Capital budgeting is the process businesses use to decide where to invest their long-term funds. It helps companies choose the right projects, like buying new machines, opening a new branch, upgrading technology, or launching a new product, that can increase future profits. In simple words, capital budgeting means checking if a big investment is worth the money and risk involved.

It is important in financial management because it directly affects a company’s growth, cash flow, and financial stability. Good investment decisions help organizations to increase returns, reduce losses, and stay competitive in the long run. Poor decisions can lead to wasted money and financial stress. Capital budgeting helps organizations make good investment decisions.

In this blog, we will discuss in detail what capital budgeting is, why it is important for your business, some effective techniques for this process, and how the real-world application of this process can impact businesses in the long run.

What is Capital Budgeting?

Capital budgeting is the process of planning and evaluating long-term investments to decide whether they are profitable for a business. In simple words, it helps a company check if spending money on a project today will generate good returns in the future.

Capital Budgeting Definition

Capital budgeting refers to the financial process used to study, compare, and select long-term projects such as new equipment, expansion plans, or technology upgrades. It guides companies in choosing the investments that offer the highest value.

Meaning of Capital Budgeting in Business

In business, capital budgeting means evaluating big financial decisions before committing money. It helps managers understand:

- How much will the project cost?

- How much profit may it generate?

- How long will it take to recover the investment

- What risks are involved?

This ensures that money is invested in projects that support growth and financial stability.

What is Capital Budgeting in Financial Management

Capital budgeting plays a big role in financial management because it helps managers make smart long-term investment decisions. It guides managers in choosing projects that can improve profits, reduce costs, and support future growth. Since these decisions involve large amounts of money, financial managers use capital budgeting to make sure every investment is planned carefully and aligned with the company’s goals.

Role of Capital Budgeting in Long-Term Planning

Capital budgeting helps businesses to plan for the future. It allows them to:

- Identify long-term investment opportunities

- Estimate future cash flows and profits

- Compare different projects using clear financial data

- Select investments that add long-term value

This process ensures the company moves in the right direction and invests in projects that support long-term success.

How Financial Managers Use Capital Budgeting

Financial managers use capital budgeting tools and techniques to evaluate each project before making a final decision. They:

- Forecast cash inflows and outflows

- Measure project profitability using methods like NPV, IRR, and Payback Period

- Analyze risks and uncertainties of projects

- Select the most beneficial and cost-effective option

This helps managers make decisions based on data, not assumptions.

What is the Capital Budgeting Process?

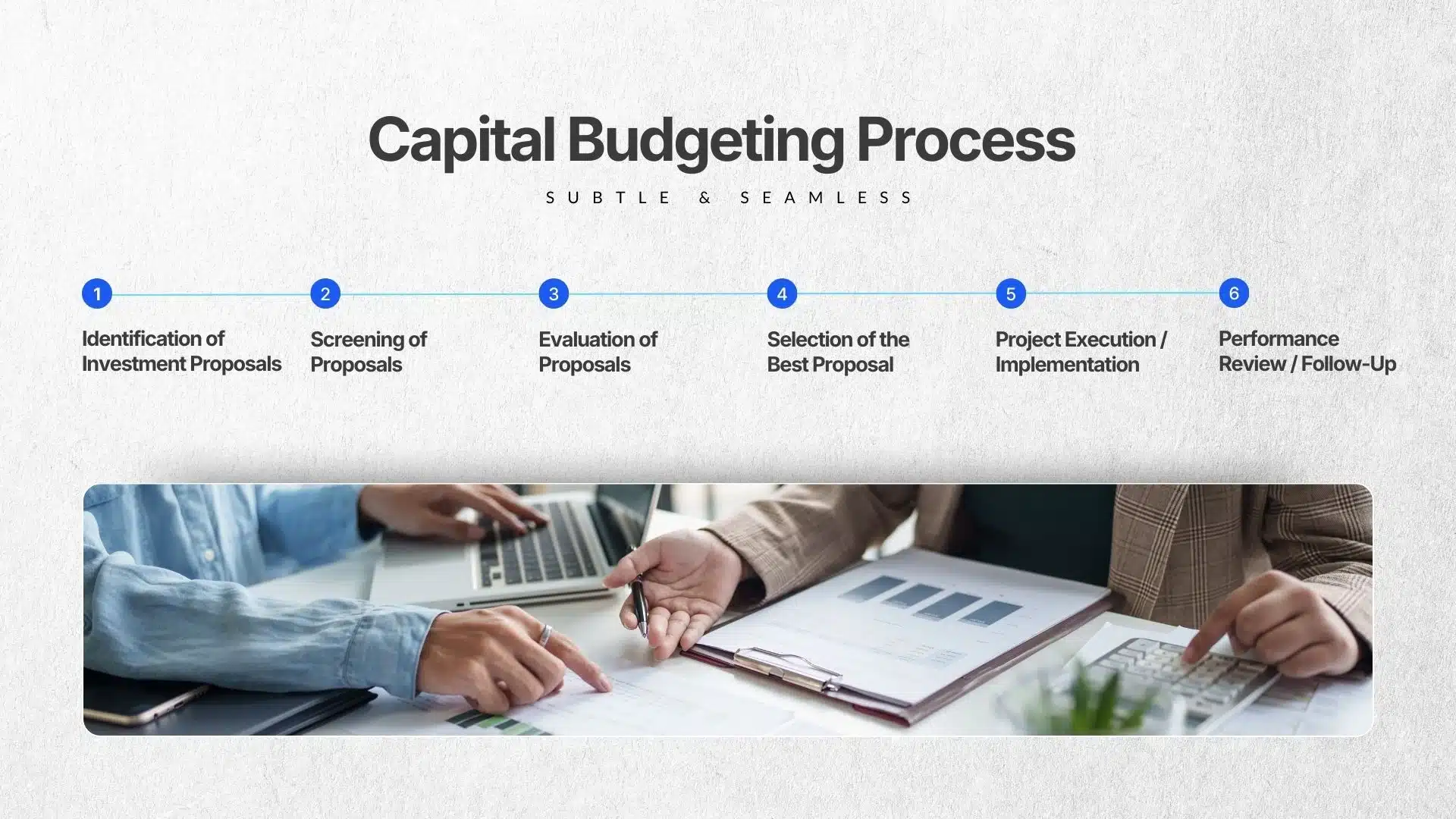

Capital budgeting is the process of selecting the best project for a business investment. The capital budgeting process includes the following key steps:

1. Identification of Investment Proposals

The first step is to identify different investment ideas. These proposals can come from various departments like production, marketing, or finance. Examples include buying new machines, launching a new product, or expanding into a new location.

2. Screening of Proposals

Once proposals are collected, the business screens them to see which projects match the company’s goals and policies. This helps remove ideas that are not feasible or useful for the business.

3. Evaluation of Proposals

In this step, each project is evaluated in detail.

The business compares:

- Cost of the project

- Expected profits

- Estimated cash flows

- Level of risk involved

Financial tools like Payback Period, Average Rate of Return (ARR), Net Present Value (NPV) and Internal Rate of Return (IRR) may be used.

4. Selection of the Best Proposal

After evaluation, the business selects the project that is most profitable, least risky, and best suited for long-term growth.

This ensures the investment will benefit the company.

5. Project Execution / Implementation

Once a project is approved, it is put into action.

This step involves arranging funds, purchasing equipment, hiring people, and starting the construction or setup work.

6. Performance Review / Follow-Up

After the project is implemented, the business reviews its actual performance. Managers compare real results with expected results to see whether the project is successful. This helps improve future capital budgeting decisions.

Importance of Capital Budgeting: Why Businesses Need It

Capital budgeting is a fundamental element in business development since it informs and directs the strategic decisions concerning long-term investments that have a bearing on growth, profitability, and sustainability. Here’s why capital budgeting is an essential tool for businesses:

- Allocation of Resources: Efficient use of resources is crucial for all businesses because resources are limited and cannot be wasted. They need to be used in projects that can yield the highest potential return for a business to grow. Capital budgeting helps businesses in such scenarios, ensuring funds are not wasted on ventures with low profitability or high risks

- Better Decision-Making: Capital budgeting helps in making better business decisions by analyzing cash flow projections (i.e., factors like expected income, expenses, and profits), return on investment, and risk factors. All this information and these data points reduce impulsiveness and help you make well-thought-out decisions

- Improved Financial Performance: Investing in the right tools/projects in a company has a direct impact on its cash flow. So better investments equal better financial health, and this can be achieved with the help of capital budgeting as it helps prioritize projects that contribute to increased revenue, cost savings, or improved operational efficiency, helping in the overall growth of the business in the long run

- Risk Management: Every investment has potential risks, and capital budgeting techniques consider these potential risks associated with each investment. This allows businesses to identify and mitigate risks before committing funds, protecting their financial well-being

- Strategic Planning: To ensure that a business can grow and sustain over a long period, they must make investments keeping in mind the benefit it can provide in the long run. It aligns with the long-term goals and vision of the company. By evaluating investments that support these goals, businesses can strategize their growth trajectory and make informed decisions about their future.

Make Smarter Business Decisions With Complete Cash Flow Visibility

Features of Capital Budgeting

Capital budgeting is a vital financial process that involves deciding on long-term investments in assets that will contribute to a company’s growth and profitability over time. Unlike routine budgeting, capital budgeting is strategic, requiring detailed analysis and careful decision-making to ensure that investments align with the company’s future goals. Here are some key features of capital budgeting:

Long-Term Focus

Capital budgeting decisions are associated with investments whose benefits are realised over a long duration, usually several years or even decades. This is because the decisions affect the structure and competitive advantages of the firm in the years to come and hence they need to have a long-term perspective. Projects financed through capital budgeting, such as establishing new service centres, purchasing advanced machinery, or investing in information technology systems, often transform the nature of the business. For this reason, they require careful deliberation and must be correctly timed with the company’s future growth.

Involves Large Cash Outflows

It is common that capital budgeting projects require a great amount of investment at the very beginning, involving large cash outflows. This makes it a risky process because a large amount of capital is committed upfront and tied up in long-term assets, reducing liquidity for other purposes in the short term. Due to the enormous risk involving a financial commitment of this magnitude, companies must ensure that such investments will bear fruit and achieve the expected results in the future.

Irreversible Decisions

Capital budgeting decisions often involve investments that are difficult or impossible to reverse once the project has begun once the project has begun. For example, the acquisition of a plant or large machinery is relatively irreversible without significant depreciation. This implies that decision makers should be cautious and ensure that serious consideration is given to all available options prior to taking any action. The irretrievable nature of loss associated with the vast majority of these investments places even more emphasis on the careful consideration of such investments prior to engagement, as a poor decision can end up having detrimental effects for years to come.

Focus on Cash Flow Analysis

In capital budgeting, cash flows are stressed more than accounting profits because they represent the real cash generated by an investment. The expected positive or negative cash flows of an investment are analysed over the entire life of the project. Since cash flow determines the continued existence of a company, capital budgeting focuses on cash flow rather than accounting profit, emphasising liquidity and the real value created by the investment.

Risk Assessment

In these projects, the risks are much higher than those of the short-term decisions owing to the long-term nature of capital investments. These risks may arise from the changes in market demand, technology advancement, policy changes, or even recessions that may make the project unfeasible. Such comprehensive risk evaluations assist in the capital budgeting process to pinpoint risks and develop plans for their correction to ensure that the investment remains viable even in the most unfavourable conditions.

Time Value of Money

In capital budgeting techniques, the time value of money (TVM) is taken into consideration meaning that it is acknowledged that the value of money is not constant. The future cash flows expected from the project are discounted to their present values, so that only those projects with sufficient returns are selected. Techniques like Net Present Value (NPV) and Internal Rate of Return (IRR) include TVM concepts and show if the investment’s anticipated gains are worth the expenses at the moment.

What are the Key Concepts in Capital Budgeting?

Cash Flows

Cash flow refers to the movement of money in and out of the company over a specific period. In capital budgeting, future cash flows from an investment are estimated to determine its profitability. These cash flows are categorized into:

- Initial Investment: The initial funds required to kickstart any project

- Operating Cash Flows: The cash generated from the project’s operations over time

- Terminal Cash Flows: The residual value at the end of the project’s life

Time Value of Money (TVM)

The time value of money is a fundamental principle in finance which posits that a dollar today is worth more than a dollar in the future due to its earning potential. Capital budgeting relies heavily on this concept to discount future cash flows to their present value.

Discount Rate

To account for the time value of money, a discount rate is applied. This rate is often set at the company’s cost of capital, which reflects the expected return on investment for the company. It reflects the opportunity cost of investing capital in a particular project versus other potential investments.

What are the Capital Budgeting Techniques?

The capital budgeting process is important for businesses to decide which long-term investments offer the best returns. Here’s a breakdown of the three most common capital budgeting methods used for the capital budgeting process:

Discounted Cash Flow (DCF) Analysis:

Concept: DCF considers the time value of money. The ability to invest and grow your money over time makes having a dollar today more valuable than having that same dollar in the future. DCF discounts future cash flows from an investment back to their present value, allowing you to compare projects with different cash flow patterns

Process:

- Estimate the project’s initial cost

- Forecast the project’s future cash inflows and outflows over its lifespan

- Choose a discount rate (usually the company’s cost of capital)

- Discount each year’s cash flow back to its present value using the discount rate

- Calculate the Net Present Value (NPV) by adding the present values of all cash flows

Interpretation:

A positive NPV indicates the project creates value, while a negative NPV suggests a loss. Choose projects with the highest NPVs, considering the risk profile

Advantages |

Disadvantages |

Considers the time value of money. |

Relies on accurate cash flow estimates, which may be uncertain. |

Accounts for the project’s entire cash flow life cycle. |

Choosing the right discount rate can significantly impact NPV. |

Payback Period:

Concept: This method focuses on how quickly an investment recovers its initial cost. The payback period is the number of years it takes for the project’s cumulative cash inflows to equal the initial investment

Process:

- Estimate the project’s initial cost

- Forecast the project’s annual cash inflows

- Divide the initial cost by the annual cash inflow to find the payback period

Interpretation:

Shorter payback periods are generally preferred, indicating faster recovery of the initial investment. However, this method ignores cash flows beyond the payback period.

Advantages |

Disadvantages |

Simple and easy to understand. |

Ignores cash flows after the payback period. |

Useful for projects with high liquidity needs or uncertain lifespans. |

Doesn’t consider the time value of money. |

Throughput Analysis (Less Common):

Concept: This method, used primarily in manufacturing and production environments, focuses on maximizing the flow of materials through a system. It considers factors like production capacity, bottlenecks, and lead times to evaluate capital projects that impact production efficiency

Process:

- Identify bottlenecks or inefficiencies in the current production system

- Analyze how proposed projects will affect production throughput (units produced per unit time)

- Choose projects that improve overall throughput and efficiency

Interpretation:

Projects that increase throughput and reduce lead times are generally preferred. This can lead to higher production volumes and potentially greater profitability.

Advantages |

Disadvantages |

Focuses on production efficiency and capacity. |

Less common than DCF and payback period. |

Useful for evaluating projects that directly impact production flow. |

May not directly translate into financial benefits and requires additional analysis. |

Which is the Right Capital Budgeting Method?

The best capital budgeting process depends on the specific project and your company’s priorities. Here’s a general guideline:

- Use DCF for a comprehensive analysis that considers all cash flows and the time value of money

- Use a payback period for projects with high liquidity needs or when the speed of investment recovery is crucial

- Use throughput analysis for production-related projects where improving efficiency is the primary goal

It’s also common to use a combination of capital budgeting methods for a more well-rounded evaluation.

What are the Metrics used in Capital budgeting?

The metrics used in capital budgeting are primarily tied to the different capital budgeting methods themselves. Here’s a breakdown of the key metrics associated with the most common methods:

Discounted Cash Flow (DCF) Analysis:

Net Present Value (NPV): The central metric in DCF. It represents the present value of all future cash flows from an investment after considering the time value of money and the discount rate. A positive NPV indicates the project creates value, while a negative NPV suggests a loss

Internal Rate of Return (IRR): The discount rate at which the NPV of a project equals zero. In simpler terms, it’s the effective rate of return on the investment. Projects with an IRR exceeding the company’s cost of capital are generally considered desirable

Payback Period:

Payback Period (Years): The number of years it takes for the cumulative cash inflows from a project to equal the initial investment. A shorter payback period indicates a faster recovery of the initial cost

Throughput Analysis:

Throughput Rate (Units per Time Period): This metric measures the rate at which materials or units are processed through a production system. Throughput analysis focuses on maximizing this rate by evaluating projects that address bottlenecks or inefficiencies

Lead Time (Time): The time it takes for a unit to move through the entire production process. Throughput analysis aims to reduce lead times by improving production flow

Additional Considerations:

Discounted Payback Period: This metric combines aspects of DCF and payback period. It discounts future cash flows within the payback period to account for the time value of money

Profitability Index (PI): This metric is a variation of NPV, calculated by dividing the project’s NPV by the initial investment. A PI greater than 1 indicates a positive NPV and potentially a good investment.

Remember, some companies may use a combination of metrics from different methods to get a more well-rounded picture before making a capital budgeting decision.

Challenges in Capital Budgeting

Here are some of the challenges businesses face in capital budgeting:

- Estimation Errors: Accurate estimation of future cash flows is challenging. Overestimating cash inflows or underestimating costs can lead to poor investment decisions.

- Market Uncertainty: Market conditions may change, affecting the projected returns of a project. Companies must account for economic, political, and competitive risks.

- Behavioural Biases: Decision-makers may have biases that affect their judgment, such as overconfidence or aversion to loss, leading to suboptimal investment choices.

- Technological Changes: Rapid technological advancements can render a project obsolete, affecting its long-term viability.

Best Practices in Capital Budgeting

- Comprehensive Analysis: Conduct a thorough analysis using multiple capital budgeting techniques to get a well-rounded view of a project’s potential.

- Sensitivity Analysis: Perform sensitivity analysis to understand how changes in key assumptions impact the project’s outcome.

- Real Options Analysis: Consider real options analysis, which provides flexibility in decision-making by evaluating different scenarios and potential adjustments during the project’s life.

- Regular Reviews: Regularly review and update capital budgeting processes to incorporate new data, market conditions, and company goals.

What Is the Difference Between Capital Budgeting and Working Capital Management?

Now that we have got a fair understanding of the what and how of capital budgeting, let us also answer one of the most commonly asked questions i.e. difference between capital budgeting and working capital management.

Difference |

Capital Budgeting |

Working Capital Management |

Definition |

Capital budgeting refers to the assessment, estimation, and decision-making of organizations regarding fixed and long-term asset investments such as plants, equipment, technologies, and other ongoing projects aimed at generating growth |

Working capital management is the process of handling the short-term assets and liabilities of the organization to facilitate its day to day operations and ensure good cash flow practices. |

Objective |

Aims to enhance the shareholder value and the profits generated in the long run through interventions of investments |

Aims to ensure that cash levels are optimal, to be able to meet the immediate needs of the business without running into a cash problem. |

Nature of Investments |

It requires large amounts of money to be invested in fixed assets and generally non-recurring |

It involves short-term budgets that include current assets (for example, inventory and receivables) and current liabilities (such as payables) which are frequently readjusted. |

Decision Impact |

Most of the decisions cannot be reversed and they have long term effects on the organization’s structure, operations and growth |

Decisions are not final in nature; however, they are revisited on a consistent basis due to the dynamic nature of cash flows of the organization. |

Risk Level |

Greater risk because the returns are over a long period of time and the economy is susceptible to changes. |

Lower risk since adjustments can be made quickly to respond to immediate financial needs |

Examples |

Construction of a new plant, introduction of a new product, or investment in equipment. |

Managing accounts receivable, optimizing inventory, paying off short-term debt. |

Conclusion

Capital budgeting is an important process for making strategic investment decisions that drive long-term growth and profitability. By understanding its concepts, techniques, and metrics, businesses can more easily navigate the complexities of capital investments. As market conditions and technologies advance with time, continuous refinement of capital budgeting practices will ensure that companies remain agile and capable of capturing opportunities that align with their strategic objectives. For businesses seeking to improve their financial performance and sustain competitive advantage, learning the art of capital budgeting should be a priority.

Frequently Asked Questions (FAQs)

1. What is capital budgeting in simple words?

Capital budgeting, in simple words, is the process of deciding whether a long-term investment is worth the money and risk.

It helps businesses analyse future cash flows, profitability, and risks before committing funds to major projects.

2. What are the main steps in the capital budgeting process?

The capital budgeting process includes identifying investment opportunities, estimating cash flows, evaluating projects using techniques like NPV and IRR, selecting the best project, implementing it, and reviewing performance. These steps ensure the business invests in profitable and strategically aligned projects.

3. Why is capital budgeting important for businesses?

Capital budgeting is important because it helps companies make informed long-term investment decisions that impact profitability, cash flow, and growth. It prevents resources from being wasted on unprofitable or high-risk projects.

4. What is an example of capital budgeting in India?

An example of capital budgeting in India is a manufacturing company evaluating whether to build a new plant, purchase automated machinery, or expand into a new state. These decisions require analysing costs, future cash flows, and long-term returns.

5. What are the most common capital budgeting techniques?

The most common capital budgeting techniques are Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, Profitability Index (PI), and Discounted Cash Flow (DCF) analysis. These methods help businesses compare and prioritise projects based on returns and risk.

6. How does capital budgeting help in risk management?

Capital budgeting helps in risk management by identifying future uncertainties, analysing project risks, and comparing alternatives before investment. It ensures companies choose safer and more predictable long-term projects.

7. What is the difference between capital budgeting and working capital management?

Capital budgeting deals with long-term investment decisions like new plants or equipment, while working capital management focuses on short-term cash, inventory, payables, and receivables.

Together, they help businesses maintain stability and growth.

8. What is the time value of money in capital budgeting?

The time value of money means money today is worth more than money in the future due to its earning potential. Capital budgeting uses this concept to discount future cash flows and calculate NPV and IRR.

9. Which capital budgeting method is best for decision-making?

NPV is considered the most reliable capital budgeting method because it measures the real value a project adds to the company after accounting for the time value of money. Businesses often use IRR and payback period alongside NPV for a complete analysis.

10. What challenges do companies face in capital budgeting?

Companies face challenges like estimating future cash flows accurately, market uncertainty, risk evaluation, technological changes, and behavioural biases during capital budgeting.

Overcoming these issues is essential for choosing profitable long-term investments.