Money no longer stops at national borders. An Indian exporter can receive dollars from the US in a few days, a family can pay university fees in Australia, and a startup can settle software bills in Europe from a laptop in Bengaluru. All of this happens through cross-border payments.

What has changed is speed and scale. Earlier, international transfers were rare, slow, and reserved for big companies. Today, freelancers, students, e-commerce sellers, and small businesses rely on international payments as part of their daily lives. A single payment can involve multiple banks, different currencies, compliance checks, and digital networks that work behind the scenes.

For businesses, cross-border money movement is now tied directly to growth. Indian exporters depend on reliable inflows, SaaS firms pay global vendors regularly, and digital creators receive earnings from overseas platforms. For individuals, it is about education, family support, and global opportunities.

Yet many people still wonder what actually happens when money crosses borders, why fees vary so much, and why some payments take longer than others. This blog breaks it down step by step. It explains what are cross-border payments, how they move across countries, which systems power them, and what options Indians have for sending money abroad.

What are Cross-Border Payments

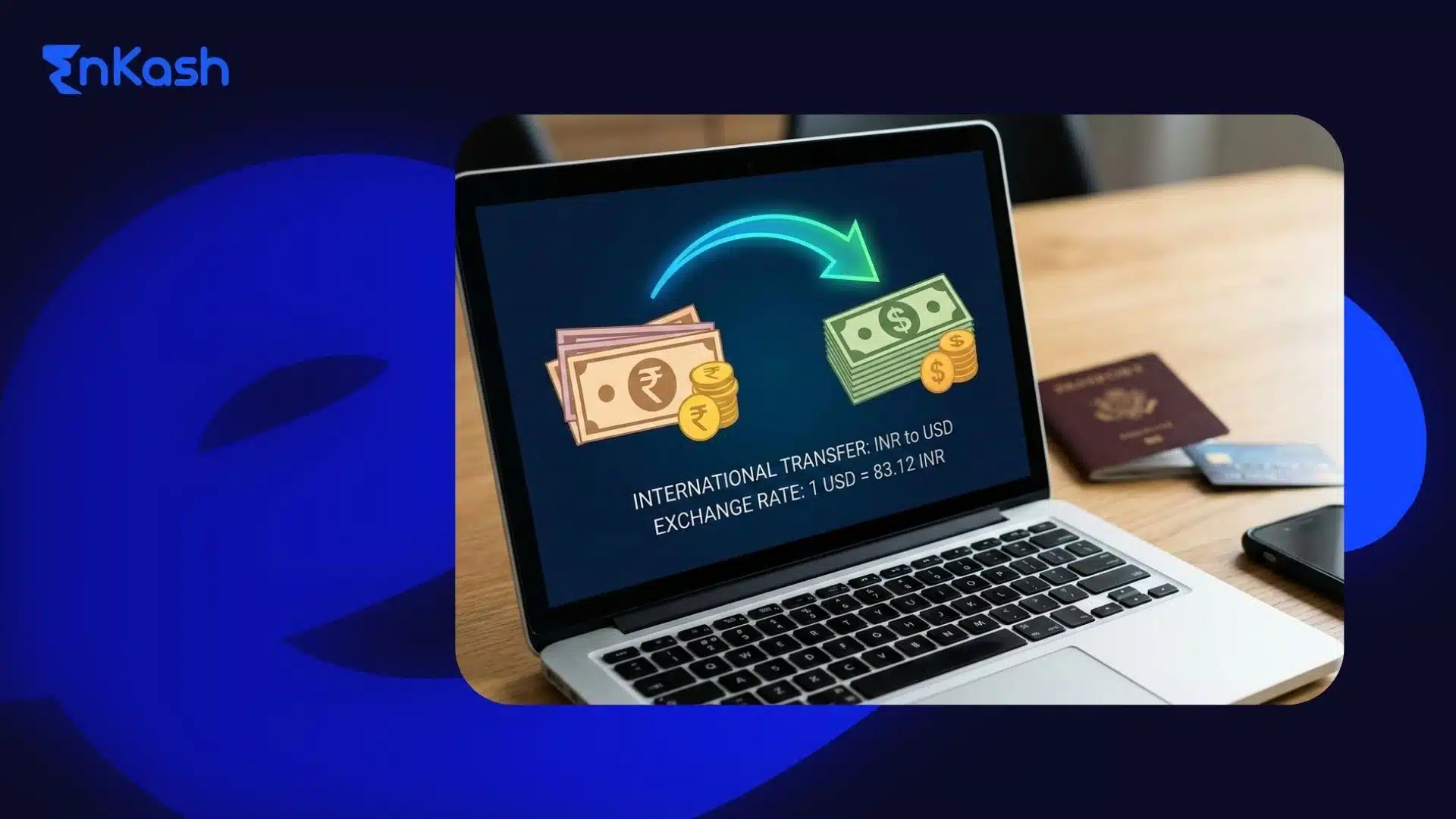

Cross-border payments refer to money moving from one country to another through formal financial channels. If the payer is in India and the recipient is overseas, the transaction automatically becomes an international transfer, regardless of its size or purpose.

What makes these payments different from domestic ones is the additional layer of currency conversion, banking networks, and compliance checks. For instance, when an Indian business pays a supplier in Europe, the amount is first converted from rupees into euros. The funds then travel through intermediary banks before reaching the recipient’s account. That end-to-end movement is what the industry recognizes as a cross-border transaction.

These payments are now part of everyday financial activity. An Indian student paying tuition in Canada is making a cross-border payment. A freelancer receiving dollars from a US client is also part of the same system. Even paying for global software, cloud services, or online subscriptions falls under this category.

It is useful to distinguish between two related terms. International payments is a broad category that includes all transfers across borders for business or personal reasons. Cross-border remittance is a subset of this and typically refers to individuals sending money to family members or dependents in another country. The underlying systems are similar, but the intent behind the payment is different.

In India, multiple groups rely on these transactions every day. Exporters depend on them for revenue. Startups use them to settle bills with global vendors. Families use them to fund education and living expenses abroad. Freelancers and digital creators depend on them to receive earnings from overseas clients and platforms.

If money crosses India’s border in either direction, it qualifies as a cross-border payment. The complexity does not lie in the definition, but in how the money actually travels, which the next section explains in detail.

How Cross-Border Payments Work

Payment Initiation

The journey begins when the sender initiates a transfer via a bank or a digital payment platform. At this point, the sender provides key details, such as the recipient’s name, bank account number, bank code, and payment purpose. The transaction is still domestic until the system prepares it for cross-border routing. Accuracy here matters, because small errors can stop the payment later.

Currency Conversion

Once the payment is ready to move internationally, the sender’s currency is converted into the recipient’s currency. For example, rupees may change into dollars or euros depending on where the money is going. The exchange rate applied at this stage directly affects how much the recipient finally receives.

Routing Through Banking Networks

After conversion, the payment travels through one or more intermediary banks that connect the sender’s bank with the recipient’s bank. These partner banks act as bridges in different countries. This multi-layer movement explains why international transfers do not settle instantly like domestic ones.

Parallel Compliance Checks

While the money is moving, banks run regulatory and security screenings in the background. They check for valid documentation, payment purpose, and anti-money laundering rules. If anything appears unclear, the transaction can pause until the issue is resolved.

Final Settlement to the Recipient

In the last step, the recipient’s bank receives the cleared funds and credits them to the beneficiary’s account in local currency. Only then does the recipient gain full access to the money.

Read more: What is a NeoBank? Features, Benefits, and Top Players in India

Cross-Border Remittance Explained

What Does Remittance Mean

Remittance refers to individuals sending money across countries for personal needs rather than business transactions. The sender is usually a person, and the recipient is a family member, dependent, or close relative.

Why Do Indians Use Cross-Border Remittance

Money moves both into and out of India. Indians working abroad regularly send funds home for household expenses, medical needs, or savings. At the same time, families in India send money overseas to support students studying in countries like the US, UK, Canada, and Australia. All of this falls under cross-border remittance.

How Does Remittance Typically Proceed

Most transfers pass through banks, licensed money transfer companies, or digital remittance platforms. The sender initiates the payment, selects the destination country, and chooses how the recipient will receive the funds, either in a bank account or through authorized cash pickup points.

Documentation and Compliance

Basic regulatory rules still apply. Senders generally provide identity proof and a clear purpose for the transfer. Paperwork is lighter than business payments, but banks still run standard compliance checks.

International Payment Systems

Bank-to-Bank Messaging Networks

Traditional cross-border transfers rely on global messaging networks that allow banks to communicate securely. These networks do not move money themselves, but they carry payment instructions between financial institutions so funds can be routed and settled correctly across borders.

Global Card Payment Rails

International card networks such as Visa and Mastercard act as another layer of the international payment system. They enable cross-border spending through credit and debit cards for e-commerce, travel, and subscriptions. Settlement happens between banks behind the scenes, even though the user only sees a card transaction.

Digital Remittance Platforms

Fintech companies operate proprietary networks that connect banks, wallets, and cash partners across countries. These platforms often bypass multiple intermediaries, which can make transfers faster and more transparent for everyday users sending money abroad.

Real-Time Cross-border Corridors

Some countries are now linking their instant payment systems directly with partners abroad. These corridors allow near real-time settlement for specific routes instead of relying only on traditional banking channels.

How SWIFT Payment Works

SWIFT is a secure messaging network that connects banks around the world. It does not move money itself. Instead, it allows banks to send standardized payment instructions to one another so they can settle transfers correctly.

Message Creation at the Sender Bank

When a payment is initiated, the sender’s bank creates a structured SWIFT message containing the beneficiary’s details, bank codes, amount, and purpose. This message acts like a digital instruction sheet for the transfer.

Routing Through Correspondent Banks

The message travels through one or more partner banks in different countries. Each bank reads the instruction, verifies it, and passes it along until it reaches the recipient’s bank. This routing layer is why some transfers take time.

Settlement and Crediting

Once the final bank receives the message, it settles the payment and credits the beneficiary’s account in local currency. Any applicable fees are deducted during this stage.

Even with new digital rails emerging, SWIFT remains central to global banking because it is trusted, standardized, and accepted almost everywhere. Understanding how SWIFT payment works helps users make sense of delays, fees, and routing in cross-border payments.

Bank Transfer Methods for International Payments

Direct Bank Transfers

Most traditional International payments start with a direct instruction to your bank. You submit beneficiary details, currency, and purpose, and the bank routes the payment through its global partner network. This method is reliable for high-value or business transfers, but it can involve multiple intermediary banks.

Correspondent Banking Route

When your bank does not have a branch in the destination country, it uses a correspondent bank as a bridge. The payment passes through one or more partner banks before reaching the final recipient. This explains why timelines and fees can vary.

Wire-Based Transfers

Banks also use wire-based channels for urgent or large transactions. These are structured, documented transfers that prioritize accuracy and security over speed. They are common in corporate and trade-related payments.

Digital Bank-Enabled Platforms

Many banks now offer digital portals or apps for cross-border transfers. Users can initiate payments online, track status, and receive notifications, making traditional banking methods more user-friendly.

Choosing the Right Bank Transfer Methods

The best option depends on your priority. If security and compliance matter most, traditional banks work well. If cost and speed are critical, digital or fintech-linked routes may be better.

What is a Cross-Border Wire Transfer

A cross-border wire transfer is a formal bank-to-bank transfer of money across countries. It is used when the sender needs a secure and traceable way to move funds internationally. Companies use wire transfers to pay overseas suppliers, settle trade invoices, or release large business payments. Individuals rely on them for tuition fees, property purchases, or high-value one-time transfers.

The sender’s bank sends payment instructions through global banking channels to the recipient’s bank. The transfer may pass through partner banks that verify details before forwarding it.

Most transfers settle within one to five working days. Delays usually happen due to compliance checks, bank holidays, or incorrect beneficiary information. Wire transfers are chosen when accuracy, security, and clear financial records matter more than speed or cost.

Role of Banks and Payments Banks in Cross-Border Payments

Traditional Banks as the Backbone

Commercial banks remain the primary gatekeepers of cross-border money movement. They hold customer accounts, verify documentation, process currency conversion, and route payments through global banking networks. For businesses and high-value transfers, traditional banks provide compliance assurance, audit trails, and regulatory alignment.

How do Banks Connect Across Countries

When a bank does not have a branch in the destination country, it relies on correspondent banking partnerships. These partner banks act as intermediaries that help move funds securely from sender to recipient across jurisdictions.

What Payments Banks Can and Cannot do

Payments Banks in India are designed mainly for domestic digital transactions, deposits, and small-value payments. They generally do not handle full-scale international transfers like commercial banks. Their role in cross-border payments is limited and mostly indirect.

Where Payments Banks Fit in the Ecosystem

Payments Banks work best for receiving funds, managing day-to-day balances, and enabling digital payouts within India. They may integrate with fintech platforms that offer international remittance services, but the actual cross-border settlement usually happens through partner banks.

Choosing Between Them

For large or business-related transfers, traditional banks are more suitable. For everyday digital money management in India, Payments Banks offer speed, convenience, and low domestic costs.

Challenges in Cross-Border Payments

High and Unpredictable Costs

Fees can stack up quickly in international transfers. Banks may charge processing fees, currency conversion markups, and intermediary bank deductions. Senders often do not know the final cost upfront, which makes budgeting difficult for businesses and individuals alike.

Delays in Settlement

Unlike domestic payments, cross-border transfers rarely settle instantly. Routing through multiple banks, time zone differences, and public holidays can slow things down. Even a small documentation issue can pause a payment for days.

Currency Fluctuations

Exchange rates change constantly. A delay between payment initiation and settlement can reduce the amount the recipient ultimately receives, creating uncertainty for both parties.

Compliance Friction

Banks must follow strict anti-money laundering and regulatory rules. If purpose codes, documents, or beneficiary details are unclear, payments can be held, questioned, or even rejected.

Lack of Transparency

Senders often struggle to track where their money is at each stage. Many systems do not provide real-time visibility, leaving users unsure about status, fees, or expected delivery time.

Benefits of Modern Cross-Border Payment Solutions

Faster Delivery of Funds

New digital payment rails are shortening transfer timelines significantly. Many providers now process international transfers within hours rather than days by reducing the number of intermediary banks involved in the journey.

Lower and Clearer Costs

Modern platforms typically show fees and exchange rates upfront before the sender confirms the payment. This transparency helps businesses and individuals plan expenses with greater certainty instead of facing unexpected deductions later.

Better Visibility and Tracking

Most fintech platforms offer real-time tracking dashboards. Users can see when a payment is initiated, processed, and delivered, which reduces anxiety and improves trust in the system.

Simplified User Experience

Digital-first providers allow users to send money abroad through mobile apps or web portals with minimal paperwork. Pre-saved beneficiary details, automated forms, and instant verification make the process smoother.

Wider Access for Individuals and SMEs

Small businesses, freelancers, and everyday users can now access international payment services that were once dominated by large banks. This levels the playing field for global trade and remote work.

Cross-Border Payments vs Domestic Payments

Basis |

Cross-Border Payments |

Domestic Payments |

|---|---|---|

Geography |

Money moves between two different countries |

Money moves within the same country |

Currency |

Often involves currency conversion |

Usually stays in one currency |

Processing Chain |

May pass through intermediary banks or partner networks |

Typically routed within local banking rails |

Settlement Time |

Commonly takes longer due to routing and checks |

Usually faster, often same-day or near real-time |

Cost Structure |

Higher fees due to FX markup, bank charges, intermediaries |

Lower costs, fewer fee layers |

Exchange Rate Impact |

Final amount can vary due to rate movement |

No exchange rate impact |

Compliance Checks |

Heavier checks due to cross-country regulations |

Lighter checks within local rules |

Transparency |

Tracking can be limited in traditional routes |

Better visibility in most domestic systems |

Error Risk |

Higher risk if beneficiary details or codes are incorrect |

Lower risk due to standardized local formats |

Best Suited For |

Global trade, overseas tuition, international vendor payments |

Salaries, bills, local transfers, domestic merchant payments |

Conclusion

Cross-border payments have moved from being a convenience to a core requirement for India’s economy. Every export, global service, tuition payment, and overseas remittance depends on reliable international payments. The real advantage now lies in choosing the right rail rather than accepting slow, expensive defaults.

Businesses must prioritize speed, cost transparency, and compliance, not convenience alone. Individuals should focus on clear fees, fair exchange rates, and secure delivery. Traditional banks, SWIFT networks, and modern digital platforms will continue to coexist, but users who understand how each works will always get better outcomes.

As India integrates deeper into global commerce, smarter cross-border payment choices will directly translate into faster growth, lower friction, and stronger financial trust.

Frequently Asked Questions

1. How do banks decide the exchange rate for an international transfer?

Banks start with the interbank market rate and then add a margin to cover operational and risk costs. The margin can vary by currency pair, transaction size, and customer profile. Some institutions apply a fixed spread, while others adjust it dynamically during the day, which is why two banks rarely quote identical rates at the same moment.

2. Why do some transfers deduct money after the recipient receives funds?

Intermediary banks sometimes process their fees after settlement rather than before. This happens because each routing bank settles independently and may apply charges at different stages. The recipient then sees a lower final amount even though the sender paid an initial fee at the time of initiation.

3. What happens if the beneficiary details are slightly incorrect?

Most banks place the payment on hold rather than rejecting it outright. They contact the sender for clarification or correction, which can add several days to the timeline. In some cases, the funds are returned minus processing charges, making accuracy critical from the start.

4. Why do public holidays affect international transfers more than domestic ones?

Cross-border payments depend on multiple countries working simultaneously. If any bank in the routing chain is closed for a local holiday, the entire transaction pauses until operations resume, even if the sender’s country is fully open for business.

5. How do compliance checks differ for personal versus business payments?

Personal transfers usually require identity proof and a stated purpose, while business payments need invoices, contracts, or trade documents. Companies face deeper scrutiny around sanctions, counterparties, and end use of funds, which can lengthen approval times.

6. Can a sender cancel an international transfer after initiation?

Cancellation is possible but not guaranteed. If the funds have already moved through intermediary banks, reversal becomes complex and may incur additional fees. The sooner the request is raised, the higher the chance of recovery.

7. Why do some providers deliver funds faster even across the same countries?

Speed depends on whether the provider uses direct corridors or multiple correspondent banks. Platforms with pre-funded local accounts can release money instantly on the recipient side, while traditional routes must wait for full cross-border settlement.

8. How do banks protect users from fraud in global transfers?

Banks monitor transactions for unusual patterns, verify beneficiary information, and screen against global watchlists. They may temporarily block high-risk payments and call the customer for confirmation before releasing funds.

9. Why do fees differ so much between small and large transfers?

Many banks charge a flat processing fee plus a percentage-based markup on currency conversion. For small transfers, the flat component makes costs appear high, while larger transactions benefit from economies of scale.

10. What happens if a payment fails after leaving the sender’s account?

The funds are usually routed back through the same banking chain, but this can take several days. Once returned, the sender may still bear intermediary charges, even though the payment never reached the beneficiary.