IFSC Codes List of IFSC Codes and MICR Codes of All Banks in India

IFSC Codes of Top Indian Banks

Punjab National Bank

State Bank of India

Bank of India

Airtel Payments Bank

Axis Bank

Bank of Baroda

IFSC stands for Indian Financial System Code. It is an 11-character alphanumeric code of identify bank branches participating in NEFT, RTGS, and IMPS. Every bank branch has a unique IFSC code that helps the RBI ensure secure transactions.

How to Find the IFSC Code of Any Bank

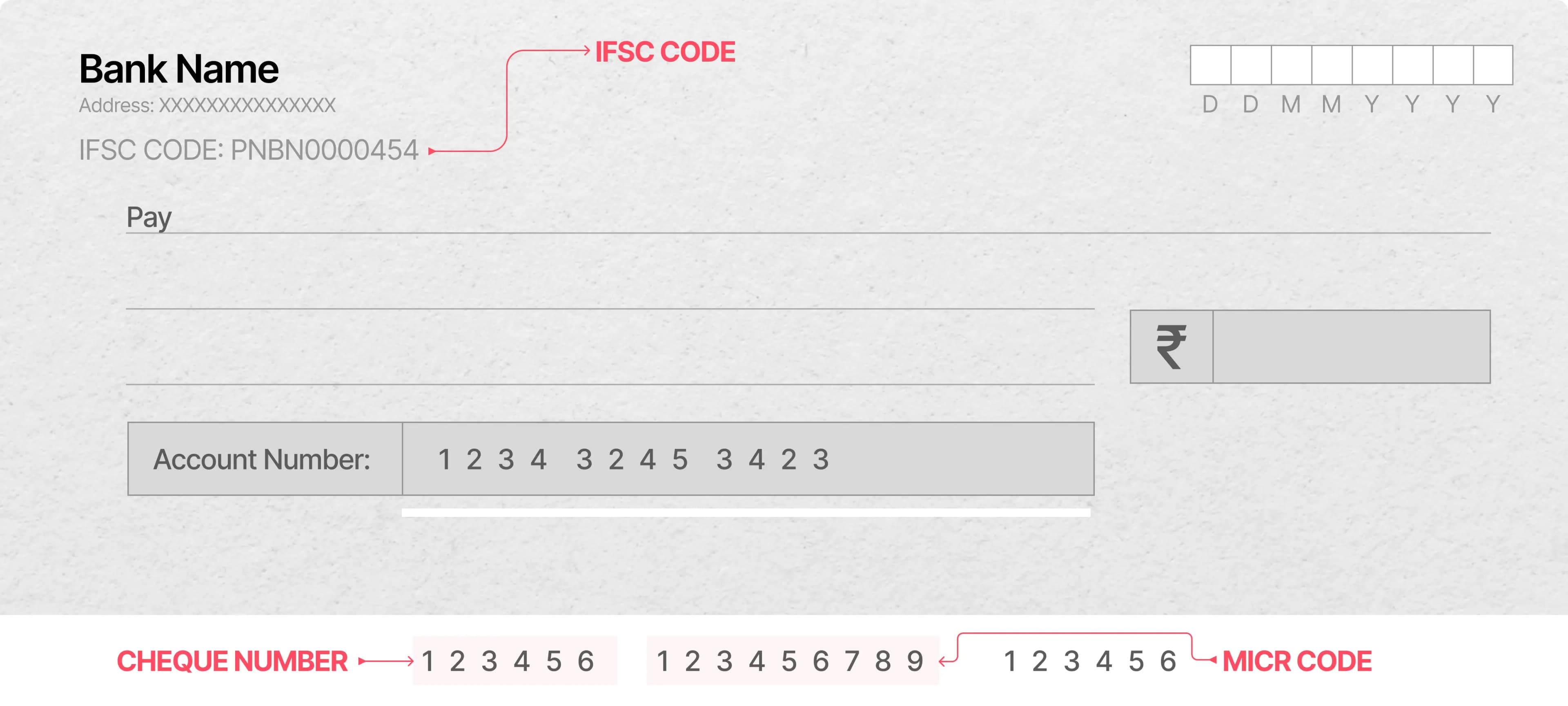

Cheque Book / Passbook: The IFSC code is printed near your account number and branch details, and you can find it on the Cheque Leaf.

Net Banking or Mobile App: Log in and check the Account Details.

RBI Official Directory: The Reserve Bank of India provides a verified list of IFSC codes for all banks and branches in India.

IFSC Code Finder Tool: Use our online IFSC Code Search to instantly get the correct IFSC and MICR code by entering your bank name, state, district, or branch

Looking for your bank’s IFSC code? You can easily find it using multiple sources.

Locate the IFSC Code on the Cheque Leaf

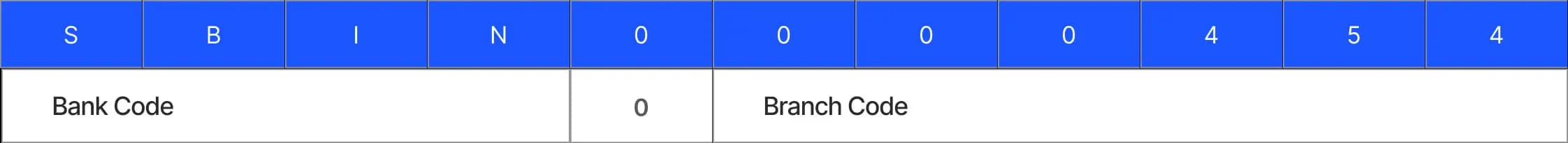

IFSC Code Format

AAAA – Represents the bank name (first four letters)

0 The fifth character is always zero, reserved by the RBI

BBBBBB – Indicates the specific branch code

Every bank branch in India has its unique IFSC code, which is used for secure online transactions. The IFSC code is an 11-character alphanumeric code that follows a fixed pattern:

AAAA0BBBBBB

Example: SBIN0000454 — here, SBIN identifies State Bank of India, and 000454 represents the branch code.

Electronic Funds Transfer in India using IFSC Code:

The IFSC code is used in three electronic fund transfer methods—NEFT, RTGS, and IMPS. Customers may simply move money across accounts with these kinds of electronic fund transfers.

Because fund transfers are only permitted if precise information, such as the payee's bank account number and IFSC code, is supplied, using electronic transfer systems reduces the chances of a transaction going wrong.

NEFT- NEFT stands for National Electronic Fund Transfer. It deals with moving money from one bank account to another. In India, this method of transferring money is widely used. In order to guarantee the safe transfer of funds between bank accounts, IFSC codes must be appropriately used. The beneficiary name, account number, and account type must be provided in addition to the IFSC code. NEFT transactions are processed in half-hourly batches throughout the day.

RTGS- The full form of RTGS is Real Time Gross Settlement. It is a well-liked method for transferring money quickly between banks without having to wait. Similar to NEFT, IFSC codes aid in accurately identifying the participating bank branches. High-value transactions often employ RTGS fund transfers, which are instantly cleared. The payee's name, the account number, the IFSC code, and the transaction amount are all important for the RTGS transaction.

IMPS- The most widely used is IMPS, which stands for Immediate Payment Service. Started in November 2010, it is a new alternative in India. Money may be moved immediately and across all major Indian banks using this service, which can be accessed online, through an ATM, or on a mobile device. This technique is known for being safe, quick, affordable, and unrestricted in terms of the maximum amount that may be moved. Banks typically allow ₹2 lakh, though each bank defines its own limit. An IFSC code is required to start an IMPS transfer.

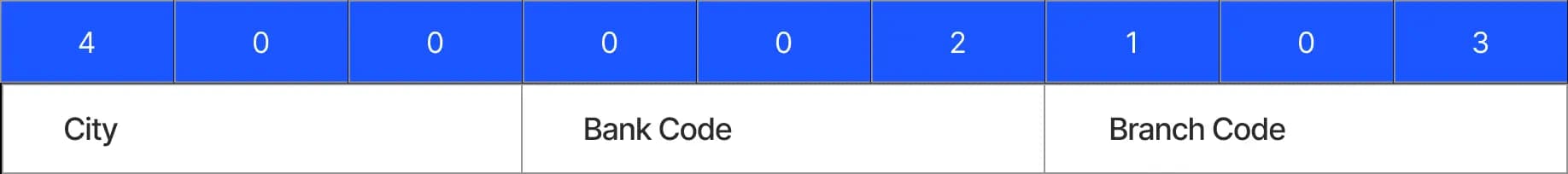

What is MICR Code and How It Differs from IFSC

The MICR Code (Magnetic Ink Character Recognition Code) is a 9-digit numeric code printed on cheques to speed up and authenticate the processing of cheques. It uniquely identifies a bank branch, similar to the IFSC code, but serves a different purpose.

Structure of a MICR Code

Example MICR: 400002103

Find a bank check's MICR code:

This appears beside the check number. A magnetic character ink reader is the only device that can read the MICR code, which is presented in a different font and ink than the check number.

Benefits of MICR Code

The use of unique magnetic ink and character recognition(MICR) technology assists banks in processing checks swiftly and safely. This enables automated cheque clearing, reducing manual intervention and errors.

Faster Cheque Clearance: Enables quick and automated cheque processing.

High Accuracy: Reduces manual errors during cheque verification.

Enhanced Security: Helps identify fake or tampered cheques.

Nationwide Standardization: Ensures uniform banking operations across all branches.

Reliable Fund Settlement: Speeds up interbank cheque transfers and payments.

How to Transfer Money Using the IFSC Code of a Bank Account

You can easily transfer money online using the IFSC (Indian Financial System Code) through NEFT, RTGS, or IMPS.

Steps to Transfer Money Using IFSC Code:

Log in to your internet or mobile banking account.

Add a beneficiary by submitting their name, account number, and the IFSC code.

Choose the transfer mode – NEFT, RTGS, or IMPS.

Enter the amount and confirm the transaction.

The money is securely transferred to the recipient's account based on the selected mode.

Top Bank IFSC, MICR & SWIFT Codes List

| Bank Name | IFSC Code | MICR Code | SWIFT Code |

|---|---|---|---|

Airtel Payments Bank | AIRP0000001 | NA | NA |

Axis Bank | UTIB0000400 | 560211061 | AXISINBB194 |

Canara Bank | CNRB0005479 | 560015123 | CNRBINBBLFD |

Citibank | CITI0000003 | 560037002 | CITIINBI |

HDFC Bank | HDFC0000128 | 560240065 | HDFCINBBGBH |

HSBC Bank | HSBC0400002 | NA | NA |

IDBI Bank | IBKL0NEFT01 | 560259006 | IBKLINBB008 |

IndusInd Bank | INDB0000018 | 560234021 | INDBINBBBGM |

Kotak Mahindra Bank | KKBK0000261 | 400485002 | KKBKINBB |

Punjab National Bank | PUNB0112000 | 560024029 | PUNBINBBBCY |

State Bank of India | SBIN00CARDS | 560002021 | SBININBB112 |

Yes Bank | YESB0CMSNOC | 561532028 | YESBINBB |

How to Register the Beneficiary Account?

You must register the beneficiary's account in your online or mobile banking site before making any online transaction. This guarantees that your money is safely sent to the right person and the transaction can be tapped easily.

Log in to your internet or mobile banking account.

Go to the 'Funds Transfer' or 'Manage Beneficiary' section.

Click on 'Add New Beneficiary'.

Enter the beneficiary's name, account number, and IFSC code.

Verify details carefully and submit the request.

Your bank sends an OTP for confirmation.

Once verified, the beneficiary is activated (usually within 30 minutes to 4 hours, depending on the bank).

Note: After activation, you can securely transfer money using NEFT, RTGS, or IMPS.

Difference Between MICR and IFSC Code

| MICR Code | IFSC Code |

|---|---|

| Magnetic Ink Character Recognition Code | Indian Financial System Code |

| 9-digit numeric code | 11-character alphanumeric code |

| Used for cheque clearing | Used for online fund transfers (NEFT, RTGS, IMPS) |

| Use for Offline transactions | Use for Online transactions |

| Cheques and bank documents | Cheques, passbooks, and online banking portals |

Frequently Asked Questions (FAQs)

Have more questions?

01. How to check the IFSC code?

You can check the IFSC code on your bank's passbook, cheque book, or on the bank's website. It's also available through online IFSC code finders.

02. How to find the IFSC code?

Visit your bank's official website or use an IFSC code search tool. You can also find it printed on cheques and bank statements.

03. How to find the IFSC code from the account number?

You can't get the IFSC code directly from the account number, but you can find it using your bank name, branch, or city via an IFSC code lookup tool.

04. Are IFSC code and SWIFT code the same?

No. The IFSC code is used for domestic transfers within India, while the SWIFT code is used for international transactions.

05. How to find HDFC IFSC code?

You can find the HDFC Bank IFSC code on the cheque book, passbook, or you can get the IFSC Code by visiting the HDFC Bank IFSC search page online.

06. How many digits does an IFSC code have?

An IFSC code consists of 11 characters — the first 4 represent the bank, the fifth is always zero, and the last 6 identify the branch.

07. Where is the IFSC code written?

The IFSC code is printed on the top of your cheque leaf and on the first page of your passbook. It also appears in the net banking account details.

08. How to find MICR code?

The MICR code is printed at the bottom of cheques beside the cheque number. It can also be found on your passbook or bank website.

09. What should I do if I transferred money to the wrong account?

Immediately contact your bank and raise a written complaint. The bank will verify the details and may initiate a reversal process if the funds haven't been claimed.

10. What is the IFSC code of SBI?

The State Bank of India (SBI) Head Office, Head office, is situated at Madame Cama Road, Nariman Point, Mumbai – 400021, Maharashtra. Its IFSC code is SBININBB104, the MICR code is 400002087, and the SWIFT code for international transfers is SBININBB. This IFSC code is used to carry out NEFT, RTGS, and IMPS transactions to SBI's main branch.

11. Are the CIF and IFSC codes are Same?

No, there is a difference between the IFSC and CIF codes. While the IFSC (Indian Financial System Code) is used to identify a particular bank branch for online financial transfers like NEFT, RTGS, or IMPS, the CIF (client Information File) number is a unique identifier given to each client of a bank that holds their personal and account data. The bank branch is identified by the IFSC code, and the consumer is identified by the CIF code.

12. Are the branch code and IFSC Code the Same?

No, there is a difference between the IFSC code and the branch code. The IFSC (Indian Financial System Code) is an 11-character alphanumeric code used for electronic fund transfers like NEFT, RTGS, and IMPS. The branch code is a unique number used to identify a particular bank branch. Both have different functions in banking, even though the branch code is represented by the final six digits of the IFSC code.