sheet, it influences profitability and financial ratios derived from the accounts.

13. What Is a Common-Size Balance Sheet?

A common-size balance sheet expresses every item as a percentage of total assets. This format helps compare companies of different sizes and analyze trends over time by standardizing financial data.

14. What Is a Provisional Balance Sheet?

A provisional balance sheet is an unaudited, temporary financial statement prepared before final accounts. It is commonly used for loan applications, internal reviews, or initial financial planning when audited figures are not available.

15. What Are Reserves and Surplus in a Balance Sheet?

Reserves and surplus represent the company’s accumulated profits, retained earnings, and funds set aside for contingencies or future growth. They strengthen a company’s net worth and support expansion plans or unforeseen expenses.

16. How to Calculate Debt from a Balance Sheet?

To calculate total debt from a it, add short-term borrowings (current liabilities) and long-term loans (non-current liabilities).

Total Debt = Short-Term Debt + Long-Term Debt

17. What Is the Formula of a Balance Sheet?

It’s formula is based on the fundamental accounting equation:

Assets = Liabilities + Equity

This formula ensures that the company’s financial position is always balanced and accurately recorded.