The Role of Payment Methods in Checkout Flow Success

In an e-commerce business, your checkout page is where intent becomes action. This is where buyers finally decide whether they trust your process enough to complete a transaction. A poorly designed checkout experience can undo all the effort that went into product discovery, cart selection, and offers. Among the many factors that influence this step, the most critical is the variety and reliability of payment methods available to the user.

To put it simply, what is a payment method? It refers to the instrument or channel a buyer uses to complete their purchase. These may include debit cards, credit cards, mobile wallets, net banking, UPI, or even pay-later solutions. Each customer may have a preferred digital payment method, and forcing them into a single option increases the risk of drop-offs.

A checkout experience that limits the customer to just one or two modes is no longer acceptable in India’s diverse market. This is where multiple payment methods become important. The ability to choose how to pay is no longer seen as convenience. It is now considered basic hygiene. In fact, having multiple payment options in checkout can influence a customer’s perception of brand trust, tech readiness, and even reliability.

India has quickly moved into a world dominated by real-time digital transactions. With the rise of UPI, tokenised card networks, and mobile-first interfaces, the ecosystem of payment methods in India has expanded to include dozens of safe and verified channels. Consumers are no longer relying on a single app or a default method. They compare offers, test gateway speeds, and prefer options that do not fail.

To match this behavior, e-commerce platforms need to revisit how they structure their checkout payment flow. The focus should not be on just plugging in rails. The goal should be to offer the most relevant checkout page payment options that align with the user’s intent, device, and location.

Adding more than one electronic payment method is not just about adding more code. It is about creating a seamless and stable flow where different user segments can find what they need without switching to another site. The next few sections will show how to build this system correctly.

Read more: QR Code Payments in India: UPI, Contactless Solutions, and Secure Payment Practices for SMBs

Navigating the Payment Universe in Indian E-Commerce

Understanding the landscape of payment methods in India starts with recognizing how fast the digital economy has evolved. A few years ago, most buyers were still using cash or card-based transactions. Today, the range of available options includes QR-based UPI, tap-to-pay cards, mobile wallets, EMI at checkout, and app-linked BNPL offers. Each of these is an example of a specific e-payment method built for a particular use case or user preference.

The shift from physical cash to electronic transactions has introduced multiple digital payment methods that now dominate the online space. In fact, UPI alone contributes to billions of monthly transactions across all categories. Wallets and net banking are still active in specific user brackets, and the increasing use of credit for small-ticket purchases has made pay-later models popular even in non-metro areas.

What works in urban Bengaluru may not work in rural Madhya Pradesh. This is why businesses must offer different types of payment methods to suit a wide customer base. For example, some users may still prefer paying with cards on delivery terminals, while others may choose wallet balance or mobile-verified UPI apps.

The best e-commerce platforms build a system that includes all types of payment methods relevant to their audience. Instead of forcing a one-size-fits-all checkout, the goal should be to guide the buyer toward completing the transaction using whichever electronic payment method they trust.

This flexibility builds confidence and directly improves success rates across channels.

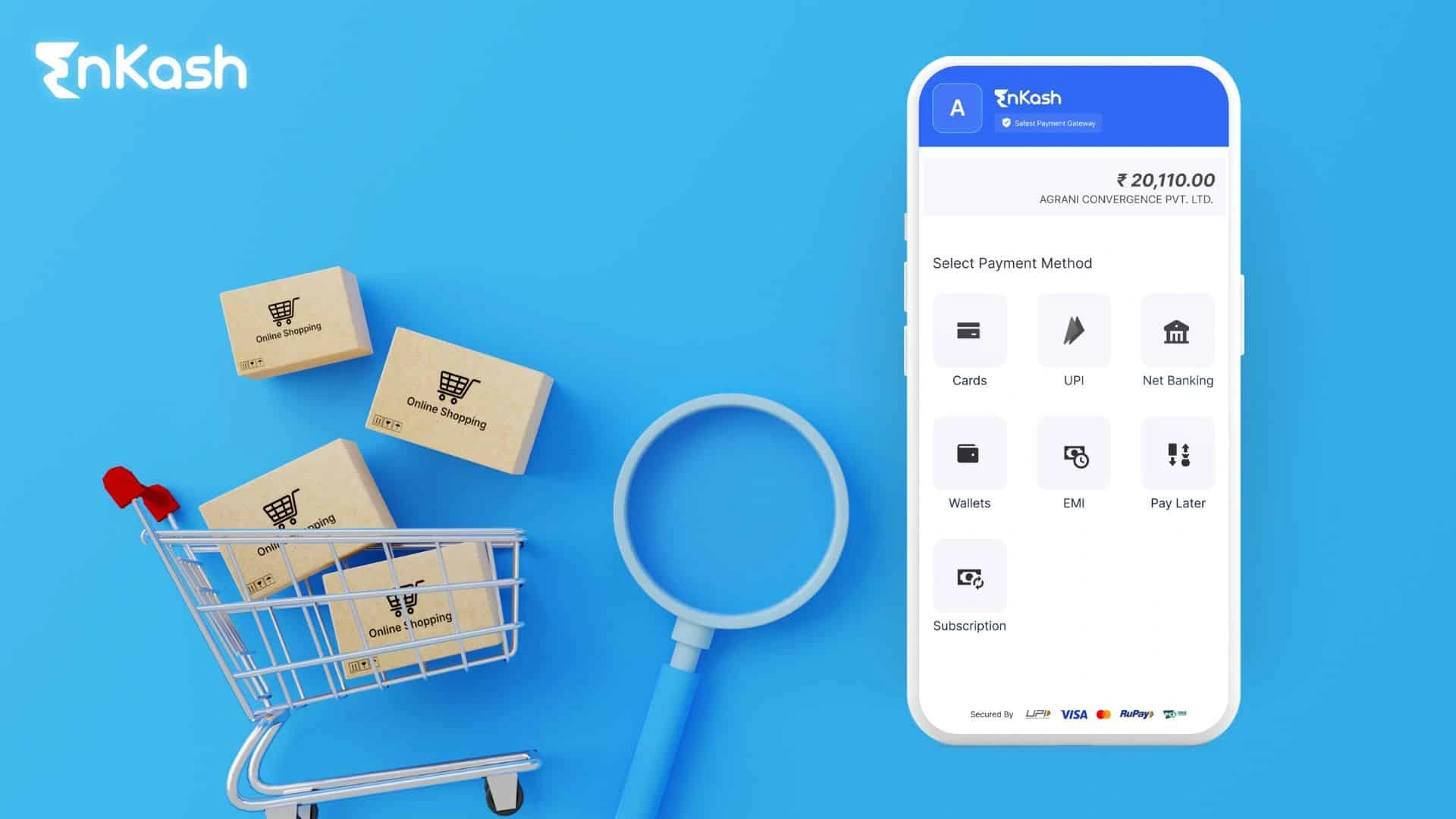

UPI, Cards, Wallets and More: Core Checkout Payment Modes

Indian shoppers today use a wide range of payment methods to complete online transactions. From instant UPI transfers to flexible EMI offers, every buyer brings their own preferred e-payment method to the checkout. If your platform does not support these options, you risk losing customers at the final step. Below is a closer look at the most used checkout payment modes in India.

- Unified Payments Interface (UPI)

This is the most dominant digital payment method in India. It works through intent and collection modes, is available 24/7, and supports seamless integration on both web and mobile. UPI is free for customers and shows the highest transaction success rates.

- Cards: Debit, Credit, and Prepaid

These remain common for high-ticket purchases. RBI guidelines now require card tokenisation, which keeps user data safe. Credit card EMI is also a leading electronic payment method among working professionals and first-time borrowers.

- Mobile Wallets and PPIs

Wallets such as Paytm or Mobikwik are frequently used for smaller purchases or app-linked rewards. Many now support UPI, making them more versatile than before. They are still effective when used in the right shopping categories.

- Net Banking

This is preferred for large-value orders, bulk purchases, or specific brand-loyal customers. It redirects users to their bank interface, and while slower than other modes, it remains a reliable option.

- BNPL and EMI at Checkout

Pay-later options have gained massive traction, especially among younger buyers. These services offer quick credit lines and increase the average order value. Displaying these during checkout improves trust and boosts conversion.

- QR and Contactless Methods

Some businesses now accept QR-based checkout payment during delivery. This is particularly helpful for customers who still hesitate to pay in advance.

Including these different payment methods as part of your checkout page payment options ensures that no buyer feels restricted, which directly increases completion rates.

Presenting Checkout Options That Users Trust

Even with all the right payment methods, how you present them makes a significant difference. A clear, simple, and fast interface improves buyer confidence. Your goal should be to reduce hesitation and encourage immediate action. The layout of your checkout page payment options can directly influence how quickly a customer completes the transaction.

Here are key design choices that make a real impact:

- Display All Major Modes Together

Showing all different payment methods on one screen avoids confusion. Do not hide important options behind multiple clicks. Let users quickly pick their preferred e-payment method.

- Auto-Suggest Based on Past Use

If the customer has used UPI before, show it at the top. Personalized placement of checkout payment options based on history or device makes the process feel faster and more familiar. - Highlight Offers and EMI Plans

Many users respond well to visible benefits. Show cashback, discounts, or no-cost EMI next to eligible electronic payment method selections. This makes the offer clear without needing extra clicks.

- Use Clear Labels and Icons

Every digital payment method should be shown with its official logo and a short name. This builds recognition and avoids accidental selection.

- Minimize Redirection Steps

Try to keep the customer on one screen for as long as possible. Redirections to bank or wallet pages can increase drop-offs. Use embedded flows wherever the API allows.

These small improvements across your checkout page payment options reduce confusion and increase conversions, even if your multiple payment options in checkout remain the same.

When One Gateway Isn’t Enough

Relying on a single payment gateway can be risky, especially in a market where customer expectations are tied closely to convenience and reliability. A payment gateway may offer access to many payment methods, but it still operates through a limited set of partner banks or networks. This creates gaps during peak hours, system updates, or technical failures. To solve this, businesses now adopt multiple payment methods through more than one gateway.

Here’s why relying on just one isn’t enough anymore:

- Reduce Transaction Failures

Payment failures are often linked to bank-side issues. If a UPI transfer fails through one gateway, another can process it successfully. This improves the success rate across e-payment methods.

- Support for Varied Instruments

Not every gateway supports all digital payment methods equally. Some may be strong on cards, others on wallets or BNPL. Using multiple providers gives broader coverage across all checkout payment modes.

- Enable Smart Routing

Multi-gateway setups allow routing based on card type, issuing bank, or even real-time performance. This ensures each checkout page payment option is processed in the most stable environment.

- Handle High Volume Efficiently

During flash sales or festive traffic, a single gateway may throttle or slow down. With multiple integrations, the load is distributed, keeping the checkout payment flow consistent.

Enabling Multiple Payment Methods via Smart Tools

Offering multiple payment methods is not just about adding more buttons on your checkout page. It involves technical setup, backend logic, and the ability to handle failures or speed issues without affecting user experience. This is where smart tools and platforms help businesses simplify complex checkout payment flows.

Here are the key tools and approaches used by Indian companies today:

- Direct Gateway APIs

Gateways like EnKash, Paytm, PayU, and Razorpay allow integration through their APIs. Each supports a wide range of digital payment methods, including UPI, cards, wallets, and EMI. These platforms also include features such as refunds, real-time tracking, and transaction reporting. Businesses can choose which e-payment methods to enable per user group or product type.

- Routing Engines and Orchestrators

Platforms act as layers between the customer and multiple gateways. These tools detect the best route for each transaction, improving uptime and reducing declines. They let you handle multiple payment options in checkout without manually managing separate connections.

- Hosted Checkout Pages

If you’re looking for a quick launch, hosted checkout pages provided by gateways come with pre-built options for all types of payment methods. You can customise the interface while skipping deep technical integration. These are ideal for small businesses or single-product shops.

- BNPL and EMI Plug-ins

Buy Now Pay Later tools offer SDKs that can be dropped into the payment screen. These increase order value and expand the range of electronic payment methods without changing the main flow.

- UPI and Wallet SDKs

UPI Intent flows or mobile wallets like PhonePe and Amazon Pay can be integrated using SDKs that trigger native apps directly. This makes your checkout page payment options feel smooth and quick on mobile.

By using the right mix of these tools, you can create a reliable and flexible setup for offering different payment methods across user segments.

Behind the Checkout Wall: Building the Payment Flow

Once the decision to offer multiple payment methods is made, the technical part begins. Designing the checkout payment flow requires both front-end and backend planning. It’s not just about adding extra lines of code. Each electronic payment method should be designed to work seamlessly within the page layout and ensure quick completion.

Here’s how the internal structure should be planned:

- Segmented Layout for All Payment Modes

Divide the payment screen into sections, clearly showing all checkout page payment options. Use tabs or labeled boxes to organize cards, UPI, wallets, and pay-later tools.

- Tokenised Card Flows

Store card details using tokens, not raw data. This meets compliance requirements and makes repeat payments smoother without re-entering sensitive details.

- UPI Intent and Collect Integration

Integrate both types of UPI flows. Intent allows app switching, while Collect generates a virtual address request. These options cover both mobile and desktop transactions for one e-payment method.

- Wallet and Net Banking Redirection

Redirect flows must open in-app or in new tabs with prefilled values. Reduce manual typing by passing order values and identifiers to each digital payment method selected.

- BNPL and EMI Widgets

Add credit-based modes to the cart view or as part of the checkout payment screen. Display applicable limits and terms clearly. This adds flexibility to users and encourages larger cart values.

- Fallback Handling in UI

Always show an alternative payment method when one fails. Keep retry flows minimal to avoid frustration.

A well-structured payment wall ensures that users can choose from different types of payment methods without confusion or delays.

Read more: Common Mistakes to Avoid While Integrating Payment Gateways

Challenges of Managing Diverse Payment Modes

Adding multiple payment methods offers great benefits, but it also introduces new layers of complexity. From technical issues to regulatory requirements, managing a wide mix of checkout payment options can become difficult without proper planning. If handled poorly, these challenges may create friction instead of solving it.

Here are common problems businesses face:

- Integration Complexity

Each electronic payment method comes with its own documentation, logic, and testing needs. Managing these across multiple platforms increases development time and cost.

- Inconsistent User Interface

Offering different payment methods can clutter the checkout page if not presented properly. A disorganised layout may confuse users and lead to drop-offs.

- Gateway Downtime and Failures

Relying on one provider for certain e-payment methods may create delays during technical outages. Without fallback logic, the entire checkout payment flow may break.

- Regulatory Compliance

Card tokenisation, wallet KYC rules, and transaction reporting must be followed strictly. Non-compliance can lead to penalties or blocked services.

- Security Risks

Supporting multiple payment options in checkout means handling more data points. Any lapse in encryption or token handling may affect buyer trust.

Payment Routing: The Invisible Fixer

One of the most effective ways to improve the performance of multiple payment methods is to use intelligent routing. This approach ensures that each transaction is sent through the best available path, based on real-time factors. The user may never notice this in action, but it plays a big role in delivering smooth and reliable checkout payment experiences.

Here is how routing enhances your payment setup:

- Reduce Declines Through Smart Path Selection

Routing can automatically detect which channel has the highest success rate for a specific card or UPI ID. This improves approval rates across digital payment methods.

- Adapt to Bank or Gateway Outages

When a particular bank or processor is down, the system instantly redirects the payment to another option. This keeps your checkout page payment options stable during high traffic periods.

- Customise Based on User Segment

You can assign routing rules based on payment amount, region, device type, or customer profile. This ensures the most relevant e-payment method is always prioritised.

- Lower Operational Friction

Automated routing removes the need for manual switching or technical overrides, letting you manage different payment methods efficiently behind the scenes.

Routing is a critical layer in making multiple payment options in checkout work at scale.

Step-by-Step: How to Add Payment Method in Checkout Page

Setting up multiple payment methods requires more than a basic integration. You need a structured plan that considers both the technical flow and user experience. If done right, it can increase trust, reduce cart abandonment, and improve your overall conversion rate.

Follow this step-by-step guide to implement a smooth and scalable system:

- Step 1: Define Your User Segments

Understand your audience. Urban shoppers may prefer UPI or credit-based tools, while others may choose wallets or net banking. This helps you decide which checkout page payment options to prioritise.

- Step 2: Choose Integration Type

Decide between direct gateway APIs or a single platform that supports different payment methods under one interface. This will shape your technical flow and development effort.

- Step 3: Configure Each Payment Mode

Enable cards, wallets, UPI, net banking, and credit-based tools as required. Make sure each e-payment method is tested individually before going live.

- Step 4: Design a Clean Checkout Layout

Group your checkout payment options clearly. Avoid overlapping sections or confusing labels. Use recognisable icons and short names.

- Step 5: Add Fallback and Routing Logic

Create routing rules that switch between channels in case of failures. This ensures your electronic payment method remains available even during network issues.

- Step 6: Test with Real Scenarios

Validate every flow using actual test cases, including failed payments, partial payments, and device-based triggers.

Conclusion

A reliable checkout experience begins with the right mix of payment methods. In today’s digital market, offering just one or two options no longer meets the expectations of modern buyers. Instead, customers want control over how they pay, where they pay from, and what tools they use to complete the process.

By supporting multiple payment options in checkout, businesses can remove friction at the final step. This leads to fewer abandoned carts, faster order processing, and higher customer satisfaction. From UPI to card tokenisation, and from pay-later to mobile wallets, every electronic payment method plays a unique role in helping people feel safe and confident while transacting online.

Choosing the right setup involves more than adding options. It requires clear layout design, smart routing rules, secure token handling, and ongoing performance tracking. The focus must always remain on trust, clarity, and speed.

Whether you are launching a new platform or improving an existing one, take time to understand how users interact with checkout page payment options. Every small improvement in flow, reliability, and flexibility leads to a stronger business outcome.

Getting your checkout payment system right is no longer a technical upgrade. It is a business necessity.

FAQs

- What are some risks of not offering different payment methods on your checkout page?

If your checkout page lacks different payment methods, users may abandon the transaction. Limited options fail to address diverse customer preferences. In India, buyers expect UPI, wallets, cards, or EMI. Missing even one preferred mode can directly affect your checkout payment success rate. - How do digital payment methods influence customer trust in new e-commerce businesses?

Customers associate secure digital payment methods with platform credibility. When a store offers verified and reliable options, users feel more confident during transactions. A clean interface, clear refund policies, and smooth checkout payment flows build trust, especially for first-time buyers exploring new platforms. - Why is it important to update your payment stack regularly?

Payment technologies evolve quickly. New e-payment methods, RBI mandates, and user behaviors require updates to stay compliant and competitive. Regular reviews ensure your checkout page payment options remain relevant, secure, and functional across devices and use cases. - Can multiple payment methods improve your return customer rate?

Yes, offering multiple payment methods creates a seamless checkout experience, making users more likely to return. Convenience builds brand loyalty, especially when preferred payment methods are pre-saved or auto-detected. Repeat buyers value familiarity in how they complete payments. - Is there a limit to how many payment modes can be offered on one checkout page?

There is no fixed limit, but too many checkout page payment options can overwhelm users. The key is to balance variety with simplicity. Group similar payment methods and use smart layouts to avoid clutter, while still giving users choice. - What is the difference between payment method variety and payment method reliability?

Variety refers to the range of types of payment methods you offer, while reliability focuses on how often each mode works without error. A great experience needs both. Even with all different payment methods available, users won’t convert if success rates are low. - How do mobile-first buyers interact with payment methods differently?

Mobile users prefer fast-loading, tap-friendly e-payment methods like UPI or wallets. Complex redirects or lengthy form fields cause drop-offs. Optimising checkout payment flows for smaller screens increases mobile conversions and helps meet expectations of India’s growing mobile commerce base. - Should businesses prioritise local payment preferences for regional customers?

Yes . In India, payment methods vary by region. Some areas lean toward wallets, others prefer UPI or COD. Adapting checkout page payment options based on user location can increase transaction success and create a more personalised experience. - How do tokenisation rules affect the use of card payments?

Tokenisation replaces raw card data with encrypted values, keeping transactions secure. Merchants must comply by storing only tokens, not actual card numbers. This change affects how electronic payment method flows are built, requiring updates across checkout and backend systems. - What is the role of analytics in managing payment method performance?

Analytics reveal which payment methods have high failure rates, longer processing times, or user drop-offs. Tracking usage patterns helps businesses refine checkout payment strategies, disable underperforming options, and highlight the best-performing digital payment methods during peak times.