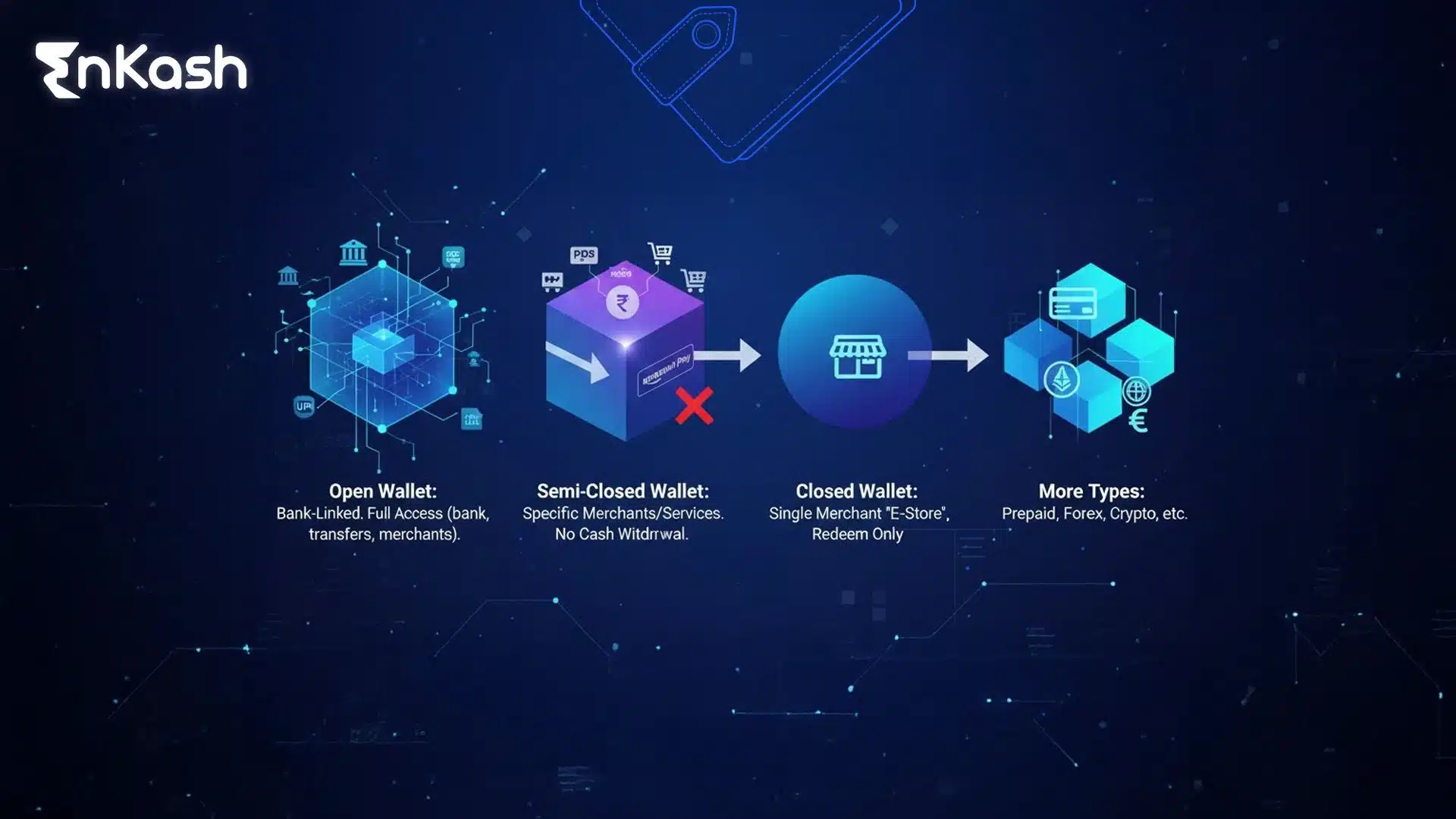

Digital payments in India feel natural for many people now, and this shift has encouraged users to look closely at how each wallet format behaves. A digital wallet acts like a pocket of stored value that helps move money without dealing with physical cash or card swipes. You load it with funds, link it to a bank account, or add money during a purchase, and the flow stays steady without extra effort. India supports several structures for wallet operations because different use cases call for different setups. This is why the market shows types of wallets that serve clear functions. An open wallet supports a broad range of transactions across many services. A semi-closed wallet works only within approved merchant networks that accept this form of payment. A closed wallet stays linked to a single brand account and supports tasks such as refunds or stored credits. People also see growing interest in formats such as crypto wallet, IoT wallet, white label Wallet, grey label wallet, and co-branded wallets, each offering a specific purpose within the digital journey.

This blog explains these formats in an easy way so readers understand what each wallet allows, why businesses prefer certain structures, and how these choices influence payment experiences in the Indian market.

How Digital Wallets Work in a Real Payment Environment

A digital wallet holds value in a secure digital space and helps people move money without relying on physical tools. It supports linked accounts, completes payments smoothly, and keeps the flow consistent. The experience feels familiar once a person uses it a few times, because the interface guides each step with clarity.

What a Digital Wallet Actually Does

A digital wallet keeps funds ready for everyday needs. People add money, link a bank account, or store payment details in a protected format. This setup works across shopping, travel bookings, utility payments, and small daily expenses. Balance updates appear quickly, and each transaction shows up in a simple view. These functions shape the base for many types of wallets used in the digital payment space.

How Wallets Operate Within the Payment Rail

Wallet platforms follow regulated systems that protect transactions from misuse. The structure ensures safe movement of money, accurate settlement for merchants, and a clear record for users. These elements support formats like the open wallet, which depends on broader access and reliable compliance.

Where Wallets Fit in Everyday Transactions

People use digital wallets in a wide range of situations. Someone may place a food order, pay for a ride, or complete a quick online purchase. A semi-closed wallet works well here because it operates within approved merchant networks and helps users complete payments without interruptions.

Why the Market Uses Multiple Wallet Types

Different needs create space for varied wallet structures. A closed wallet supports refunds or store credits within a single brand account. Someone managing digital assets may turn to a crypto wallet for controlled access. Smart devices handle micro payments through an IoT wallet. Businesses may select a white label Wallet, grey-label wallet, or co-branded wallets to build trust, retain customers, or streamline their systems. These formats serve different purposes, which is why types of e-wallets continue to evolve.

Primary Types of Digital Wallets in India

Different wallet formats support different payment needs, and each structure follows its own set of rules. These categories help people understand where a balance can be used, how widely it can move, and what kind of control a provider holds. The aim here is to break down the main groups in a clear and practical way.

Open Wallet

An open wallet gives users broad access across many services. People can pay merchants, send money to others, and move funds into a bank account when required. This structure supports a wide transaction range because the system is built for higher flexibility. Businesses choose this format when they want customers to rely on a wallet for everyday payments without feeling restricted.

Semi-Closed Wallet

A semi-closed wallet works within approved merchant networks that accept this form of payment. Users can shop, pay for digital services, settle rides, or use the balance for small purchases as long as the merchant is part of the supported list. This format suits situations where the focus is controlled acceptance, but still broad enough for regular spending.

Closed Wallet

A closed wallet links directly to a single brand account. It usually holds refunds, store credits, or prepaid balances created during purchases. People use it when they want quick access to funds that stay within that specific ecosystem. This setup helps brands maintain a clean flow for returns, cancellations, and rewards without depending on external channels.

Advanced and Emerging Wallet Categories

Digital payments now support several specialised formats that extend beyond the basic three wallet groups, and related ecosystems such as crypto assets also use wallet-like structures. These models serve new behaviours, smart devices, brand partnerships, and evolving digital assets. Each format sits in its own corner of the ecosystem and solves a specific requirement for users or businesses.

Crypto Wallet

A crypto wallet helps people manage digital assets through secure access controls. It stores private keys in a protected space and allows users to view, send, or receive supported tokens. People who explore long-term digital holdings rely on this format because it gives them a sense of direct ownership. The structure also keeps access separate from regular payment balances, which maintains clarity for users who handle both forms of value.

IoT Wallet

An IoT wallet supports payments triggered by connected devices. A smart appliance, a meter, or a vehicle can initiate a tiny transaction without manual input. This model suits environments where micro payments happen frequently and need steady automation. The design helps users avoid repeated steps, especially when devices handle the routine task on their behalf.

White label Wallet

A white-label Wallet allows a business to offer its own wallet experience using an existing infrastructure. The front end carries the brand identity, while the underlying system handles settlement, storage, and flow control. This setup works well for companies that want a quick launch, a seamless look, and a trusted backend without building every layer from scratch.

Grey label wallet

A grey label wallet uses a shared platform while giving the business moderate control over the customer interface. It sits between full branding and basic templated solutions. Small and mid-sized companies choose this option when they need a cost-friendly path to introduce wallet features, maintain a recognisable look, and handle customer activity without heavy technical investment.

Co-branded wallets

Co-branded wallets support partnerships between a financial institution and a commercial brand. The design blends shared rewards, streamlined spending, and familiar branding. Users benefit from a consistent experience linked to their regular shopping or service patterns. Businesses value this format because it helps build loyalty and creates a smoother loop between payments and repeat activity.

Business Logic Behind These Wallet Types

Every wallet model exists because it solves a different business requirement. Providers look at cost, user behaviour, merchant reach, and brand goals before choosing a structure. These decisions shape how the payment flow is designed and how customers interact with the balance.

Why Companies Choose a Specific Wallet Category

Companies select a wallet type that aligns with their product journey. A brand that wants full control may prefer a closed wallet, since it keeps refunds and credits within its environment. A platform that needs widespread acceptance may choose an open wallet for smoother spending across services. Businesses that focus on guided spending choose formats that suit structured use cases such as transit, online services, or controlled merchant networks.

Cost, Licensing, and Merchant Network Requirements

Each wallet category carries its own cost considerations. Broader models require stronger infrastructure, deeper compliance, and a wider partner network. Structured wallets, such as the semi-closed wallet, reduce these layers because their use is limited to selected merchants. Companies look at operational cost, volume expectations, and settlement needs before deciding on the format that works best for them.

Opportunities for Revenue and Engagement

Wallets help businesses create steady engagement. A brand using a co-branded wallet adds value with rewards and repeated spending loops. A company using a white label Wallet gets a branded environment without building the technical base. These decisions support wider goals such as customer retention, increased usage, and a smoother purchase journey.

Benefits of Digital Wallets for Users and Businesses

Digital wallets improve daily transactions for consumers and create practical advantages for service providers. The experience feels lighter for users, and businesses gain more control over their payment flow. Each benefit builds on simple design choices that help both sides interact with money in a cleaner and more predictable way.

Faster Payments and Smoother Checkouts

A digital wallet completes payments in a few steps and reduces the need for extra inputs. People pay faster because they rely on stored details or ready balances. This speed matters during online shopping, travel bookings, or routine Utility bill payments, where delayed responses disrupt the flow.

Secure Transactions and User Protection

Wallets store sensitive details in a safe format and use layered checks to protect the user. These security features help prevent misuse and strengthen trust during frequent transactions. People feel more confident when they know their information stays protected across different services.

Better Spending Insights

A digital wallet presents spending information in a clear view. People can see where money moves, track frequent purchases, and adjust habits when needed. This visibility supports better planning and gives users a sense of control over everyday expenses.

Rewards and Cashback Gains

Wallet providers attach simple reward structures to encourage steady usage. People gain access to partner offers, instant cashback, or brand credits based on their activity. These benefits add value during routine purchases and help users rely on the digital flow without feeling restricted.

Business Side Benefits: Retention and Lower Processing Costs

Businesses value wallets because they reduce friction during checkout and maintain a consistent customer loop. A smooth payment path lowers dropouts, supports faster conversions, and keeps users engaged. Companies also reduce processing costs by guiding parts of the payment cycle through their chosen wallet format.

Comparison of Major Wallet Types

A side-by-side view makes it easier to see how each wallet model differs in flexibility, control, and real-world usage.

Wallet Type |

Usage Scope |

Cash Withdrawal |

Merchant Acceptance |

Best Fit For |

Key Strength |

Open wallet |

Broad usage across supported services |

Allowed |

Wide network |

Users who want full flexibility |

Stronger access and wider utility |

Semi-closed wallet |

Limited to approved merchant networks |

Not allowed |

Controlled list |

Routine spends within supported platforms |

Balanced control and ease |

Closed wallet |

Single brand environment |

Not allowed |

Brand specific |

Refunds, store credits, prepaid balances |

Smooth handling of brand transactions |

Crypto wallet |

Digital asset management |

Not applicable |

Depends on the platform |

Users handling digital tokens |

Direct control over private keys |

IoT wallet |

Device-initiated micro payments |

Not applicable |

Automated use cases |

Smart devices and connected systems |

Continuous low-value transactions |

White label wallet |

Custom-branded environment |

Depends on setup |

Varies by partner design |

Companies seeking a branded wallet |

Fast launch with full brand presence |

Grey label wallet |

Shared platform with partial branding |

Depends on configuration |

Varies within the shared system |

Smaller businesses |

Lower cost with moderate control |

Co-branded wallets |

Joint brand and financial partner usage |

Depends on design |

Specific partner network |

Loyalty-driven ecosystems |

Rewards and repeat usage loops |

How to Choose the Right Wallet Type

People and businesses select wallet formats based on how they spend, what they sell, and the level of control they need. Each model suits a different pattern, so the choice depends on clarity around daily habits and long-term goals.

Factors for Individual Users

People look for convenience first. Someone who shops across many platforms feels more comfortable with formats that offer wide acceptance. A semi-closed wallet works for those who stay within a familiar group of services. A closed wallet helps when refunds or store credits need quick access during repeated purchases. Users who explore digital assets may rely on a crypto wallet for secure handling of their tokens. A person using connected devices benefits from an IoT wallet, since it supports automated micro payments without repeated steps.

Factors for Businesses and Fintech Builders

Companies choose a format that aligns with their service design. A brand that wants tight control over refunds and loyalty activity may introduce a closed wallet to keep funds within its system. A business that needs a broader reach may look at the structure behind an open wallet. A provider that aims for faster deployment and a full brand experience may select a white label wallet, while a smaller firm may turn to a grey-label wallet to balance cost and customisation. Partners seeking loyalty-driven engagement use co-branded wallets to create shared rewards and smoother spending loops.

How Wallet Technology Is Evolving

Digital wallets continue to adapt as payment behaviour shifts and new technology shapes how people manage money. Each advancement pushes providers to refine security, expand utility, and support new ways of spending. The next phase focuses on connection, automation, and deeper trust.

Interoperable Wallet Ecosystems

Interoperability aims to create smoother movement between payment tools. A user could move funds or complete a transaction without switching between separate environments. Providers see value in this direction because it reduces friction and makes the wallet feel more universal. This level of connection supports both simple purchases and long term digital planning.

Convergence with Account Based Payments and Tokenisation

Wallets are moving closer to account-based systems that streamline how money flows. Tokenisation strengthens this shift by protecting sensitive details during every step. These layers help users feel safer while they pay through familiar channels. The change also supports wallet formats that need tighter checks such as an open wallet or a semi-closed wallet.

Growth of Device-Led Payments

Machine-initiated payments create a new space for micro transactions. An IoT wallet supports this flow because it handles tiny amounts sent by connected devices without user intervention. Growth in smart appliances, mobility systems, and automated services pushes this model forward.

Blockchain Backed Wallet Structures

Some providers explore blockchain-based structures to increase transparency and strengthen access control. A crypto wallet fits into this path because it manages digital tokens under user-controlled keys. As digital assets expand, this model creates room for more advanced formats built on distributed systems.

Why Wallet Choices Matter in a Digital Economy

Digital payments feel smoother when people understand the types of wallets that support their daily activities. Each format influences how money moves, how fast a payment settles, and how much control a person or business holds during a transaction. Some models give wider freedom for routine spending, while others maintain structure within a defined space.

This range helps users choose a setup that fits their habits and gives businesses the ability to shape payment flows that match their service goals. Clear distinctions between wallet formats also help customers manage refunds, store value safely, and use connected devices without extra steps. As digital behaviour grows stronger and more integrated across services, wallet systems will continue to evolve. New designs will focus on safety, steady performance, and a better balance between convenience and control. These changes will guide both individuals and companies toward cleaner, more reliable digital payment experiences.

FAQs

1. How does a digital wallet store money securely?

A digital wallet protects stored value through layered checks, controlled access, and protected data pathways. The system keeps payment details in a safe environment, updates balances in real time, and prevents misuse through device verification. These elements help users trust the wallet during frequent transactions.

2. Can a digital wallet replace a physical card for daily spending?

Yes, it can handle most everyday payments. People complete purchases, pay transport fares, and settle small online transactions without using a card. This shift reduces the need to carry physical tools and creates a faster flow during routine spending moments.

3. What makes the types of wallets different from each other?

Each category supports a different scope. Some formats allow broad transactions across many services, while others work inside controlled merchant networks or a single brand environment. These structures help people choose a wallet that matches their payment patterns and comfort level.

4. Do wallets have spending or balance limits?

Most providers set limits to keep the system safe and predictable. These limits adjust based on verification levels, the nature of the service, and the provider’s internal policy. Users can check these caps inside the wallet to plan their spending comfortably.

5. Can digital wallets be used for recurring payments?

Yes, many wallet systems support recurring billing. Users can pay for streaming services, digital subscriptions, and routine utilities without repeating the setup. This feature helps maintain consistency and reduces friction during monthly payments.

6. How do merchants benefit from wallet-based payments?

Merchants see fewer dropouts, faster checkouts, and better customer engagement. Wallet users complete transactions with fewer steps, which raises the chance of a finished purchase. The structure also helps merchants handle refunds, credits, and small payments smoothly.

7. Can someone use a digital wallet without linking a bank account?

A person can use certain wallet formats by adding money through supported loading methods. The experience may be limited, but it still works for smaller purchases and brand-specific spending. Linking an account expands the range of transactions and makes the flow more flexible.

8. Are digital wallets safe during high-volume events like sales or festival shopping?

Yes, they are built to handle sudden spikes in demand. Wallet providers scale their systems during large events to prevent delays. This preparation helps users complete purchases without disruptions, even when transaction volumes rise sharply.

9. What happens if a transaction fails in a digital wallet?

A failed transaction usually moves into a review cycle where the system checks settlement records, verifies the payment path, and confirms whether the amount has left the user’s balance. If the funds remain unprocessed, the wallet restores the amount automatically. In rare cases where extra time is required, users can view the status in their transaction history or contact support. Providers use strict checks to ensure a clean reversal.

10. Why do businesses offer rewards through wallet transactions?

Businesses use rewards to build regular engagement and create familiar spending patterns. Cashback, points, and partner credits encourage users to return to the same platform because the experience feels more valuable with every purchase. These incentives help brands strengthen loyalty, increase transaction frequency, and guide customers toward repeat behaviour. The reward cycle benefits the user as well, since routine payments provide small gains over time.