Introduction

Seamless and secure transactions are key reasons businesses are switching to cashless payment systems, now the norm in today’s digital economy. A white label wallet facilitates this transition by providing the means for companies to introduce their own branded digital wallet without the hassle of technology development from scratch. It helps businesses unlock deeper customer engagement by providing personalized payment solutions and then building trust with them. In addition to startups, A white label wallet lets an enterprise offer branded payments, loyalty, and transfers by partnering with an RBI-authorised PPI issuer, so the enterprise controls the UX while the licensed issuer operates the regulated wallet. Let’s examine the meaning, benefits, and the leading white label wallet solutions in India.

White-Label Wallets in India: Meaning & Benefits

What is a White Label Wallet?

A white label wallet is a co-branded wallet offered via a licensed issuer, with permitted use cases (merchant payments, P2P, bill pay) and RBI-defined limits. It’s a pre-built white-label wallet solution that eliminates building complex tech from scratch and saves the company both time and resources. With a white label digital wallet, businesses can introduce a broad set of financial services like money transfer, utility bill payment, online shopping, loyalty programs, etc., all under their company name. Not only does this increase customer trust, but it also makes the whole payment process very smooth. Demand for white-label PPI wallets in India spans fintech, retail, education, and telecom, driven by faster go-to-market and brand-controlled UX. A white-label e-wallet solution gives both startups and established companies a way to gain access to the digital payments market quickly while having complete control over the user experience.

It is the combination of convenience, security, and innovation that allows companies to grow without any limitations. It’s an efficient way to build a secure, flexible, feature-rich digital payment ecosystem under your brand.

Benefits

A white label digital wallet solution is a great choice for businesses that wish to enter the digital payment arena, as it has many advantages. It simplifies financial operations and improves customer experience, brand visibility, and long-term growth. By adopting a white-label digital wallet, companies can drastically save time and resources while providing a smooth, safe, and personalized payment experience.

We will now look closely at the most significant advantages:

- Faster Market Entry

The introduction of a white label wallet solution enables companies to enter the market in a matter of weeks instead of spending months building from scratch. The ready infrastructure allows brands to invest more of their efforts in marketing and user experience rather than tackling development issues. - Cost-Effective

Payment platform development can be a costly and lengthy process. A white-label wallet reduces costs by providing a configurable, ready system. Vendors typically handle maintenance and security updates, and thus, the company’s running cost is further lowered. - Brand Customization

A unique brand is what each company aims for. With a white label wallet, the firms can customize everything, from app layout and color scheme to UI, ensuring customers experience the intended brand. - Regulatory Compliance

Regulatory compliance in India means operating under RBI’s PPI Master Directions, following KYC/AML rules, and meeting PCI DSS requirements where cardholder data is processed. Secure transactions are a result of this compliance, and the users and the regulators’ faith in the wallet is also assured. - User Trust and Security

User trust improves when providers implement multi-factor authentication, encryption, transaction monitoring, dispute redressal, and RBI-mandated controls. Users are more inclined to trust a payment system that is both safe and from a well-known brand.

Selecting the most suitable white-label wallet can assist businesses in streamlining their processes, winning customers over, and providing pristine digital payment experiences that are well integrated.

Popular Types of White Label Wallet

There are multiple white-label wallet types designed for specific business needs. Whether it is a mobile application, a web-based system, or an enterprise solution, these wallets are there to help organizations with payment processing in a simple and effective manner. Now, let’s examine the most popular types of wallets more closely:

White Label Mobile Wallet App

A white-label mobile wallet lets users pay, transfer, earn rewards, send money, and get rewards right from their mobile phones. It is very suitable for companies that want to provide very convenient payment solutions. Mobile wallets will incorporate many different functionalities like QR code payments, loyalty points, and instant refunds. This helps startups and fintechs go to market quickly in a cash-light economy.

Online Wallet White Label

An online white-label wallet that allows users to purchase products and services online without revealing their credit card information. This wallet type is usually associated with online retail transactions, service providers, and digital marketplaces. It provides users with both security and ease of use if they prefer payment via web browsers instead of mobile apps.

White-label e-wallet

White-label wallets can integrate UPI rails (for UPI-linked flows) and PPI rails for wallet balances, depending on the use case and regulatory scope. It is a one-stop solution for companies that want to offer a full financial ecosystem under their brand.

All these white label wallets are effective in promoting cashless, convenient, and secure transaction methods. No matter if your business is in retail, finance, education, or travel, the right white label e wallet can improve customer satisfaction, speed up your processes, and maintain customer loyalty. Using these wallets is about making digital transactions quicker, safer, and more intimate—just the way customers expect in the interconnected world of today.

Use Cases of White Label Wallet

In recent years, the adoption of white-label wallet solutions in India has accelerated due to the country’s digital engagement. Companies from various industries are adopting digital wallet white label technology for faster, easier, and more secure payments. Such facilities assist firms to automate their financial processes, improve the service offered to customers, and boost customer loyalty—all this, while retaining control over branding and features. The applications of white label digital wallet solutions are not only for large corporations but also for fintech startups.

Now, let us see some of the most common applications:

- Fintech Startups

Fintech firms characterize rapid and cutting-edge technology. A white-label digital wallet allows a startup to develop its own application for payments quickly, without incurring huge development costs. These wallets can facilitate P2P transfers, bill payments, and merchant payments. - Corporate Expense Management

Many firms use white-label wallets to manage internal payments, such as reimbursements for employees, travel expenditures, and payments to suppliers, more efficiently. It reduces manual paperwork and provides real-time transaction visibility. If companies add such wallets to their systems, they can make accounting easier and increase efficiency. - Retail and E-Commerce

To increase customer interaction, retailers and e-commerce portals are going for white label solutions of online wallets. All the transactions, like managing loyalty programs, gift cards, cashback, and even quick refunds, will be done through the customer’s brand interface. This encourages the customers to come back and, at the same time, gives the business a better chance at customer retention. - Education and Healthcare

The digital white label wallet solutions are the schools, colleges, and healthcare facilities’ way of streamlining their payments for fees, bills, and other services. Parents or patients could pay online, thereby eliminating the need for cash, which also reduces queues and cash handling.

White Label Wallet SDK and API Integration

A white label wallet solution that comes with robust SDK and API integration support is a lot more powerful. SDK (Software Development Kit) is a collection of tools that developers can use to effortlessly integrate wallet capabilities into an already existing app or system without rebuilding the app. The whole process of creating a white-label mobile wallet gets simplified, allowing for the quick integration of fundamental features such as safe payment processing, transaction tracking, and KYC verification. Similarly, APIs connect the wallet platform with payment gateways, banks, loyalty, and analytics systems that link the digital wallet white-label platform with payment gateways, banks, and other third-party systems such as loyalty programs or analytics tools. This continuous communication between the various services assures that all the transactions are done securely and in real-time. For businesses, this kind of integration brings in the capability to expand, customize, and innovate according to their requirements without affecting the existing ecosystem. It also guarantees the protection of the data by facilitating encrypted data exchange and adherence to industry standards. SDKs and APIs help companies launch a white-label digital wallet faster.

Best White Label Wallet Providers in India

India has become a rapidly growing market for white label wallet solutions, and it is very attractive to fintech companies that have decided to take the plunge with secure, customizable, and feature-rich platforms. By making this move, they have ensured that the businesses are there in the digital payments space without worrying about infrastructure, regulations, or technology development. Factors like scalability, ease of integration, security standards, and compliance with RBI regulations play an important role in deciding the best white label wallet. The following are some of the most esteemed and favored suppliers in India, recognized for their creativity and dependability.

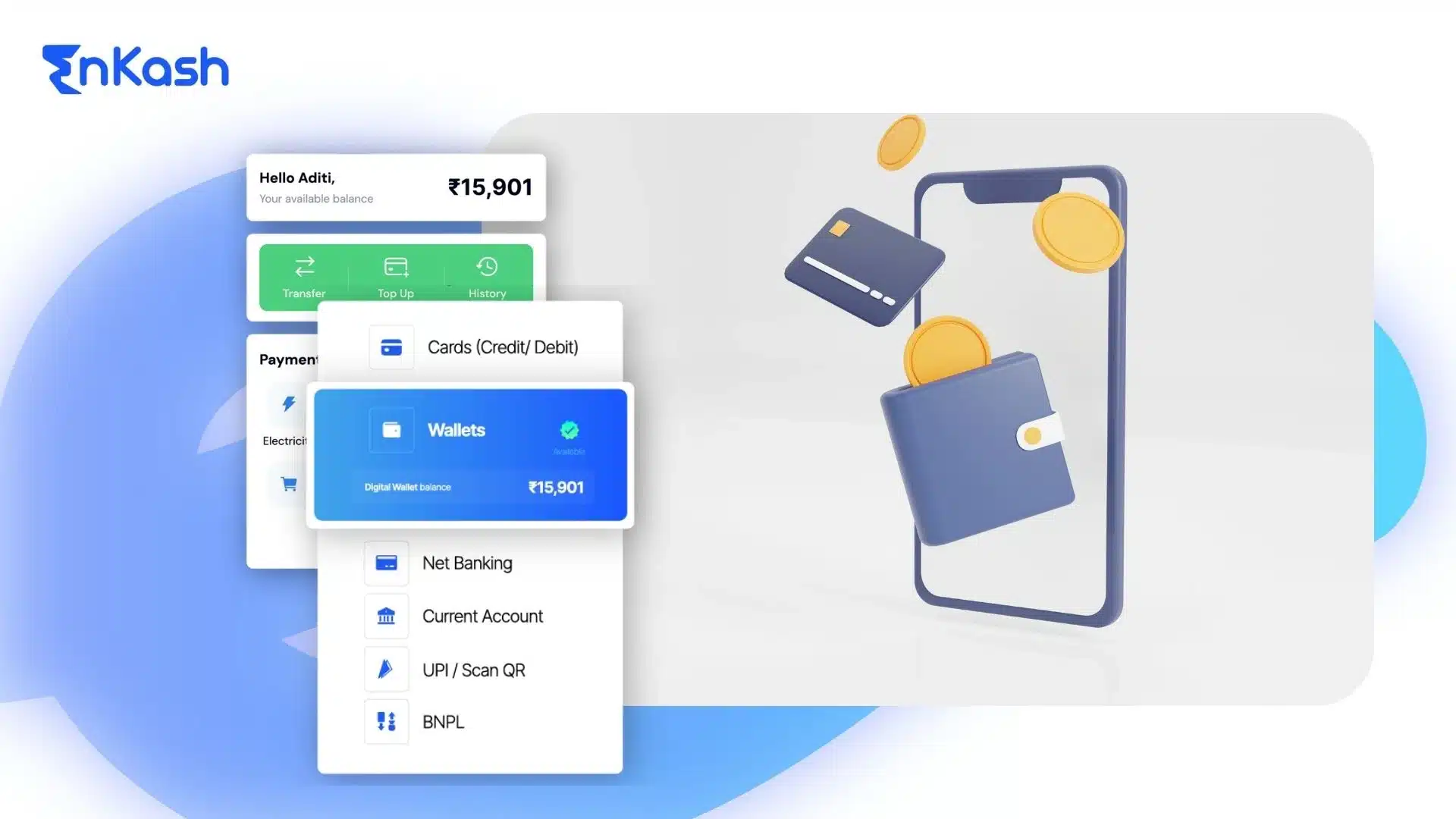

EnKash

EnKash empowers businesses to build and launch their own co-branded digital wallets through its Wallet-as-a-Service (WaaS) platform—built on a fully licensed, compliant, and API-first foundation. With RBI-authorized PPI and PA/PG licenses, enterprises and startups can instantly access regulated wallet infrastructure without spending months on approvals or technology setup.

Designed for scale, EnKash’s wallet platform seamlessly integrates card issuance, payments, settlements, and expense management—all under your brand identity. From customer onboarding and merchant payouts to reimbursements and loyalty programs, every wallet use case is covered within one ecosystem.

With PCI-DSS-certified infrastructure, AI-driven fraud intelligence, and enterprise-grade encryption, EnKash ensures compliance and trust at every step. This makes it the preferred co-branded wallet partner for businesses aiming to launch secure, scalable, and branded payment experiences across India.

Paytm for Business

Paytm for Business offers digital wallet white label services under which brands get to create their own payment ecosystem. Besides that, the company is also allowing the use of functionalities such as peer-to-peer payments, UPI, and transactions with merchants. For one, the platform is backed by Paytm, the brand known for its strong presence in the digital space and a wide-reaching network, hence it enjoys a huge trust factor.

Open Money

Open Financial Technologies offers API-driven financial integrations; verify white-label wallet issuing availability and RBI PPI authorisation before onboarding. It is basically a very good solution for those startups and small and medium-scale businesses that tend to have wallets combined with other banking services.

MobiKwik and Razorpay

Evaluate MobiKwik and Razorpay for payment infrastructure and APIs; confirm whether white-label PPI-wallet issuing is offered under RBI authorisation. They provide excellent APIs and compliance support, making it possible for businesses of any size to receive the necessary flexibility.

There are many advantages of opting for a trustworthy provider like EnKash, and the most significant ones are that it delivers a compliant, scalable white-label wallet solution when operated under an RBI-authorised program with proper controls.

Conclusion

In conclusion, a white label digital wallet is an entry point to digital payments—businesses can launch quickly without the trouble of building technology from scratch. It gives total customization, smooth integration, and an uninterrupted payment experience in your brand name. By selecting the top white label wallet, firms can offer secure and easy-to-use payment solutions that foster customer trust and loyalty. The business models of a cashless economy are such that companies like EnKash can quickly and effortlessly roll out their own digital wallet white label solution and remain in the game. White-label wallets are a proven path to simple, secure, growth-ready payments when operated under RBI-authorised programs.

FAQs

1. What does white label wallet mean?

A white label wallet is a fully ready-to-go digital payment solution that companies can rebrand and use as their own.

2. What are the advantages of a white label digital wallet solution for businesses?

It offers great time and money savings, and the market entry is speedy with full brand personalization.

3. Which white-label wallet providers should I evaluate in India?

Solutions such as EnKash are considered to be one of the leading white label wallet solutions in India with a blend of security, adaptability, and regulatory compliance.

4. What precautions are taken for the white label digital wallets in terms of security?

Security depends on provider controls; look for encryption, MFA, fraud monitoring, PCI DSS, where applicable, and RBI KYC/AML compliance

5. What should be my criteria for selecting a white label wallet provider?

Seek out the providers that provide hassle-free integration, the highest security, vast scalability, and adherence to Indian regulations like RBI’s guidelines and KYC requirements.