Banking in India relies on clear identification systems that ensure each transaction reaches the right destination. These systems support cheque processing, account verification, and digital transfers, thereby reducing the risk of errors during routine activities. People encounter terms like branch code, IFSC code, and MICR code when they open an account, use a chequebook, or complete online payments, and each term carries a specific purpose within the banking framework.

Many individuals search for explanations of what is branch code is, how a bank branch code is assigned, or where they can locate it when needed. Others look for details on the role of MICR code during cheque clearance or how an IFSC code guides electronic payments. These identifiers may appear similar at first glance, yet each code serves a distinct function and is tied to a different stage in the banking process.

A clear understanding of these codes helps customers avoid delays, failed transfers, or mismatches during verification. It also brings clarity when reviewing chequebooks, online forms, or digital payment screens.

What is a Branch Code

A branch code points to the exact banking branch that maintains a customer’s account. The number is assigned when a bank sets up a branch in a location. It acts as a unique identifier for that branch within the bank’s internal systems. Every branch receives its own number, which helps the institution keep track of which accounts belong to each branch.

Banks use a bank branch code during tasks that rely on branch-specific records. Routine requests move through these internal pathways. KYC updates, account corrections, and profile checks each follow a path back to the home branch. The code keeps that route clean. It lets the operations team validate where a request should land, and it helps avoid mistakes when multiple branches handle similar files.

Some customers search for a branch code finder when they cannot spot the number on their documents. A branch code on a cheque might be mentioned near the printed address or close to the account details. Each bank designs its chequebook layout differently, so placement varies slightly from bank to bank. A quick look at the cheque usually reveals it, but certain formats take a moment to read.

Understanding the branch code makes service requests simpler. It guides the internal flow of information and confirms the correct processing point. When a customer submits a branch-linked request, the code tells the system where it should go. This makes branch-linked service requests easier to route and process accurately.

What Is MICR Code

A MICR code helps banks identify and clear cheques with accuracy. Machines read this code through magnetic ink, which allows the system to pick up the printed details even when the cheque carries marks or light wear. The MICR code in full form is Magnetic Ink Character Recognition, and the technology supports cheque movement across the clearing network.

Each MICR bank branch receives a nine-digit number. The first three digits represent the city code, the next three the bank code, and the last three the branch code. These segments help scanners sort cheques quickly, and the structure keeps the process consistent across different banks.

People searching for what is MICR code in a chequebook usually find it along the lower edge of the cheque. It appears in a special font that machines can read with precision. The number stays consistent for that branch, which helps banks verify details without manual checks.

The MICR code supports the full clearing cycle. It guides sorting, reduces handling errors, and ensures cheques reach the correct branch for final review. Customers may not interact with the code directly, yet the system relies on it to keep cheque processing smooth and dependable.

What Is an IFSC Code

An IFSC code helps payment systems identify the correct branch during a digital transfer. The code has eleven characters, and each part directs the transaction through a structured route. Banks rely on this format to maintain accuracy when money moves between accounts, whether the transfer involves the same bank or different institutions.

The first section of the IFSC code identifies the bank, the fifth character is ‘0’, and the last six characters identify the branch.The first part links the cheque to a city The remaining characters point to the specific branch linked to the account. This structure allows payment systems to match a request with the correct destination without manual checks.

Customers use the IFSC code when they set up transfers, add beneficiaries, or update banking details. The number appears on chequebooks, passbooks, and bank websites. Many users confirm the code through secure search tools that list verified branch information. This reduces the chance of routing errors during a transaction.

The IFSC code plays a central role in digital banking. It supports clean routing, reduces mismatches, and helps the system validate each step before the transaction reaches the destination branch. Accurate entry of this code ensures that payments move without interruption or delay.

Differences Between IFSC, MICR, and Branch Code

Banks use these codes for separate workflows, and each code carries its own structure, purpose, and point of use. Below is a clear comparison that helps customers choose the right identifier for each transaction.

Parameter |

Branch Code |

IFSC Code |

MICR Code |

Primary Purpose |

Identifies the exact branch linked to the account. |

Directs digital transfers to the correct branch. |

Supports cheque sorting and verification through magnetic ink. |

Core Function in Banking |

Routing of branch-level service requests, reconciliation and record management. |

Routing of NEFT, RTGS, and IMPS transfers across the banking network. |

Automated cheque scanning within the clearing system. |

Format |

Numeric code assigned by the bank. |

Eleven character alphanumeric sequence combining bank and branch details. |

Nine digit numeric code with city, bank and branch segments. |

Technology or System Backing |

Internal branch identification systems. |

Transfer systems operated under the Reserve Bank of India. |

Magnetic Ink Character Recognition scanners. |

Where Customers See It |

Chequebooks, passbooks and branch documents. |

Chequebooks, passbooks, official bank websites and verified lookup tools. |

Lower edge of the cheque in magnetic ink. |

When It Is Required |

KYC updates, account modifications, branch specific service requests. |

Beneficiary setup and digital transfers between accounts. |

Cheque deposits and clearing activities. |

Risk of Using Wrong Code |

Misrouting of branch linked requests. |

Failed or delayed digital transfers. |

Cheque rejection during scanning. |

Relation to Other Codes |

Does not replace IFSC code or MICR code. |

Works alongside MICR code and branch code for different tasks. |

Supports cheque flow while IFSC code supports digital flow. |

User Interaction Level |

Customers interact during branch related tasks. |

Customers interact during online payments. |

Customers rarely interact directly. |

How to Find IFSC, MICR, and Branch Code

Banks share these codes across several documents and secure platforms, and each code appears in a predictable location. A quick check through the right source helps customers confirm the correct number before completing a transaction or submitting a request.

Official Bank Documents

Chequebooks and passbooks display all three codes in clear printed formats. The IFSC code appears near the account details; the MICR code is along the lower edge of the cheque in magnetic ink; and the branch code may appear close to the printed branch address.

Bank Websites and Digital Platforms

Each bank publishes verified branch information on its official website. Customers can search for branch listings and confirm the IFSC code, MICR code, and branch code without relying on external sources. Mobile banking portals and online profiles show these codes once an account is linked.

Secure Lookup Tools

Trusted search tools help users find the correct IFSC code, MICR code, and branch code when documents are unavailable. These tools pull data from verified databases, reducing the risk of incorrect routing during digital transfers or cheque processing.

Branch Visit

A customer can request the codes directly from a branch when additional confirmation is needed. Staff members provide the details through printed slips or service counters, which supports clarity during account modification or beneficiary setup.

RBI Directories

The Reserve Bank of India maintains updated lists of IFSC codes and MICR codes. These directories serve as authoritative references for customers who want to validate branch information from an official source.

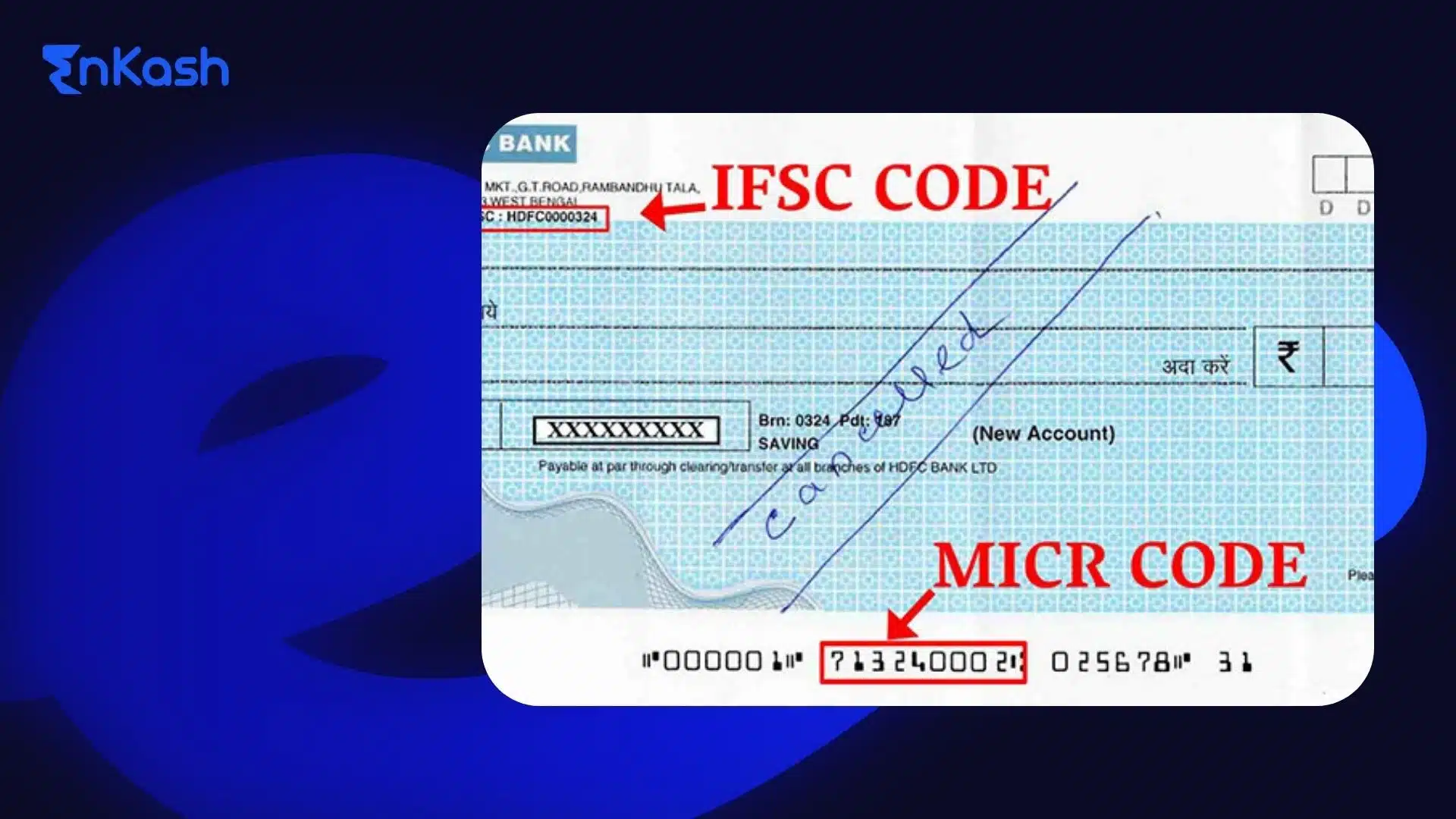

IFSC, MICR and Branch Code on Cheque

A cheque carries all three codes in a structured layout, and each position serves a specific purpose. Reading these locations correctly helps customers verify details before submitting a cheque for deposit or using it to update account information.

Placement of IFSC Code

The IFSC code is printed near the account holder’s details on the cheque. Banks keep it in a visible area so customers can confirm the number during beneficiary setup or when entering a digital transfer. This placement keeps the code easy to locate when a cheque is the only available reference.

Placement of MICR Code

The MICR code appears along the lower edge of the cheque. It is printed in magnetic ink, which allows scanners to read the number with high accuracy. The characters follow a specific font style designed for machine reading. This position remains consistent across cheques issued by different banks, as it supports the clearing system.

Placement of Branch Code

A branch code on a cheque may appear near the printed address of the issuing branch or in the section that displays account information. Each bank uses its own template, so the exact placement varies. The number helps confirm which branch issued the cheque when customers review service request documents.

What is a CIF Number in Banking

A CIF number helps a bank link all the products and services held by a customer under a single profile. The number stays with the customer, even when new accounts or deposits are added over time. It acts as a consolidated reference that allows the system to review information without relying on separate records for each account.

Banks use the CIF number for customer-level verification tasks. When a person updates their contact details, requests an account modification, or applies for a service, the system uses the CIF number to match the request to the correct profile. This reduces manual checks and helps maintain consistency across savings accounts, deposits, loans, and cards.

Customers sometimes confuse the CIF number with a branch code or an IFSC code, but the two serve different purposes. A branch identifier points to the account location, and digital transfer codes guide payments. The CIF number stays focused on the customer and supports internal workflows that require a complete view of their banking relationship.

The number appears on passbooks, account statements, and some digital channels. When customers cannot locate it, a branch can provide the number after verification. This helps them complete service requests that depend on customer-level records rather than branch information.

How Banking Codes Support Secure Processing

How These Codes Support Accurate Identification

Each code helps the banking system recognise the correct branch, customer profile or payment route. A branch code identifies the exact location where the account is maintained. An IFSC code directs digital transfers. A MICR code guides cheque movement. These identifiers reduce errors and help the system process information at scale.

How They Improve Transaction Flow

Digital transfers move through structured channels, and the IFSC code ensures the request reaches the right branch. Cheques pass through a scanning network, and the MICR code allows machines to read details quickly. Branch-linked requests use the branch code to reach the correct desk. Each code supports a different stage, which creates a smooth flow from the start of a transaction to its completion.

How They Strengthen Verification and Compliance

Banks follow strict verification rules under regulatory systems. These codes help maintain accurate records for internal checks, audit trails and compliance reviews. They make it easier to spot mismatches, confirm account details and maintain clean routing across channels that involve payments or service requests.

How They Reduce Risks for Customers

A wrong entry can interrupt a transfer or delay a cheque. Clear identification through these codes protects customers from routing errors. The system uses these numbers to match each request to the correct location, ensuring safety and clarity when money moves from one account to another.

Why These Codes Support Daily Banking Activity

Consumers interact with them during beneficiary setup, cheque deposits, KYC updates and account modifications. Accurate use of each code keeps transactions steady and reduces operational issues, which helps customers complete tasks without disruption.

Role of RBI in Managing and Updating These Codes

The Reserve Bank of India provides authoritative directories for IFSC and MICR codes. Branch identifiers are typically maintained within bank systems (and in many cases align with the branch portion of IFSC). When a branch opens, closes, or shifts location, the revised code structure is updated through RBI channels and shared with banks for integration. Digital transfers and cheque clearing rely on these updates to keep routing accurate, and RBI oversight ensures that every code matches its assigned branch and payment function.

Impact of Bank Mergers on IFSC, MICR and Branch Codes

How Mergers Trigger Code Changes

When banks merge, the combined entity restructures its network, leading to revisions to IFSC, MICR, and branch codes across affected branches. The changes help unify digital routing, cheque processing and internal branch tracking. Updated codes replace earlier identifiers, enabling the system to move transactions through a single consolidated network.

How Customers Should Verify Updated Codes

Customers must confirm new codes through official bank notices, RBI directories and updated chequebooks. Digital channels reflect these numbers once the merger is fully incorporated into the banking system. A customer setting up a transfer or depositing a cheque should check the revised identifiers, as older codes may be deprecated for certain rails or require updated mapping depending on the bank’s migration timeline.

Where Revised Identifiers Appear

Updated IFSC code, MICR code and branch code appear on passbooks, chequebooks, bank websites and secure lookup tools. Physical documents issued after the merger always carry the correct codes, and customers should rely on these sources when completing payments or account-related tasks.

Common Customer Mistakes and How to Avoid Them

Entering an Incorrect IFSC Code During Transfers

A customer may enter the wrong IFSC code while adding a beneficiary. This can disrupt routing and lead to failed transfers. Verifying the number directly with the bank before saving it prevents such issues. Rechecking the details before every transfer adds another layer of safety.

Misreading the MICR Code on Cheques

Some customers mistake the cheque number for the MICR code, as both appear along the lower section. The MICR code follows a clear nine-digit format and sits in magnetic ink. Checking its placement and structure avoids scanning errors during cheque deposits.

Using Incorrect Branch Code for Service Requests

A request that depends on the home branch may be delayed when the wrong branch code is entered. Customers should refer to passbooks or verified lookup tools instead of guessing the number. Confirming the correct code ensures that the request reaches the intended branch without manual rerouting.

How These Codes Interact With Modern Payment Interfaces

How Identification Codes Support Digital Transfers

Modern payment systems move funds through structured channels, and each identifier helps direct the request to the correct branch. The IFSC code guides NEFT, IMPS and RTGS transfers by linking the transaction to the right bank and branch. Payment engines use this code to validate routing before the transfer is processed.

How These Codes Fit Into UPI and Linked Systems

UPI relies on mapped account details stored within bank systems, and the IFSC code remains part of that background data. It ensures that the virtual address connects to the correct branch. When users update account information in UPI-linked applications, the system checks these identifiers to maintain accurate mapping across banks.

How Clearing Systems Use MICR Code and Branch Code

Cheque-based activity still depends on MICR code for scanning and sorting, while the branch code supports branch-level processing. These identifiers allow the clearing network to move paper-based transactions through the correct verification path.

Closing Thoughts

Clear identification is the foundation of reliable banking, and each code plays a separate role in that structure. A customer who checks the IFSC code before authorising a transfer, verifies the MICR code when using a cheque, or confirms the branch code during a service request strengthens the accuracy of every step in the process. These numbers guide systems that move money, validate accounts and route requests to the correct branch. The most practical habit is to confirm each code through official bank documents or verified digital sources before proceeding. This single check reduces errors, protects transactions and keeps your banking activity aligned with the correct records.

FAQs

1. Can a bank change my IFSC code without notice?

Banks update the IFSC code when branches shift, merge or restructure their network. Customers receive formal communication through statements, email or SMS. Updated codes also appear on bank websites and RBI directories. Checking these sources helps ensure digital transfers route correctly after a structural change.

2. Does every branch have its own MICR code?

Each cheque-enabled branch receives a unique MICR code for clearing. The number supports machine scanning, which allows the system to sort cheques accurately. Branches that do not issue cheques may not have a MICR assignment. Customers can confirm the correct code through official bank records.

3. Can I complete a transfer if the IFSC code is entered incorrectly?

A wrong IFSC code disrupts routing within the transfer system and prevents successful processing. Payment engines verify this code before moving funds, so incorrect entries trigger rejection. Rechecking the number before submitting a transfer reduces the chance of delays or failed transactions.

4. Do cheque reissues change the MICR code?

A new chequebook carries the same MICR code unless the branch itself undergoes a structural change, such as a merger or location shift. The code is tied to the branch, not the booklet. Customers should still verify printed details when receiving a fresh set of cheques.

5. Can two branches share the same branch code?

Banks assign a distinct branch code to each operational location. The number helps the system track branch-level activity, so duplication is not permitted. When branches merge, only the surviving branch retains its identifier. Customers should rely on updated bank documents to confirm the correct value.

6. Does UPI use IFSC code in the background?

UPI uses virtual addresses for front-end activity, but the system still relies on mapped account details, including the IFSC code, to maintain accurate routing. This connection ensures that funds move to the correct branch behind the scenes. Customers do not enter the code manually during UPI transfers.

7. Why does my passbook show multiple codes?

Passbooks display information relevant to different processes. The branch code supports internal tracking. The IFSC code guides digital payments. The MICR code is used for cheque clearing. Each number serves a distinct purpose, and the presence of multiple identifiers supports both digital and paper-based transactions.

8. Can I use MICR code for digital transfers?

Digital transfers do not rely on the MICR code. The clearing system uses MICR for cheque processing alone. Online payments require an IFSC code to route the transaction to the correct branch. Entering the MICR code during digital transfers will not complete the request.

9. How do I verify a code after a bank merger?

Customers should check the updated IFSC, MICR, and branch codes through bank notices, revised chequebooks, and official directories. Merger-related changes appear in digital banking portals once the system update is complete. Confirming the numbers before a transfer or deposit ensures accurate routing.

10. What should I do if my cheque shows a smudged MICR code?

A smudged MICR code can disrupt machine scanning during cheque clearing. Customers should request a new chequebook when the printed line is damaged. Using a cheque with unclear characters may result in rejection, delaying processing. A fresh booklet restores clarity and supports reliable scanning.