Introduction

In today’s fast-evolving digital commerce space, businesses are constantly looking for smarter and simpler ways to accept online payments. Payment gateways and payment buttons are the two common options usually considered. While both are aimed at accepting digital payments, they are very different when it comes to functionality, integration, and preferred usage. This blog explores the difference between a payment button and a payment gateway, helping you understand which solution fits your business needs better.

What Is a Payment Button and a Payment Gateway?

A payment button is a ready-to-use tool to accept payments, which can be embedded on websites, emails, or landing pages, or shared as a direct link. It is a fast, no-code approach that makes it very helpful for freelancers, consultants, startups, and other small organizations to collect payments without the need to develop a payment system. This tool is marketed towards quick sales, one-time transactions, or firms unable to dedicate substantial technical resources. Meanwhile, a payment gateway is a stronger and bigger infrastructure that authorizes and processes digital transactions between customers and merchants. It usually integrates customer transactions with an e-commerce application, shopping cart, and banks to secure the whole transaction process, including encryption and fraud prevention. The payment gateway provides for more customization, scalability, and control; however, it needs much more technical integration so that it can best serve high-volume or complex businesses. Both enable online transactions, but the choice depends on the business model, expected transaction volume, and level of customization required. For example, an individual may prefer using a payment button solution to accept payments without having to directly integrate a payment gateway themselves.

Key Differences Between Payment Button and Payment Gateway

Understanding the payment gateway vs payment button debate starts with comparing key differences:

Features |

Payment Button |

Payment Gateway |

|---|---|---|

Ease of setup |

Extremely user-friendly; can be added via simple embed code or link. |

It can be integrated into the website or the app through the support of APIs and developers. |

Checkout Experience |

Offers a basic, ready-made checkout flow with limited flexibility. |

Fully customized based on user behavior and branding. |

Transaction Volume |

Built for small-scale transactions or limited sales volume. |

Designed for large sales and working with complex business operations. |

Functionality |

Provides core payment collection features only. |

Offers additional tools like multi-currency, auto-billing, fraud prevention, etc. |

Best For |

Freelancers, NGOs, and micro-entrepreneurs with simple payment needs. |

Large retailers, SaaS platforms, and global businesses need robust systems. |

Cost & Resources |

Budget-friendly and requires no technical expertise. |

May incur higher setup and maintenance costs with a need for technical resources. |

How Payment Button Solutions Simplify Transactions

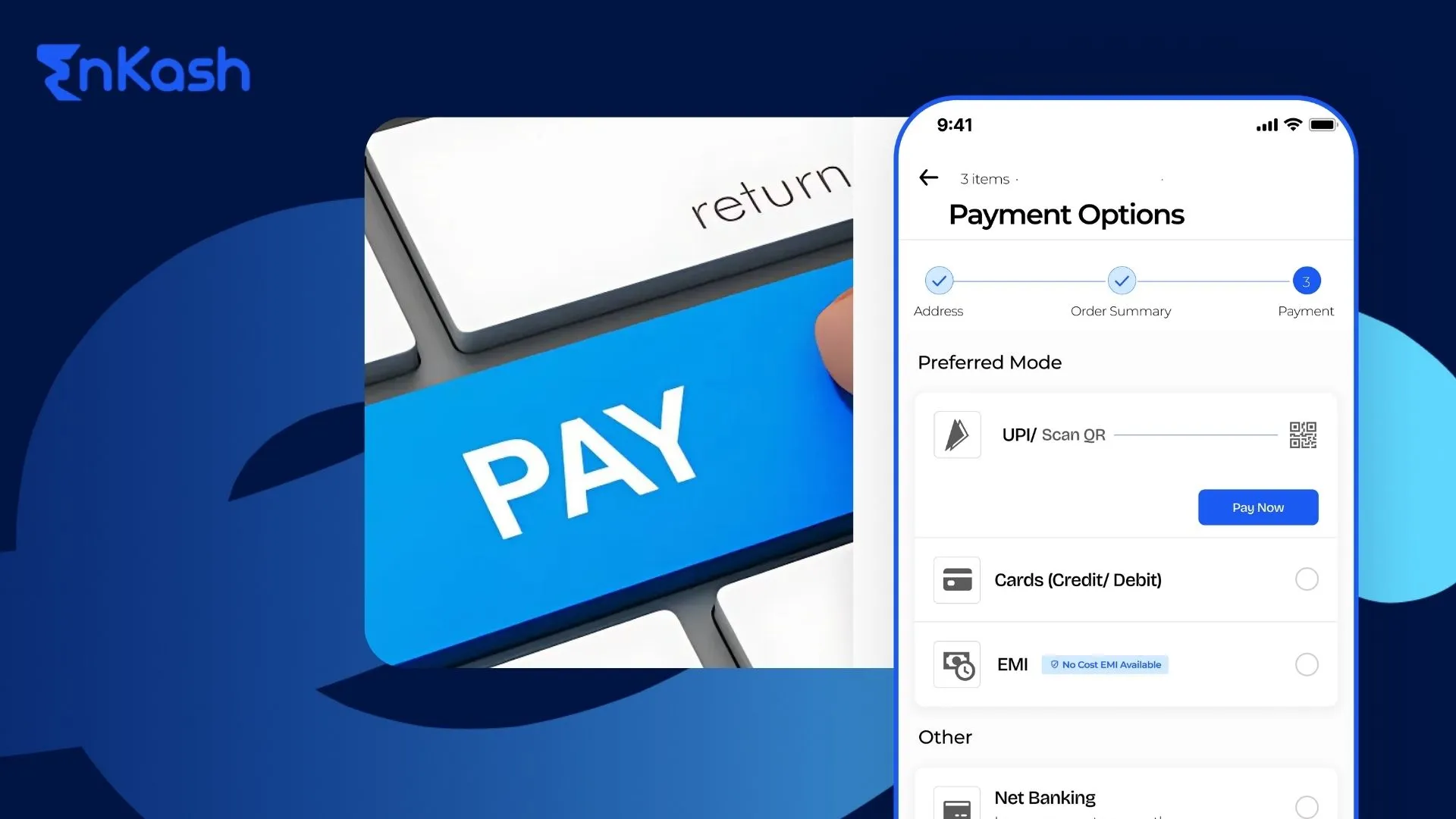

With the world of payments ever transforming, businesses-whether big or small-are in search of swift, secure, and clean ways to accept online payments. A very nifty feature, the payment button enables one to collect payments without going through the full gateway implementation process. Even better are the plug-and-play solutions from EnKash-and presumably other payment processors-that do not require any sort of technical integration or coding knowledge.

A payment button is just a ready-made online payment method that can be wrapped up and embedded on any website or landing page, and can also be shared with others via email or WhatsApp. They thus afford the immediacy and the flexibility to accept payment just upon clicking it for a quick ad, sale on social media, or charges for services or a donation.

Just go to EnKash Dashboard, generate a button, configure it against the exact amount or purpose, and send a link to someone. No backend setup, coding, or onboarding-long process needed-just a few minutes and you’re set to go live. The simplicity of the payment buttons makes them extremely handy for those businesses that do not have a dedicated developer or the time to maintain a full website. Also, the EnKash button comes with features for secure processing, notifications, and tracking to keep the user informed of every transaction. This solution from the activities of freelancers or NGOs allows these users to receive digital payments quickly, safely, and efficiently.

When Should I Use a Payment Button? Use Cases and Benefits

If you’re asking yourself, “When should I use a payment button?”, the answer lies in your business model, technical readiness, and payment needs. Below are some of the most common use cases where payment buttons make perfect sense.

Freelancers Needing Fast Payments for Services

Freelancers working on tight deadlines and fast deliverables must have a smooth method of collecting payments. They simply send their clients a payment button link instead of sending them bank details or requiring them to go through a lengthy checkout procedure.

Small Businesses Selling through Social Media

Not every business has an e-commerce website. Many startups and small sellers conduct their sales on Instagram, Facebook, or WhatsApp. Payment buttons allow sellers to attach payment links to posts and messages so customers can just click on those links to pay.

NGOs Collecting Donations

There is a need for donations to be accepted quickly during a fundraising event or an emergency. Payment buttons simplify the process by acting as one-click tools through which a donor can simply donate without going through a long checkout page.

Home-Based Entrepreneurs

Home-based bakers, artists, crafters, and tutors usually do not have the technical resources to set up a full-fledged online payment system. A payment button equips them with a lightweight, cheap, and simple-to-use method to receive payments; they may choose to do so without any further setup or developer assistance.

One-Time or Non-Subscription Payments

Not every business runs under recurring subscriptions. Many services—like event registrations, consultations, workshops, or digital products—go for one-time payments. A payment button works well with fast, non-recurring transactions where setting up a complete payment gateway would be unnecessary or overkill.

When Should You Go for a Payment Gateway? Some Ideal Scenarios Explained

A payment gateway is not just a passing online transaction tool — it is a comprehensive infrastructure for securely processing, authorizing, and managing payments online. But you might ask, “When should I use a payment gateway?” The answer lies in the complexity, scale, and needs of your business. Let’s explore the ideal scenarios where a payment gateway is the right fit.

E-commerce transactions with multiple products and a large volume of inventory

Any online store that sells multiple products will have its transaction flow smoothed by integration facilities that a payment gateway presents. Such businesses would need shopping carts and a fast, secure checkout flow. Ensure that your payment gateways accept high-volume transactions while still letting the customers enjoy a smooth checkout experience, which results in lower cart abandonment and higher conversion.

A business that requires recurring billing or subscription models

Whenever your business is subscription-based, Software-as-a-Service, online learning, or content memberships, it needs recurring billing. The payment gateways are made to accept auto-renewals, invoice cycles, and subscription management. They automate the whole process for you: charging the customer, dealing with failed payments, all while maintaining your compliance.

Businesses Needing Customized Advanced Fraud Detection and Analytics

Online fraud is becoming one of the biggest problems faced by digital merchants. Payment gateways come with inherent fraud detection features, including AI risk analysis, 3D secure authentication, geolocation tracking, and velocity checks. For companies whose business transactions are large or whose customer base is huge, these features become crucial to ensure safety and reduce chargebacks.

Enterprises Seeking Custom Checkout Experiences

A payment gateway offers plenty of customization opportunities to companies wishing to have full control over customer experience. Aside from designing and building their custom checkout pages, they can create personalized Thank You pages that integrate upsells and cross-sells. Businesses can also integrate their loyalty points, discount engines, and coupon systems into the payment flow.

International Operations with Multi-Currency Support

Multi-currency support is essential for businesses operating internationally, enabling transactions in customers’ local currencies. Payment gateways typically offer all sorts of multi-currency processing, tax calculation, and local payment method integration.

Pros and Cons of Payment Buttons

Pros Of Payment Buttons

1. Easy Set-Up and Easy to Integrate

These are extremely easy to set up. You do not need any technical knowledge or the help of a developer.. Most portals offer a user-friendly dashboard where you can generate a button or link and embed it on any website, email, or even elsewhere on messaging apps.

2. Suitable For Small Businesses And Freelancers

Payment buttons support smaller-scale operations. Be it a freelancer, a home-based vendor, or a startup, you can accept payments instantly through them without having to install a full-fledged site or shopping cart.

3. No Coding Required

One of the biggest perks of payment buttons is the no-code aspect. Making, editing, and deploying the button requires no writing of code – this makes operations ideal for non-technical persons.

4. Cost-Effective

Payment button solutions usually have lower upfront costs compared to full payment gateways, and many providers waive setup or maintenance fees, though standard transaction charges still apply.

5. Flexible and Shareable

The link to the payment button can be shared via email, SMS, WhatsApp, or even social media. This makes for a flexible tool for collecting just any payments without going through a complicated checkout process.

Cons of Payment Buttons

1. Limited Features

Payment buttons, easy as they are, may be lacking in advanced features like subscription billing, multi-currency support, or in-depth analytics. This becomes a limiting factor for a growing business.

2. Minimal Customization

Customizing the user journey or branding within the checkout experience is often restricted when using basic payment buttons. You hardly have any control over the way the user may experience the payment process.

3. Not Suitable for Large Inventories

For businesses with many multiples of products or SKUs, the payment button may not be the most prudent way to handle payments. It’s more for selling one product or single payment purchases.

4. Less Scalable

If you rely solely on payment buttons, what works for you today may not work tomorrow. You will need the features and scalability a payment gateway provides.

Pros and Cons of Payment Gateway

Pros of Payment Gateway

1. Full Checkout Experience

Payment gateways allow you to create a complete branded checkout journey. You retain full control over the design, flow, and UX of the checkout process—something any business would invest in to build trust in the minds of customers and increase conversions.

2. Advanced Features and Analytics

With a payment gateway, you can take advantage of recurring billing, fraud detection, real-time analytics, fraud monitoring, transaction history, and many other features that help you secure and manage your payments more directly.

3. Reliable, Scalable, and Secure

The gateways process thousands upon thousands of transactions while adhering to security standards such as PCI-DSS, encryption, and tokenization. They are ideal choices for enterprises and burgeoning businesses.

4. Multi-Currency and World Support

If you do global business or contemplate a global expansion, a payment gateway offers multi-currency support, allowing buyers to pay in their currencies. This makes your service more accessible and competitive worldwide.

5. Integration with Shopping Carts

Payment gateways and e-commerce platforms, with their shopping carts, integrate perfectly, enabling an automated selling process. This is an important factor for big businesses with huge stocks.

Cons of Payment Gateways

1. Having Technical Knowledge Is a Must

What makes setting up a payment gateway complex is that a developer will probably need to be hired. It generally requires API integrations as well as server-side configurations.

2. Higher Setup and Maintenance Fees

A payment gateway does come with fees like the setup fee, the monthly fee, or the transaction fee. That may not be the best choice for a little setup or a startup.

3. Slower Deployment

Roll-out of a payment gateway will take much time due to the restraints imposed by technical and compliance requirements. For any business that needs to make an immediate go-live commitment, it is not a solution.

Payment Button or Gateway: Which Is Better?

When trying to ascertain what is better, a payment button or a gateway, the answer is rightfully tied to your business goals and operational needs. The payment button is for those who want to quickly start accepting payments with little or no tech. It is great for small businesses, freelancers, NGOs, or anyone handling one-time transactions or social selling. A payment button solution requires a few clicks to accept payments with no need for full setup of the website or any tough backend integration. Conversely, a payment gateway best suits businesses with significantly large transaction volumes, billing, or requirements for heavy customizations, and maybe higher levels of security. If you’re running an actual e-commerce store or a subscription-based business, then a payment gateway would be your best bet, providing tools such as fraud detection, analytics, and multiple currencies. Despite their great depth, gateways do tend to require a fair amount of setup and maintenance. Luckily, modern solutions such as EnKash now offer hybrid payment solutions, allowing businesses to smoothly scale from initiating with quick payment buttons right through to more sophisticated and full-fledged payment gateway types as the business grows. So maybe, rather than considering payment gateways vs payment buttons, the apt question should be-what suits your business today and will fit your business tomorrow?

Conclusion

Whether a one-person company or an established firm, you may want to weigh the pros and cons of whether to have a payment gateway or a simple payment button. Payment buttons are quick and easy, while payment gateways allow for greater customization and scalability. Consider your business model, how you want to grow, and the support on the tech side to decide. With EnKash, you can try both and stick to whatever works for you-the best way to process digital payments in simple, scalable, secure ways.