When you top up a wallet, you add a certain amount of money to a digital account before spending it. The wallet stores this balance, which can be used later for supported transactions like online payments or shopping. Transfers are allowed only in full-KYC semi-closed or open wallets. It functions similarly to a prepaid payment method, where you load value before spending it.

A rechargeable wallet gives you the flexibility to pay instantly without entering your bank details every time. The stored money acts as a ready fund for small and frequent transactions. This makes it easy to manage payments for bills, groceries, and travel tickets from a single place.

In simple words, a wallet top-up means loading digital cash into your account. You can do this using your bank account, debit or credit card, or through a UPI transfer. Each time you top up, the wallet updates your balance, and you can use it for any supported transaction.

Evolution of Wallet Systems in India

Digital wallets have evolved quickly in the last decade. In the beginning, users had to manually add money through net banking or cards. Today, you can top up your wallet directly through UPI or automatic balance recharges.

The shift gained momentum when mobile payments became mainstream. The Reserve Bank of India introduced clear rules for prepaid payment instruments, which made wallet usage more secure and transparent. Full-KYC wallets now allow higher wallet top-up limits and faster transfers.

As the digital ecosystem matured, wallet services became more than just payment tools. Some wallets now connect with UPI, loyalty programs, and partner services that support small financial products. For millions of users, topping up a wallet has become a routine part of digital living.

Main Methods to Add Money to the Wallet

Adding money to a digital wallet is simple, but the method you choose can affect how fast the balance updates and what charges apply. Each wallet supports multiple ways to load funds. Here are the main methods you can use to add money to a wallet in India.

Bank Account or Net Banking

The most direct way to top up a wallet is through a linked bank account. Almost every wallet app allows you to add money using Net Banking. You simply log in, choose your bank from the list, enter the amount, and confirm the transfer through your bank’s secure page.

Once the transaction goes through, the wallet updates the balance instantly. Some users prefer this method because it connects directly to their account without saving card details. For larger transfers, Net Banking provides a stable and traceable option.

Debit and Credit Card

You can also recharge your wallet using your debit or credit card. This method suits users who want quick access without setting up UPI or Net Banking. You enter your card details, specify the amount, and authenticate with a one-time password.

The transaction usually reflects within seconds. Some wallets may place limits on the number of card transactions per day or charge a small fee for credit cards. However, for users who use cards frequently for online payments, this method feels natural and reliable.

UPI Transfers and Linking

A popular way to top up an e-wallet today is through UPI. Every major wallet app now supports UPI transfers, allowing users to load money directly from their bank using a UPI ID. The process is straightforward: enter your desired amount, select your UPI-linked account, approve the payment, and your wallet balance updates instantly.

UPI top-ups are secure, quick, and do not involve service fees in most cases. Users who prefer instant transactions for small amounts often rely on this feature. It has made wallet top up as simple as sending a message.

Cash or Partner Reload Points

Some wallets, especially specialized or semi-closed PPIs, may allow cash loading through authorized partners, depending on RBI rules and the provider’s policy. This method benefits users who do not use online banking or prefer paying in cash.

To use this service, you visit a listed partner location, provide your registered number, pay the cash, and the wallet reflects the updated balance shortly after. This method keeps wallet use inclusive for all customers, even those with limited access to digital payment tools.

API-Based or Business Integrations

Certain platforms and enterprises use wallet recharge API integration to automate balance updates. Businesses can use recharge APIs to automate balance additions, provided these flows comply with RBI KYC and PPI norms.

This method is more technical but essential for digital businesses. It ensures that funds are added to customer wallets instantly when they make payments or claim rewards. For consumers, it means smoother transactions and no waiting time for manual wallet top-ups.

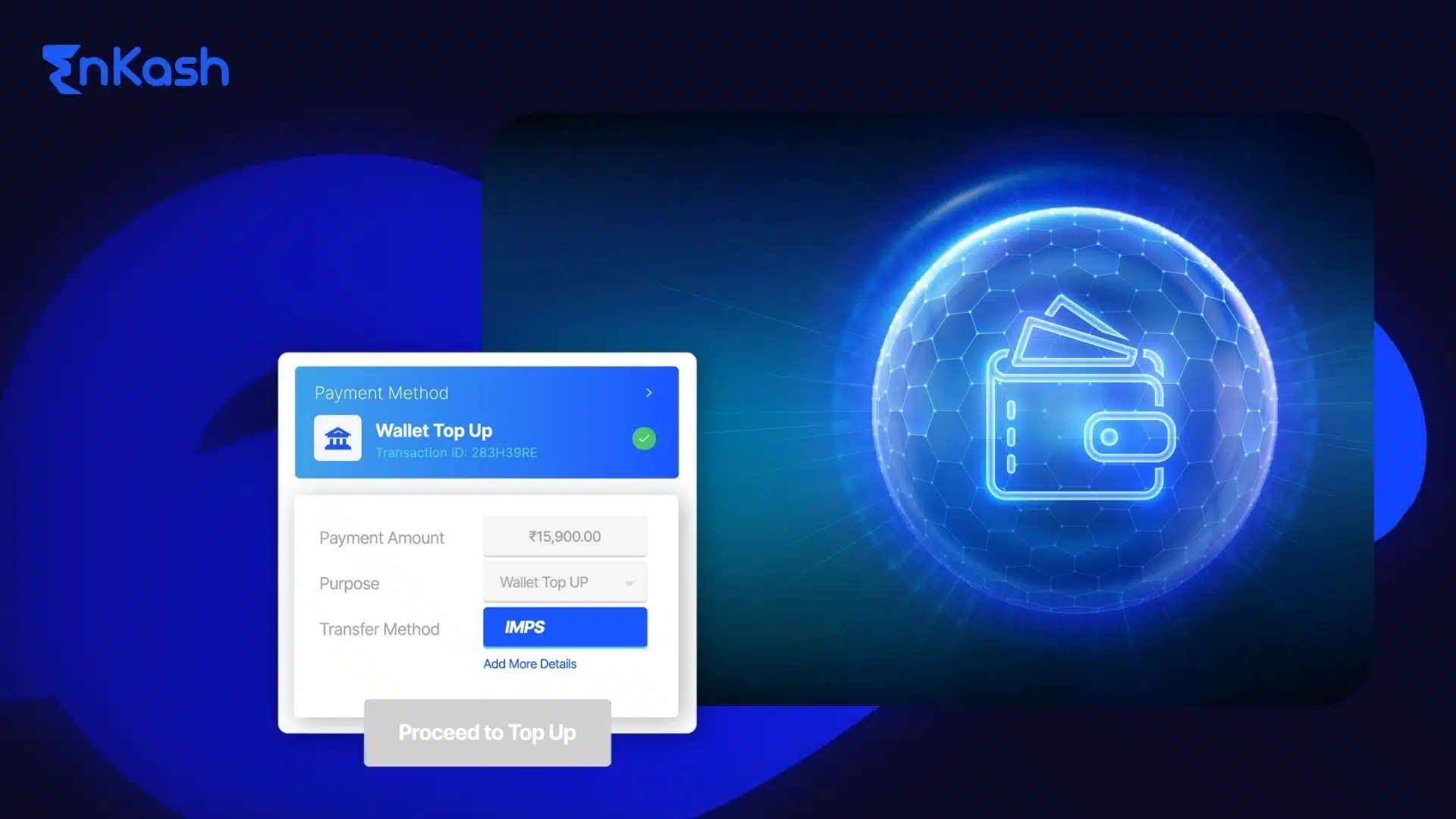

Step-by-Step Guide to Wallet Recharge

Recharging a digital wallet is easy when you know the right steps. Every platform may look slightly different, but the process remains similar. Below is a clear guide showing how to recharge a wallet safely and efficiently using the most common methods.

Preparing Your Wallet

Before you begin, make sure your wallet account is fully set up. Most wallets require identity verification before allowing higher balance limits. Complete your KYC process if it is pending. Link your bank account or debit card so that future top-ups are quick.

Next, create a secure password or biometric lock for the app. Check your internet connection, update the wallet to the latest version, and ensure your bank account has a sufficient balance. These steps help avoid payment failures when you add money to the wallet.

How to Add Money Using UPI Wallet

UPI is one of the most convenient ways to load funds. Here is how you can add money to your wallet using a UPI wallet:

- Open your wallet app and tap on “Add Money” or “Top Up.”

- Enter the amount you want to add.

- Select “UPI” as your payment option.

- Choose the linked bank account or enter your UPI ID.

- Confirm the transaction through your UPI app.

- Wait for the success message, then check your updated balance.

The transfer usually takes just a few seconds. UPI does not charge for wallet top-ups, and the transaction reflects immediately. If you plan frequent top-ups, you can enable auto-pay options within some wallet apps.

How to Add Money Using Card or Bank Account

You can also top up your wallet directly through your bank account or card. Here’s how:

- Go to the “Add Money” option in your wallet.

- Select “Bank Account” or “Card” as the payment mode.

- Enter the desired amount and choose your linked account or card.

- Authenticate using an OTP or PIN.

- Wait for the transaction confirmation and view your updated balance.

This method works best for users who prefer traditional banking channels. It gives flexibility and ensures reliable transfers, particularly when topping up large sums.

Troubleshooting Top-Up Issues

Sometimes, a wallet recharge online might not reflect immediately. This can happen due to a slow network, bank downtime, or payment gateway delay. When that occurs, check your transaction status in both the wallet and bank app.

If money is deducted but not added, wait a few minutes. Most wallets auto-reverse failed transactions within a short time. If the delay continues, contact the wallet’s customer care with your transaction ID.

Always double-check the top-up amount before confirming a payment. Never refresh the page or close the app during a transaction. Keep screenshots or reference numbers until the balance appears. These small steps ensure every wallet top-up stays safe and smooth.

Read more: How to check UPI Transaction Status?

Wallet Top-Up Limits, Fees, and Regulations

Digital wallets are regulated under the Reserve Bank of India’s prepaid payment instrument framework. This ensures that wallet recharges and fund transfers happen within safe and defined limits. Understanding these limits and charges helps you manage your transactions better and stay compliant with the rules.

Top-Up Limits in India

Each wallet operates under guidelines set by the RBI. A basic wallet, created without full identity verification, allows smaller transactions and lower balances. Once you complete your full KYC process, the top-up limit in India increases significantly.

Full-KYC wallets can hold balances up to ₹2,00,000, as per RBI’s latest PPI guidelines. The exact figure may differ slightly among wallet providers. Some wallets also set daily or monthly loading limits to prevent misuse or fraudulent activities.

Users can track their remaining limit in the app itself. It is wise to check this before you top up your wallet, particularly if you are adding large amounts or making multiple recharges in a day.

Fees and Charges

Wallet top-ups are mostly free when you use a UPI or bank transfer. These methods are encouraged because they involve direct and verified banking channels. However, adding funds through a credit card may involve a small convenience charge, which varies across providers.

If you use a third-party platform for wallet recharges, make sure to check for service fees before confirming payment. Some platforms charge a nominal processing fee, especially for international cards or business accounts. A clear look at the transaction summary helps avoid surprises later.

For regular digital payment users, bank-based recharges are the most cost-effective way to maintain a wallet balance.

RBI and PPI Guidelines

Every digital wallet in India functions under the prepaid payment instrument (PPI) model regulated by the RBI. These guidelines protect users by setting clear conditions for wallet creation, top-up processes, and fund transfers.

The rules require all wallets to perform KYC verification, maintain detailed records, and follow data security standards. Each provider must also report suspicious or irregular transactions. These measures keep digital wallets safe and transparent.

For users, it means that their online wallet recharge activity is backed by proper compliance and monitoring. It also ensures that every transaction follows a controlled flow from the bank to the wallet account.

Security and Fraud Prevention

Safety is central to digital wallet use. Always use your wallet’s official app, and never click links from unknown sources for recharges or refunds. Use secure passwords or biometric verification. Avoid public networks when performing a wallet top-up.

Check your transaction history frequently and enable alerts for every recharge. If you notice any unauthorized activity, contact the wallet provider’s support team immediately.

These habits, along with RBI’s safety framework, create a dependable environment.

Read More: RBI PPI’s Guidelines

Choosing the Right Recharge Wallet App in India

There are many digital wallets available today, each promising fast transactions and reliable service. Choosing the right one depends on how you use the wallet, how often you recharge, and which features matter most. The right app should be easy to use, secure, and flexible for your lifestyle.

Evaluation Criteria

Before downloading any wallet, check its recharge options and top-up experience. A good recharge wallet app Indian users can rely on should allow quick UPI transfers, instant refunds, and smooth tracking of past transactions. Look for wallets that clearly display your limits, balance, and recharge history in one place.

Security is equally important. Choose a wallet that uses verified logins, one-time passwords, and biometric access. Check if it offers customer support for failed recharges or delays. A transparent app gives you full control over how you add money to your wallet without unnecessary steps.

You should also review cashback offers, loyalty points, or integrated bill payment features. These can make each wallet top-up more rewarding if you use the app regularly. However, focus on the reliability of transactions before the offers.

Major Wallet Apps and Their Recharge Features

Several wallets have built strong reputations across India’s digital payment space. Paytm, PhonePe, Amazon Pay, Google Pay, and MobiKwik are among the most widely used. All of them allow users to recharge wallet balances through UPI, debit card, or Net Banking.

Paytm and MobiKwik support direct balance loading for small daily purchases. Amazon Pay integrates with your shopping account and supports instant UPI transfers. PhonePe and Google Pay link directly to bank accounts and provide cashback rewards.

Each wallet varies in top-up speed, limit, and user interface. For most users, UPI-based recharges work best because they are quick, secure, and free of additional charges. If you use cards for payments frequently, pick a wallet that supports automatic card recharges or scheduled top-ups.

Suitability by User Type

Different wallets fit different needs. Regular shoppers may prefer wallets that offer cashback or coupons. Daily commuters might choose those that integrate with MetroCards or utility services. Business users could prefer wallets with wallet recharge API integration and detailed transaction analytics.

If your focus is convenience, pick a wallet that allows direct UPI linking without separate steps. If your goal is better financial tracking, go for one that provides downloadable statements and real-time alerts. For those managing larger sums, a full-KYC wallet ensures higher top-up limits and better transfer flexibility.

Wallet Recharge API Integration for Businesses

For companies managing prepaid systems or digital credits, wallet recharge API integration automates balance updates securely and in real time. Businesses can embed these APIs into their platforms so customers can top up wallet balances instantly after payments or loyalty rewards. The process involves authentication, fund transfer, and callback confirmation, ensuring accuracy at scale. Strong encryption, RBI-compliant KYC checks, and audit logs keep transactions protected. This integration saves time, reduces manual errors, and improves user experience. As digital commerce expands, automated wallet APIs are becoming a key feature for businesses that handle frequent customer recharges.

Conclusion

Topping up a digital wallet has become a normal part of daily payments in India. The process is quick, safe, and supported by multiple options such as bank transfers, cards, and UPI. A rechargeable wallet helps manage money efficiently while maintaining full control over spending. Users benefit from instant access, transparent records, and secure transactions. Businesses gain automation through wallet recharge API integration. With clear RBI regulations and modern technology, digital wallets continue to build trust and convenience. Choosing the right platform ensures every wallet top-up stays smooth, reliable, and ready for the next transaction.

FAQs

1. What is the difference between a wallet top-up and a bank transfer?

A wallet top-up means adding money to a stored digital balance, while a bank transfer moves funds directly between two accounts. The wallet balance acts like prepaid credit. It allows quicker small transactions without re-entering bank details every time, making everyday payments more convenient and controlled.

2. Can I use any bank to add money to a digital wallet?

Yes, most digital wallets in India allow transfers from any major bank. Once you link your account, you can add funds through UPI, Net Banking, or debit card. However, some wallets may require full KYC verification before accepting funds from different banks or setting higher top-up limits.

3. How long does it take for a wallet recharge to reflect?

Wallet recharges through UPI or debit card usually reflect within seconds. If you use Net Banking, it may take a few minutes depending on the bank’s response time. In rare cases, server delays can extend the wait. If the amount doesn’t appear, most wallets auto-reverse the transaction within a short period.

4. Are there any limits on how much I can top up my wallet in a month?

Yes. Limits depend on your wallet’s KYC status and provider policy. Basic wallets allow smaller amounts, while full-KYC wallets can hold up to one lakh rupees or more. Check the “balance limit” or “top-up limit” section in your app before adding money to avoid exceeding your allowed threshold.

5. Can I use a credit card to add money to my wallet?

Most wallets accept credit cards for loading funds, though a small convenience fee might apply. It’s useful when you want flexibility or reward points from your card issuer. However, you should review your wallet’s fee policy since not all providers support credit cards for regular top-ups.

6. Is it possible to schedule automatic wallet top-ups?

Some wallets offer an auto top-up feature that adds money automatically when your balance drops below a chosen limit. It’s especially useful for users who make daily payments. You can enable this through the wallet’s settings and link it to your preferred UPI or bank account for seamless recharges.

7. What happens if my wallet top-up fails but money is deducted?

If a wallet top-up fails, do not worry. Most wallets automatically refund the deducted amount within a few minutes or hours. You can check the transaction ID in your app or bank statement. If the refund does not appear, contact customer support with the payment reference details for quick resolution.

8. How secure is it to recharge a wallet online through public Wi-Fi?

It is unsafe to make wallet payments on public Wi-Fi networks. These networks can expose sensitive data like passwords or OTPs. Always use a private internet connection and avoid clicking on links claiming instant recharges. Secure apps with multi-factor authentication protect your wallet top-up transactions from unauthorized access.

9. Can I transfer the wallet balance back to my bank account?

Yes, some full-KYC wallets allow transferring unused balance back to your bank account, depending on the provider’s policy. The process involves selecting “Transfer to Bank,” entering the amount, and confirming through authentication. Some wallets may apply a small fee for this service, while others provide free withdrawals for verified full-KYC users.

10. How can businesses benefit from wallet recharge API integration?

Businesses use wallet recharge API integration to automate balance updates, offer loyalty rewards, and manage customer payments efficiently. It reduces manual intervention and errors while ensuring instant fund allocation. This technology helps merchants maintain seamless user experiences, especially for prepaid services or subscription-based platforms that handle frequent transactions.